Brief Description.

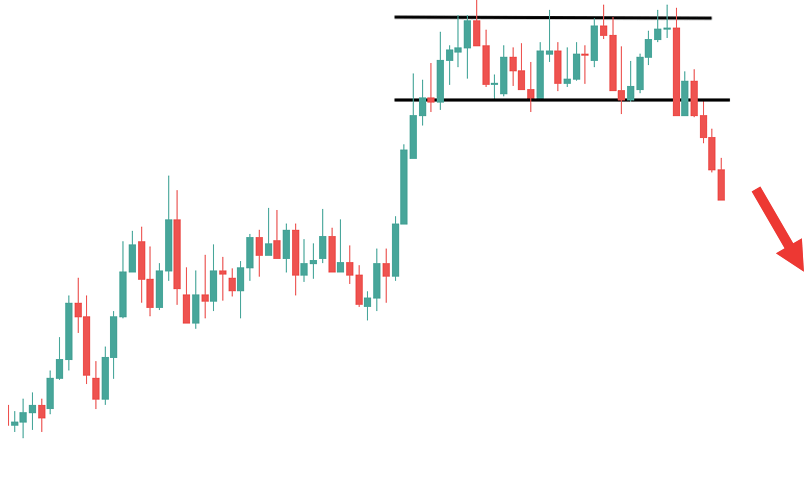

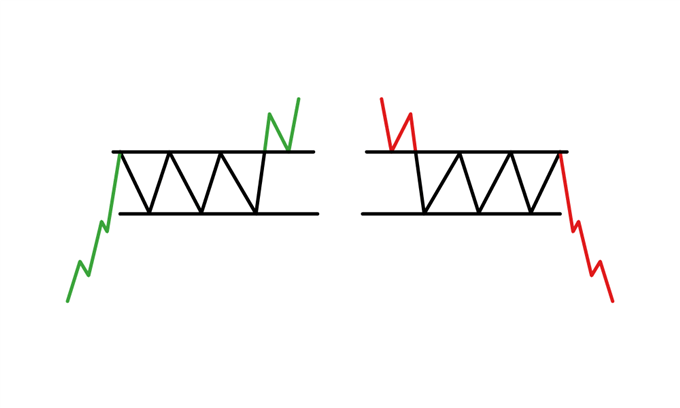

Dear traders aap ko batana chahta hun ki rectangle chart pattern for trading karne ke liye Tiger ko bahut hi experience hona chahie trading Mein Kyun ki yah pattern aik Khas consolidation of market ke bad candlesticks per apply kiya jata hai aur Is ke break through per trading Strategy ko develop Kiya jata hai Rectangle chart pattern, jo ke ek popular technical analysis pattern hai, ek range-bound market ko represent karta hai. Is pattern mein price do horizontal levels ke beech move karta hai: ek support level (neeche ka line) aur ek resistance level (upar ka line). Jab market kisi specific range mein trade kar raha hota hai, to price is range ke andar fluctuate karta hai. Ye pattern sideways market conditions ko signal karta hai, jahan buyers aur sellers ka balance hota hai, aur price na to upar jaata hai aur na neeche. Is pattern ka duration thoda long ho sakta hai, aur yeh typically short-term traders ke liye beneficial hota hai. Rectangle pattern ko "box pattern" bhi kaha jaata hai, kyun ke yeh price action ko ek rectangular shape mein form karta hai.

How to trade Rectangle Pattern.

Dear traders Rectangle pattern ko trade karte waqt, sabse pehle yeh zaroori hai ke aap support aur resistance levels ko accurately identify karein. Jab price resistance level ko touch karta hai aur neeche aata hai, to traders ko sell signal milta hai, aur jab price support level ko touch kar ke upar jaata hai, to buy signal milta hai. Rectangle pattern mein breakout ke baad price move karta hai jo ek clear direction dikhata hai, aur yeh breakout trend ke shuru hone ka signal hota hai. Agar price resistance ko break kar ke upar jaata hai, to yeh buying opportunity hoti hai, aur agar support level break ho jaata hai, to selling opportunity milti hai. Traders ko chahiye ke wo breakout hone par volume ko bhi monitor karein, kyun ke high volume breakout ka confirmation deta hai.

How to Stop Loss.

Dear traders Agar price breakout ke baad trend mein jaata hai, to traders apni profits ko maximize karne ke liye trailing stop loss ka use karte hain. Rectangle pattern ko trade karte waqt patience zaroori hai, kyun ke yeh pattern kabhi kabhi lamba time le sakta hai, lekin sahi strategy aur discipline ke saath traders achi returns hasil kar sakte hain.Rectangle pattern ke saath trading karte waqt risk management bohot zaroori hota hai. Jab traders rectangle pattern mein enter karte hain, to unko apni entry aur exit points ko define karna chahiye. Stop loss ko support ya resistance level ke thoda bahar set karna chahiye, taake agar price pattern ke andar se break ho kar reverse hota hai, to unka risk limited ho. Risk-to-reward ratio ko dhyaan mein rakhte hue, traders apne potential profits aur losses ko manage karte hain.

Dear traders aap ko batana chahta hun ki rectangle chart pattern for trading karne ke liye Tiger ko bahut hi experience hona chahie trading Mein Kyun ki yah pattern aik Khas consolidation of market ke bad candlesticks per apply kiya jata hai aur Is ke break through per trading Strategy ko develop Kiya jata hai Rectangle chart pattern, jo ke ek popular technical analysis pattern hai, ek range-bound market ko represent karta hai. Is pattern mein price do horizontal levels ke beech move karta hai: ek support level (neeche ka line) aur ek resistance level (upar ka line). Jab market kisi specific range mein trade kar raha hota hai, to price is range ke andar fluctuate karta hai. Ye pattern sideways market conditions ko signal karta hai, jahan buyers aur sellers ka balance hota hai, aur price na to upar jaata hai aur na neeche. Is pattern ka duration thoda long ho sakta hai, aur yeh typically short-term traders ke liye beneficial hota hai. Rectangle pattern ko "box pattern" bhi kaha jaata hai, kyun ke yeh price action ko ek rectangular shape mein form karta hai.

How to trade Rectangle Pattern.

Dear traders Rectangle pattern ko trade karte waqt, sabse pehle yeh zaroori hai ke aap support aur resistance levels ko accurately identify karein. Jab price resistance level ko touch karta hai aur neeche aata hai, to traders ko sell signal milta hai, aur jab price support level ko touch kar ke upar jaata hai, to buy signal milta hai. Rectangle pattern mein breakout ke baad price move karta hai jo ek clear direction dikhata hai, aur yeh breakout trend ke shuru hone ka signal hota hai. Agar price resistance ko break kar ke upar jaata hai, to yeh buying opportunity hoti hai, aur agar support level break ho jaata hai, to selling opportunity milti hai. Traders ko chahiye ke wo breakout hone par volume ko bhi monitor karein, kyun ke high volume breakout ka confirmation deta hai.

How to Stop Loss.

Dear traders Agar price breakout ke baad trend mein jaata hai, to traders apni profits ko maximize karne ke liye trailing stop loss ka use karte hain. Rectangle pattern ko trade karte waqt patience zaroori hai, kyun ke yeh pattern kabhi kabhi lamba time le sakta hai, lekin sahi strategy aur discipline ke saath traders achi returns hasil kar sakte hain.Rectangle pattern ke saath trading karte waqt risk management bohot zaroori hota hai. Jab traders rectangle pattern mein enter karte hain, to unko apni entry aur exit points ko define karna chahiye. Stop loss ko support ya resistance level ke thoda bahar set karna chahiye, taake agar price pattern ke andar se break ho kar reverse hota hai, to unka risk limited ho. Risk-to-reward ratio ko dhyaan mein rakhte hue, traders apne potential profits aur losses ko manage karte hain.

تبصرہ

Расширенный режим Обычный режим