Tweezer Top Pattern ek aisa chart pattern hai jo Forex trading mein bahut ahmiyat rakhta hai. Is pattern ka upyog karke traders market trend ko samajh skte hain aur price action ki analysis kar sakte hain.

Tweezer Top Pattern information

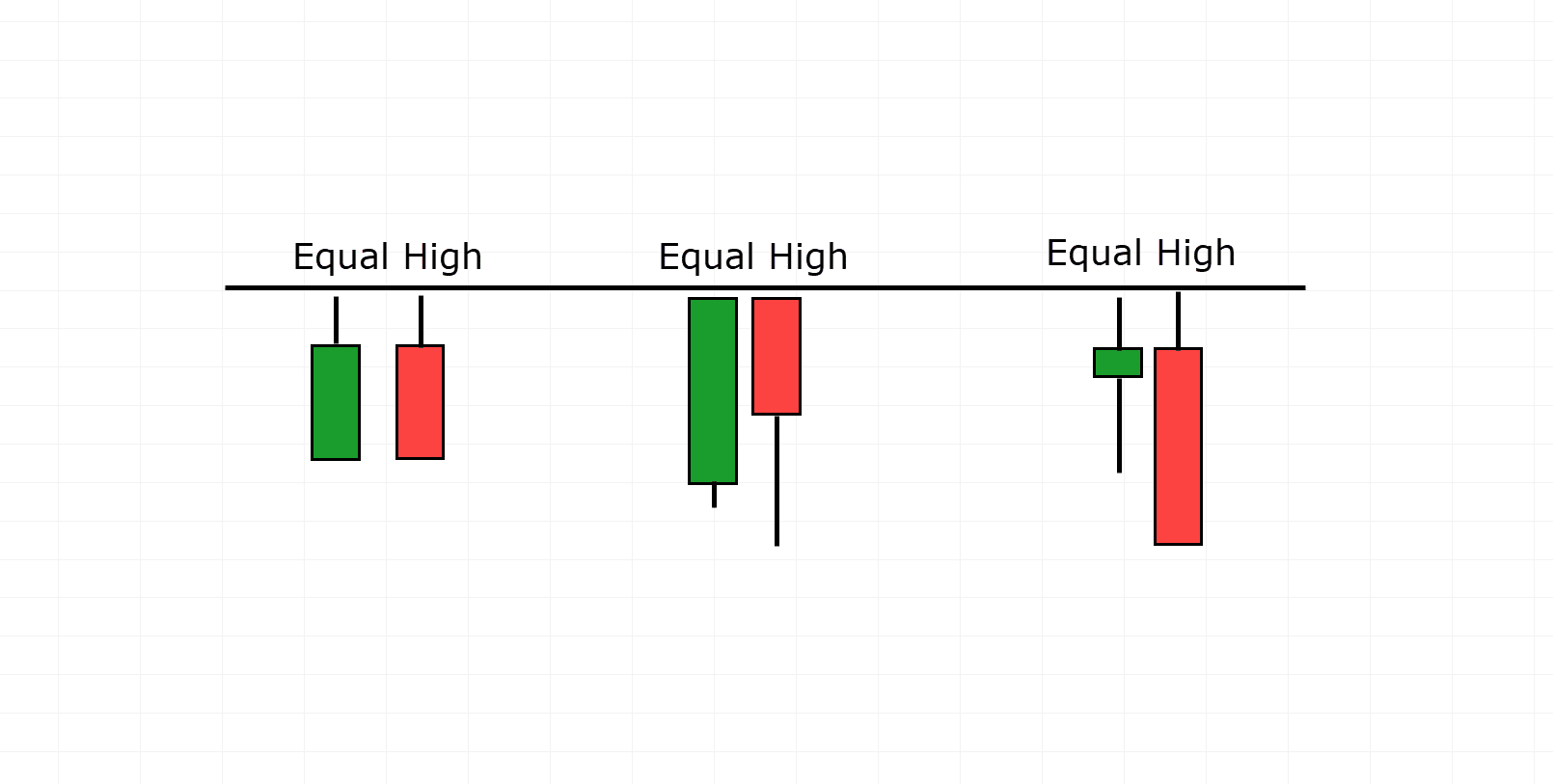

Tweezer Top Pattern ek reversal pattern hai jo uptrend ke ant mein dikhta hai. Is pattern mein do candles hti hain - ek bullish candle aur ek bearish candle. Bullish candle uptrend ke dauran banai jti h aur bearish candle uske baad banai jati ha

Tweezer Top Pattern ka upyog karna

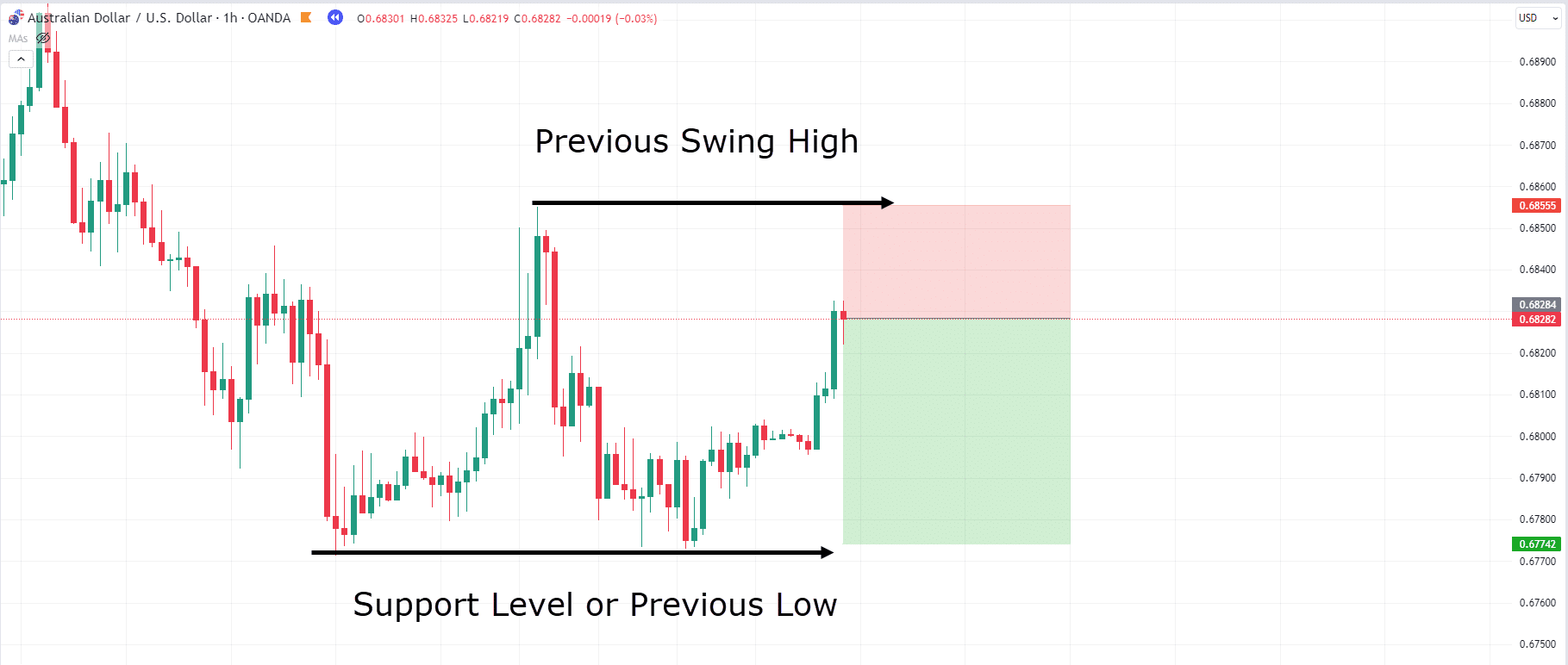

Tweezer Top Pattern ka upyog karne se traders ko market ki direction ka pata chalta hai. Agar is pattern ke baad bearish candle banai jati hai to yeh ek reversal signal hai aur traders ko sell karne ke liye suggest karta hai. Agar is pattern ke baad bhi bullish candle banai jati hai to yeh continuation signal hai aur traders ko buy karne ke liye suggest karta hai.is me apko signal ki smjh hni chaye.

Entry exit points

Is pattern ka upyog karne se traders ko entry aur exit points ka pata chalta hai. Tweezer Top Pattern ke baad sell karne se traders ko jyada profit mil sakta hai aur buy karne se traders ko loss kam ho sakta hai.is me apko entry exit points ka pta hna chaye k jis time kam down ho ap exit kr skty hen.

Conclusion

Tweezer Top Pattern ka Forex trading mein bahut ahmiyat hai. Is pattern ka upyog karke traders market ki direction ka pata laga sakte hain aur entry aur exit points ka pata kar sakte hain. Is pattern ke bad sell krne sy traders ko jyada profit mil sakta hai aur buy krne sy traders ko loss kam ho sakta hai.

تبصرہ

Расширенный режим Обычный режим