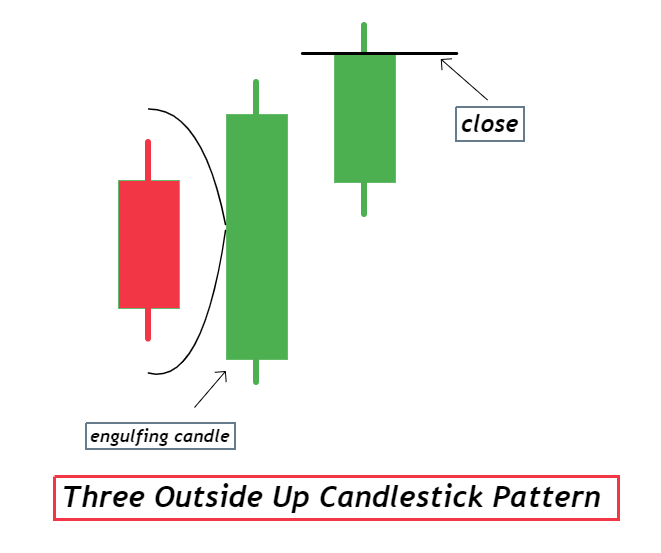

Three outside up candlestick pattern

three outside up candlestick pattern aik kesam ka technical chart pattern hota hey yeh pattern forex market mein three candlestick pattern aik bullish reversal pattern hota hey jes mein bullish engulfing candlestick pattern banta hey third bullish candlestick reversal candlestick pattern ka he kam kar sakte hey yeh forex market ka three down pattern kay opposite he pattern hota hey

Identify Three outside up pattern

1st step

forex chart par aik he jaice upper or lower candlestick bante hein center ize ke aik three candlestick wazah tor par he nazar atte hey jo keh aik bearish nature ke candlestick he ban sakte hey

2nd Step

2nd step mein aik longer white candlestick ban sakte hey jo keh bullish nature ke he hote hey jo keh pehle bearish candlestick kay nechay wazah nazar aay ge yeh pattern forex market ein aik candlestick pattern ke wazah he nomaish kar sakta hey jo keh forex market mein pehle candlestick ko ghaihray hove dekha sakte hey dosree candlestick kay upper or lower hesay ke lambai bhe aik jaice he hote hey

kunkeh yeh step zaroore hota hey kunkeh yeh oljhan ke wajah he ban sakta hey forex market kay es step kay pattern 2 lines wallay bullish candlstick kay pattern he ho sakty hein three outside pattern ke confirmation karnay kay ley humen third or end step ka ait karna chihay

3rd Step

es step mein 2nd candlestick say agay aik or bullih candlestick nazar atte hey tesareecandlestick ka size dosree candlestick ka competition mein he zyada ho sakta hey important batyeh hote hey keh tesareecandlestick ka close hona hamaisha dosree bullish candlestick kay darjay say zyada hota hey

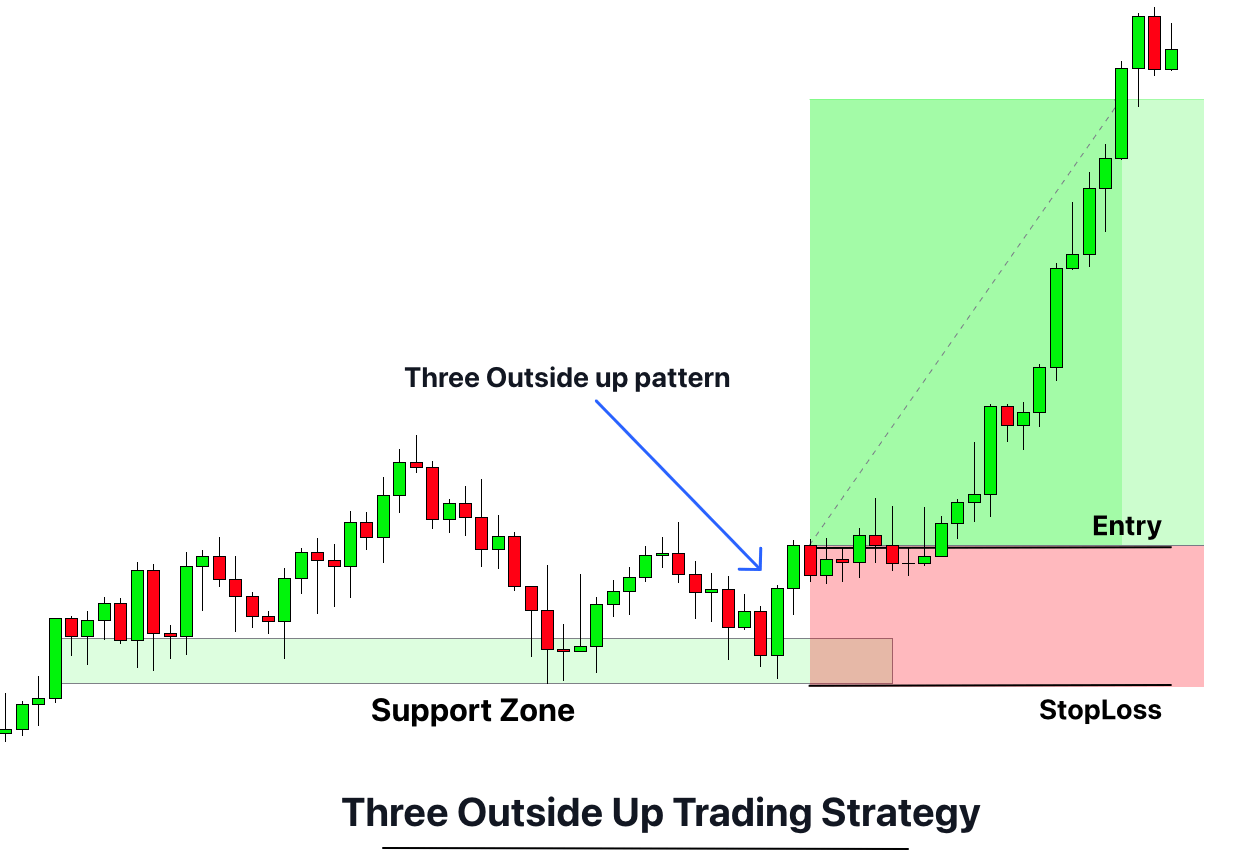

Trade with Three outside Up pattern

forex market mein three outside up pattern kay sath deal kartay time trade mein enter honay kay ley sab say best time woh hota hey jab forex market mein third candlestick ka end hota hey yeh forex market mein anay wale market mein ezaffay ko he identify kar sakte hey jes behtar paish raft kay imkanat bhe barah saktay hein

Stop loss

jaisa keh ap jantay hein keh forex trading mein risk management bhe bayhad zarore hota hey stop loss ko dosree lower engulfing candlestick ka belkul nechay he rakha ja sakta hey

take profit

jab support zone kay sath trade ke jate hey to forex market ka yeh pattern higher level kaysath he trade kar sakta hey es ley profit laynay kay ley ap ko forex market mein trade ko profit min he close karna chihay or resistance zone par ap trailing stop indicator ko he estamal karna chihay

three outside up candlestick pattern aik kesam ka technical chart pattern hota hey yeh pattern forex market mein three candlestick pattern aik bullish reversal pattern hota hey jes mein bullish engulfing candlestick pattern banta hey third bullish candlestick reversal candlestick pattern ka he kam kar sakte hey yeh forex market ka three down pattern kay opposite he pattern hota hey

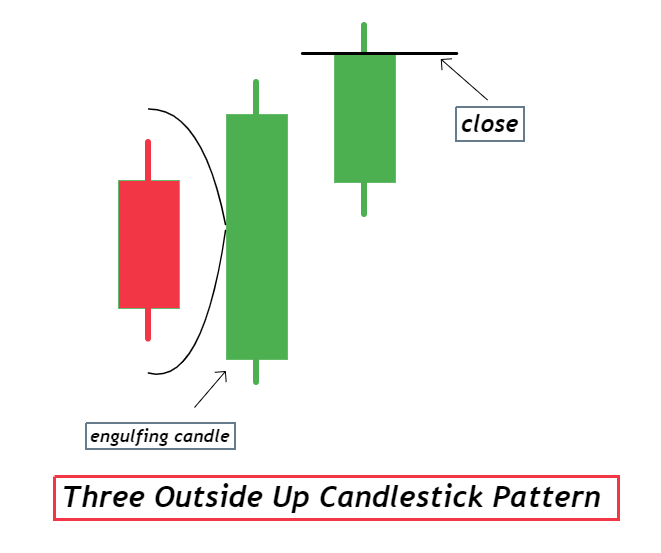

Identify Three outside up pattern

1st step

forex chart par aik he jaice upper or lower candlestick bante hein center ize ke aik three candlestick wazah tor par he nazar atte hey jo keh aik bearish nature ke candlestick he ban sakte hey

2nd Step

2nd step mein aik longer white candlestick ban sakte hey jo keh bullish nature ke he hote hey jo keh pehle bearish candlestick kay nechay wazah nazar aay ge yeh pattern forex market ein aik candlestick pattern ke wazah he nomaish kar sakta hey jo keh forex market mein pehle candlestick ko ghaihray hove dekha sakte hey dosree candlestick kay upper or lower hesay ke lambai bhe aik jaice he hote hey

kunkeh yeh step zaroore hota hey kunkeh yeh oljhan ke wajah he ban sakta hey forex market kay es step kay pattern 2 lines wallay bullish candlstick kay pattern he ho sakty hein three outside pattern ke confirmation karnay kay ley humen third or end step ka ait karna chihay

3rd Step

es step mein 2nd candlestick say agay aik or bullih candlestick nazar atte hey tesareecandlestick ka size dosree candlestick ka competition mein he zyada ho sakta hey important batyeh hote hey keh tesareecandlestick ka close hona hamaisha dosree bullish candlestick kay darjay say zyada hota hey

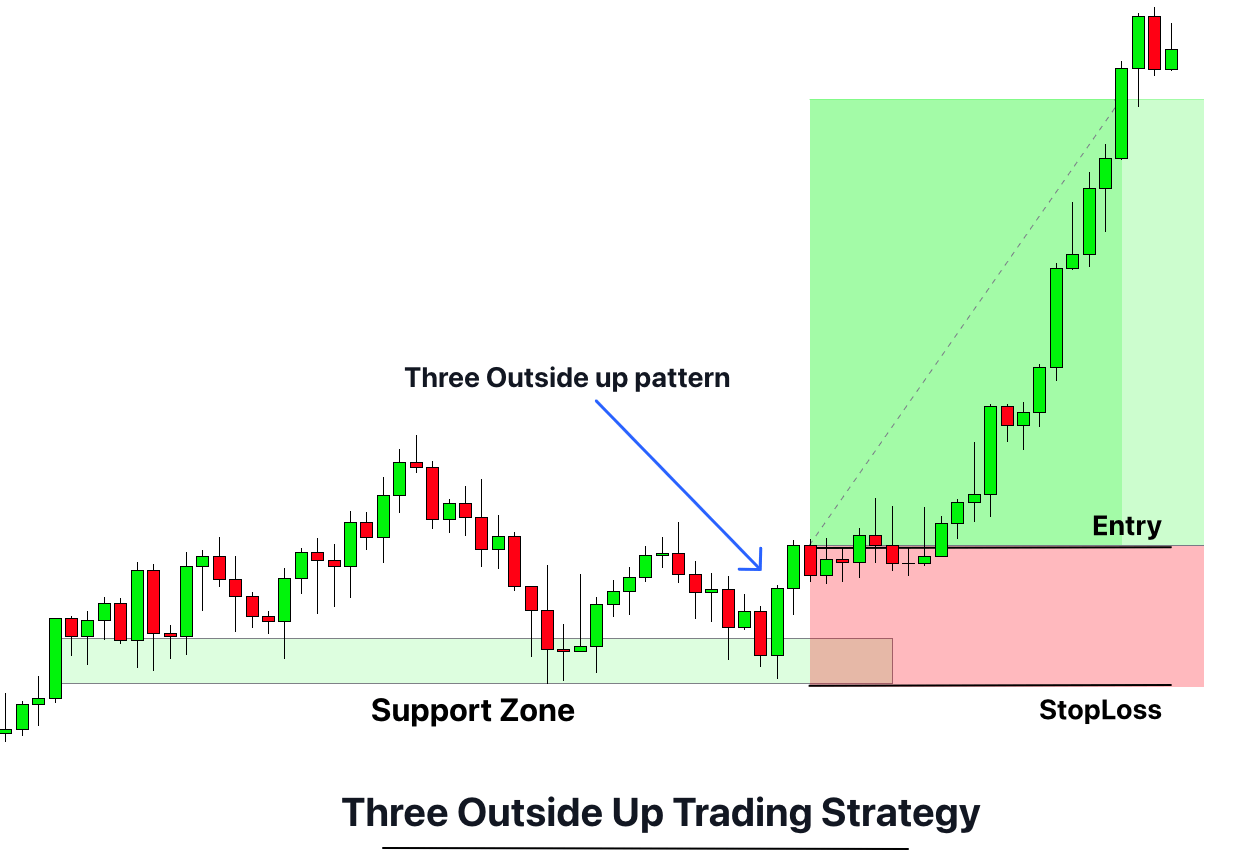

Trade with Three outside Up pattern

forex market mein three outside up pattern kay sath deal kartay time trade mein enter honay kay ley sab say best time woh hota hey jab forex market mein third candlestick ka end hota hey yeh forex market mein anay wale market mein ezaffay ko he identify kar sakte hey jes behtar paish raft kay imkanat bhe barah saktay hein

Stop loss

jaisa keh ap jantay hein keh forex trading mein risk management bhe bayhad zarore hota hey stop loss ko dosree lower engulfing candlestick ka belkul nechay he rakha ja sakta hey

take profit

jab support zone kay sath trade ke jate hey to forex market ka yeh pattern higher level kaysath he trade kar sakta hey es ley profit laynay kay ley ap ko forex market mein trade ko profit min he close karna chihay or resistance zone par ap trailing stop indicator ko he estamal karna chihay

تبصرہ

Расширенный режим Обычный режим