Brief Description.

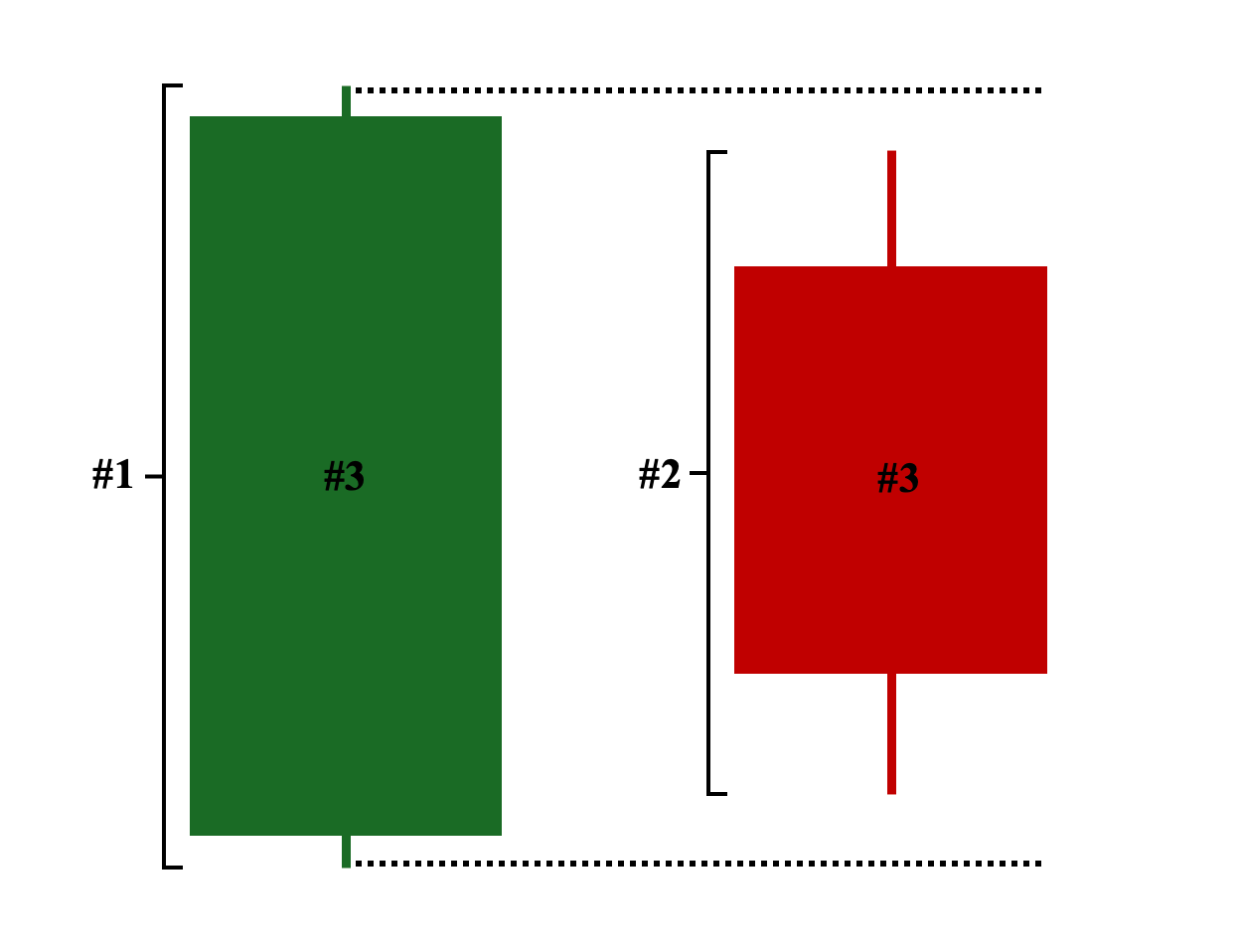

Dear friends aaj ham Jis topic per discussion Karen ge isy Inside bar candlestick pattern Kaha jata hai jo ki trading mein bahut hi Karamad aur mufeed candlestick pattern hai Inside Bar candlestick aik chhoti candlestick hoti hai jo apni pehle wali candlestick ke high aur low ke darmiyan rehti hai. Yeh price action ka aik important pattern hai jo market mein consolidation ya uncertainty ko show karta hai. Jab market ka trend rukta hai ya naye trend ke liye prepare kar raha hota hai, tab Inside Bar banti hai. Traders is pattern ka use karte hain taake aglay price movement ka andaza lagaya ja sake.

Inside Bar Candlestick Trading Strategy.

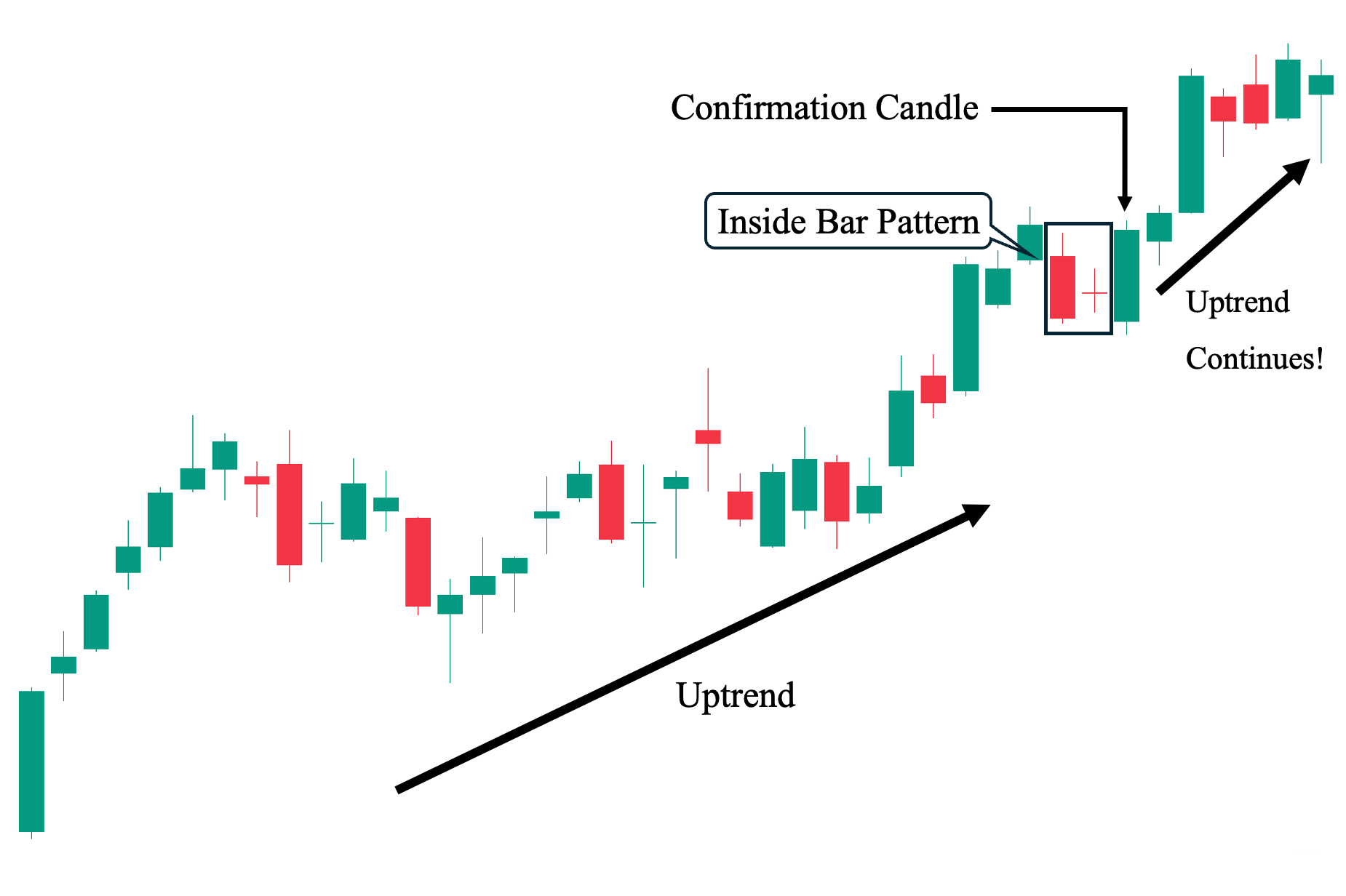

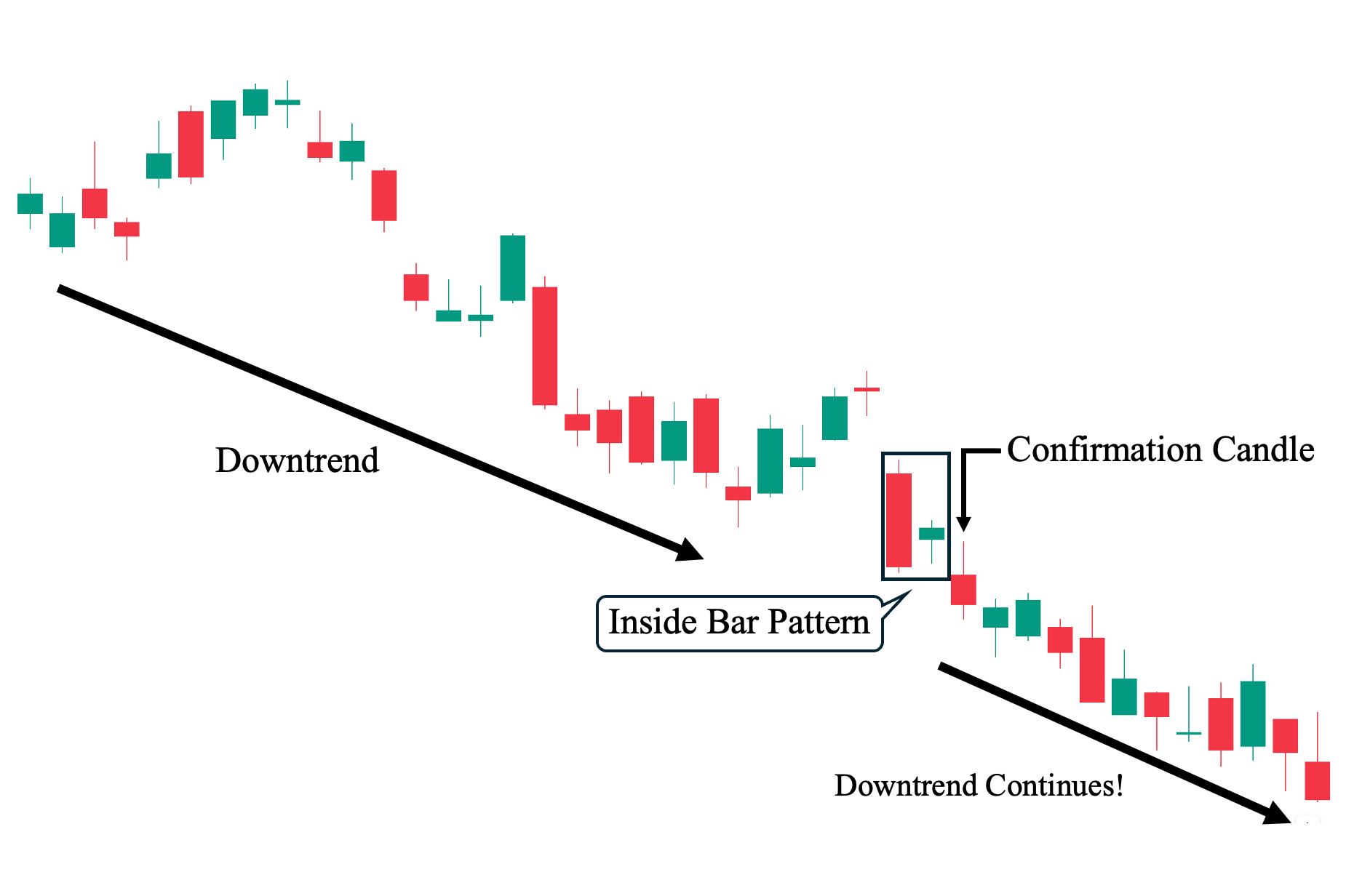

Dear friends aap ko btata chaloon kay Trend continuation strategy mein, agar market pehle se hi bullish ya bearish hai, to traders assume karte hain ke trend barqarar rahega aur ussi direction mein position lete hain. Inside Bar ke pattern ko trade karte waqt do approaches use hoti hain: breakout trading aur trend continuation. Breakout trading mein, trader is baat ka wait karta hai ke price Inside Bar ke high ya low ko tod de. Agar price high todta hai, to buy position open ki jaati hai aur agar low todta hai to sell position open ki jaati hai. Stop-loss usually Inside Bar ke high ya low par lagaya jata hai taake risk control kiya ja sake.

Risk Management & Trading Tips.

Dear friends aap ko btata chaloon kay Inside Bar ka pattern tab zyada effective hota hai jab yeh strong support ya resistance zone ke kareeb banta hai. Is pattern ko trade karte waqt patience aur discipline bohot zaroori hai, kyun ke hamesha har breakout profitable nahi hota. Inside Bar pattern ko trade karte waqt risk management bohot zaroori hai. Hamisha apne capital ka chhota hissa risk par lagayein, jaise ke 1-2% tak. Fake breakouts se bachne ke liye confirmation ka wait karna acha hai, jaise ke high timeframes par analysis karna.

Dear friends aaj ham Jis topic per discussion Karen ge isy Inside bar candlestick pattern Kaha jata hai jo ki trading mein bahut hi Karamad aur mufeed candlestick pattern hai Inside Bar candlestick aik chhoti candlestick hoti hai jo apni pehle wali candlestick ke high aur low ke darmiyan rehti hai. Yeh price action ka aik important pattern hai jo market mein consolidation ya uncertainty ko show karta hai. Jab market ka trend rukta hai ya naye trend ke liye prepare kar raha hota hai, tab Inside Bar banti hai. Traders is pattern ka use karte hain taake aglay price movement ka andaza lagaya ja sake.

Inside Bar Candlestick Trading Strategy.

Dear friends aap ko btata chaloon kay Trend continuation strategy mein, agar market pehle se hi bullish ya bearish hai, to traders assume karte hain ke trend barqarar rahega aur ussi direction mein position lete hain. Inside Bar ke pattern ko trade karte waqt do approaches use hoti hain: breakout trading aur trend continuation. Breakout trading mein, trader is baat ka wait karta hai ke price Inside Bar ke high ya low ko tod de. Agar price high todta hai, to buy position open ki jaati hai aur agar low todta hai to sell position open ki jaati hai. Stop-loss usually Inside Bar ke high ya low par lagaya jata hai taake risk control kiya ja sake.

Risk Management & Trading Tips.

Dear friends aap ko btata chaloon kay Inside Bar ka pattern tab zyada effective hota hai jab yeh strong support ya resistance zone ke kareeb banta hai. Is pattern ko trade karte waqt patience aur discipline bohot zaroori hai, kyun ke hamesha har breakout profitable nahi hota. Inside Bar pattern ko trade karte waqt risk management bohot zaroori hai. Hamisha apne capital ka chhota hissa risk par lagayein, jaise ke 1-2% tak. Fake breakouts se bachne ke liye confirmation ka wait karna acha hai, jaise ke high timeframes par analysis karna.

تبصرہ

Расширенный режим Обычный режим