Dark Cloud Cover Candlestick pattern

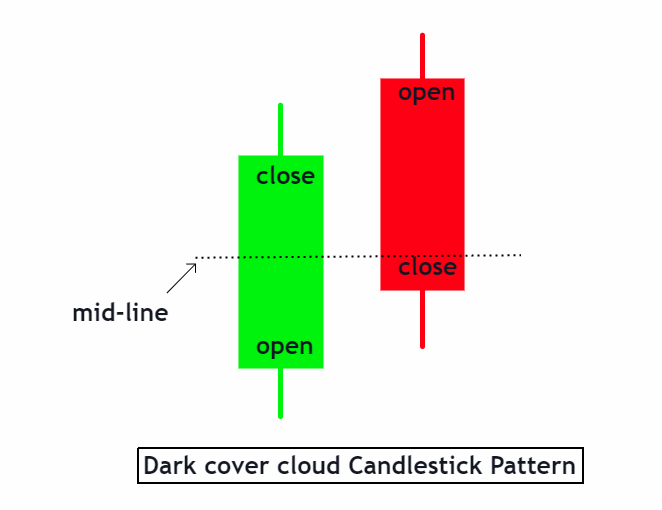

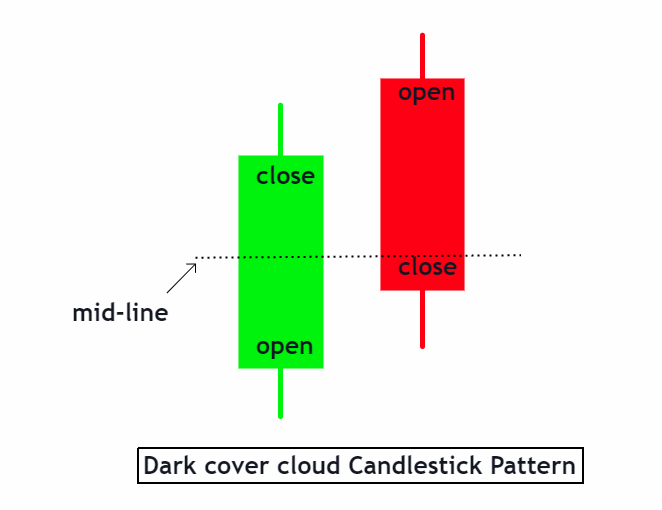

forex market mein dark cloud cover candlestick pattern aik kesam ka candlestick pattern hota hey jo keh forex market mein he paya jata hey jo keh bearish reversal candlestick hota hey es kesam kay chart pattern mein aik bearish candlestick hote hey jabkeh aik bullish say chalnay wale candlestick hote hey jo keh forex market mein es kesam ke candlestick ko follow karte hey yeh forex market mein bllish white candlstick say zyda close ho jate hey yeh candlestick kay average point say he nechay hote hey forex market mein bullish candlestick kay close honay or bearish candlestick kay opening kay darmean mein distance forex market kay darmean ein gap ko he identify kar sakta hey

How to find Dark Cloud Cover Candlestick Pattern

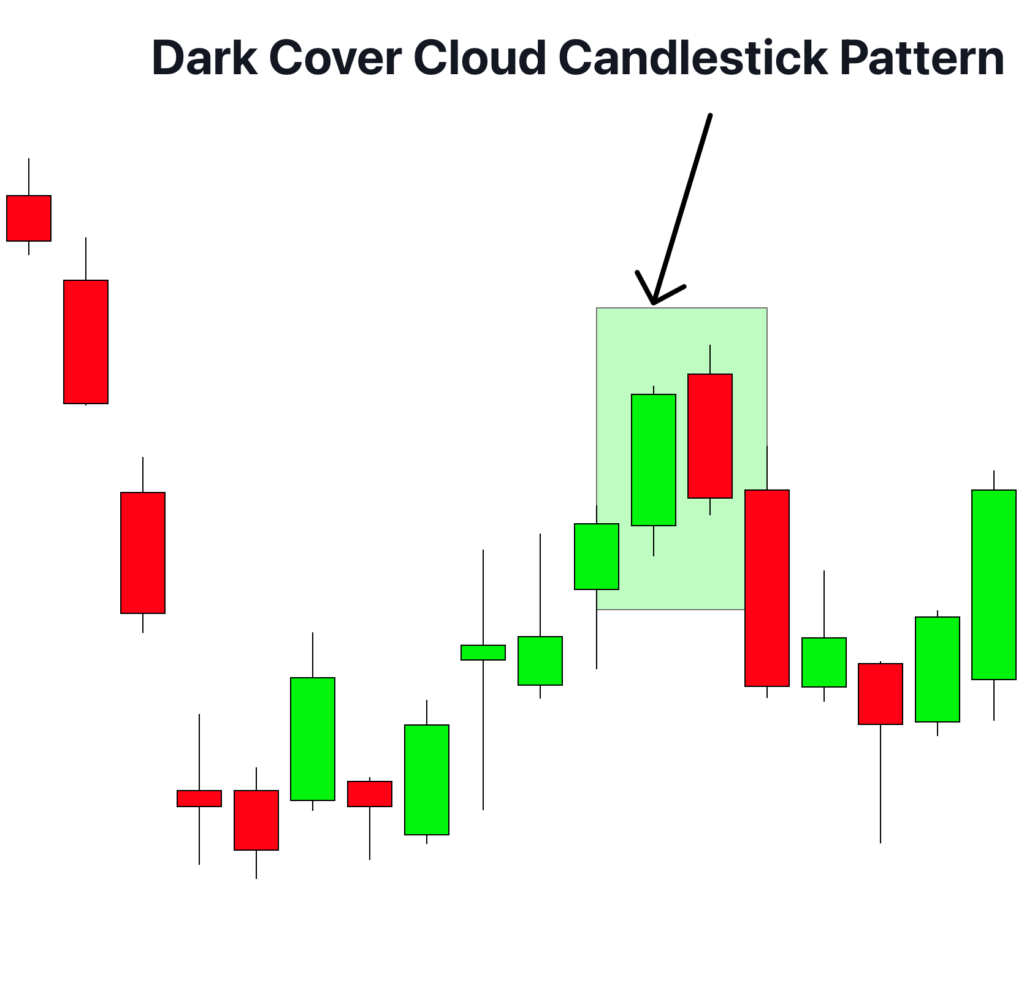

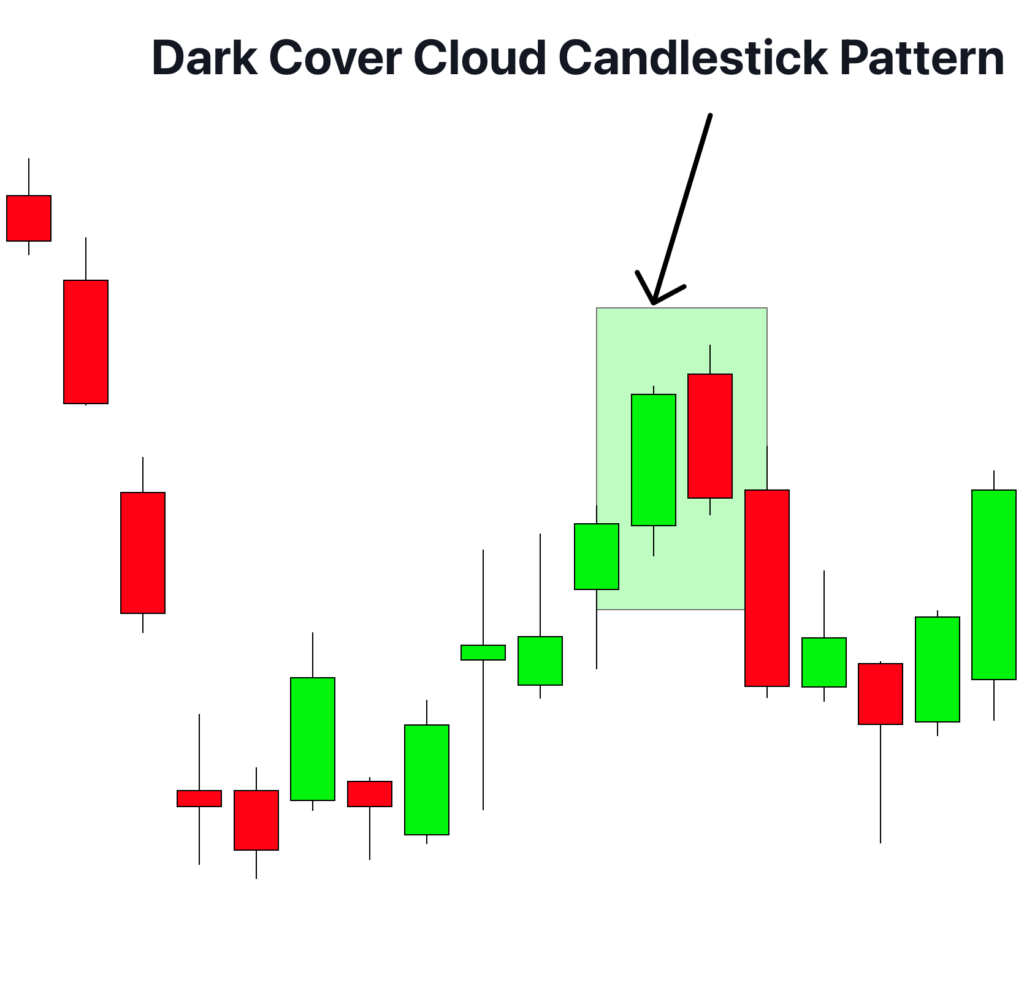

forex market mein dark cloud cover candlestick pattern ak assan sa pattern hota hey jo keh forex 2 alag kesam kay opposite rang ke candlestick say mell kar bana hota hey es kesam kay pattern ko 2 step say he samajh saktay hein

Step 1

market pehlay say he bullish kay trend mein hote hey jo keh forex chart par aik mamol ce bullish candlestick ko wazah kar sakte hey yeh candlestick aik kesam ke baqaida candlestick hote hey jes ke body or wick size regular hota hey

Step2

aik bearish candlestick pattern hota hey yeh forex market kay majodah bullish candlestick ko follo kar sakte hey or yeh bullish white candlestick ko follow kar sakte hey yeh forex market kay price kay gap ko he wazah kar sakte hey mazeed yeh keh dosree bearish candlestick ka close hona pehle bearish candlestick white candlestick kay average point say nechay he hota hey

Understanding Dark Cloud Cover Pattern

hum forex market kay dark cloud cover pattern ko 2 step mein samjh saktay hein pehle candlestick batate hey keh forex market mein bulls ka ab bhe control hey keh forex market mein buyer ke tadad seller par have hey es kesam kay step say trader forex market mein majodah bullish trend ko bhe identify kar sakta hey jes ke wajah say assert ko buy kar saktay hein or forex market ka trend start ho jata hey

dosray step mein dark clousd cover pattern roshan day walay pattern ko dahnp layta hey experience trader ko yeh ehsas hona start ho jata hey keh bearish ka day start honay wala hey raftar mein he yeh tabdele ho ge or bear bulls say wazan he otha saktay hein mazeed losses or profit say trader apnay assert ko sell ka wazan he rakh saktay hein

Dark Cloud Cover Trading Strategy

forex market mein dark Cloud Cover candlestick Pattern kay hawalay say trading strategy hote hey keh yeh forex market kay support or resistance zone kay sungom say mell kar bante hey

Entry

Entry

es kesam kay chart pattern mein pehle candlestick aik kesam ke bullish candlestick hote hey jo keh forex market kay anay walay tred kay baray mein malomaat frahm kar saktay hein aik candlestick ko dosree black candlestick kay zahair honay ka intazar karna chihay dosree candlestick ke zahair ke shape forex market ke trade kay baray mein kheyal rakh sakte hey or forex market mein bearish ka jazba anay walay trend kaybaray mein he ho ga

Stop loss

forex market kay es pattern say nametnay kay baray mein stop loss he best point hota hy or forex market ke best position dosree candlestick ke highs position say he oper rakh de jate hey es tarah aik trader stop loss ko hesaf rakh sakta hey

Take Profit

forex market mein take profit level say ap relative strength index indicator ko he estamal kr saktay hein profit kay target ko hasell karnay kay ley serf black pattern ka he estamal kafe nahi hota hey mesal kay tor par jab indicator oversold signal dekhay ga to sell ke trade open kar saken gay

forex market mein dark cloud cover candlestick pattern aik kesam ka candlestick pattern hota hey jo keh forex market mein he paya jata hey jo keh bearish reversal candlestick hota hey es kesam kay chart pattern mein aik bearish candlestick hote hey jabkeh aik bullish say chalnay wale candlestick hote hey jo keh forex market mein es kesam ke candlestick ko follow karte hey yeh forex market mein bllish white candlstick say zyda close ho jate hey yeh candlestick kay average point say he nechay hote hey forex market mein bullish candlestick kay close honay or bearish candlestick kay opening kay darmean mein distance forex market kay darmean ein gap ko he identify kar sakta hey

How to find Dark Cloud Cover Candlestick Pattern

forex market mein dark cloud cover candlestick pattern ak assan sa pattern hota hey jo keh forex 2 alag kesam kay opposite rang ke candlestick say mell kar bana hota hey es kesam kay pattern ko 2 step say he samajh saktay hein

Step 1

market pehlay say he bullish kay trend mein hote hey jo keh forex chart par aik mamol ce bullish candlestick ko wazah kar sakte hey yeh candlestick aik kesam ke baqaida candlestick hote hey jes ke body or wick size regular hota hey

Step2

aik bearish candlestick pattern hota hey yeh forex market kay majodah bullish candlestick ko follo kar sakte hey or yeh bullish white candlestick ko follow kar sakte hey yeh forex market kay price kay gap ko he wazah kar sakte hey mazeed yeh keh dosree bearish candlestick ka close hona pehle bearish candlestick white candlestick kay average point say nechay he hota hey

Understanding Dark Cloud Cover Pattern

hum forex market kay dark cloud cover pattern ko 2 step mein samjh saktay hein pehle candlestick batate hey keh forex market mein bulls ka ab bhe control hey keh forex market mein buyer ke tadad seller par have hey es kesam kay step say trader forex market mein majodah bullish trend ko bhe identify kar sakta hey jes ke wajah say assert ko buy kar saktay hein or forex market ka trend start ho jata hey

dosray step mein dark clousd cover pattern roshan day walay pattern ko dahnp layta hey experience trader ko yeh ehsas hona start ho jata hey keh bearish ka day start honay wala hey raftar mein he yeh tabdele ho ge or bear bulls say wazan he otha saktay hein mazeed losses or profit say trader apnay assert ko sell ka wazan he rakh saktay hein

Dark Cloud Cover Trading Strategy

forex market mein dark Cloud Cover candlestick Pattern kay hawalay say trading strategy hote hey keh yeh forex market kay support or resistance zone kay sungom say mell kar bante hey

Entry

Entry es kesam kay chart pattern mein pehle candlestick aik kesam ke bullish candlestick hote hey jo keh forex market kay anay walay tred kay baray mein malomaat frahm kar saktay hein aik candlestick ko dosree black candlestick kay zahair honay ka intazar karna chihay dosree candlestick ke zahair ke shape forex market ke trade kay baray mein kheyal rakh sakte hey or forex market mein bearish ka jazba anay walay trend kaybaray mein he ho ga

Stop loss

forex market kay es pattern say nametnay kay baray mein stop loss he best point hota hy or forex market ke best position dosree candlestick ke highs position say he oper rakh de jate hey es tarah aik trader stop loss ko hesaf rakh sakta hey

Take Profit

forex market mein take profit level say ap relative strength index indicator ko he estamal kr saktay hein profit kay target ko hasell karnay kay ley serf black pattern ka he estamal kafe nahi hota hey mesal kay tor par jab indicator oversold signal dekhay ga to sell ke trade open kar saken gay

تبصرہ

Расширенный режим Обычный режим