Neckline Forex Trading mein ek aham factor hai jo traders ke liye bohat ahmiyat rakhta hai. Is article mein hm ap ko batayen gy k neckline kya hta h aur forex trading mein is ki kya ahmiyat hai.

Neckline details

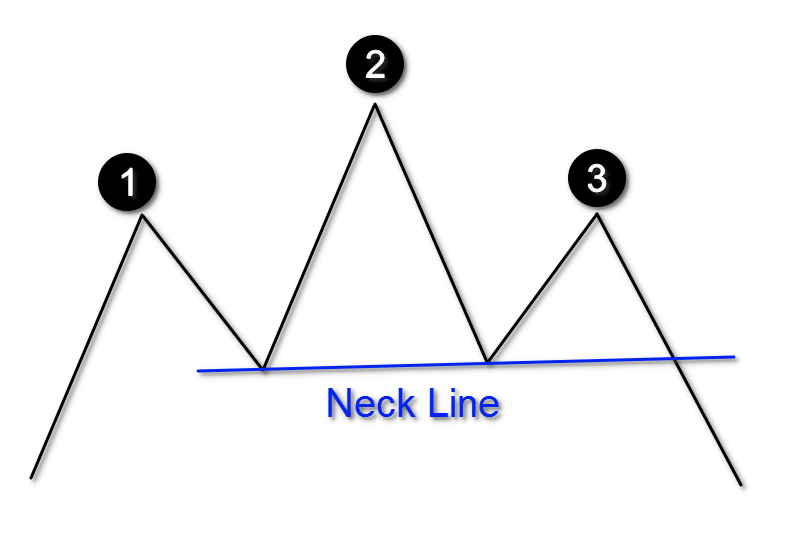

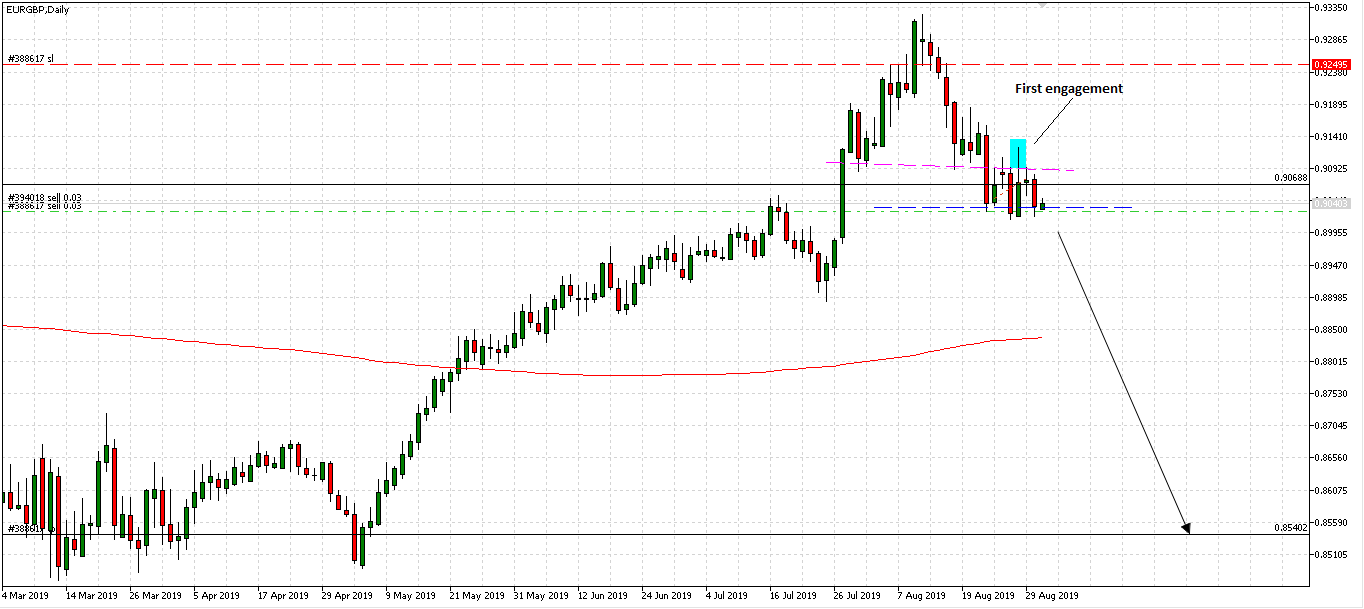

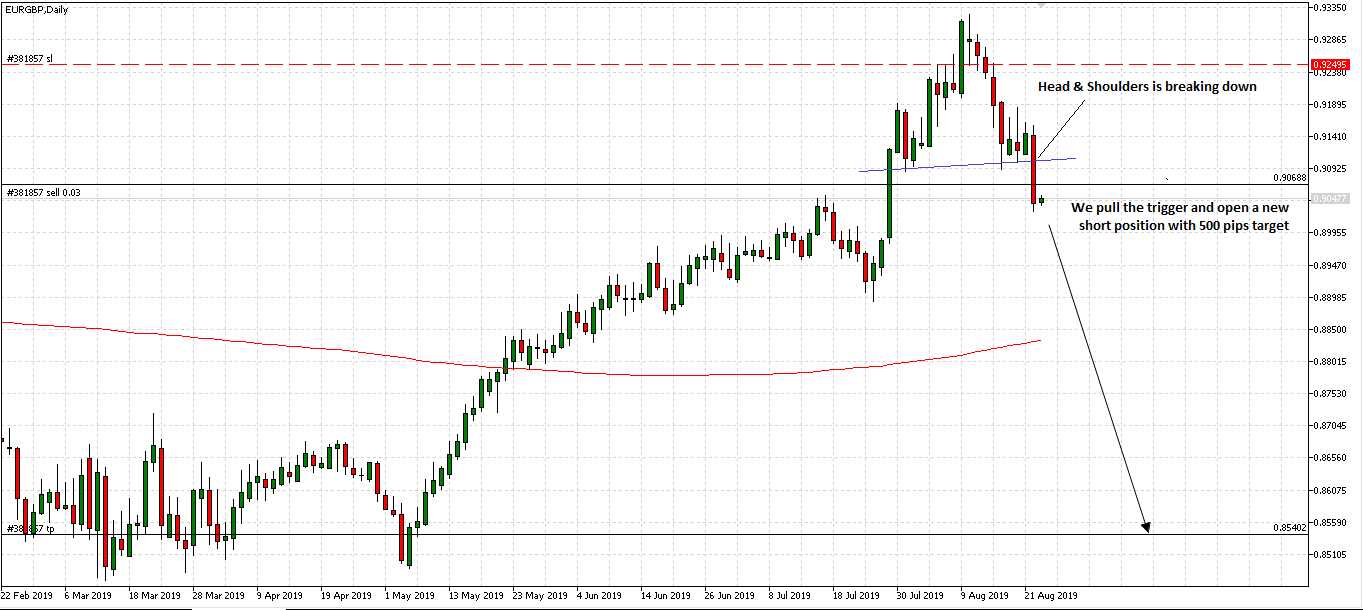

Neckline ek technical analysis tool hai jo chart analysis mein use hota hai. Jab koi stock ya currency pair ksi trend mein hta hto neckline trend ki pehchan karne mein madad dta hai. Neckline support aur resistance level ko represent krta h.

Importance of Neckline

Neckline forex trading me ek aham tool h jo traders ki madad karta hai trend analysis mein. Agar koi currency pair neckline se upr jaata hai to trend bullish yaani uptrend h aur agar neckline sy neeche jata h to trend bearish yaani down trend hai.

Signal indication

Neckline ke sath traders ko support aur resistance level ko b samajhna chahiye. Agar neckline support level ko cross karta hai to yeh bullish signal h,aur agar resistance level ko cross krta hai to ye bearish signal hai.

Analysis process

"Neckline"ko analyze karne se traders ko entry aur exit points ka pta chalta hai. Agar neckline se upar jaane wala trend confirm ho jaaye to traders ko buy karna chahiye aur agar neckline se neeche jaane wala trend confirm ho jaaye to traders ko sell karna chahiye.

Conclusion

Neckline forex trading mein ek aham tool hai jo trend analysis mein madad dta h. Traders ko neckline ko analyze karke support aur resistance level ko samajhna chahiye. Neckline ke saath, traders ko entry aur exit points ka pata chalta hai.

Neckline details

Neckline ek technical analysis tool hai jo chart analysis mein use hota hai. Jab koi stock ya currency pair ksi trend mein hta hto neckline trend ki pehchan karne mein madad dta hai. Neckline support aur resistance level ko represent krta h.

Importance of Neckline

Neckline forex trading me ek aham tool h jo traders ki madad karta hai trend analysis mein. Agar koi currency pair neckline se upr jaata hai to trend bullish yaani uptrend h aur agar neckline sy neeche jata h to trend bearish yaani down trend hai.

Signal indication

Neckline ke sath traders ko support aur resistance level ko b samajhna chahiye. Agar neckline support level ko cross karta hai to yeh bullish signal h,aur agar resistance level ko cross krta hai to ye bearish signal hai.

Analysis process

"Neckline"ko analyze karne se traders ko entry aur exit points ka pta chalta hai. Agar neckline se upar jaane wala trend confirm ho jaaye to traders ko buy karna chahiye aur agar neckline se neeche jaane wala trend confirm ho jaaye to traders ko sell karna chahiye.

Conclusion

Neckline forex trading mein ek aham tool hai jo trend analysis mein madad dta h. Traders ko neckline ko analyze karke support aur resistance level ko samajhna chahiye. Neckline ke saath, traders ko entry aur exit points ka pata chalta hai.

تبصرہ

Расширенный режим Обычный режим