Daw Theory ek trading aur investment approach hai jo Charles Dow ne 19th century ke akhir mein develop ki thi. Ye theory financial markets ki price movement ko samajhne ke liye use ki jati hai, khaaskar forex aur stock market mein. Dow Theory ka ye kehna hai ke market ki movement random nahi hoti, balki kuch specific trends aur patterns ke mutabiq chalti hai. Is theory ke zariye traders aur investors apni investments ko samajh sakte hain aur unhe better manage kar sakte hain.

Market Trends and Dow Theory

Dow Theory ke mutabiq, market teen main trends mein chalti hai: primary, secondary, aur minor. Primary trend wo hota hai jo bohot lambi duration ke liye chalta hai, jaise ke ek saal ya us se zyada. Ye trend ya to bullish (upar ki taraf) ho sakta hai ya bearish (neeche ki taraf). Secondary trend wo hota hai jo primary trend ke against short-term reversal ya correction hota hai, jo kuch hafte ya mahine tak reh sakta hai. Minor trend short-term fluctuations hota hai jo din ya hafto tak rehta hai, aur ye markets ke daily volatility ke wajah se hota hai.

Market Phases

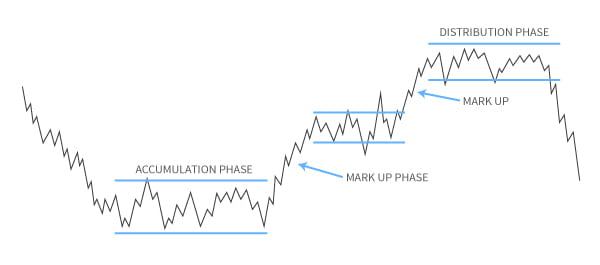

Dow Theory market ko teen phases mein divide karti hai: accumulation phase, public participation phase, aur distribution phase. Accumulation phase mein smart investors aur professional traders assets buy karte hain jab ke market depressed hoti hai aur prices low hoti hain. Public participation phase wo hota hai jab aam log bhi market mein interest lena shuru kar dete hain aur prices rapid growth dikha rahi hoti hain. Distribution phase mein wo log jo pehle se investment kar chuke hote hain wo apne assets sell karte hain kyunke prices high ho jati hain aur unhe lagta hai ke market ab neeche aane wali hai.

Use of Dow Theory in Forex Trading

Forex trading mein, Dow Theory ka istimaal trends aur phases ko samajhne ke liye kiya jata hai. Forex traders primary trend ko pehchan kar ke long-term buy ya sell positions le sakte hain. Agar primary trend bullish ho, to trader apni strategy ko us ke mutabiq adjust kar sakte hain aur buying positions prefer karte hain. Isi tarah, agar trend bearish ho, to selling positions pe focus kiya jata hai. Iske ilawa, Dow Theory ke phases ka bhi forex mein analysis hota hai jisse traders accumulation aur distribution phases ka faida uthate hain aur apne profits maximize kar sakte hain.

Market Trends and Dow Theory

Dow Theory ke mutabiq, market teen main trends mein chalti hai: primary, secondary, aur minor. Primary trend wo hota hai jo bohot lambi duration ke liye chalta hai, jaise ke ek saal ya us se zyada. Ye trend ya to bullish (upar ki taraf) ho sakta hai ya bearish (neeche ki taraf). Secondary trend wo hota hai jo primary trend ke against short-term reversal ya correction hota hai, jo kuch hafte ya mahine tak reh sakta hai. Minor trend short-term fluctuations hota hai jo din ya hafto tak rehta hai, aur ye markets ke daily volatility ke wajah se hota hai.

Market Phases

Dow Theory market ko teen phases mein divide karti hai: accumulation phase, public participation phase, aur distribution phase. Accumulation phase mein smart investors aur professional traders assets buy karte hain jab ke market depressed hoti hai aur prices low hoti hain. Public participation phase wo hota hai jab aam log bhi market mein interest lena shuru kar dete hain aur prices rapid growth dikha rahi hoti hain. Distribution phase mein wo log jo pehle se investment kar chuke hote hain wo apne assets sell karte hain kyunke prices high ho jati hain aur unhe lagta hai ke market ab neeche aane wali hai.

Use of Dow Theory in Forex Trading

Forex trading mein, Dow Theory ka istimaal trends aur phases ko samajhne ke liye kiya jata hai. Forex traders primary trend ko pehchan kar ke long-term buy ya sell positions le sakte hain. Agar primary trend bullish ho, to trader apni strategy ko us ke mutabiq adjust kar sakte hain aur buying positions prefer karte hain. Isi tarah, agar trend bearish ho, to selling positions pe focus kiya jata hai. Iske ilawa, Dow Theory ke phases ka bhi forex mein analysis hota hai jisse traders accumulation aur distribution phases ka faida uthate hain aur apne profits maximize kar sakte hain.

تبصرہ

Расширенный режим Обычный режим