Engulfing Candlestick Patterns: Forex Trading Mein Ahmiyat

1. Ta'aruf

Engulfing candlestick patterns trading ki duniya mein ek ahmiyat rakhte hain. Yeh patterns market ki mood aur price action ko darust karte hain. Jab kisi market mein price movement ko samajhne ki koshish ki jati hai, toh yeh patterns traders ke liye bohot madadgar sabit hote hain.

2. Candlestick Patterns Ki Pehchan

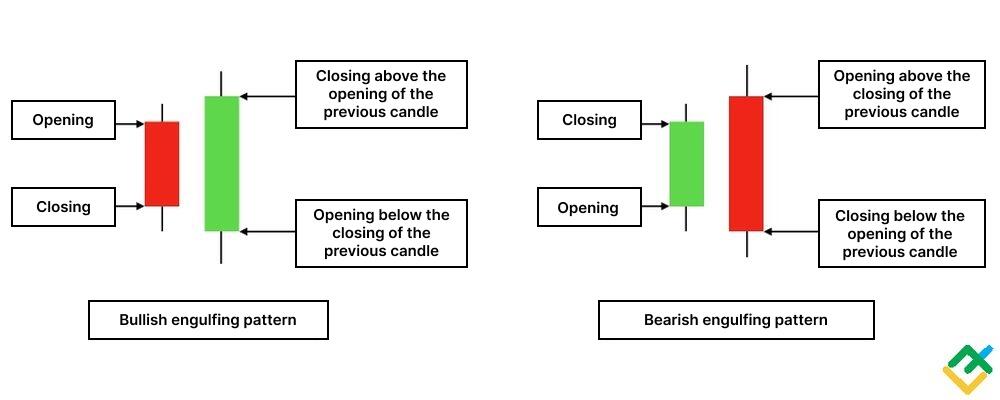

Candlestick patterns do qisam ke hote hain: bullish aur bearish. Bullish engulfing pattern tab banta hai jab choti bearish candle ke baad badi bullish candle aati hai, jo pehli candle ko engulf karti hai. Iska matlab hai ke market mein buying pressure barh raha hai. Iske bilkul ulat, bearish engulfing pattern hota hai, jahan badi bearish candle choti bullish candle ko engulf karti hai, jo selling pressure ka izhar karta hai.

3. Bullish Engulfing Pattern

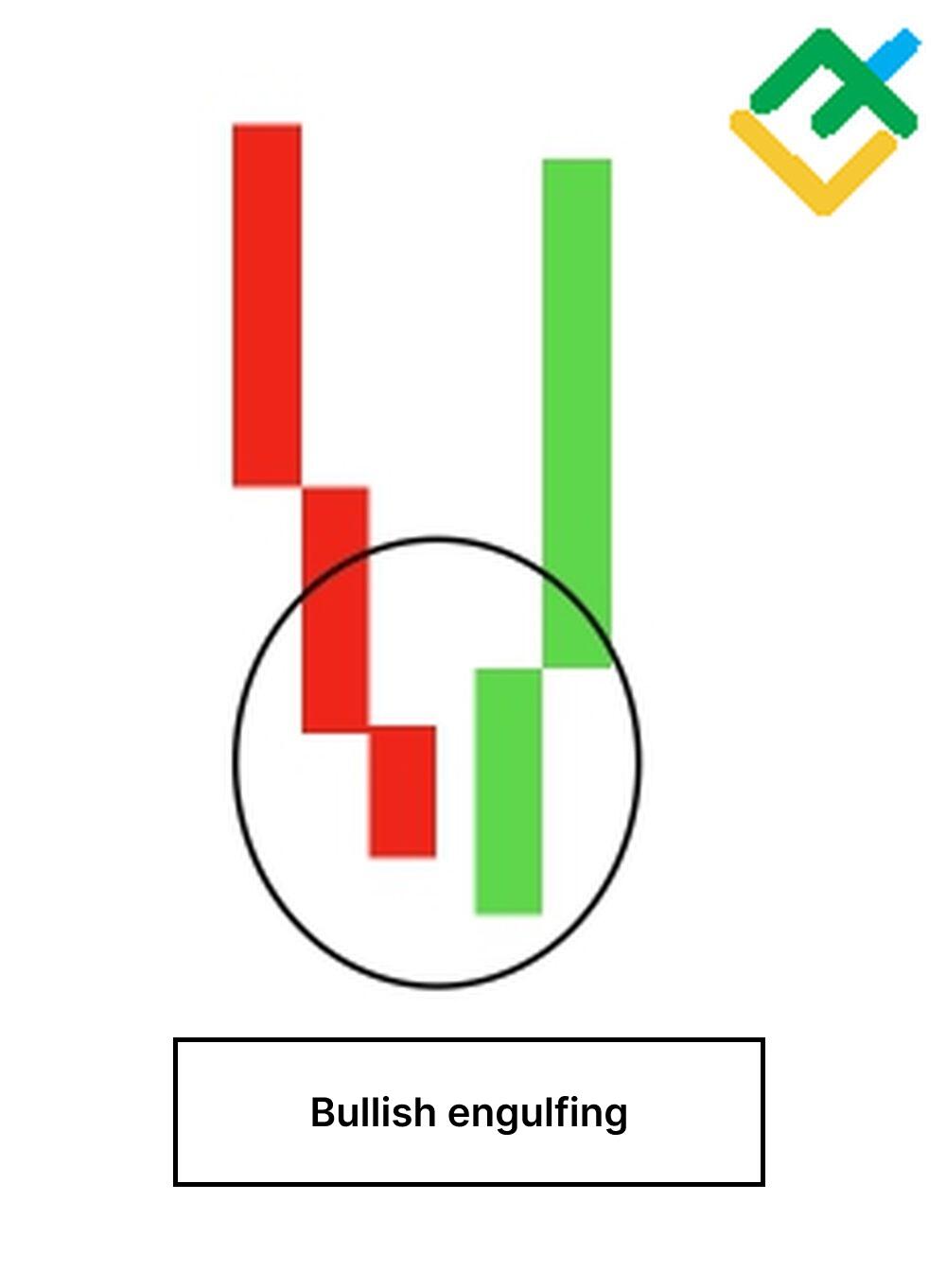

Bullish engulfing pattern ko samajhna asaan hai. Yeh tab hota hai jab ek bearish candle ke baad ek badi bullish candle aati hai. Iska matlab hai ke buyers ne market par control hasil kar liya hai aur price ki upar ki taraf movement ki umeed hai. Is pattern ki pehchan trading ke liye faida mand hai kyunki yeh reversal ka signal hota hai.

4. Bearish Engulfing Pattern

Bearish engulfing pattern, bullish ke bilkul ulat hota hai. Isme ek bullish candle hoti hai jo choti hoti hai, aur uske baad badi bearish candle aati hai. Is pattern ka matlab hai ke sellers ne market par control hasil kar liya hai. Yeh bhi reversal ka signal hai, lekin iski direction downwards hoti hai.

5. Market Context

Engulfing patterns ki tasveer sirf ek candle ke roshni mein nahi samjhi ja sakti. Yeh hamesha market context mein samjhe jate hain. Jab yeh patterns kisi strong resistance ya support level ke aas paas bante hain, toh inka signal aur bhi mazidah hota hai. Isliye, traders ko hamesha context ka khayal rakhna chahiye.

6. Volume Ka Ahamiyat

Engulfing patterns ka samajhne ke liye volume bhi bohot zaroori hai. Agar bullish engulfing pattern ke saath volume barh raha ho, toh yeh signal zyada strong hota hai. Yeh darust market participation ko darust karta hai. Usi tarah, agar bearish engulfing pattern ke saath volume hai, to ye bhi selling pressure ko darust karta hai.

7. Time Frames

Engulfing patterns kisi bhi time frame par ban sakte hain, lekin zyada significant patterns un time frames par hote hain jahan traders zyada active hote hain, jaise daily ya weekly charts. Chote time frames par patterns ka signal kabhi kabhi fake bhi ho sakta hai, isliye patience aur analysis zaroori hai.

8. Confirmation Ki Zaroorat

Har engulfing pattern ke liye confirmation ki zaroorat hoti hai. Ye confirmation kisi doosre technical indicators, jaise moving averages, RSI, ya support aur resistance levels se milta hai. Is se traders ko aur bhi confidence milta hai ke market kis taraf move kar sakta hai.

9. Risk Management

Trading mein risk management kaamyaab hone ke liye bohot zaroori hai. Jab aap engulfing pattern ki madad se trade karte hain, toh stop loss set karna na bhoolen. Bullish engulfing ke liye stop loss pehle candle ke low par rakhna chahiye, aur bearish engulfing ke liye pehle candle ke high par.

10. Strategy Banate Waqt

Engulfing patterns ko apne trading strategy mein shamil karna chahiye, lekin ye zaroori hai ke aap inhe akela na lein. Hamesha inhe dusre indicators ke saath combine karna behtar hai, taake aapki trading strategy zyada effective ho.

11. Psychological Aspect

Engulfing patterns ka ek psychological aspect bhi hota hai. Jab traders ye patterns dekhte hain, to unki emotional response market ki direction par asar kar sakti hai. Isliye, is aspect ko samajhna bhi zaroori hai taake aap trading decisions lete waqt behtar faisle kar sakein.

12. Practicing Engulfing Patterns

Engulfing patterns ki pehchan aur inke sath trading karne ke liye practice karna bohot zaroori hai. Aap demo accounts par practice kar sakte hain taake aap is pattern ki madad se trading mein maharat hasil kar sakein. Practice ke zariye aap in patterns ko identify karne aur unke sath trade karne ki skills improve kar sakte hain.

13. Inhe Kaise Implement Karein

Engulfing patterns ko apne trading plan mein shamil karne ke liye aapko inhe identify karna hoga, confirmation indicators ke sath dekhna hoga, aur risk management strategies implement karni hongi. Yeh aapko successful trading ke liye ek strong foundation faraham karenge.

14. Aakhri Baat

Engulfing candlestick patterns trading mein bohot hi valuable tools hain. Yeh traders ko market ki psychology aur price action ka andaza dene mein madadgar sabit hote hain. Lekin, in patterns ka use sirf patterns dekh kar nahi, balki market context, volume, aur confirmation ke sath karna chahiye. Trading ke safar mein sabar aur practice ka daira kabhi khatam nahi hota.

1. Ta'aruf

Engulfing candlestick patterns trading ki duniya mein ek ahmiyat rakhte hain. Yeh patterns market ki mood aur price action ko darust karte hain. Jab kisi market mein price movement ko samajhne ki koshish ki jati hai, toh yeh patterns traders ke liye bohot madadgar sabit hote hain.

2. Candlestick Patterns Ki Pehchan

Candlestick patterns do qisam ke hote hain: bullish aur bearish. Bullish engulfing pattern tab banta hai jab choti bearish candle ke baad badi bullish candle aati hai, jo pehli candle ko engulf karti hai. Iska matlab hai ke market mein buying pressure barh raha hai. Iske bilkul ulat, bearish engulfing pattern hota hai, jahan badi bearish candle choti bullish candle ko engulf karti hai, jo selling pressure ka izhar karta hai.

3. Bullish Engulfing Pattern

Bullish engulfing pattern ko samajhna asaan hai. Yeh tab hota hai jab ek bearish candle ke baad ek badi bullish candle aati hai. Iska matlab hai ke buyers ne market par control hasil kar liya hai aur price ki upar ki taraf movement ki umeed hai. Is pattern ki pehchan trading ke liye faida mand hai kyunki yeh reversal ka signal hota hai.

4. Bearish Engulfing Pattern

Bearish engulfing pattern, bullish ke bilkul ulat hota hai. Isme ek bullish candle hoti hai jo choti hoti hai, aur uske baad badi bearish candle aati hai. Is pattern ka matlab hai ke sellers ne market par control hasil kar liya hai. Yeh bhi reversal ka signal hai, lekin iski direction downwards hoti hai.

5. Market Context

Engulfing patterns ki tasveer sirf ek candle ke roshni mein nahi samjhi ja sakti. Yeh hamesha market context mein samjhe jate hain. Jab yeh patterns kisi strong resistance ya support level ke aas paas bante hain, toh inka signal aur bhi mazidah hota hai. Isliye, traders ko hamesha context ka khayal rakhna chahiye.

6. Volume Ka Ahamiyat

Engulfing patterns ka samajhne ke liye volume bhi bohot zaroori hai. Agar bullish engulfing pattern ke saath volume barh raha ho, toh yeh signal zyada strong hota hai. Yeh darust market participation ko darust karta hai. Usi tarah, agar bearish engulfing pattern ke saath volume hai, to ye bhi selling pressure ko darust karta hai.

7. Time Frames

Engulfing patterns kisi bhi time frame par ban sakte hain, lekin zyada significant patterns un time frames par hote hain jahan traders zyada active hote hain, jaise daily ya weekly charts. Chote time frames par patterns ka signal kabhi kabhi fake bhi ho sakta hai, isliye patience aur analysis zaroori hai.

8. Confirmation Ki Zaroorat

Har engulfing pattern ke liye confirmation ki zaroorat hoti hai. Ye confirmation kisi doosre technical indicators, jaise moving averages, RSI, ya support aur resistance levels se milta hai. Is se traders ko aur bhi confidence milta hai ke market kis taraf move kar sakta hai.

9. Risk Management

Trading mein risk management kaamyaab hone ke liye bohot zaroori hai. Jab aap engulfing pattern ki madad se trade karte hain, toh stop loss set karna na bhoolen. Bullish engulfing ke liye stop loss pehle candle ke low par rakhna chahiye, aur bearish engulfing ke liye pehle candle ke high par.

10. Strategy Banate Waqt

Engulfing patterns ko apne trading strategy mein shamil karna chahiye, lekin ye zaroori hai ke aap inhe akela na lein. Hamesha inhe dusre indicators ke saath combine karna behtar hai, taake aapki trading strategy zyada effective ho.

11. Psychological Aspect

Engulfing patterns ka ek psychological aspect bhi hota hai. Jab traders ye patterns dekhte hain, to unki emotional response market ki direction par asar kar sakti hai. Isliye, is aspect ko samajhna bhi zaroori hai taake aap trading decisions lete waqt behtar faisle kar sakein.

12. Practicing Engulfing Patterns

Engulfing patterns ki pehchan aur inke sath trading karne ke liye practice karna bohot zaroori hai. Aap demo accounts par practice kar sakte hain taake aap is pattern ki madad se trading mein maharat hasil kar sakein. Practice ke zariye aap in patterns ko identify karne aur unke sath trade karne ki skills improve kar sakte hain.

13. Inhe Kaise Implement Karein

Engulfing patterns ko apne trading plan mein shamil karne ke liye aapko inhe identify karna hoga, confirmation indicators ke sath dekhna hoga, aur risk management strategies implement karni hongi. Yeh aapko successful trading ke liye ek strong foundation faraham karenge.

14. Aakhri Baat

Engulfing candlestick patterns trading mein bohot hi valuable tools hain. Yeh traders ko market ki psychology aur price action ka andaza dene mein madadgar sabit hote hain. Lekin, in patterns ka use sirf patterns dekh kar nahi, balki market context, volume, aur confirmation ke sath karna chahiye. Trading ke safar mein sabar aur practice ka daira kabhi khatam nahi hota.

تبصرہ

Расширенный режим Обычный режим