Keltner Channel Kya Hai? Ek Mukammal Rehnumai

Keltner Channel aik mashhoor technical indicator hai jo financial markets mein trading aur analysis ke liye use hota hai. Iska istamaal asaan hai aur yeh traders ko asset price ke trends aur volatility samajhne mein madad deta hai. Yeh article Keltner Channel ko samajhne aur iske istemal ko behtar banane ke liye 7 headings ke zariye rehnumai faraham karega.

1. Keltner Channel Ka Taaruf

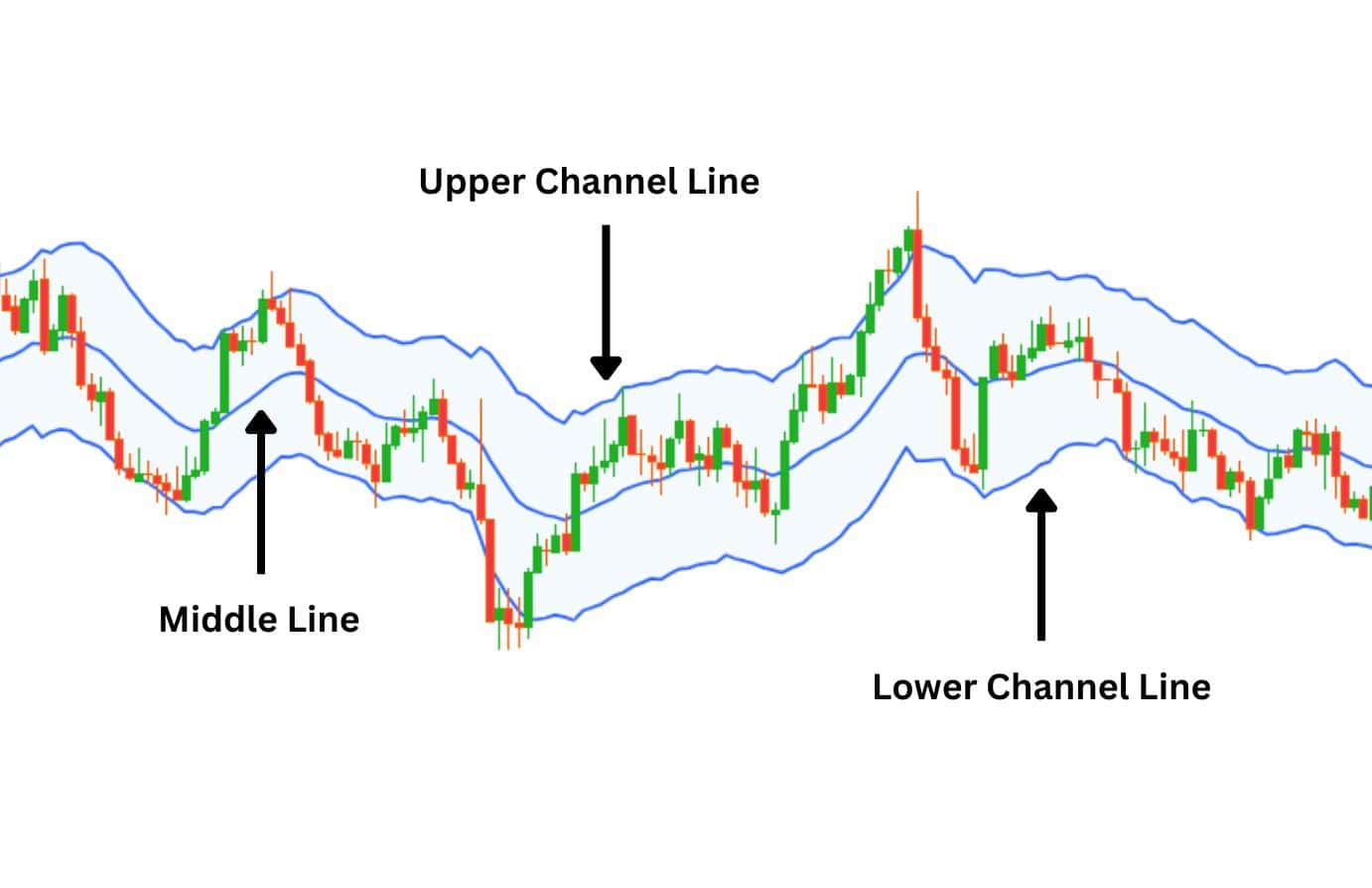

Keltner Channel aik trend-following indicator hai jo Charles Keltner ne 1960s mein introduce kiya. Yeh indicator price ke moving average aur volatility ko combine karta hai taake ek "channel" ya range banayi ja sake jisme price move karti hai. Yeh channel assets ki expected range dikhata hai, aur jab price is range ke bahar nikalti hai toh yeh potential trade signals provide karta hai.

2. Keltner Channel Banane Ka Tareeqa

Keltner Channel ko banane ke liye pehle asset ka moving average calculate kiya jata hai. Yeh moving average aksar 20-period exponential moving average (EMA) hota hai. Uske baad Average True Range (ATR) ka istemal kiya jata hai taake volatility measure ki ja sake. Keltner Channel ki upper aur lower lines moving average se ATR ke multiple ko add aur subtract karke banayi jati hain:

Ye multiplier aksar 2 hota hai lekin traders isay adjust kar sakte hain apni strategy ke mutabiq.

3. Keltner Channel Ka Maqsad aur Faida

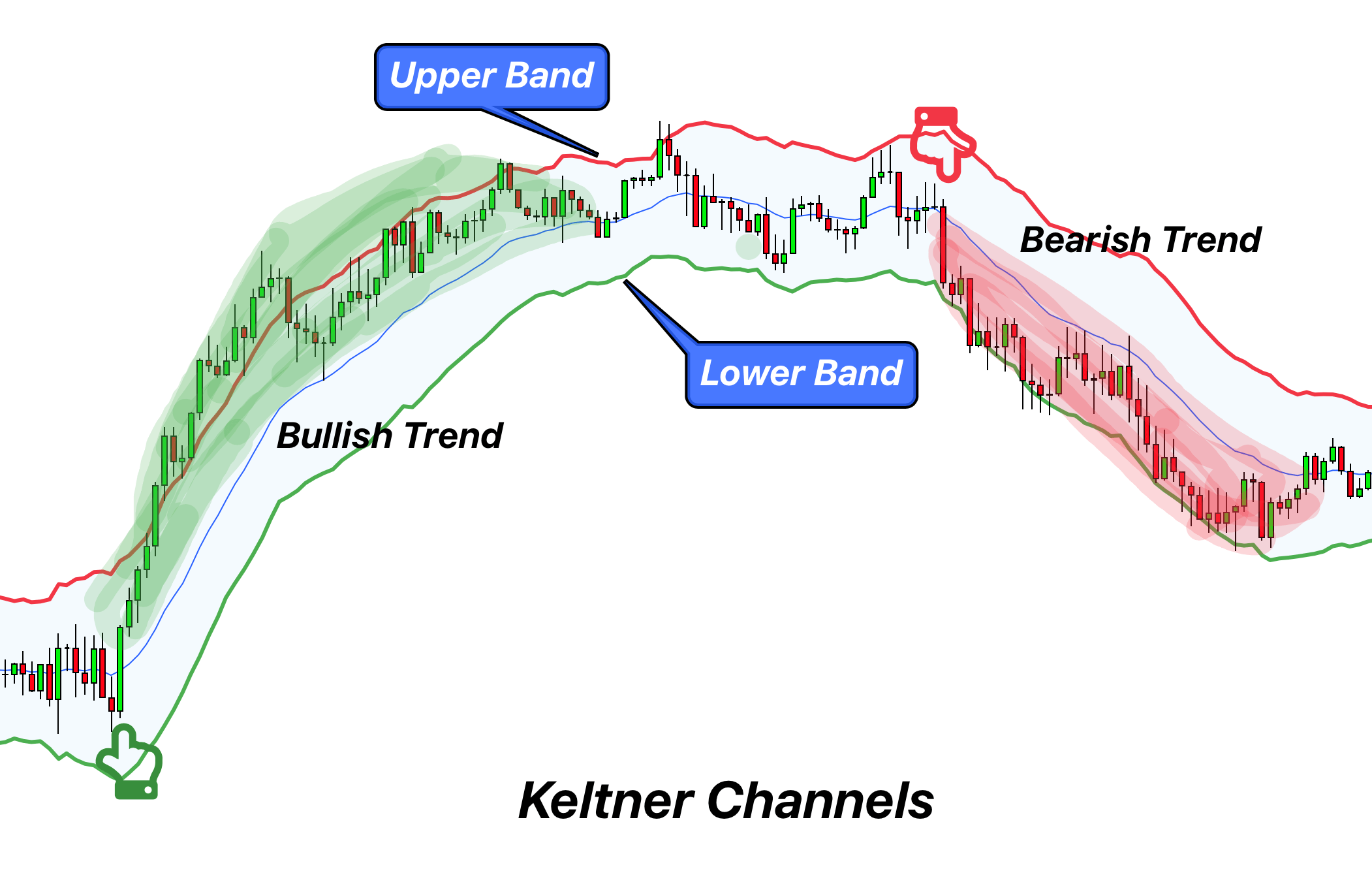

Keltner Channel ka asar trading decisions ko asaan banana hai. Yeh indicator price movements ke range ko highlight karta hai aur jab price channel ke upar ya neeche break hoti hai, toh yeh ek signal ho sakta hai ke price trend mein change aa raha hai. Yeh traders ko overbought aur oversold zones bhi identify karne mein madad deta hai, jisse wo time pe entry aur exit kar sakte hain.

4. Keltner Channel Aur Bollinger Bands Ka Farq

Bohat se traders Keltner Channel aur Bollinger Bands mein confuse hote hain kyunki dono indicators range-based hain. Lekin in dono mein kuch basic farq hain:

Keltner Channel ko trend-following indicators ke sath use karna asaan hota hai, jabke Bollinger Bands ziada chanchal markets ke liye behtar hain.

5. Keltner Channel Ke Signals Aur Inka Analysis

Keltner Channel ke kuch aham signals hain jo traders ko trading decisions lene mein madadgar hote hain:

Keltner Channel ko doosre indicators ke sath combine karke behtareen trading strategy banayi ja sakti hai. Kuch mashhoor indicators jo Keltner Channel ke sath use kiye jate hain wo hain:

Keltner Channel ko trading strategy mein shamil karna behtareen aur simple approach hai. Lekin hamesha yaad rakhen ke yeh indicator akele use karna risky ho sakta hai. Yeh kuch tareeqe hain jo Keltner Channel ko strategy mein shamil karte waqt madadgar ho sakte hain:

Keltner Channel trading aur market analysis mein aik qabil-e-aitmaad tool hai jo ke asaani se istamal ho sakta hai. Lekin yaad rakhein ke ye indicator best results tabhi dega jab ise doosre indicators ke sath combine kiya jaye aur trading strategy mein risk management ko bhi shamil kiya jaye.

Keltner Channel aik mashhoor technical indicator hai jo financial markets mein trading aur analysis ke liye use hota hai. Iska istamaal asaan hai aur yeh traders ko asset price ke trends aur volatility samajhne mein madad deta hai. Yeh article Keltner Channel ko samajhne aur iske istemal ko behtar banane ke liye 7 headings ke zariye rehnumai faraham karega.

1. Keltner Channel Ka Taaruf

Keltner Channel aik trend-following indicator hai jo Charles Keltner ne 1960s mein introduce kiya. Yeh indicator price ke moving average aur volatility ko combine karta hai taake ek "channel" ya range banayi ja sake jisme price move karti hai. Yeh channel assets ki expected range dikhata hai, aur jab price is range ke bahar nikalti hai toh yeh potential trade signals provide karta hai.

2. Keltner Channel Banane Ka Tareeqa

Keltner Channel ko banane ke liye pehle asset ka moving average calculate kiya jata hai. Yeh moving average aksar 20-period exponential moving average (EMA) hota hai. Uske baad Average True Range (ATR) ka istemal kiya jata hai taake volatility measure ki ja sake. Keltner Channel ki upper aur lower lines moving average se ATR ke multiple ko add aur subtract karke banayi jati hain:

- Upper Line = Moving Average + (ATR * Multiplier)

- Lower Line = Moving Average - (ATR * Multiplier)

Ye multiplier aksar 2 hota hai lekin traders isay adjust kar sakte hain apni strategy ke mutabiq.

3. Keltner Channel Ka Maqsad aur Faida

Keltner Channel ka asar trading decisions ko asaan banana hai. Yeh indicator price movements ke range ko highlight karta hai aur jab price channel ke upar ya neeche break hoti hai, toh yeh ek signal ho sakta hai ke price trend mein change aa raha hai. Yeh traders ko overbought aur oversold zones bhi identify karne mein madad deta hai, jisse wo time pe entry aur exit kar sakte hain.

4. Keltner Channel Aur Bollinger Bands Ka Farq

Bohat se traders Keltner Channel aur Bollinger Bands mein confuse hote hain kyunki dono indicators range-based hain. Lekin in dono mein kuch basic farq hain:

- Keltner Channel volatility ko ATR ke zariye measure karta hai, jabke Bollinger Bands standard deviation ka istemal karte hain.

- Keltner Channel price ke trends ke sath closely follow karta hai, jabke Bollinger Bands mein volatility zyada wide range cover karti hai.

Keltner Channel ko trend-following indicators ke sath use karna asaan hota hai, jabke Bollinger Bands ziada chanchal markets ke liye behtar hain.

5. Keltner Channel Ke Signals Aur Inka Analysis

Keltner Channel ke kuch aham signals hain jo traders ko trading decisions lene mein madadgar hote hain:

- Breakout Signal: Agar price Keltner Channel ki upper line se upar chali jaye, toh yeh bullish trend ka sign ho sakta hai, aur agar price lower line ke neeche break ho toh yeh bearish trend ka ishara hai. Lekin, yeh zaroori nahi ke har breakout ek reliable signal ho.

- Reversal Signal: Agar price channel ke ek side mein continuously rehti hai aur wapis central moving average ki taraf aati hai, toh yeh reversal ka ishara ho sakta hai. Yeh situation us waqt hoti hai jab market me temporary exhaustion aata hai.

Keltner Channel ko doosre indicators ke sath combine karke behtareen trading strategy banayi ja sakti hai. Kuch mashhoor indicators jo Keltner Channel ke sath use kiye jate hain wo hain:

- Relative Strength Index (RSI): RSI ke sath Keltner Channel ko use karna overbought aur oversold conditions identify karne mein madadgar hai. Agar RSI aur Keltner Channel dono overbought signal dein, toh yeh short-selling ka acha mauqa ho sakta hai.

- Moving Average Convergence Divergence (MACD): MACD aur Keltner Channel ke sath price trends aur reversals ka analysis asaan ho jata hai. Agar MACD crossover aur Keltner Channel breakout ek sath ho rahe hain, toh yeh strong trend ka indication ho sakta hai.

Keltner Channel ko trading strategy mein shamil karna behtareen aur simple approach hai. Lekin hamesha yaad rakhen ke yeh indicator akele use karna risky ho sakta hai. Yeh kuch tareeqe hain jo Keltner Channel ko strategy mein shamil karte waqt madadgar ho sakte hain:

- Trend Identification: Keltner Channel ke zariye pehle identify karein ke asset ka trend kya hai, aur uske mutabiq trading positions lehen.

- Breakout Trading: Jab bhi price upper ya lower line se break kare, toh potential trend follow karne ka sochain. Lekin yeh breakout signal ko doosre indicators ke sath confirm karna zaroori hai.

- Risk Management: Keltner Channel ki volatility measurement ki wajah se yeh risk management mein bhi madadgar hai. Stop-loss aur take-profit levels set karne ke liye Keltner Channel ki upper aur lower lines ko reference ke tor pe use karna acha hota hai.

Keltner Channel trading aur market analysis mein aik qabil-e-aitmaad tool hai jo ke asaani se istamal ho sakta hai. Lekin yaad rakhein ke ye indicator best results tabhi dega jab ise doosre indicators ke sath combine kiya jaye aur trading strategy mein risk management ko bhi shamil kiya jaye.

تبصرہ

Расширенный режим Обычный режим