Bin Bar Candlestick Chart Patterns

Bin Bar candlestick chart patterns ek unique aur insightful trading strategy hai jo aksar traders ke liye market ka sentiment samajhne aur trading decisions lene ke liye istamaal hoti hai. Iska asal maqsad price action ke zariye support, resistance, aur reversal points ka pata lagana hota hai.

Bin Bar Patterns ki Samajh

Bin Bar candlestick patterns do candlesticks par mabni hote hain:

1. Bullish Bin Bar: Ye pattern tab banta hai jab doosri candlestick pehli candlestick ke low ko cover karte hue oopar close kare, jo bullish trend ka ishara deta hai.

2. Bearish Bin Bar: Ye pattern tab banta hai jab doosri candlestick pehli candlestick ke high ko cover karte hue neeche close kare, jo bearish trend ka signal deta hai.

Bin Bar Patterns ki Shakal

Key Features:

1. Size aur Range: Dono candlesticks ki body aur wick ka size significant hota hai.

2. Relationship: Pehli aur doosri candlestick ka overlap hona zaruri hai (doosri candlestick pehli ko “engulf” karti hai).

3. Positioning: Ye patterns aksar trend continuation ya reversal zones par bante hain.

Types of Bin Bar Patterns

1. Inside Bar (Continuation):

Jab doosri candlestick pehli candlestick ke andar reh kar close kare.

Ye aksar consolidation phase aur breakout ka signal deta hai.

2. Engulfing Bar (Reversal):

Jab doosri candlestick pehli candlestick ko poora cover kar le.

Ye bullish ya bearish reversal ka strong signal hai.

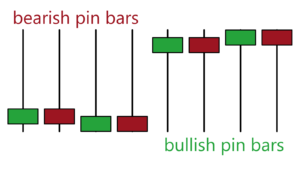

3. Pin Bar (Rejection):

Jab candlestick ki wick lambi ho aur body choti.

Ye rejection aur trend reversal ka ishara deta hai.

Trading Strategy for Bin Bar Patterns

1. Trend Analysis:

Bin Bar patterns ko hamesha trend ke context mein dekhein. Agar pattern ek strong trend ke against banta hai, to ye reversal ka signal ho sakta hai.

2. Support aur Resistance:

Agar Bin Bar pattern support ya resistance level par banta hai, to iska signal zyada mazboot hota hai.

3. Confirmation Tools:

Hamesha indicators jaise ke RSI, MACD, aur moving averages ke saath confirmation lein.

Example:

Agar ek bearish Bin Bar resistance zone par banta hai aur RSI overbought zone mein ho, to ye selling ka acha mauqa ho sakta hai. Isi tarah, bullish Bin Bar support zone par buying ka signal deta hai.

Advantages of Bin Bar Patterns

1. Simple aur Reliable: Asaan hai samajhna aur har time frame par kaam karta hai.

2. Risk Management: Ye patterns precise stop-loss aur take-profit points identify karte hain.

3. Universal Application: Forex, stocks, crypto, har market mein kaam karta hai.

Limitations of Bin Bar Patterns

1. False Signals: Low-volume markets mein ye patterns galat signals de sakte hain.

2. Market Context ka Ahmiyat: In patterns ka analysis bina trend aur context ke akela kaafi nahi hai.

3. Lagging Indicator Risk: Confirmation ka intezar karte karte entry miss ho sakti hai.

Conclusion

Bin Bar candlestick chart patterns ek behad powerful tool hain jo market ka sentiment samajhne mein madadgar hote hain. Lekin inko sirf context aur confirmation indicators ke saath hi use karein. Practice aur market ka analysis in patterns ko samajhne ka sabse acha tareeqa hai.

Bin Bar candlestick chart patterns ek unique aur insightful trading strategy hai jo aksar traders ke liye market ka sentiment samajhne aur trading decisions lene ke liye istamaal hoti hai. Iska asal maqsad price action ke zariye support, resistance, aur reversal points ka pata lagana hota hai.

Bin Bar Patterns ki Samajh

Bin Bar candlestick patterns do candlesticks par mabni hote hain:

1. Bullish Bin Bar: Ye pattern tab banta hai jab doosri candlestick pehli candlestick ke low ko cover karte hue oopar close kare, jo bullish trend ka ishara deta hai.

2. Bearish Bin Bar: Ye pattern tab banta hai jab doosri candlestick pehli candlestick ke high ko cover karte hue neeche close kare, jo bearish trend ka signal deta hai.

Bin Bar Patterns ki Shakal

Key Features:

1. Size aur Range: Dono candlesticks ki body aur wick ka size significant hota hai.

2. Relationship: Pehli aur doosri candlestick ka overlap hona zaruri hai (doosri candlestick pehli ko “engulf” karti hai).

3. Positioning: Ye patterns aksar trend continuation ya reversal zones par bante hain.

Types of Bin Bar Patterns

1. Inside Bar (Continuation):

Jab doosri candlestick pehli candlestick ke andar reh kar close kare.

Ye aksar consolidation phase aur breakout ka signal deta hai.

2. Engulfing Bar (Reversal):

Jab doosri candlestick pehli candlestick ko poora cover kar le.

Ye bullish ya bearish reversal ka strong signal hai.

3. Pin Bar (Rejection):

Jab candlestick ki wick lambi ho aur body choti.

Ye rejection aur trend reversal ka ishara deta hai.

Trading Strategy for Bin Bar Patterns

1. Trend Analysis:

Bin Bar patterns ko hamesha trend ke context mein dekhein. Agar pattern ek strong trend ke against banta hai, to ye reversal ka signal ho sakta hai.

2. Support aur Resistance:

Agar Bin Bar pattern support ya resistance level par banta hai, to iska signal zyada mazboot hota hai.

3. Confirmation Tools:

Hamesha indicators jaise ke RSI, MACD, aur moving averages ke saath confirmation lein.

Example:

Agar ek bearish Bin Bar resistance zone par banta hai aur RSI overbought zone mein ho, to ye selling ka acha mauqa ho sakta hai. Isi tarah, bullish Bin Bar support zone par buying ka signal deta hai.

Advantages of Bin Bar Patterns

1. Simple aur Reliable: Asaan hai samajhna aur har time frame par kaam karta hai.

2. Risk Management: Ye patterns precise stop-loss aur take-profit points identify karte hain.

3. Universal Application: Forex, stocks, crypto, har market mein kaam karta hai.

Limitations of Bin Bar Patterns

1. False Signals: Low-volume markets mein ye patterns galat signals de sakte hain.

2. Market Context ka Ahmiyat: In patterns ka analysis bina trend aur context ke akela kaafi nahi hai.

3. Lagging Indicator Risk: Confirmation ka intezar karte karte entry miss ho sakti hai.

Conclusion

Bin Bar candlestick chart patterns ek behad powerful tool hain jo market ka sentiment samajhne mein madadgar hote hain. Lekin inko sirf context aur confirmation indicators ke saath hi use karein. Practice aur market ka analysis in patterns ko samajhne ka sabse acha tareeqa hai.

تبصرہ

Расширенный режим Обычный режим