Ladder Top Pattern

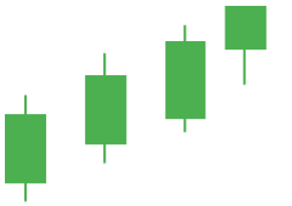

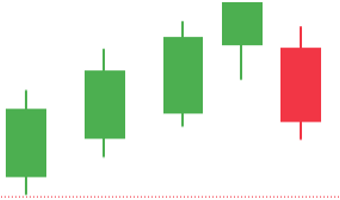

ladder top candlestick pattern aik bearish trend reversal candlestick pattern hota hey es kesam kay chart pattern mei 4 bullish candlestick hote hein jo keh forex market mein bullish trend kay end mein he zahair hota hey

forex market ka yeh pattern trend kay end par he zahair hota hey es ka matlabyeh hota hey keh yeh trend kay end par he zahair hota hey or opposite type ka he turning point he hota hey

Identify Ladder Top Pattern

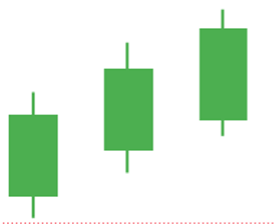

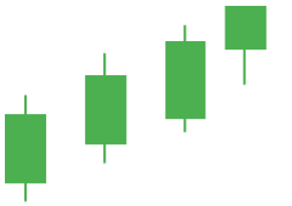

forex market mein ladder top pattern mein pehle teen candlestick white hote hein or forex market mein long body par moshtamel hote hein

pehle teen candlestick ka opening or close hona hamaish es tarah ka he hota hey har cadlestick ka open hona or close hona hamaisha aik he jaisa hota hey

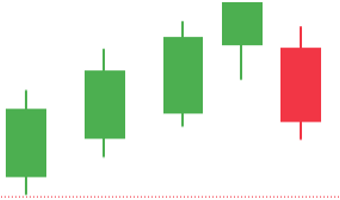

4th candlestick white body mein he hot hey short ce bullish candlestick bante hey

5th candlestick black hote hey jo keh bearish candlestick hote hey yeh candlestick 4th candlestick say nechay hote hey

Understanding Ladder Top pattern

third candlestick or 4th candlestick ke body belkul nechay long body wale candlestick hote hey ab yeh market mein tabdele he nazar atte hey kunkeh ladder top candlestick pattern ke identification ho gai hey trader kay pass ab market reversal janay kay baray mein kafe limit tak he yaqen ho jata hey jes ke wajah say price ko apnay assert sell karnay ka he time hota hey buyer ke tadad mein seller kay competition mein kafe ezafa ho jata hey

Trading strategy

ladder top pattern ke trading strategy yeh hote hey kunkeh ladder top bearish trend reversal janay ke taraf eshara kartay hein yeh aik candlestick pattern hota hey es ley resistance zone bearish trend kay reversal janay ke taraf eshara kartay hein

Entry

jab forex market kay resistance zone mein yeh enter hote hey to yeh forex market mein ladder top candlestick pattern banta hey to bearish trade close karnay par sell order open karna chihay

Stop loss

ladder top say oper resistance zone ke highs kay oper he rakhna chihay yeh sab say best ho ga ap stop loss ko best option kay tor par he estamal kar saktay hein

Take profit

ap ko take profit kay ley dosray technical indicator ka he estamal kar saktay hein jaisay ATR indicator trailing stop say he trade ko close kar saktay hein

ladder top candlestick pattern aik bearish trend reversal candlestick pattern hota hey es kesam kay chart pattern mei 4 bullish candlestick hote hein jo keh forex market mein bullish trend kay end mein he zahair hota hey

forex market ka yeh pattern trend kay end par he zahair hota hey es ka matlabyeh hota hey keh yeh trend kay end par he zahair hota hey or opposite type ka he turning point he hota hey

Identify Ladder Top Pattern

forex market mein ladder top pattern mein pehle teen candlestick white hote hein or forex market mein long body par moshtamel hote hein

pehle teen candlestick ka opening or close hona hamaish es tarah ka he hota hey har cadlestick ka open hona or close hona hamaisha aik he jaisa hota hey

4th candlestick white body mein he hot hey short ce bullish candlestick bante hey

5th candlestick black hote hey jo keh bearish candlestick hote hey yeh candlestick 4th candlestick say nechay hote hey

Understanding Ladder Top pattern

third candlestick or 4th candlestick ke body belkul nechay long body wale candlestick hote hey ab yeh market mein tabdele he nazar atte hey kunkeh ladder top candlestick pattern ke identification ho gai hey trader kay pass ab market reversal janay kay baray mein kafe limit tak he yaqen ho jata hey jes ke wajah say price ko apnay assert sell karnay ka he time hota hey buyer ke tadad mein seller kay competition mein kafe ezafa ho jata hey

Trading strategy

ladder top pattern ke trading strategy yeh hote hey kunkeh ladder top bearish trend reversal janay ke taraf eshara kartay hein yeh aik candlestick pattern hota hey es ley resistance zone bearish trend kay reversal janay ke taraf eshara kartay hein

Entry

jab forex market kay resistance zone mein yeh enter hote hey to yeh forex market mein ladder top candlestick pattern banta hey to bearish trade close karnay par sell order open karna chihay

Stop loss

ladder top say oper resistance zone ke highs kay oper he rakhna chihay yeh sab say best ho ga ap stop loss ko best option kay tor par he estamal kar saktay hein

Take profit

ap ko take profit kay ley dosray technical indicator ka he estamal kar saktay hein jaisay ATR indicator trailing stop say he trade ko close kar saktay hein

تبصرہ

Расширенный режим Обычный режим