Monte Carlo Simulation in Index Trading

Monte Carlo simulation ek statistical technique hai jo uncertainty aur randomness ko model karne ke liye use hoti hai. Ye method financial markets mein predictions banane ke liye bhi apply hoti hai, khaas tor pe index trading mein. Index trading mein, aap kisi stock market index (jaise S&P 500, NASDAQ, etc.) ke upar investment karte hain, aur Monte Carlo simulation aapko is index ke future performance ko predict karne mein madad deti hai.

What is Index Trading?

Index trading ka matlab hai kisi particular stock market index ko buy ya sell karna. Index ek group hota hai companies ka, jo kisi specific market ko represent karti hain. Jaise S&P 500 mein 500 large US companies hain. Jab aap index ko trade karte hain, toh aap in companies ke overall performance ka bet lagate hain, na ke individual stocks ka.

Iska faida ye hai ke aapko individual companies ke risk se bachne ka moka milta hai, lekin phir bhi market ke overall trends aur movements ka faida uthate hain.

Monte Carlo Simulation: Basic Concept

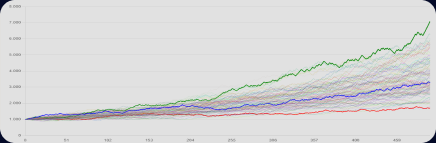

Monte Carlo simulation aik computational technique hai jo kisay bhi random process ko simulate karne ke liye use hoti hai. Isme, aap multiple random trials (ya “simulations”) run karte hain taake aapko kisi process ke possible outcomes ka ek distribution mil sake. Monte Carlo simulation ki khas baat ye hai ke ye randomness ko incorporate karti hai, jo real-world markets mein hoti hai.

Index trading mein, aap Monte Carlo simulation ko use karte hain taake market ke future moves ka prediction kar sakein. Ye simulation aapko har ek possible outcome dikhati hai, jisme risk aur uncertainty ko dhyan mein rakha jata hai.

How Monte Carlo Simulation Works in Index Trading?

Monte Carlo simulation ko index trading mein risk management ke liye bhi use kiya jata hai. Index trading mein risk kaafi hota hai, jaise price volatility, market crashes, ya unforeseen events (e.g., pandemics, economic downturns). Monte Carlo simulation aapko yeh samajhne mein madad deti hai ke in risks ka market ke future performance pe kya impact ho sakta hai.

For example, agar aap S&P 500 index ke upar invest kar rahe hain, toh Monte Carlo simulation aapko future price movements ke multiple scenarios dikhayegi, jisme worst-case aur best-case scenarios bhi shamil honge. Aap dekh sakte hain ke aapke investment pe risk kitna ho sakta hai, aur aap apni strategy accordingly adjust kar sakte hain.

Benefits of Using Monte Carlo Simulation in Index Trading

Monte Carlo simulation ek powerful tool hai jo index trading mein uncertainty ko handle karne, risk ko analyze karne aur different trading scenarios ko simulate karne mein madad deti hai. Iska use kar ke, aap apni investment strategy ko optimize kar sakte hain aur better decision-making kar sakte hain. Lekin, is technique ko use karte waqt, aapko iski limitations bhi samajhni chahiye aur simulation ke results ko carefully evaluate karna chahiye. Index trading mein Monte Carlo simulation ka istemal aapko market ke unpredictable nature ko samajhne aur apni trading strategies ko behtar banane mein madad de sakta hai.

Monte Carlo simulation ek statistical technique hai jo uncertainty aur randomness ko model karne ke liye use hoti hai. Ye method financial markets mein predictions banane ke liye bhi apply hoti hai, khaas tor pe index trading mein. Index trading mein, aap kisi stock market index (jaise S&P 500, NASDAQ, etc.) ke upar investment karte hain, aur Monte Carlo simulation aapko is index ke future performance ko predict karne mein madad deti hai.

What is Index Trading?

Index trading ka matlab hai kisi particular stock market index ko buy ya sell karna. Index ek group hota hai companies ka, jo kisi specific market ko represent karti hain. Jaise S&P 500 mein 500 large US companies hain. Jab aap index ko trade karte hain, toh aap in companies ke overall performance ka bet lagate hain, na ke individual stocks ka.

Iska faida ye hai ke aapko individual companies ke risk se bachne ka moka milta hai, lekin phir bhi market ke overall trends aur movements ka faida uthate hain.

Monte Carlo Simulation: Basic Concept

Monte Carlo simulation aik computational technique hai jo kisay bhi random process ko simulate karne ke liye use hoti hai. Isme, aap multiple random trials (ya “simulations”) run karte hain taake aapko kisi process ke possible outcomes ka ek distribution mil sake. Monte Carlo simulation ki khas baat ye hai ke ye randomness ko incorporate karti hai, jo real-world markets mein hoti hai.

Index trading mein, aap Monte Carlo simulation ko use karte hain taake market ke future moves ka prediction kar sakein. Ye simulation aapko har ek possible outcome dikhati hai, jisme risk aur uncertainty ko dhyan mein rakha jata hai.

How Monte Carlo Simulation Works in Index Trading?

- Define the Parameters: Sabse pehle, aapko woh parameters define karne hote hain jo simulation mein use honge. Ye parameters stock prices, volatility, returns, aur time horizon ho sakte hain.

- Random Sampling: Iske baad, aap random numbers generate karte hain jo price movements ya returns ko model karte hain. Yeh random numbers historical data, stock price distributions, ya probability functions se derive kiye jaate hain.

- Simulate Price Movements: Har random number ke sath, simulation ek possible path generate karti hai, jo future index price movements ko represent karta hai. Har trial ek different outcome ke liye hai.

- Repeat the Process: Simulation ko multiple times repeat kiya jata hai (e.g., 10,000 times). Har simulation ek different future price path dikhata hai.

- Analyze the Results: Jab simulation complete ho jati hai, toh aapko ek large dataset milti hai jo future outcomes ke possible scenarios ko represent karti hai. Aap in results ko analyze karte hain taake aapko expected returns, risk, aur probability distributions ka idea ho sake.

Monte Carlo simulation ko index trading mein risk management ke liye bhi use kiya jata hai. Index trading mein risk kaafi hota hai, jaise price volatility, market crashes, ya unforeseen events (e.g., pandemics, economic downturns). Monte Carlo simulation aapko yeh samajhne mein madad deti hai ke in risks ka market ke future performance pe kya impact ho sakta hai.

For example, agar aap S&P 500 index ke upar invest kar rahe hain, toh Monte Carlo simulation aapko future price movements ke multiple scenarios dikhayegi, jisme worst-case aur best-case scenarios bhi shamil honge. Aap dekh sakte hain ke aapke investment pe risk kitna ho sakta hai, aur aap apni strategy accordingly adjust kar sakte hain.

Benefits of Using Monte Carlo Simulation in Index Trading

- Uncertainty Modeling: Monte Carlo simulation randomness aur uncertainty ko realistically model karti hai. Aapko ek accurate representation milti hai ki market kis tarah behave kar sakta hai.

- Risk Assessment: Ye method aapko risk ko samajhne mein madad deti hai. Aap easily dekh sakte hain ke kis scenario mein aapka capital zyada risk mein hai aur kis mein aapko potential profits ho sakte hain.

- Scenario Analysis: Aap different market conditions ke under apne investment ke outcomes dekh sakte hain. Aapko har possible outcome ka probability distribution milta hai, jo decision-making ko behad effective banata hai.

- Improved Strategy Development: By using Monte Carlo simulations, you can test various trading strategies under different market conditions. Ye aapko ek deeper insight de sakti hai ki kis strategy ke sath aapko best results milne ki umeed ho sakti hai.

- Data Dependency: Monte Carlo simulation kaafi data-driven hoti hai. Agar aapke paas inaccurate ya incomplete data hai, toh simulation ke results bhi unreliable ho sakte hain.

- Complexity: Simulation ka process complex ho sakta hai, khaas agar aap multiple factors ko model kar rahe hain. Aapko advanced mathematical aur statistical tools ki zaroorat pad sakti hai.

- No Guarantee of Accuracy: Monte Carlo simulation ek tool hai, lekin future market movements ko accurately predict karne ki koi guarantee nahi hai. Ye only possible scenarios ke baare mein insight deti hai.

- Assumptions: Is method mein kuch assumptions bhi hoti hain, jaise randomness, historical trends, aur normal distribution. Agar market kisi unexpected direction mein move kare, toh simulation ka result inaccurate ho sakta hai.

Monte Carlo simulation ek powerful tool hai jo index trading mein uncertainty ko handle karne, risk ko analyze karne aur different trading scenarios ko simulate karne mein madad deti hai. Iska use kar ke, aap apni investment strategy ko optimize kar sakte hain aur better decision-making kar sakte hain. Lekin, is technique ko use karte waqt, aapko iski limitations bhi samajhni chahiye aur simulation ke results ko carefully evaluate karna chahiye. Index trading mein Monte Carlo simulation ka istemal aapko market ke unpredictable nature ko samajhne aur apni trading strategies ko behtar banane mein madad de sakta hai.

تبصرہ

Расширенный режим Обычный режим