Trade Execution aur Engulfing Pattern ki Samajh

Trade execution ka matlab hota hai kisi trade ko initiate karna, yani buy ya sell order place karna. Yeh trading ka bohot zaroori step hai jisme trader apni strategy ko implement karta hai aur market mein position leta hai. Engulfing pattern ek candlestick pattern hai jo ke trend reversal ka ishara deta hai aur trading mein market ke sentiments ko pehchanne ke liye bohot istemal hota hai.

Engulfing Pattern Ka Asal Matlab

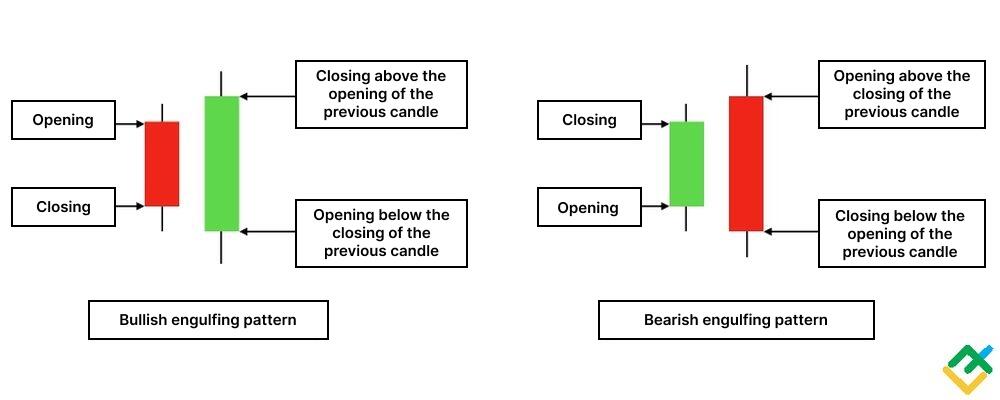

Engulfing pattern mein do candles hoti hain - ek choti candle aur doosri badi candle jo ke pehli candle ko puri tarah se cover ya "engulf" kar leti hai. Do mukhtalif kisam ke engulfing patterns hain:

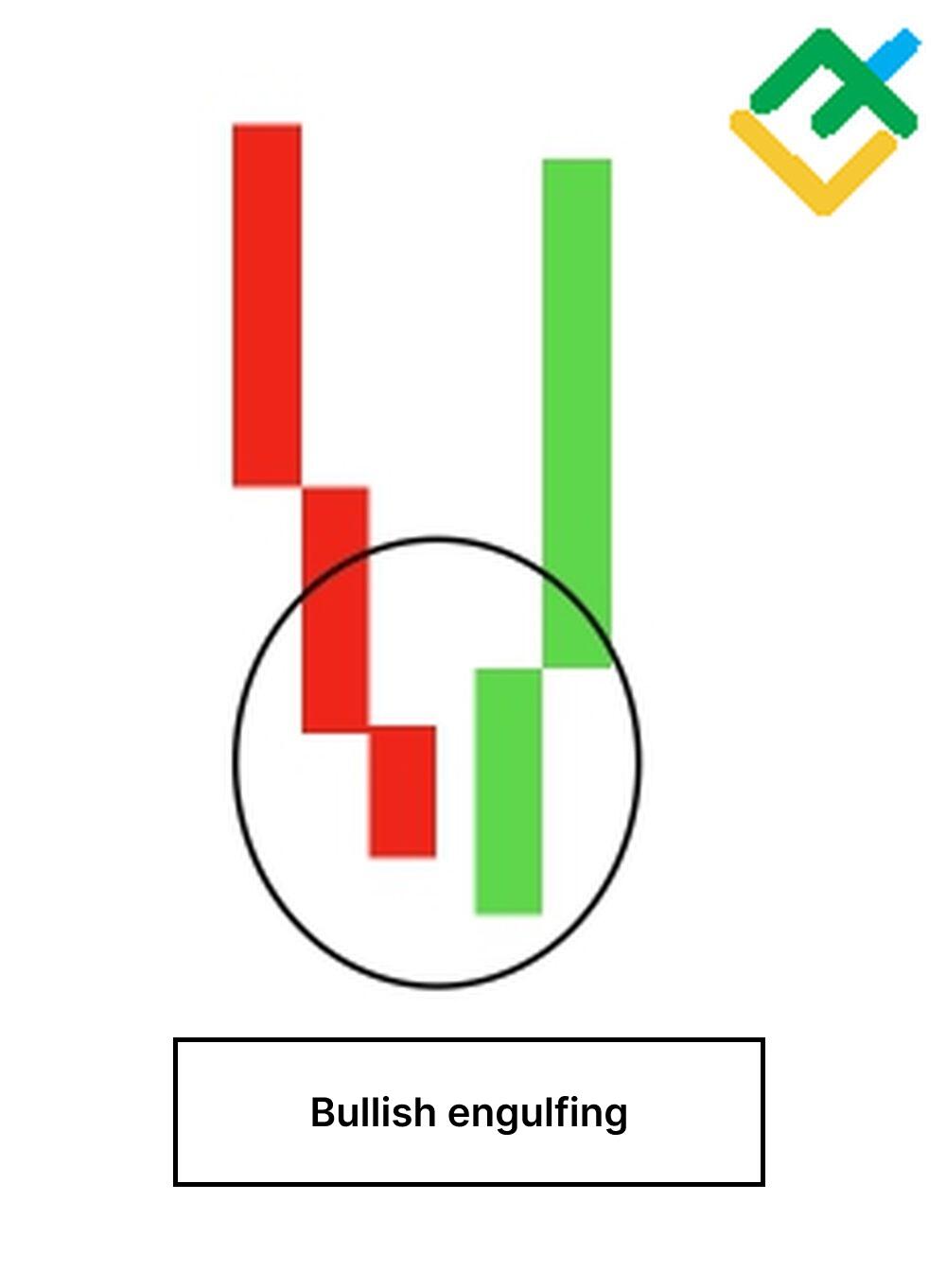

1. Bullish Engulfing Pattern: Yeh tab hota hai jab market mein bearish trend ho aur ek green (bullish) candle, red (bearish) candle ko engulf kar le. Iska matlab hota hai ke buyers ne control le liya hai aur price upar ja sakti hai.

2. Bearish Engulfing Pattern: Yeh tab hota hai jab market bullish ho aur ek red candle, green candle ko engulf kar le. Yeh ishara hai ke sellers ne control le liya hai aur price neeche gir sakti hai.

Entry Point Pe Tawajju

Engulfing pattern par trade execute karte waqt entry point pe tawajju dena zaroori hota hai. Jab bullish engulfing pattern ban jaye, toh trader doosri green candle ke close hone ka intezaar karta hai takay trend reversal ki confirmation mil sake. Uske baad agle candle ke open hote hi buy order place kiya jata hai.

Wahi tareeqa bearish engulfing pattern mein bhi hota hai. Trader doosri red candle ke close hone ka intezaar karta hai aur phir sell order place karta hai. Entry ke liye ye confirmation isliye zaroori hai ke false signals se bacha ja sake.

Stop Loss aur Target Levels ka Tayeun

Engulfing pattern ke sath trade karte waqt stop loss aur target levels set karna bhi bohot zaroori hai:

Bullish Engulfing: Stop loss ko bearish candle ke low ke niche rakhte hain.

Bearish Engulfing: Stop loss ko bullish candle ke high ke upar rakhte hain.

Target level set karte waqt trader risk-reward ratio dekh kar decide karta hai ke kitna profit lena hai. Aam taur par engulfing pattern ke sath 1:2 ya 1:3 ka risk-reward ratio rakha jata hai.

Volume ka Kirdar

Volume bhi engulfing pattern ke sath trade execution mein ahm kirdar ada karta hai. Agar bullish ya bearish engulfing pattern ke sath volume bhi zyada ho, toh yeh market mein strong buying ya selling pressure ko zahir karta hai. High volume ke sath engulfing pattern ka signal zyada reliable aur trend reversal ka chance bhi barh jata hai.

Time Frame ka Intikhab

Engulfing pattern har time frame par kaam karta hai lekin iski strength aur reliability mukhtalif hoti hai. Short time frames (jaise 5-minute ya 15-minute) par patterns zyada bante hain lekin signals kamzor ho sakte hain. Long time frames, jaise 1-hour, daily, ya weekly, par engulfing patterns strong aur reliable hote hain. Isliye trading strategy aur market conditions ke mutabiq time frame ka intekhab zaroori hai.

Risk Management aur Position Sizing

Risk management aur position sizing trade execution mein essential hain. Har trade mein apne capital ka chhota hissa hi invest karna chahiye taake agar trade market ke against bhi jaye toh bhi total capital par zyada asar na ho. Engulfing pattern ke sath trade karte waqt risk management ko hamesha priority deni chahiye.

Nateeja

Engulfing pattern ek maqbool aur effective candlestick pattern hai jo ke traders ko market ke trend reversal ka pata lagane mein madad deta hai. Is pattern ke sath trade karte waqt entry points, stop loss, target levels, volume aur time frame par tawajju dena bohot zaroori hai. Iske sath sath, risk management aur position sizing bhi important hain taake trades zyada safe aur profitable rahen.

Trade execution ka matlab hota hai kisi trade ko initiate karna, yani buy ya sell order place karna. Yeh trading ka bohot zaroori step hai jisme trader apni strategy ko implement karta hai aur market mein position leta hai. Engulfing pattern ek candlestick pattern hai jo ke trend reversal ka ishara deta hai aur trading mein market ke sentiments ko pehchanne ke liye bohot istemal hota hai.

Engulfing Pattern Ka Asal Matlab

Engulfing pattern mein do candles hoti hain - ek choti candle aur doosri badi candle jo ke pehli candle ko puri tarah se cover ya "engulf" kar leti hai. Do mukhtalif kisam ke engulfing patterns hain:

1. Bullish Engulfing Pattern: Yeh tab hota hai jab market mein bearish trend ho aur ek green (bullish) candle, red (bearish) candle ko engulf kar le. Iska matlab hota hai ke buyers ne control le liya hai aur price upar ja sakti hai.

2. Bearish Engulfing Pattern: Yeh tab hota hai jab market bullish ho aur ek red candle, green candle ko engulf kar le. Yeh ishara hai ke sellers ne control le liya hai aur price neeche gir sakti hai.

Entry Point Pe Tawajju

Engulfing pattern par trade execute karte waqt entry point pe tawajju dena zaroori hota hai. Jab bullish engulfing pattern ban jaye, toh trader doosri green candle ke close hone ka intezaar karta hai takay trend reversal ki confirmation mil sake. Uske baad agle candle ke open hote hi buy order place kiya jata hai.

Wahi tareeqa bearish engulfing pattern mein bhi hota hai. Trader doosri red candle ke close hone ka intezaar karta hai aur phir sell order place karta hai. Entry ke liye ye confirmation isliye zaroori hai ke false signals se bacha ja sake.

Stop Loss aur Target Levels ka Tayeun

Engulfing pattern ke sath trade karte waqt stop loss aur target levels set karna bhi bohot zaroori hai:

Bullish Engulfing: Stop loss ko bearish candle ke low ke niche rakhte hain.

Bearish Engulfing: Stop loss ko bullish candle ke high ke upar rakhte hain.

Target level set karte waqt trader risk-reward ratio dekh kar decide karta hai ke kitna profit lena hai. Aam taur par engulfing pattern ke sath 1:2 ya 1:3 ka risk-reward ratio rakha jata hai.

Volume ka Kirdar

Volume bhi engulfing pattern ke sath trade execution mein ahm kirdar ada karta hai. Agar bullish ya bearish engulfing pattern ke sath volume bhi zyada ho, toh yeh market mein strong buying ya selling pressure ko zahir karta hai. High volume ke sath engulfing pattern ka signal zyada reliable aur trend reversal ka chance bhi barh jata hai.

Time Frame ka Intikhab

Engulfing pattern har time frame par kaam karta hai lekin iski strength aur reliability mukhtalif hoti hai. Short time frames (jaise 5-minute ya 15-minute) par patterns zyada bante hain lekin signals kamzor ho sakte hain. Long time frames, jaise 1-hour, daily, ya weekly, par engulfing patterns strong aur reliable hote hain. Isliye trading strategy aur market conditions ke mutabiq time frame ka intekhab zaroori hai.

Risk Management aur Position Sizing

Risk management aur position sizing trade execution mein essential hain. Har trade mein apne capital ka chhota hissa hi invest karna chahiye taake agar trade market ke against bhi jaye toh bhi total capital par zyada asar na ho. Engulfing pattern ke sath trade karte waqt risk management ko hamesha priority deni chahiye.

Nateeja

Engulfing pattern ek maqbool aur effective candlestick pattern hai jo ke traders ko market ke trend reversal ka pata lagane mein madad deta hai. Is pattern ke sath trade karte waqt entry points, stop loss, target levels, volume aur time frame par tawajju dena bohot zaroori hai. Iske sath sath, risk management aur position sizing bhi important hain taake trades zyada safe aur profitable rahen.

تبصرہ

Расширенный режим Обычный режим