1. Trade Order Block Karne Ka Matlab

Assalamu alaikum trade order block karne ke kuchh vaidh Hain jinko sanvidhan jaruri hai trading system ke andar.

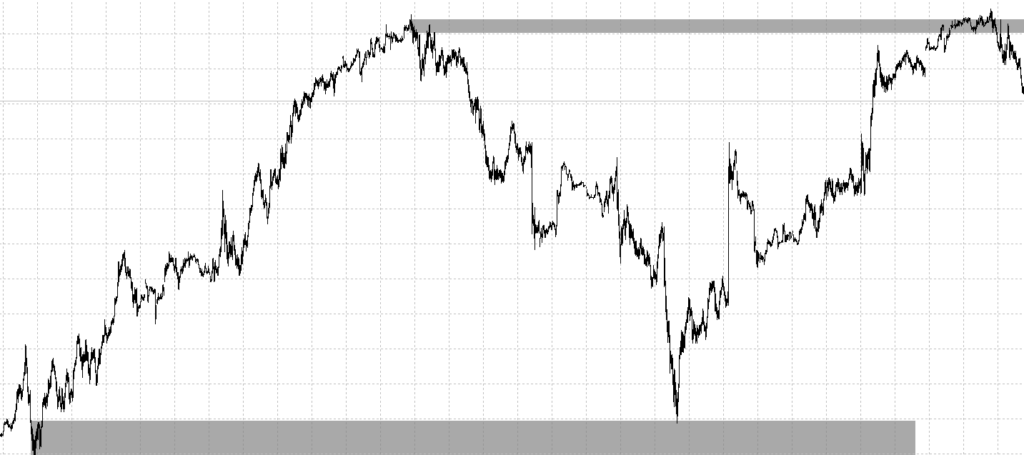

Trade order block karna ka matlab hai kisi specific transaction ko rokna ya delay karna. Ye aksar tab hota hai jab ek trader ya organization ko lagta hai ke koi order unke fayde ke khilaf ho sakta hai ya koi technical ya legal issue ho. Order block karna financial market me ek zaroori tool hai jo trading ko secure aur effective banata hai.

2. Kya Wajuhat Hoti Hain Order Block Karne Ki?

Trade order block karne ke kuchh vajah ho sakte hain jismein teen se char factor asar andaaz hote hain ek technical nurses mein a sakti hai price action ho sakta hai aur iske andar ek risk management ho sakti ha.

Order block karne ki kai wajahain ho sakti hain. Pehli wajah risk management hoti hai, jahan trader apni investment ko loss se bachaane ke liye orders block karta hai. Dusri wajah technical problems hain, jaise system malfunction ya server ka down hona. Kabhi kabar compliance issues bhi hotay hain, jahan rules aur regulations ki waja se order block karna padta hai.

3. System Aur Tools Ka Istemaal

Order block karne ke liye specialized trading platforms ka istemaal hota hai. In platforms me risk management tools hote hain jo trader ko alert karte hain aur block karne ka option dete hain. Kisi trade ko block karne ke liye apko order id ya details enter karni hoti hain, aur phir system us order ko execute hone se rok deta hai. Is process me manual aur automatic dono options available hain.

4. Order Block Karne Ke Asraat

Order block karne ka asar market ki liquidity par bhi hota hai, kyon ke block kiye gaye orders supply aur demand me changes la sakte hain. Aksar ye market volatility ko bhi badhate hain, lekin agar sahi time aur strategy ke saath use kiya jaye to ye ek faida mand technique hai. Traders ke liye ye zaroori hai ke wo is technique ko samajh kar aur responsible tarike se use karein. Order block karne ke asaraat heart rader ko yah Janna chahie ki forex trading ke andar order block karne ke kya sakte hain inko janne ke liye trading ka experience jaruri hai

.

Assalamu alaikum trade order block karne ke kuchh vaidh Hain jinko sanvidhan jaruri hai trading system ke andar.

Trade order block karna ka matlab hai kisi specific transaction ko rokna ya delay karna. Ye aksar tab hota hai jab ek trader ya organization ko lagta hai ke koi order unke fayde ke khilaf ho sakta hai ya koi technical ya legal issue ho. Order block karna financial market me ek zaroori tool hai jo trading ko secure aur effective banata hai.

2. Kya Wajuhat Hoti Hain Order Block Karne Ki?

Trade order block karne ke kuchh vajah ho sakte hain jismein teen se char factor asar andaaz hote hain ek technical nurses mein a sakti hai price action ho sakta hai aur iske andar ek risk management ho sakti ha.

Order block karne ki kai wajahain ho sakti hain. Pehli wajah risk management hoti hai, jahan trader apni investment ko loss se bachaane ke liye orders block karta hai. Dusri wajah technical problems hain, jaise system malfunction ya server ka down hona. Kabhi kabar compliance issues bhi hotay hain, jahan rules aur regulations ki waja se order block karna padta hai.

3. System Aur Tools Ka Istemaal

Order block karne ke liye specialized trading platforms ka istemaal hota hai. In platforms me risk management tools hote hain jo trader ko alert karte hain aur block karne ka option dete hain. Kisi trade ko block karne ke liye apko order id ya details enter karni hoti hain, aur phir system us order ko execute hone se rok deta hai. Is process me manual aur automatic dono options available hain.

4. Order Block Karne Ke Asraat

Order block karne ka asar market ki liquidity par bhi hota hai, kyon ke block kiye gaye orders supply aur demand me changes la sakte hain. Aksar ye market volatility ko bhi badhate hain, lekin agar sahi time aur strategy ke saath use kiya jaye to ye ek faida mand technique hai. Traders ke liye ye zaroori hai ke wo is technique ko samajh kar aur responsible tarike se use karein. Order block karne ke asaraat heart rader ko yah Janna chahie ki forex trading ke andar order block karne ke kya sakte hain inko janne ke liye trading ka experience jaruri hai

.

تبصرہ

Расширенный режим Обычный режим