Trading mein overbought aur oversold do ahem terms hain jo market ke conditions aur price action ko samajhne mein madad karte hain. Yeh terms technical indicators par mabni hain aur ye batate hain ke kisi asset (jaise ke stocks, forex, ya cryptocurrency) ki price ek specific level par pohanch gayi hai jahan se ya to price gir sakti hai (overbought) ya phir barh sakti hai (oversold). Yeh dono concepts trading ke liye bohat important hain kyunke yeh market ke reversal points ko highlight karte hain jahan se price action ka direction badal sakta hai.

Overbought aur Oversold kya hain

Overbought aur oversold levels ko identify karne ke liye kuch popular technical indicators ka use kiya jata hai. In indicators ke through traders ko yeh samajhne mein asaani hoti hai ke koi asset overbought hai ya oversold, aur yeh indicators unke trading decisions ko guide karte hain.

Important Indicators jo Overbought aur Oversold ko Identify Karte Hain

Traders overbought aur oversold conditions ko use karte hain taake market ke reversal points par trade enter ya exit kar saken. Yahan kuch strategies hain jo overbought aur oversold levels par trading ke liye istimaal ki jaati hain:

Faide

Overbought aur Oversold ka Practical Example

Agar aik stock ka RSI 75 hai, to yeh overbought condition ko indicate karta hai. Iska matlab hai ke ab is stock ki price upar se neeche aane ka chance hai. Trader yahan par sell ya short position open kar sakta hai aur stop loss ko thoda upar set kar sakta hai taake agar price zyada upar jaye to risk manage ho sake. Aise hi, agar ek stock ka RSI 25 hai, to yeh oversold condition hai aur price ke rebound hone ka chance hai. Trader is level par buy position open kar sakta hai aur apna stop loss is level se neeche set kar sakta hai.

Overbought aur oversold levels trading ke liye bohot valuable hain kyunke yeh market ke trend reversal aur entry-exit points ko samajhne mein madadgar hain. Inhe samajhne ke liye RSI, Stochastic Oscillator, Bollinger Bands aur CCI jaise indicators use kiye jate hain jo trading mein high probability trade setups provide karte hain. Har trader ko yeh indicators aur inka analysis samajhna chahiye aur apni trading strategy mein shamil karna chahiye. Lekin, inka andha dhund use nahi karna chahiye kyunke market ka trend aur volatility bhi dekhni chahiye taake accurate decision-making ho sake.

Overbought aur Oversold kya hain

- Overbought: Jab koi asset (jaise stock, currency, ya commodity) ki price bohot zyada barh jati hai aur wo apni actual value se zyada high levels par trade ho rahi hoti hai, to us condition ko "overbought" kaha jata hai. Yeh condition us waqt hoti hai jab buyers ne excessive buying kar li ho aur asset ki price short-term mein kaafi upar pohanch gayi ho. Overbought ka matlab yeh hota hai ke ab market mein price ke girne ka chance barh gaya hai, kyunke price apne maximum potential par hai.

- Oversold: Oversold wo situation hai jab asset ki price kaafi zyada gir gayi ho aur wo apni intrinsic ya fair value se neeche trade ho rahi ho. Yeh condition tab aati hai jab sellers ne excessive selling ki ho aur ab buyers ke interest badhne ka chance hota hai. Oversold condition mein price ke rebound karne yani wapas upar jane ka chance hota hai kyunke ab wo asset low price par attractive lag raha hota hai.

Overbought aur oversold levels ko identify karne ke liye kuch popular technical indicators ka use kiya jata hai. In indicators ke through traders ko yeh samajhne mein asaani hoti hai ke koi asset overbought hai ya oversold, aur yeh indicators unke trading decisions ko guide karte hain.

Important Indicators jo Overbought aur Oversold ko Identify Karte Hain

- Relative Strength Index (RSI):

- RSI aik popular momentum indicator hai jo overbought aur oversold levels ko identify karne mein madad karta hai. Iska scale 0 se 100 tak hota hai.

- Jab RSI 70 se zyada hota hai, to asset overbought condition mein samjha jata hai, yani price upar se u-turn le sakti hai.

- Jab RSI 30 se neeche hota hai, to asset oversold condition mein samjha jata hai, yani ab price niche se u-turn le sakti hai.

- Stochastic Oscillator:

- Stochastic Oscillator bhi overbought aur oversold conditions ko highlight karta hai. Iska scale bhi 0 se 100 tak hota hai.

- Jab yeh indicator 80 se upar ho, to asset overbought condition mein hota hai.

- Jab yeh 20 se neeche ho, to asset oversold condition mein hota hai.

- Stochastic oscillator market ki momentum aur price ka trend reversal samajhne mein madad karta hai.

- Commodity Channel Index (CCI):

- CCI aik aur indicator hai jo market ki momentum aur trend ko study karta hai. Yeh -100 se +100 ke darmiyan operate karta hai.

- Jab CCI +100 ke upar ho, to asset overbought condition mein hota hai aur price neeche ja sakti hai.

- Jab CCI -100 ke neeche ho, to asset oversold condition mein hota hai aur price rebound kar sakti hai.

- Bollinger Bands:

- Bollinger Bands aik volatility indicator hai jo price ke overbought aur oversold levels ko pehchan'ne mein madadgar hai. Bollinger Bands ke upper aur lower bands price ke range aur volatility ko indicate karte hain.

- Jab price upper band ke kareeb hoti hai, to asset overbought samjha jata hai aur price neeche aane ka chance hota hai.

- Jab price lower band ke kareeb hoti hai, to asset oversold samjha jata hai aur price upar jane ka chance hota hai.

Traders overbought aur oversold conditions ko use karte hain taake market ke reversal points par trade enter ya exit kar saken. Yahan kuch strategies hain jo overbought aur oversold levels par trading ke liye istimaal ki jaati hain:

- RSI Reversal Strategy:

- Jab RSI 70 ya is se upar pohanch jaye to yeh overbought condition hai aur yahan short-sell ya sell karna profitable ho sakta hai.

- Similarly, jab RSI 30 ya neeche ho to yeh oversold condition hai aur yahan buy ya long position enter karna profitable ho sakta hai.

- Is strategy mein, trader RSI ka use karta hai aur jab yeh critical levels par hota hai to trade open ya close karta hai.

- Stochastic Crossover Strategy:

- Jab stochastic oscillator overbought level (80) ke kareeb ho aur %K line %D line ko neeche ki taraf cross kare, to yeh sell signal hai.

- Jab stochastic oscillator oversold level (20) ke kareeb ho aur %K line %D line ko upar ki taraf cross kare, to yeh buy signal hai.

- Yeh strategy momentum aur trend reversal par based hai aur traders ko high-probability trade setups offer karti hai.

- Bollinger Bands Bounce Strategy:

- Bollinger Bands ko use karke overbought aur oversold levels ko dekhte hain. Jab price upper band ko touch kare to yeh overbought signal hai aur yahan se price neeche gir sakti hai.

- Jab price lower band ko touch kare to yeh oversold signal hai aur yahan se price rebound kar sakti hai.

- Yeh strategy volatility par based hai aur price ke reversal ko trade karne mein madadgar hai.

- Divergence Strategy:

- Divergence ka matlab hai ke indicator aur price action opposite directions mein move kar rahe hain.

- Agar price higher highs banaye lekin RSI lower highs bana rahi ho, to yeh bearish divergence hai aur overbought condition ke baad price gir sakti hai.

- Similarly, agar price lower lows banaye lekin RSI higher lows bana rahi ho, to yeh bullish divergence hai aur oversold condition ke baad price barh sakti hai.

Faide

- Market Reversals ko Samajhna: Overbought aur oversold levels ke through traders reversal points ko pehchan sakte hain, jo ke profitable trade setups de sakte hain.

- Risk Management mein Madad: Yeh levels risk management ko asaan banate hain kyunke traders ko apne stop-loss aur take profit levels ka andaaza hota hai.

- Entry aur Exit Points: Yeh indicators asaan aur clear entry aur exit points provide karte hain jo trading ko efficient aur profitable banate hain.

- False Signals: Kabhi kabhi overbought aur oversold levels ke bawajood market trend continue karti hai aur is wajah se losses ho sakte hain.

- Market Manipulation ka Asar: Agar market mein manipulation ya high volatility ho to yeh indicators unreliable ho sakte hain aur loss ho sakta hai.

- Context ka Farq: Overbought aur oversold indicators har market condition mein kaam nahi karte. Strong trends mein yeh levels mislead kar sakte hain.

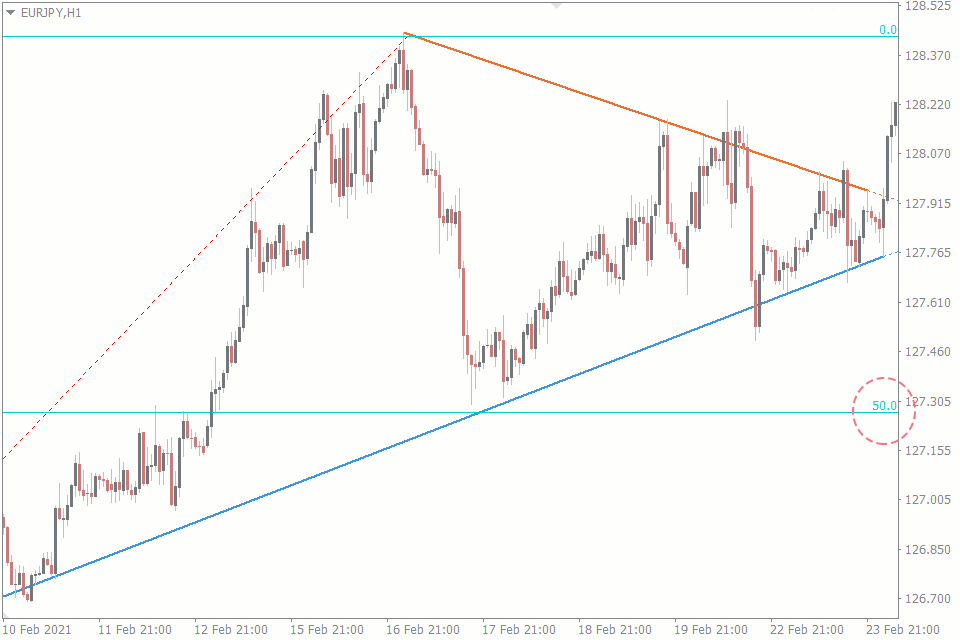

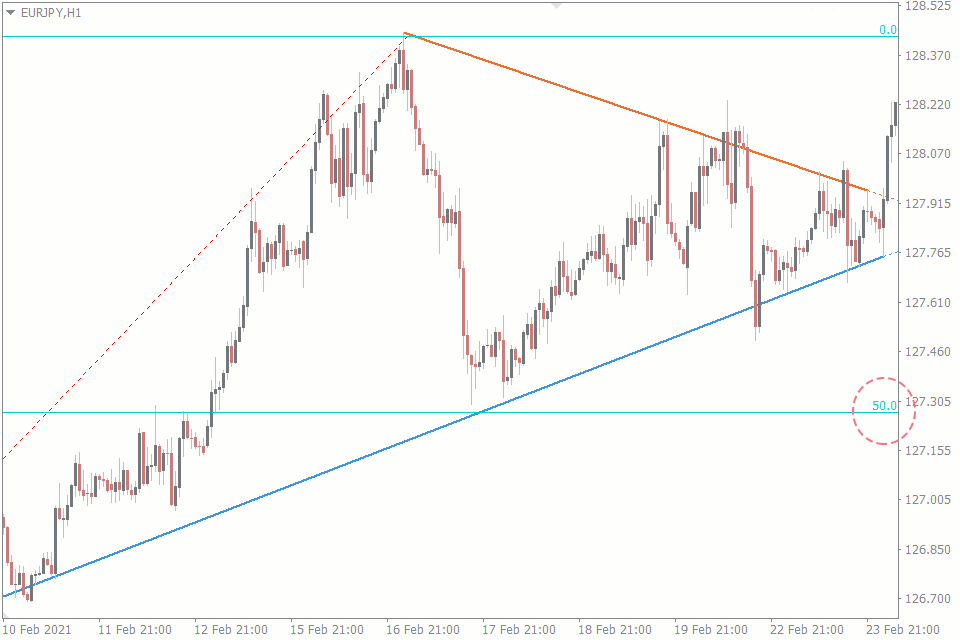

Overbought aur Oversold ka Practical Example

Agar aik stock ka RSI 75 hai, to yeh overbought condition ko indicate karta hai. Iska matlab hai ke ab is stock ki price upar se neeche aane ka chance hai. Trader yahan par sell ya short position open kar sakta hai aur stop loss ko thoda upar set kar sakta hai taake agar price zyada upar jaye to risk manage ho sake. Aise hi, agar ek stock ka RSI 25 hai, to yeh oversold condition hai aur price ke rebound hone ka chance hai. Trader is level par buy position open kar sakta hai aur apna stop loss is level se neeche set kar sakta hai.

Overbought aur oversold levels trading ke liye bohot valuable hain kyunke yeh market ke trend reversal aur entry-exit points ko samajhne mein madadgar hain. Inhe samajhne ke liye RSI, Stochastic Oscillator, Bollinger Bands aur CCI jaise indicators use kiye jate hain jo trading mein high probability trade setups provide karte hain. Har trader ko yeh indicators aur inka analysis samajhna chahiye aur apni trading strategy mein shamil karna chahiye. Lekin, inka andha dhund use nahi karna chahiye kyunke market ka trend aur volatility bhi dekhni chahiye taake accurate decision-making ho sake.

تبصرہ

Расширенный режим Обычный режим