Introduction.

Forex trading, aaj kal ka sab se popular tareeqa hai paisa kamane ka. Is tarah ke trading me, market ki movements ko samajhna aur us ke hisaab se apni strategy tayyar karna zaroori hota hai. Aik aham tareeqa jo traders use karte hain apni trading ko control karne ke liye, wo hai ATR stoploss.

What is ATR?

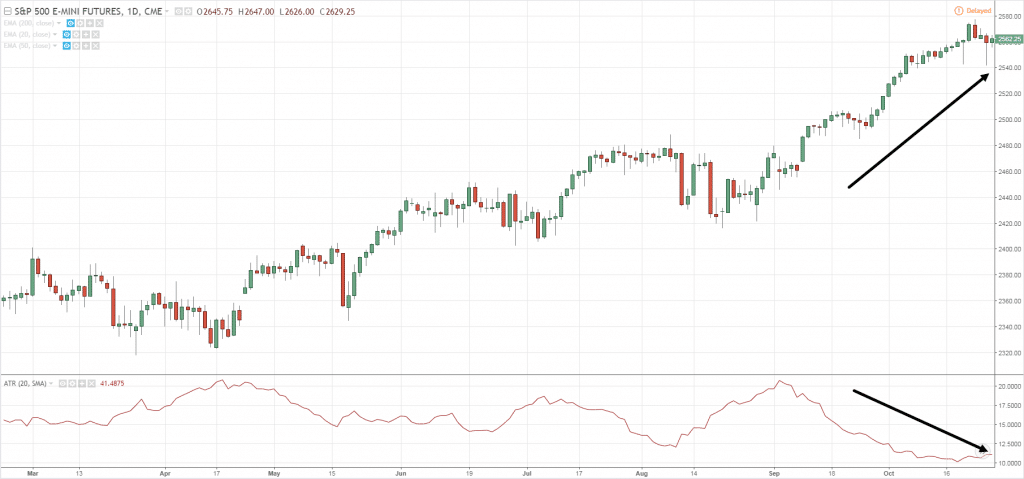

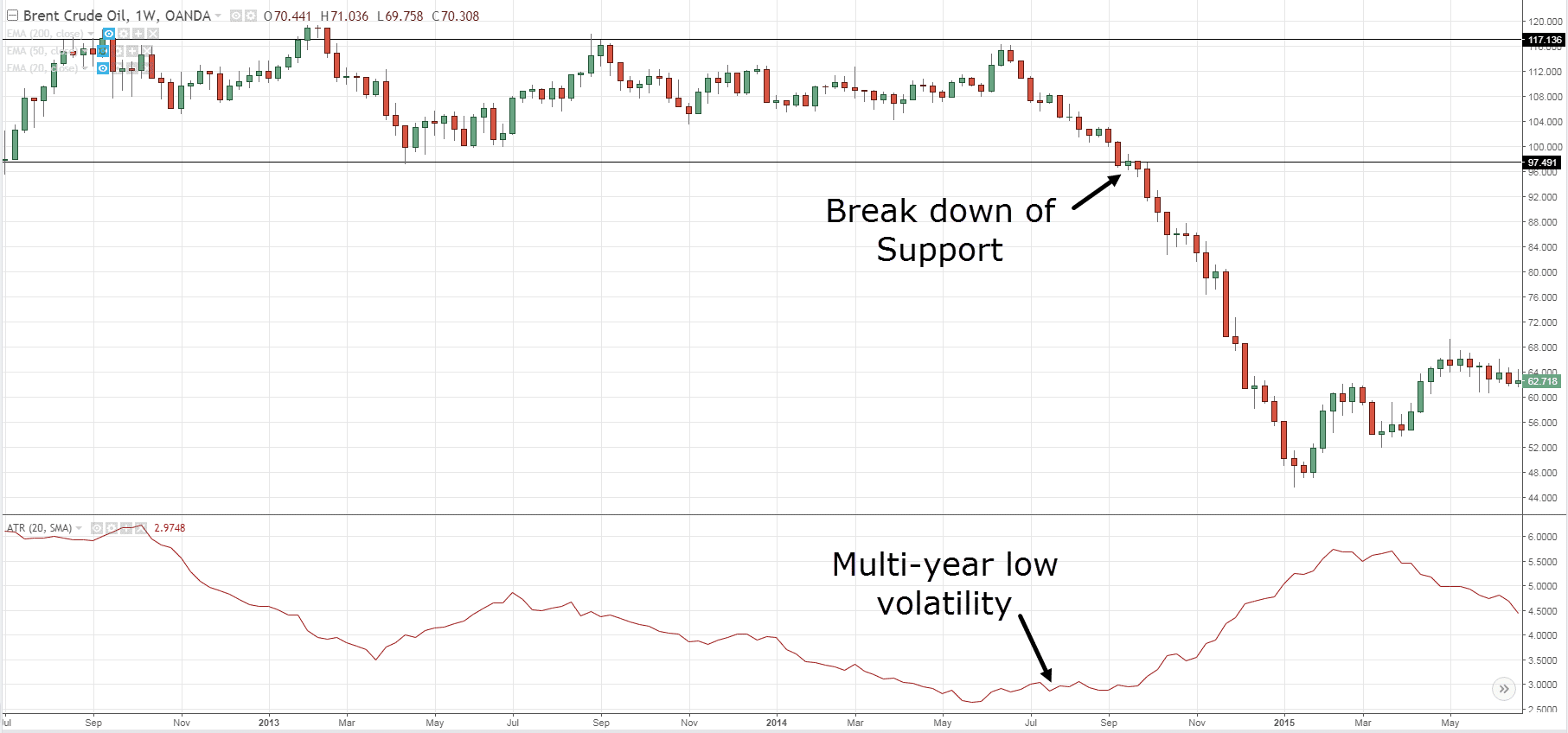

ATR ka matlab hai Average True Range. Yeh market volatility ko measure karne ke liye use kya jata hai. Is ke zariye traders ko pata chalta hai ke market kitna volatile hai aur kitna risk involved hai.

What is Stop loss?

Stop loss, aik trading strategy hai jis se traders apni investment ko protect karte hain. Jab market ki movement traders ke favour se nahi ho rahi hoti to wo apni trade ko close kar dete hain takay zyada nuqsan na ho.

What is ATR Stop loss?

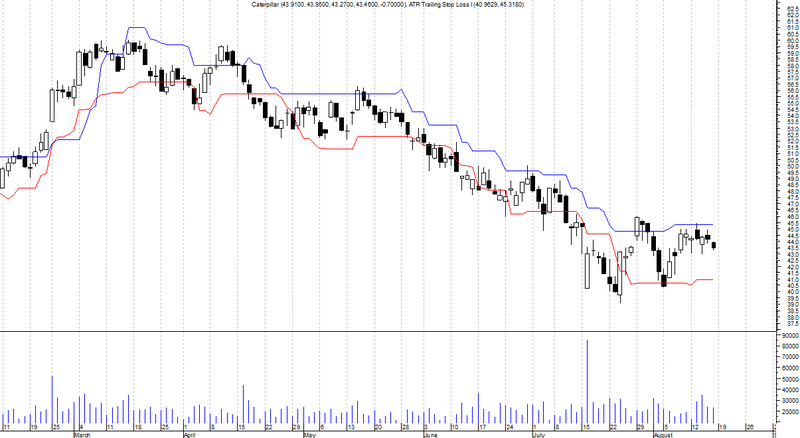

ATR stoploss, traders ki trade ko protect karne ke liye use kiya jata hai. Is me traders apni trade ko ATR ke hisaab se stoploss set karte hain. ATR ki value traders ki trade ke hisaab se tayyar hoti hai.

How does ATR Stop loss work?

ATR stop loss, traders ki trade ko protect karta hai. Agar market ki movement traders ke favour se nahi ho rahi hoti to ATR stoploss traders ko guide karta hai ke unhe apni trade ko kis level par close karna chahiye. Is se traders ko zyada nuqsan se bacha jata hai.

How to use ATR Stop loss?

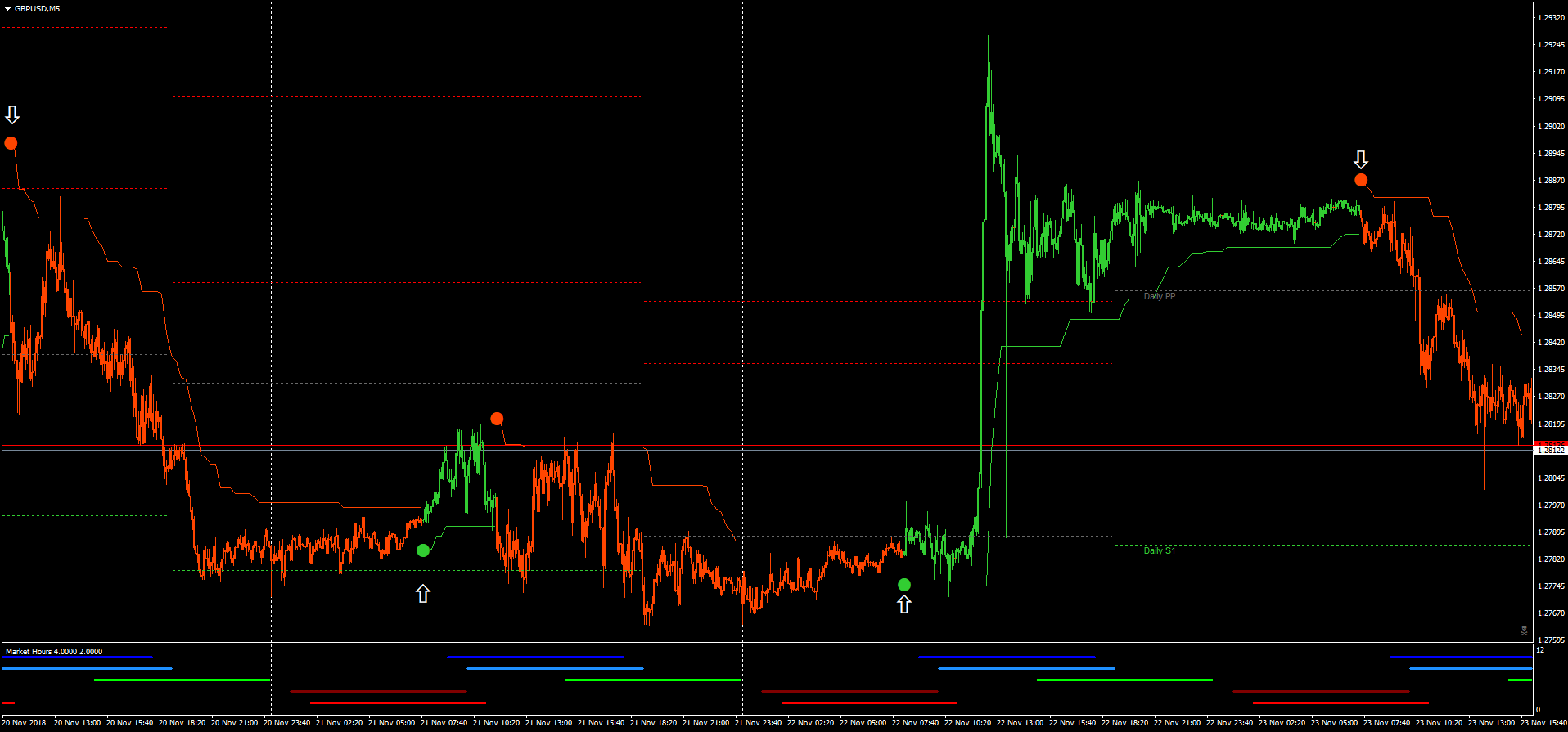

ATR stoploss ka istemal karna traders ke liye zaroori hai. Is ke liye traders ko ATR ka calculation karna zaroori hai. ATR ki value calculate karne ke liye traders ko market ke high aur low price ko dekhna hota hai.

Benefits of ATR Stop Loss.

1. Nuqsan se Bachao:

ATR stop loss, traders ko nuqsan se bachata hai. Jab market ki movement traders ke favour se nahi ho rahi hoti to ATR stoploss traders ko guide karta hai ke unhe apni trade ko kis level par close karna chahiye. Is se traders ko zyada nuqsan se bacha jata hai.

2. Risk Management:

ATR stop loss ka istemal karne se traders apni risk management ko behtar bana sakte hain. Is se traders ko pata chalta hai ke unhe kitna risk lena hai aur kitna stoploss set karna chahiye.

3. Trading Strategy:

ATR stop loss traders ki trading strategy ko behtar banata hai. Is se traders ko pata chalta hai ke market kitna volatile hai aur kitna risk involved hai. Is ke hisaab se traders apni trading strategy tayyar karte hain.

4. Reliable Tool:

ATR stop loss, traders ke liye aik reliable tool hai. Is se traders ko pata chalta hai ke market ki movement ke hisaab se unhe apni trade ko kis level par close karna chahiye. Is se traders ko zyada nuqsan se bacha jata hai.

Important Note:-

ATR stop loss, forex trading me traders ke liye aik aham tool hai apni trade ko protect karne ke liye. Is se traders ko zyada nuqsan se bacha jata hai aur wo apni trades ko success ke taraf le ja sakte hain. Is ke istemal se traders ki risk management behtar hoti hai aur un ki trading strategy ko behtar banaya jata hai.

Forex trading, aaj kal ka sab se popular tareeqa hai paisa kamane ka. Is tarah ke trading me, market ki movements ko samajhna aur us ke hisaab se apni strategy tayyar karna zaroori hota hai. Aik aham tareeqa jo traders use karte hain apni trading ko control karne ke liye, wo hai ATR stoploss.

What is ATR?

ATR ka matlab hai Average True Range. Yeh market volatility ko measure karne ke liye use kya jata hai. Is ke zariye traders ko pata chalta hai ke market kitna volatile hai aur kitna risk involved hai.

What is Stop loss?

Stop loss, aik trading strategy hai jis se traders apni investment ko protect karte hain. Jab market ki movement traders ke favour se nahi ho rahi hoti to wo apni trade ko close kar dete hain takay zyada nuqsan na ho.

What is ATR Stop loss?

ATR stoploss, traders ki trade ko protect karne ke liye use kiya jata hai. Is me traders apni trade ko ATR ke hisaab se stoploss set karte hain. ATR ki value traders ki trade ke hisaab se tayyar hoti hai.

How does ATR Stop loss work?

ATR stop loss, traders ki trade ko protect karta hai. Agar market ki movement traders ke favour se nahi ho rahi hoti to ATR stoploss traders ko guide karta hai ke unhe apni trade ko kis level par close karna chahiye. Is se traders ko zyada nuqsan se bacha jata hai.

How to use ATR Stop loss?

ATR stoploss ka istemal karna traders ke liye zaroori hai. Is ke liye traders ko ATR ka calculation karna zaroori hai. ATR ki value calculate karne ke liye traders ko market ke high aur low price ko dekhna hota hai.

Benefits of ATR Stop Loss.

1. Nuqsan se Bachao:

ATR stop loss, traders ko nuqsan se bachata hai. Jab market ki movement traders ke favour se nahi ho rahi hoti to ATR stoploss traders ko guide karta hai ke unhe apni trade ko kis level par close karna chahiye. Is se traders ko zyada nuqsan se bacha jata hai.

2. Risk Management:

ATR stop loss ka istemal karne se traders apni risk management ko behtar bana sakte hain. Is se traders ko pata chalta hai ke unhe kitna risk lena hai aur kitna stoploss set karna chahiye.

3. Trading Strategy:

ATR stop loss traders ki trading strategy ko behtar banata hai. Is se traders ko pata chalta hai ke market kitna volatile hai aur kitna risk involved hai. Is ke hisaab se traders apni trading strategy tayyar karte hain.

4. Reliable Tool:

ATR stop loss, traders ke liye aik reliable tool hai. Is se traders ko pata chalta hai ke market ki movement ke hisaab se unhe apni trade ko kis level par close karna chahiye. Is se traders ko zyada nuqsan se bacha jata hai.

Important Note:-

ATR stop loss, forex trading me traders ke liye aik aham tool hai apni trade ko protect karne ke liye. Is se traders ko zyada nuqsan se bacha jata hai aur wo apni trades ko success ke taraf le ja sakte hain. Is ke istemal se traders ki risk management behtar hoti hai aur un ki trading strategy ko behtar banaya jata hai.

تبصرہ

Расширенный режим Обычный режим