Evening Star Candlestick Pattern: A Detailed Guide

1. Introduction to the Evening Star Candlestick Pattern

Stock market aur trading ki duniya mein technical analysis ka kafi ahm role hai, aur is analysis ka ek hissa candlestick patterns hain. In patterns ka istemal traders market ke future movements ko predict karne ke liye karte hain. Evening Star candlestick pattern unhi patterns mein se ek hai jo mainly bearish reversal ko indicate karta hai. Yeh pattern aksar upar ki taraf chalti hui market mein dekha jata hai, jab market ek bullish trend mein hota hai aur phir suddenly ek reversal hota hai jo downtrend ka signal deta hai.

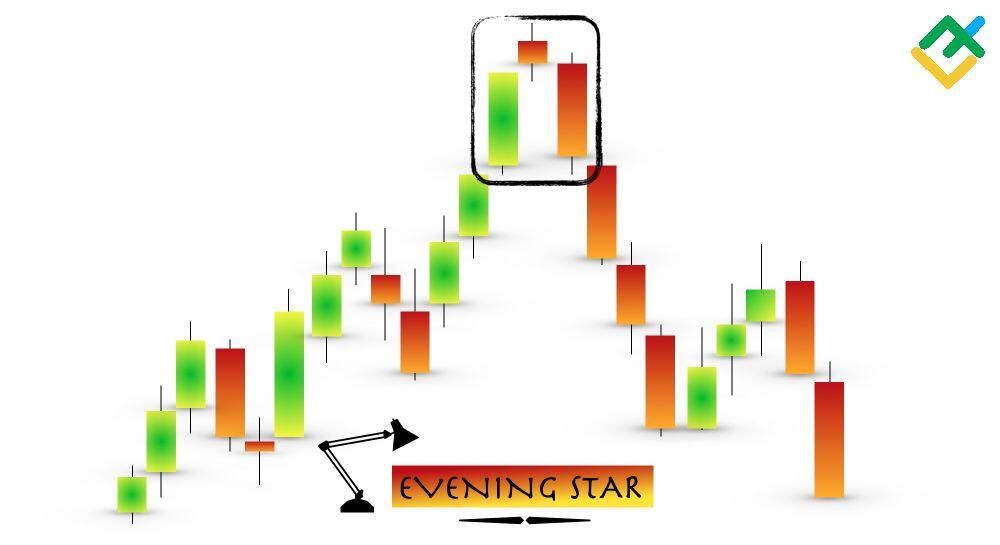

Evening Star pattern teen candlesticks ka combination hota hai, jo ek distinct shape banaata hai. Yeh pattern aksar market ke peak par nazar aata hai, aur is ka matlab hota hai ke market mein bullish trend ka end ho gaya hai aur ab bearish trend start hone wala hai.

2. The Structure of the Evening Star Pattern

Evening Star pattern mein teen candles hoti hain. Har candle ki apni ek khasiyat hoti hai, aur in sab ka combination market ke reversal ka signal deta hai.

Is pattern ka formation market mein ek transition ko dikhata hai, jahan pe bullish trend apne end par pahuchta hai aur bearish trend ki shuruat hoti hai.

3. Identifying the Evening Star Pattern in a Chart

Evening Star pattern ko identify karna relatively asaan hai agar aap candlestick charts ka analysis kar rahe hain. Yeh pattern aksar market ke peak par banta hai, jahan price already higher levels par hota hai. Jab aap chart dekhte hain, toh aapko teen distinct candles nazar aati hain jo is pattern ka hissa hoti hain.

Agar aapko first candle strong bullish hoti hai, dusri candle small ya doji type ki ho, aur teesri candle strong bearish ho, toh aap confidently keh sakte hain ke yeh Evening Star pattern hai. Yeh pattern market ke trend ko reverse karne ka signal deta hai, jo aksar ek bearish phase ki shuruat hoti hai.

4. How to Trade Using the Evening Star Pattern

Evening Star pattern ko trading mein istemal karna kafi useful ho sakta hai, lekin is pattern ko identify karne ke baad kuch important steps hain jo aapko follow karne chahiye.

5. Significance of the Evening Star Pattern in Market Analysis

Evening Star pattern ki significance ko samajhna trading mein kaafi important hai. Yeh pattern aksar market ke reversal ko dikhata hai, jo traders ke liye ek valuable tool ban sakta hai. Is pattern ke formation ke baad, market mein sellers ka dominance zyada ho jata hai, jo price ko neeche girane ka sabab banta hai.

Traders is pattern ka use kar ke apne trades ko adjust karte hain, jisse unko potential profit mil sakta hai. Agar aap is pattern ko market ke overall trend ke saath combine karte hain, toh aapko zyada accurate results mil sakte hain. For example, agar aap dekh rahe hain ke market long time se bullish tha aur ab aapko Evening Star pattern nazar aa raha hai, toh aap expect kar sakte hain ke market mein ek bearish reversal ho sakta hai.

6. Limitations and Risks of the Evening Star Pattern

Jab ke Evening Star pattern ek reliable bearish signal deta hai, lekin is pattern ka use karte waqt kuch limitations aur risks bhi hain. Sabse pehla risk yeh hai ke yeh pattern false signals de sakta hai. Kabhi kabhi market mein short-term fluctuations ke wajah se yeh pattern ban jata hai, lekin market phir bhi bullish trend mein hi rehta hai.

Is liye, traders ko hamesha is pattern ko other indicators ke saath combine karna chahiye, jaise ke moving averages ya RSI (Relative Strength Index), taake yeh ensure ho sake ke signal sahi hai. Agar aap sirf Evening Star pattern pe depend karenge, toh aap false breakouts aur losses mein phans sakte hain.

Conclusion

Evening Star candlestick pattern ek powerful tool hai jo market mein reversal ko detect karne mein madad karta hai. Yeh pattern ek strong bearish signal deta hai jab market pehle se bullish trend mein hota hai. Is pattern ka use karte waqt risk management kaafi zaroori hai, aur isse dusre technical indicators ke saath combine karke aap apni trading strategies ko zyada effective bana sakte hain. Agar aap is pattern ko sahi tarike se samajhte hain aur apply karte hain, toh yeh aapki trading ko kaafi profitable bana sakta hai.

1. Introduction to the Evening Star Candlestick Pattern

Stock market aur trading ki duniya mein technical analysis ka kafi ahm role hai, aur is analysis ka ek hissa candlestick patterns hain. In patterns ka istemal traders market ke future movements ko predict karne ke liye karte hain. Evening Star candlestick pattern unhi patterns mein se ek hai jo mainly bearish reversal ko indicate karta hai. Yeh pattern aksar upar ki taraf chalti hui market mein dekha jata hai, jab market ek bullish trend mein hota hai aur phir suddenly ek reversal hota hai jo downtrend ka signal deta hai.

Evening Star pattern teen candlesticks ka combination hota hai, jo ek distinct shape banaata hai. Yeh pattern aksar market ke peak par nazar aata hai, aur is ka matlab hota hai ke market mein bullish trend ka end ho gaya hai aur ab bearish trend start hone wala hai.

2. The Structure of the Evening Star Pattern

Evening Star pattern mein teen candles hoti hain. Har candle ki apni ek khasiyat hoti hai, aur in sab ka combination market ke reversal ka signal deta hai.

- First Candle (Bullish Candle): Pehli candle ek lambi green (bullish) candle hoti hai, jo market mein upar ki taraf movement ko show karti hai. Yeh candle market ki strength ko represent karti hai, jisme buyers dominant hote hain.

- Second Candle (Doji or Small Candle): Dusri candle aksar ek small body wali candle hoti hai, jo market ki uncertainty ko dikhati hai. Yeh candle ek doji bhi ho sakti hai, jisme market ka open aur close price kaafi close hote hain. Yeh candle bearish aur bullish forces ke beech conflict ko show karti hai.

- Third Candle (Bearish Candle): Tisri candle ek lambi red (bearish) candle hoti hai, jo market mein sellers ke dominance ko indicate karti hai. Yeh candle market ke reversal ko confirm karti hai, jisme price pehle se neeche gir raha hota hai.

Is pattern ka formation market mein ek transition ko dikhata hai, jahan pe bullish trend apne end par pahuchta hai aur bearish trend ki shuruat hoti hai.

3. Identifying the Evening Star Pattern in a Chart

Evening Star pattern ko identify karna relatively asaan hai agar aap candlestick charts ka analysis kar rahe hain. Yeh pattern aksar market ke peak par banta hai, jahan price already higher levels par hota hai. Jab aap chart dekhte hain, toh aapko teen distinct candles nazar aati hain jo is pattern ka hissa hoti hain.

Agar aapko first candle strong bullish hoti hai, dusri candle small ya doji type ki ho, aur teesri candle strong bearish ho, toh aap confidently keh sakte hain ke yeh Evening Star pattern hai. Yeh pattern market ke trend ko reverse karne ka signal deta hai, jo aksar ek bearish phase ki shuruat hoti hai.

4. How to Trade Using the Evening Star Pattern

Evening Star pattern ko trading mein istemal karna kafi useful ho sakta hai, lekin is pattern ko identify karne ke baad kuch important steps hain jo aapko follow karne chahiye.

- Confirm the Pattern: Pehle toh aapko yeh ensure karna hoga ke yeh pattern sahi tarah se banta hai. Agar pattern complete ho gaya ho, toh yeh confirm ho jata hai ke reversal ho sakta hai.

- Wait for the Close: Jab teesri bearish candle complete ho jaye, tab aapko wait karna chahiye jab tak candle close nahi hoti. Iske baad aap apna entry point decide kar sakte hain.

- Stop Loss: Trading mein risk management kaafi zaroori hai, is liye aapko apne stop loss ko bhi set karna hoga. Aksar traders apna stop loss pattern ke high ke thoda upar set karte hain, taake agar market unexpected movement kare, toh aap apne losses ko limit kar sakein.

- Entry Point: Jab aapko confirm ho jaye ke reversal ho raha hai, tab aap short position le sakte hain. Aap bearish trade mein enter kar sakte hain aur market ke neeche girne ka faida utha sakte hain.

5. Significance of the Evening Star Pattern in Market Analysis

Evening Star pattern ki significance ko samajhna trading mein kaafi important hai. Yeh pattern aksar market ke reversal ko dikhata hai, jo traders ke liye ek valuable tool ban sakta hai. Is pattern ke formation ke baad, market mein sellers ka dominance zyada ho jata hai, jo price ko neeche girane ka sabab banta hai.

Traders is pattern ka use kar ke apne trades ko adjust karte hain, jisse unko potential profit mil sakta hai. Agar aap is pattern ko market ke overall trend ke saath combine karte hain, toh aapko zyada accurate results mil sakte hain. For example, agar aap dekh rahe hain ke market long time se bullish tha aur ab aapko Evening Star pattern nazar aa raha hai, toh aap expect kar sakte hain ke market mein ek bearish reversal ho sakta hai.

6. Limitations and Risks of the Evening Star Pattern

Jab ke Evening Star pattern ek reliable bearish signal deta hai, lekin is pattern ka use karte waqt kuch limitations aur risks bhi hain. Sabse pehla risk yeh hai ke yeh pattern false signals de sakta hai. Kabhi kabhi market mein short-term fluctuations ke wajah se yeh pattern ban jata hai, lekin market phir bhi bullish trend mein hi rehta hai.

Is liye, traders ko hamesha is pattern ko other indicators ke saath combine karna chahiye, jaise ke moving averages ya RSI (Relative Strength Index), taake yeh ensure ho sake ke signal sahi hai. Agar aap sirf Evening Star pattern pe depend karenge, toh aap false breakouts aur losses mein phans sakte hain.

Conclusion

Evening Star candlestick pattern ek powerful tool hai jo market mein reversal ko detect karne mein madad karta hai. Yeh pattern ek strong bearish signal deta hai jab market pehle se bullish trend mein hota hai. Is pattern ka use karte waqt risk management kaafi zaroori hai, aur isse dusre technical indicators ke saath combine karke aap apni trading strategies ko zyada effective bana sakte hain. Agar aap is pattern ko sahi tarike se samajhte hain aur apply karte hain, toh yeh aapki trading ko kaafi profitable bana sakta hai.

تبصرہ

Расширенный режим Обычный режим