Brief Description.

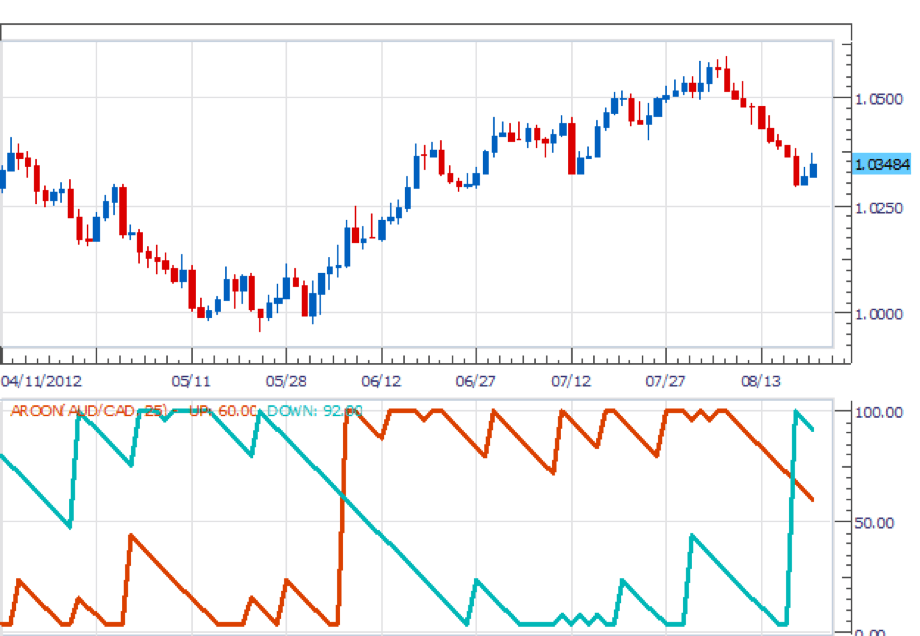

Aroon Oscillator aik mashhoor technical indicator hai jo kisi bhi asset ke price trend aur uske strength ko assess karne ke liye istimaal hota hai. Yeh indicator do mukhtalif lines, Aroon Up aur Aroon Down, ke darmiyan farq calculate karta hai. Aroon Up us waqt izafa dikhata hai jab price recent high ke qareeb hoti hai, jabke Aroon Down us waqt girawat dikhata hai jab price recent low ke qareeb hoti hai. In dono lines ka farq Aroon Oscillator banata hai, jo -100 se +100 ke darmiyan move karta hai. Jab oscillator positive hota hai to bullish trend ka pata chalta hai, aur negative hone par bearish trend ki nishani hoti hai.

Trading Strategy.

Aroon Oscillator ko trading ke faislay karne ke liye istimaal kiya jata hai. Jab oscillator +50 ya is se upar ho, to iska matlab hai ke market bullish hai aur price mazeed barhne ka imkaan hai. Is waqt trader long position kharidne ka sochta hai. Agar oscillator -50 ya is se neeche ho, to iska matlab bearish trend hai aur price mazeed gir sakti hai. Is waqt short selling ya positions close karne ka mashwara diya jata hai. Yeh indicator zyada tar trend-following strategies mein use hota hai, lekin iska acha kaam sideways market mein nahi hota.

Support & Confirmation

Aroon Oscillator ka behtareen istemal us waqt hota hai jab ise doosre indicators ke sath mila kar dekha jaye. Misal ke taur par, Moving Averages ya Relative Strength Index (RSI) ke sath iska istemal karna trend ki confirmation aur trade ke entry aur exit points identify karne mein madadgar hota hai. Aroon Oscillator ki range (-100 se +100) traders ko asani se samajhne aur signals identify karne mein madad karti hai. Lekin hamesha yaad rakhein ke yeh indicator lagging nature ka hota hai, is liye fauran signals dene ke liye sirf is par bharosa nahi karna chahiye.

Aroon Oscillator aik mashhoor technical indicator hai jo kisi bhi asset ke price trend aur uske strength ko assess karne ke liye istimaal hota hai. Yeh indicator do mukhtalif lines, Aroon Up aur Aroon Down, ke darmiyan farq calculate karta hai. Aroon Up us waqt izafa dikhata hai jab price recent high ke qareeb hoti hai, jabke Aroon Down us waqt girawat dikhata hai jab price recent low ke qareeb hoti hai. In dono lines ka farq Aroon Oscillator banata hai, jo -100 se +100 ke darmiyan move karta hai. Jab oscillator positive hota hai to bullish trend ka pata chalta hai, aur negative hone par bearish trend ki nishani hoti hai.

Trading Strategy.

Aroon Oscillator ko trading ke faislay karne ke liye istimaal kiya jata hai. Jab oscillator +50 ya is se upar ho, to iska matlab hai ke market bullish hai aur price mazeed barhne ka imkaan hai. Is waqt trader long position kharidne ka sochta hai. Agar oscillator -50 ya is se neeche ho, to iska matlab bearish trend hai aur price mazeed gir sakti hai. Is waqt short selling ya positions close karne ka mashwara diya jata hai. Yeh indicator zyada tar trend-following strategies mein use hota hai, lekin iska acha kaam sideways market mein nahi hota.

Support & Confirmation

Aroon Oscillator ka behtareen istemal us waqt hota hai jab ise doosre indicators ke sath mila kar dekha jaye. Misal ke taur par, Moving Averages ya Relative Strength Index (RSI) ke sath iska istemal karna trend ki confirmation aur trade ke entry aur exit points identify karne mein madadgar hota hai. Aroon Oscillator ki range (-100 se +100) traders ko asani se samajhne aur signals identify karne mein madad karti hai. Lekin hamesha yaad rakhein ke yeh indicator lagging nature ka hota hai, is liye fauran signals dene ke liye sirf is par bharosa nahi karna chahiye.

تبصرہ

Расширенный режим Обычный режим