Muqaddima

Fry Pan Bottom candlestick pattern share bazar mein ek bullish reversal ka aham signal samjha jata hai. Yeh pattern samajhne ke liye candlestick charting aur iska teek tajziya zaroori hai. Iss maqale mein hum Fry Pan Bottom pattern ki tafseelat, iski khasiyatain aur trading mein istemal hone wali strategies par mukammal roshni daalenge.

Candlestick Charting Ki Buniyad

Candlestick charting technical analysis ka ek intehai aham tool hai jo traders aur investors ko price movement ka tajziya karne mein madadgar hota hai. Har candlestick market ke ek waqt mein behavior ko represent karta hai - ismein opening, closing, high aur low prices shamil hoti hain. Yeh hamen market ke trend aur sentiment ka ehsaas dilata hai.

Fry Pan Bottom Pattern Ki Pehchan

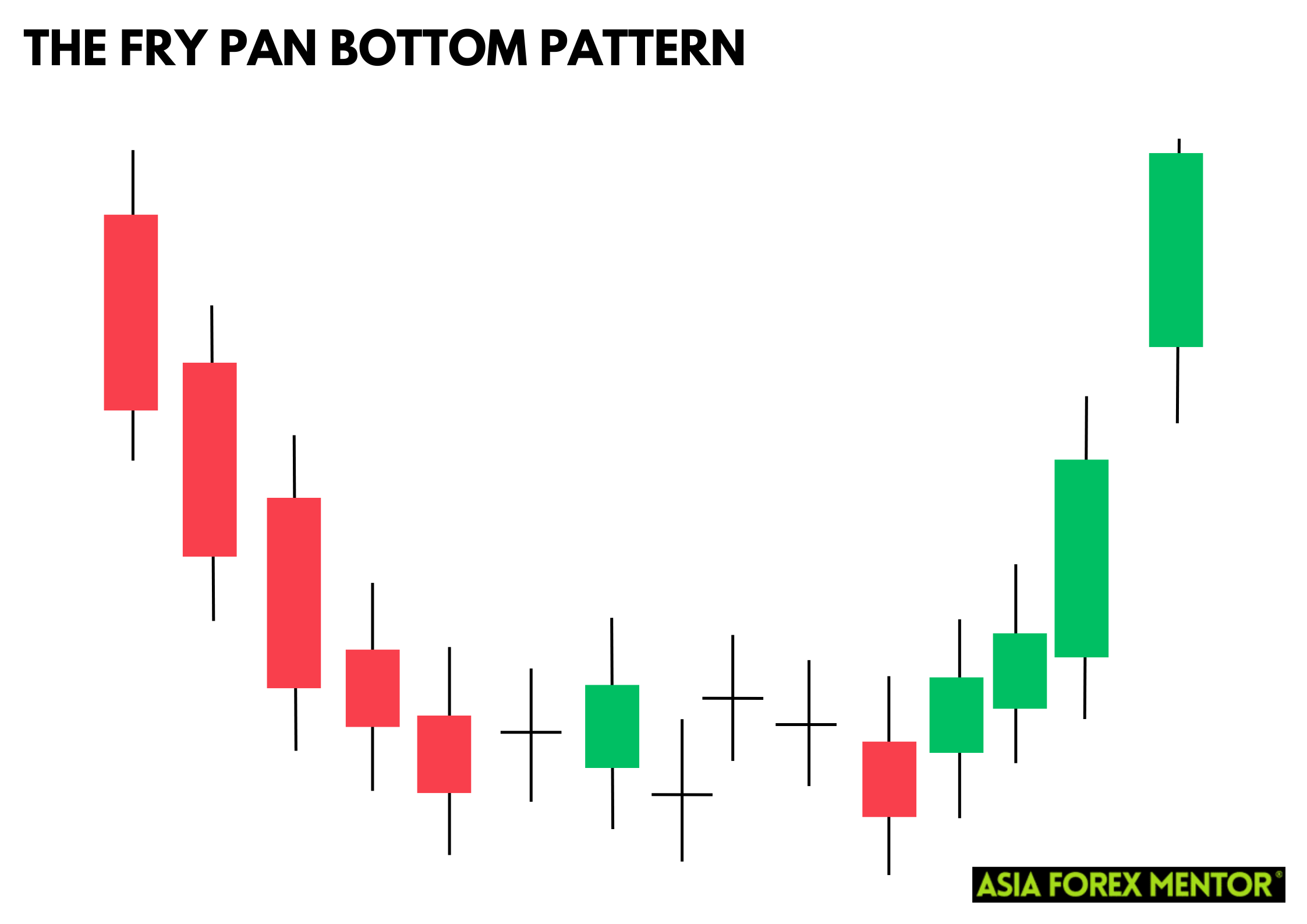

Fry Pan Bottom pattern ka naam iski khas shape ki wajah se diya gaya hai, jo frying pan ki tarah lagta hai. Yeh pattern aksar bearish trend ke baad nazar aata hai aur do ahem hissoon mein taqseem hota hai:

Base (Niche Wala Hissa): Is hisson mein market kuch waqt ke liye stable ya flat rehta hai. Yeh hissa 2-3 candlesticks par mabni hota hai jo low prices par hoti hain, magar abhi kisi reversal ka signal nahi deti.

Rim (Upar Wala Hissa): Market ke stable rehne ke baad yeh hissa shuru hota hai, jahan dheere dheere price mein izafa hota hai aur bullish momentum develop hota hai.

Fry Pan Bottom Pattern Ki Khasiyatain

Flat Base: Pattern ka pehla hissa aam taur par horizontal ya slight slope mein hota hai jo stability aur buyers ke market mein entry ka signal deta hai.

Aista Taraqqi: Rim hisson mein dheere dheere price barhne ka rujhaan hota hai jo bullish trend ke aghaaz ka signal deta hai.

Volume Ka Izafa: Agar price ke sath volume bhi izafa ho raha ho to yeh aur bhi mazboot bullish reversal signal ban jata hai.

Chart Example

Fry Pan Bottom pattern ko behtar samajhne ke liye charts ka tajziya ahem hai. Iss pattern mein aap dekh sakte hain ke kis tarah se pehle kuch candlesticks low prices par ban rahi hoti hain, aur phir dheere dheere price aur closing price upar ki taraf shift hoti hain.

Fry Pan Bottom Pattern Ki Trading Strategy

Fry Pan Bottom pattern ko trading mein istemal karne ke kuch zaroori steps hain:

Entry Point: Jab price rim ke upar barhne lage to yeh entry ka waqt hota hai. Is waqt confirmation candlestick ka intezaar zaroori hai.

Stop Loss Setting: Risk ko mohtaat tor par manage karne ke liye stop loss ko base ke niche rakhna chahiye.

Profit Target: Profit target ko pivot points ya resistance levels par set karein jahan trend ke ulatne ka imkaan ho.

Fry Pan Bottom Aur Fundamental Analysis

Fry Pan Bottom pattern ke sath sath market ke fundamental aspects ka tajziya bhi zaroori hai. Agar technical analysis bullish reversal ko support kar raha ho lekin fundamentals nahi karte, to trading se pehle market ka overall sentiment zaroor samajhna chahiye.

Forex Aur Commodities Mein Fry Pan Bottom

Fry Pan Bottom pattern sirf stocks ke liye nahi balki forex aur commodities mein bhi bullish reversal ka signal ban sakta hai. Agar forex market mein yeh pattern nazar aaye, to ye currency pairs mein ek positive trend ka ishara de sakta hai.

Nateejah

Fry Pan Bottom pattern ek qeemati tool hai jo bullish reversal ka signal deta hai. Is pattern ka behtar tajziya aur uske sath volume aur market fundamentals ka analysis karna zaroori hai. Agar aap is pattern ko samajh kar trading mein lagate hain, to yeh aapke liye profitable trading ke liye ek mazboot strategy sabit ho sakta hai.

Fry Pan Bottom candlestick pattern share bazar mein ek bullish reversal ka aham signal samjha jata hai. Yeh pattern samajhne ke liye candlestick charting aur iska teek tajziya zaroori hai. Iss maqale mein hum Fry Pan Bottom pattern ki tafseelat, iski khasiyatain aur trading mein istemal hone wali strategies par mukammal roshni daalenge.

Candlestick Charting Ki Buniyad

Candlestick charting technical analysis ka ek intehai aham tool hai jo traders aur investors ko price movement ka tajziya karne mein madadgar hota hai. Har candlestick market ke ek waqt mein behavior ko represent karta hai - ismein opening, closing, high aur low prices shamil hoti hain. Yeh hamen market ke trend aur sentiment ka ehsaas dilata hai.

Fry Pan Bottom Pattern Ki Pehchan

Fry Pan Bottom pattern ka naam iski khas shape ki wajah se diya gaya hai, jo frying pan ki tarah lagta hai. Yeh pattern aksar bearish trend ke baad nazar aata hai aur do ahem hissoon mein taqseem hota hai:

Base (Niche Wala Hissa): Is hisson mein market kuch waqt ke liye stable ya flat rehta hai. Yeh hissa 2-3 candlesticks par mabni hota hai jo low prices par hoti hain, magar abhi kisi reversal ka signal nahi deti.

Rim (Upar Wala Hissa): Market ke stable rehne ke baad yeh hissa shuru hota hai, jahan dheere dheere price mein izafa hota hai aur bullish momentum develop hota hai.

Fry Pan Bottom Pattern Ki Khasiyatain

Flat Base: Pattern ka pehla hissa aam taur par horizontal ya slight slope mein hota hai jo stability aur buyers ke market mein entry ka signal deta hai.

Aista Taraqqi: Rim hisson mein dheere dheere price barhne ka rujhaan hota hai jo bullish trend ke aghaaz ka signal deta hai.

Volume Ka Izafa: Agar price ke sath volume bhi izafa ho raha ho to yeh aur bhi mazboot bullish reversal signal ban jata hai.

Chart Example

Fry Pan Bottom pattern ko behtar samajhne ke liye charts ka tajziya ahem hai. Iss pattern mein aap dekh sakte hain ke kis tarah se pehle kuch candlesticks low prices par ban rahi hoti hain, aur phir dheere dheere price aur closing price upar ki taraf shift hoti hain.

Fry Pan Bottom Pattern Ki Trading Strategy

Fry Pan Bottom pattern ko trading mein istemal karne ke kuch zaroori steps hain:

Entry Point: Jab price rim ke upar barhne lage to yeh entry ka waqt hota hai. Is waqt confirmation candlestick ka intezaar zaroori hai.

Stop Loss Setting: Risk ko mohtaat tor par manage karne ke liye stop loss ko base ke niche rakhna chahiye.

Profit Target: Profit target ko pivot points ya resistance levels par set karein jahan trend ke ulatne ka imkaan ho.

Fry Pan Bottom Aur Fundamental Analysis

Fry Pan Bottom pattern ke sath sath market ke fundamental aspects ka tajziya bhi zaroori hai. Agar technical analysis bullish reversal ko support kar raha ho lekin fundamentals nahi karte, to trading se pehle market ka overall sentiment zaroor samajhna chahiye.

Forex Aur Commodities Mein Fry Pan Bottom

Fry Pan Bottom pattern sirf stocks ke liye nahi balki forex aur commodities mein bhi bullish reversal ka signal ban sakta hai. Agar forex market mein yeh pattern nazar aaye, to ye currency pairs mein ek positive trend ka ishara de sakta hai.

Nateejah

Fry Pan Bottom pattern ek qeemati tool hai jo bullish reversal ka signal deta hai. Is pattern ka behtar tajziya aur uske sath volume aur market fundamentals ka analysis karna zaroori hai. Agar aap is pattern ko samajh kar trading mein lagate hain, to yeh aapke liye profitable trading ke liye ek mazboot strategy sabit ho sakta hai.

تبصرہ

Расширенный режим Обычный режим