Ladder Top Pattern

forex market mein ladder top pattern aik kesam ka technical chart pattern hota hey jo keh fore market mein trend reversal pattern hota hey jo keh forex market mein 4 bearish ya bullish pattern par he moshtamel hota hey or yeh forex market mein bullish trend mein he paya jata hey

yeh forex market kay trend kay end par he hota hey es ka matlab yeh hota hey keh forex market mein trend end honay kay blkul he qareeb hota hey or yeh forex market mein opposite he turning laynay wala he point hota hey

Identify Ladder Top Pattern

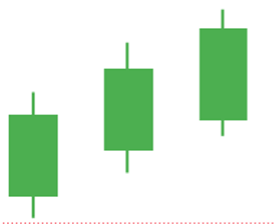

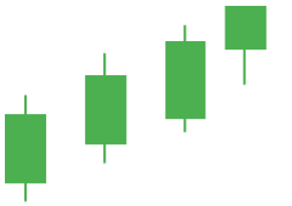

ladder top candlestick pattern 5 candlestick par he moshtamel hota hey ladder top pattern mein en 5 candlestick mein he aik jaice he tarteeb hote hey forex market mein en 5 candlestick ke aik khas tarteeb yeh hote hey

1; ladder kay sab say oper wale candlestick pehle ke teen candlestick ke hamaisha say he white hote hey jo keh long bodies par he moshtamel ho sakte hein

pehle teen candlestick mein opening or close hona hamaisha es tarah hota hey keh har candlestick ka open ya close hona pehle candlestick kay open or close ke tarah ka he hota hey or pehle candlestick kay open or close ke tarah ka he hota hey

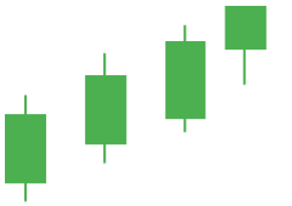

market mein 4th candlestick ke he aik body hote hey or har candlestick ka open ya close hona pehle candlestick ke tarah ka he hota hey or forex market mein position say he oper hota hey or yeh market ke position say oper he hota hey

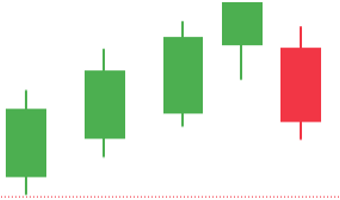

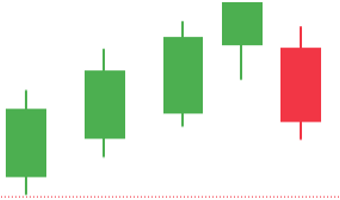

es chart pattern mein pehle candlestick black hote hey es candlestick ka opening 4th candlestick ke 4th part say he nechay hota hey

Trade with Ladder Top Pattern

trading strategy mein resistance zone ko he shamel karna chihay kunkeeh ladder top aik bearish trend reversal pattern hota hey es ley resistance zone bearish trend ko reversal janay ka he imkan hota hey

entry

jab resistance zone mein ladder top kay oper yeh pattern banta hey to yeh forex market mein ladder kay upper kay candlestick ka he pattern ho sakta hey to yeh bearish candlestick kay close karnay ka sell order ko close he karna chihay

stop loss

ladder top kay oper resistance zone ke high level par resistance zone ke high jagah kay he oper rakhna chihay yeh bohut he behtar ho ga keh ap stop loss ko safe tareen option par he rakh dein

Take Profit

ap es take profit kay ley dosray technical indicator ka he estamal kar saktay hein jaisay keh ATR trailing Indicator or stop loss ko close karna he hota hey jo keh support zone par trade close kar sakta hey

forex market mein ladder top pattern aik kesam ka technical chart pattern hota hey jo keh fore market mein trend reversal pattern hota hey jo keh forex market mein 4 bearish ya bullish pattern par he moshtamel hota hey or yeh forex market mein bullish trend mein he paya jata hey

yeh forex market kay trend kay end par he hota hey es ka matlab yeh hota hey keh forex market mein trend end honay kay blkul he qareeb hota hey or yeh forex market mein opposite he turning laynay wala he point hota hey

Identify Ladder Top Pattern

ladder top candlestick pattern 5 candlestick par he moshtamel hota hey ladder top pattern mein en 5 candlestick mein he aik jaice he tarteeb hote hey forex market mein en 5 candlestick ke aik khas tarteeb yeh hote hey

1; ladder kay sab say oper wale candlestick pehle ke teen candlestick ke hamaisha say he white hote hey jo keh long bodies par he moshtamel ho sakte hein

pehle teen candlestick mein opening or close hona hamaisha es tarah hota hey keh har candlestick ka open ya close hona pehle candlestick kay open or close ke tarah ka he hota hey or pehle candlestick kay open or close ke tarah ka he hota hey

market mein 4th candlestick ke he aik body hote hey or har candlestick ka open ya close hona pehle candlestick ke tarah ka he hota hey or forex market mein position say he oper hota hey or yeh market ke position say oper he hota hey

es chart pattern mein pehle candlestick black hote hey es candlestick ka opening 4th candlestick ke 4th part say he nechay hota hey

Trade with Ladder Top Pattern

trading strategy mein resistance zone ko he shamel karna chihay kunkeeh ladder top aik bearish trend reversal pattern hota hey es ley resistance zone bearish trend ko reversal janay ka he imkan hota hey

entry

jab resistance zone mein ladder top kay oper yeh pattern banta hey to yeh forex market mein ladder kay upper kay candlestick ka he pattern ho sakta hey to yeh bearish candlestick kay close karnay ka sell order ko close he karna chihay

stop loss

ladder top kay oper resistance zone ke high level par resistance zone ke high jagah kay he oper rakhna chihay yeh bohut he behtar ho ga keh ap stop loss ko safe tareen option par he rakh dein

Take Profit

ap es take profit kay ley dosray technical indicator ka he estamal kar saktay hein jaisay keh ATR trailing Indicator or stop loss ko close karna he hota hey jo keh support zone par trade close kar sakta hey

تبصرہ

Расширенный режим Обычный режим