Brief Description.

Dear traders abhi ham aik bahut important topic discuss karen ge kyun ki yah topic is liye discuss Kiya jaega Kyun ki aap ke knowledge mein main izaafa karna chahta hun ki technical analysis kia hote hain aur yah Kaise perform Kiya Jaate Hain aur is ka trading mein kya role hai.Technical analysis short-term aur long-term trading dono ke liye faidemand hota hai. Iska focus price action aur patterns pe hota hai, is wajah se yeh fundamental analysis se mukhtalif hai jo company ke financials ko evaluate karta hai. Technical analysis trading ka ek aham hissa hai jo price charts aur market ki historical data ko samajhne aur analyze karne ke liye istemal hota hai. Iska maqsad future price movements ki prediction karna hota hai. Indicators jaise Moving Averages, Relative Strength Index aur Bollinger Bands traders ko trend direction aur market ki volatility samajhne mein madad dete hain.

Use of Technical Analysis &Trend Analysis.

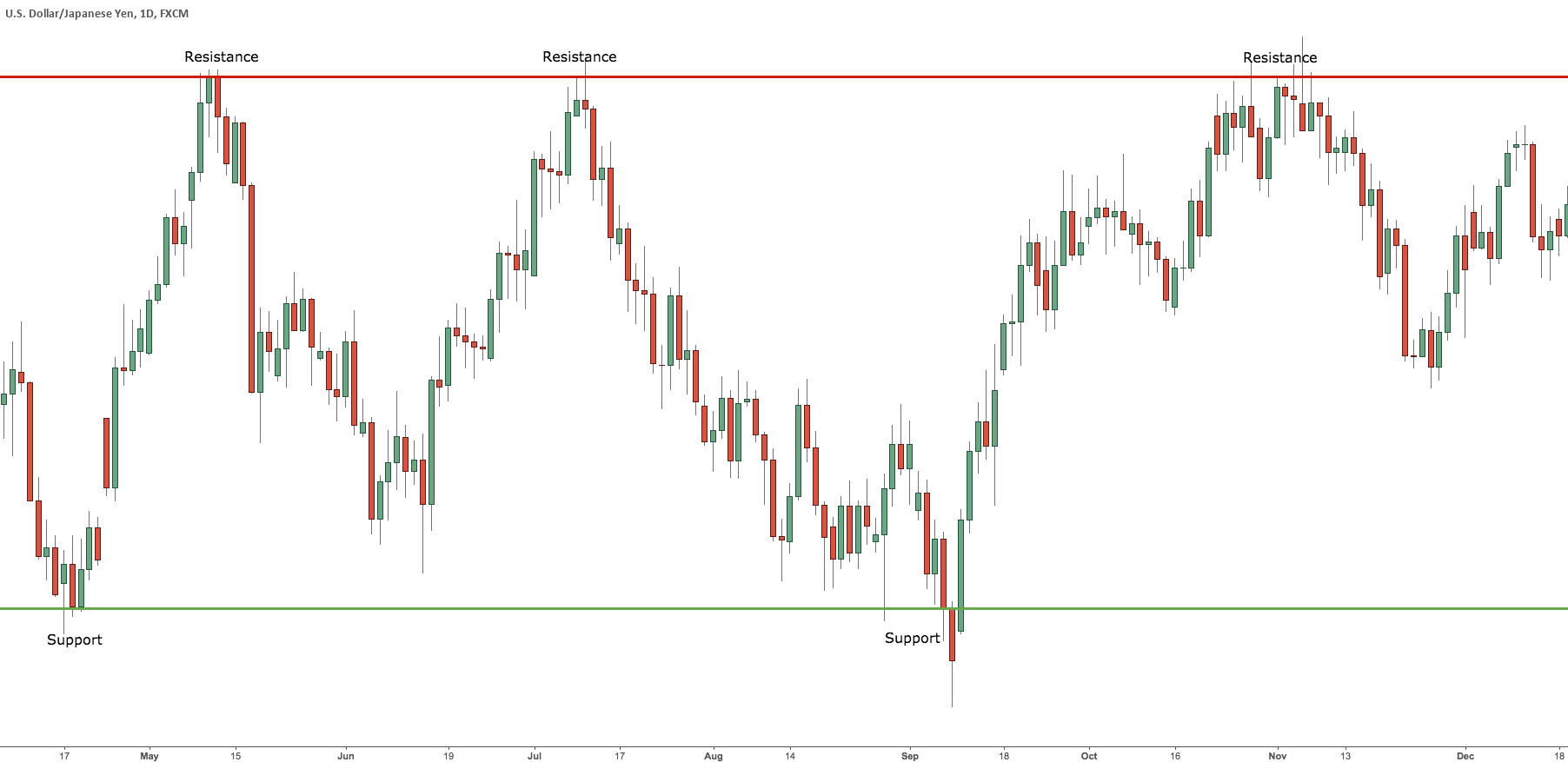

Dear traders aapke ilm nizama Karta jaaun Ki Agar aapane trend analysis karni ho to acchi Tarah Se trading chart ko read karna chahie Uske mutabik hi apni technical perform karna chahie Technical analysis ka pehla qadam trend identify karna hota hai, jo ke uptrend, downtrend, ya sideways trend ho sakta hai. Trend lines aur moving averages ka istemal karke traders ko pata chalta hai ke price kis direction mein ja raha hai. Indicators jaise RSI aur MACD overbought aur oversold conditions ko highlight karte hain, jo ke entry aur exit points decide karne mein madadgar hota hai. Fibonacci retracement aur support/resistance levels bhi price reversal points ko samajhne ke liye istemal hote hain.

Technical Analysis & Risk Management

Candlestick patterns jaise Doji, Hammer, aur Engulfing patterns market ke mood aur possible reversals ka pata dete hain. Head and Shoulders aur Double Top/Bottom jaise chart patterns future price direction ke bare mein insights dete hain. Risk management ke liye stop-loss aur take-profit orders ka istemal zaroori hai, jo traders ko unexpected losses se bacha sakta hai. Position sizing aur diversification bhi risk control karne ke effective tareeqe hain. Technical analysis ka proper istemal karte huye trading decisions zyada logical aur disciplined banti hain.

Dear traders abhi ham aik bahut important topic discuss karen ge kyun ki yah topic is liye discuss Kiya jaega Kyun ki aap ke knowledge mein main izaafa karna chahta hun ki technical analysis kia hote hain aur yah Kaise perform Kiya Jaate Hain aur is ka trading mein kya role hai.Technical analysis short-term aur long-term trading dono ke liye faidemand hota hai. Iska focus price action aur patterns pe hota hai, is wajah se yeh fundamental analysis se mukhtalif hai jo company ke financials ko evaluate karta hai. Technical analysis trading ka ek aham hissa hai jo price charts aur market ki historical data ko samajhne aur analyze karne ke liye istemal hota hai. Iska maqsad future price movements ki prediction karna hota hai. Indicators jaise Moving Averages, Relative Strength Index aur Bollinger Bands traders ko trend direction aur market ki volatility samajhne mein madad dete hain.

Use of Technical Analysis &Trend Analysis.

Dear traders aapke ilm nizama Karta jaaun Ki Agar aapane trend analysis karni ho to acchi Tarah Se trading chart ko read karna chahie Uske mutabik hi apni technical perform karna chahie Technical analysis ka pehla qadam trend identify karna hota hai, jo ke uptrend, downtrend, ya sideways trend ho sakta hai. Trend lines aur moving averages ka istemal karke traders ko pata chalta hai ke price kis direction mein ja raha hai. Indicators jaise RSI aur MACD overbought aur oversold conditions ko highlight karte hain, jo ke entry aur exit points decide karne mein madadgar hota hai. Fibonacci retracement aur support/resistance levels bhi price reversal points ko samajhne ke liye istemal hote hain.

Technical Analysis & Risk Management

Candlestick patterns jaise Doji, Hammer, aur Engulfing patterns market ke mood aur possible reversals ka pata dete hain. Head and Shoulders aur Double Top/Bottom jaise chart patterns future price direction ke bare mein insights dete hain. Risk management ke liye stop-loss aur take-profit orders ka istemal zaroori hai, jo traders ko unexpected losses se bacha sakta hai. Position sizing aur diversification bhi risk control karne ke effective tareeqe hain. Technical analysis ka proper istemal karte huye trading decisions zyada logical aur disciplined banti hain.

تبصرہ

Расширенный режим Обычный режим