Higher highs and lower lows Indicator

forex market mei higher highs or lower lows indicator forex market mein trend ko talash karnay wala indicator hota hey jo keh forex market mein trend ko talash karnay kay ley market ke peaks tak he pohnch jata hey yeh indicator assert ke values ko bhe jortay hein forex or stock market mein 2 tarah kay trend hotay hein

up trend

downtrend

trading analysis mein en 2 tarah kay trend ko samjhnay mein he madad melte hey forex market mein higher highs or adna lows ka he indicator hota hey forex market mein trading analysis ko behtar bananay kay ley upper kay trend or nechay kay trend ko behtar karnay kay ley malomaat de jate hein

higher highs or lower lows indicator ko samjhnay ka maksad

jaisa keh ap ko pehlay say he bata choka hon yeh indicator forex market kay baray mein he hota hey lahza es indicator ka basic maksad forex market ke trading strategy hota hey or forex market kay trend ka tayon karna hota hey es indicator ka basic maksad darj zail hota hey

forex market mein trend ko identify karnay kay ley higher highs or lower lows level ko jorna hota hey

yeh forex market mein nechay kay trend ka tayon karnay kay ley he estamal hota hey

significance

jadeed keam ke trading market mein higher highs or lower level ka tasowor hasell ho raha hey market kay es indicator ke importance darj zail hote hein

yeh forex market kay trend ka tayon karnay mein bhe madad karta hey yeh indicator kese assert ke zyada price or kam price mein bhe madad kar sakta hey yeh forex market mein buy ya sell signal ko kam karnay mein bhe madad kar sakta hey

forex market mein higher high or lower lows ka concept bohut he kam paya jata hey

yeh forex market kay aik trader ke news mein bhe madad kar sakta hey

Trading Strategy

Higher Highs

forex trade kay har new day kay assert kay ley forex market mein aik new price he lay kar atta hey jo keh forex market kay day kay competition mein higher day kay bohut he close hote hey ager kese assert ke price day kay hesab say assert kay bohut he close hote hey to forex market kay es trend ko higher high level he jana jata hey candlestick chart par peaks kay ley bhe high hotay hein

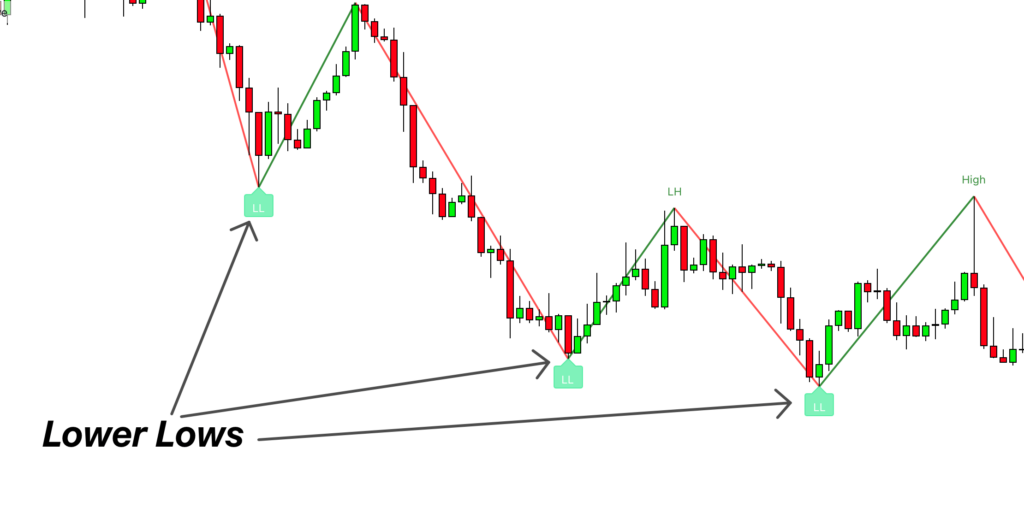

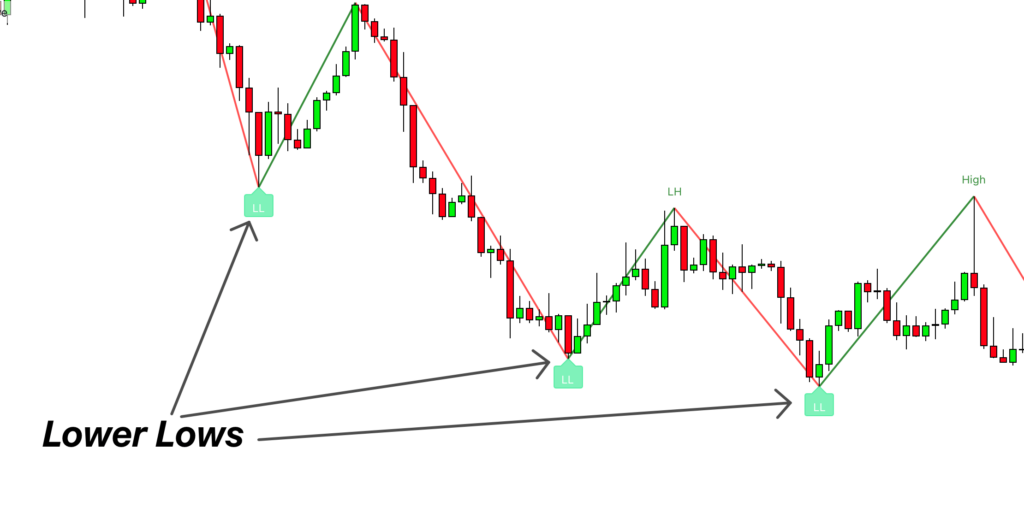

Lower Lows

yeh forex market mein kame ka trend hota hey forex market kay kese assert ke price pechlay day say he kam hote hey or market ke price competition mein lower level tak he pohnch jate hey yeh kame kay trend mein wazah he aitmad hota hey

Entry and Exit

sab say pehlay higher high or lower level ka indicator ka estamal kartay hovay forex market ke trend ke direction ko he talash karna chihay bad mein bullish direction kay ley higher high or lower level ko he talash keya ja sakta hey or yeh forex market min bullish ka he chart pattern hota hey jo keh forex market mein buy kay chance ko he talash kartay hein

forex market ke ab aik bullish trade buy mein he ho ge or es mein kamyab honay kay zyada imkanat hotay hein or yeh candlestick pattern ka estamal kartay hovay selling kay chance ko he talash kar saktay hein

take profit

ab forex market mein trade say out honay kay 2 tarekay ho saktay hein qadamat passand tareka exponential moving average hota hey ya phir yeh indicator forex market mein trend ke tabdele say he ho sakta hey bad mein yeh jare tareka RSI divergence kay sath he estamal keya jata hey

risk management

forex market mein risk management bohut he important hota hey yeh forex market mein higher highs or lower low level ka h eestamal keya ja sakta hy hamaisha apnay stop ko pechlay point par he rahna chihay ager price reversal jate bhe hey to acount safe rahay ga

forex market mei higher highs or lower lows indicator forex market mein trend ko talash karnay wala indicator hota hey jo keh forex market mein trend ko talash karnay kay ley market ke peaks tak he pohnch jata hey yeh indicator assert ke values ko bhe jortay hein forex or stock market mein 2 tarah kay trend hotay hein

up trend

downtrend

trading analysis mein en 2 tarah kay trend ko samjhnay mein he madad melte hey forex market mein higher highs or adna lows ka he indicator hota hey forex market mein trading analysis ko behtar bananay kay ley upper kay trend or nechay kay trend ko behtar karnay kay ley malomaat de jate hein

higher highs or lower lows indicator ko samjhnay ka maksad

jaisa keh ap ko pehlay say he bata choka hon yeh indicator forex market kay baray mein he hota hey lahza es indicator ka basic maksad forex market ke trading strategy hota hey or forex market kay trend ka tayon karna hota hey es indicator ka basic maksad darj zail hota hey

forex market mein trend ko identify karnay kay ley higher highs or lower lows level ko jorna hota hey

yeh forex market mein nechay kay trend ka tayon karnay kay ley he estamal hota hey

significance

jadeed keam ke trading market mein higher highs or lower level ka tasowor hasell ho raha hey market kay es indicator ke importance darj zail hote hein

yeh forex market kay trend ka tayon karnay mein bhe madad karta hey yeh indicator kese assert ke zyada price or kam price mein bhe madad kar sakta hey yeh forex market mein buy ya sell signal ko kam karnay mein bhe madad kar sakta hey

forex market mein higher high or lower lows ka concept bohut he kam paya jata hey

yeh forex market kay aik trader ke news mein bhe madad kar sakta hey

Trading Strategy

Higher Highs

forex trade kay har new day kay assert kay ley forex market mein aik new price he lay kar atta hey jo keh forex market kay day kay competition mein higher day kay bohut he close hote hey ager kese assert ke price day kay hesab say assert kay bohut he close hote hey to forex market kay es trend ko higher high level he jana jata hey candlestick chart par peaks kay ley bhe high hotay hein

Lower Lows

yeh forex market mein kame ka trend hota hey forex market kay kese assert ke price pechlay day say he kam hote hey or market ke price competition mein lower level tak he pohnch jate hey yeh kame kay trend mein wazah he aitmad hota hey

Entry and Exit

sab say pehlay higher high or lower level ka indicator ka estamal kartay hovay forex market ke trend ke direction ko he talash karna chihay bad mein bullish direction kay ley higher high or lower level ko he talash keya ja sakta hey or yeh forex market min bullish ka he chart pattern hota hey jo keh forex market mein buy kay chance ko he talash kartay hein

forex market ke ab aik bullish trade buy mein he ho ge or es mein kamyab honay kay zyada imkanat hotay hein or yeh candlestick pattern ka estamal kartay hovay selling kay chance ko he talash kar saktay hein

take profit

ab forex market mein trade say out honay kay 2 tarekay ho saktay hein qadamat passand tareka exponential moving average hota hey ya phir yeh indicator forex market mein trend ke tabdele say he ho sakta hey bad mein yeh jare tareka RSI divergence kay sath he estamal keya jata hey

risk management

forex market mein risk management bohut he important hota hey yeh forex market mein higher highs or lower low level ka h eestamal keya ja sakta hy hamaisha apnay stop ko pechlay point par he rahna chihay ager price reversal jate bhe hey to acount safe rahay ga

تبصرہ

Расширенный режим Обычный режим