MACD Trading

forex market mein MACD aik kesam ka technical indicator hota hey jo keh trend ko identify karnay mein bhe madad karta hey yeh forex market mein convergence or divergence trend ko bhe identify karnay mein bhe madad kar sakta hey jo keh forex market mein 2 moving average ko bhe identify kar sakta hey yeh indicator aik kesam ka basic indicator hota hey or forex market kay selling signal paida kar saktay hein ye indicator aik basic hota hey or effective technical indicator hota hey jo keh forex market mein buy ya sell kay signal paida kar saktay hein or forex market mein buy ya sell kay signal paida kar saktay hein

MACD indicator aik real-time ka he indicator hota hey or forex market mein kai dafa divergence or convergence ka estamal keya ja sakta hey

MACD ke pehchan

forex market mein MACD ke darj zail importance hote hey yeh forex market ka aik jadeed kesam ka technical indicator hota hey

yeh forex market ka aik real time ka he indicator hota hey

yeh forex market kay trend or es ke importance kay baray mein malomat frahm kar sakta hey

yeh forex market mein buy ya sell ke madad kar sakta hey

forex market ka aik trader MACD ke madad say sahi entry or exit kay rastay mein bhe madad kar sakta hey

MACD ke types

MACD lines forex market mein tabdele kay sath he chal sakte hein pricce paspai or central line darmean mein he kashesh kar sakte hein hum MACD lines ko 2 types mein taqeem kar saktay hein

MACD lines Divergence

ager forex market ke prices central line say he hat jate hein to forex market ke prices divergence mein bullish trend ko he identify kar sakte hein yeh woh time hota hey jab forex market bullish kay sath he trend kar rehe hote hein or forex market mein buyer ke tadad zyada ho jate hey MACD lines mein Divergence ka fasla barah jata hey MACD lines ko bullish kay sath he sahi direction ko he identify keya ja sakta hey

MACD line Convergence

jaisa keh forex market ke prices MACD line ke taraf barhte hote hein yeh forex market ke prices mein hum ahange hote hey forex market mein prices ko hum ahang karna market mein bearish kay trend ko he identify kar sakte hein or forex market ka trend bearish ka he hota hey yeh forex market mein assert sell ka chance frahm kar sakta hey

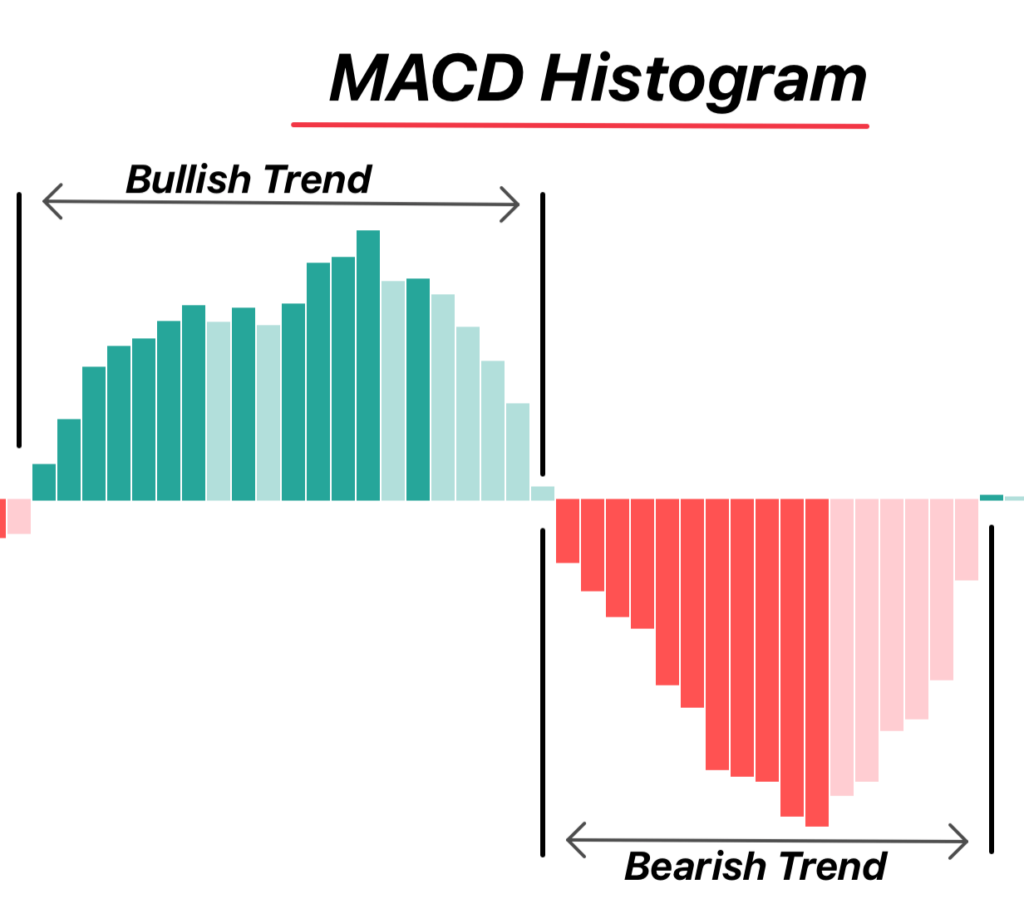

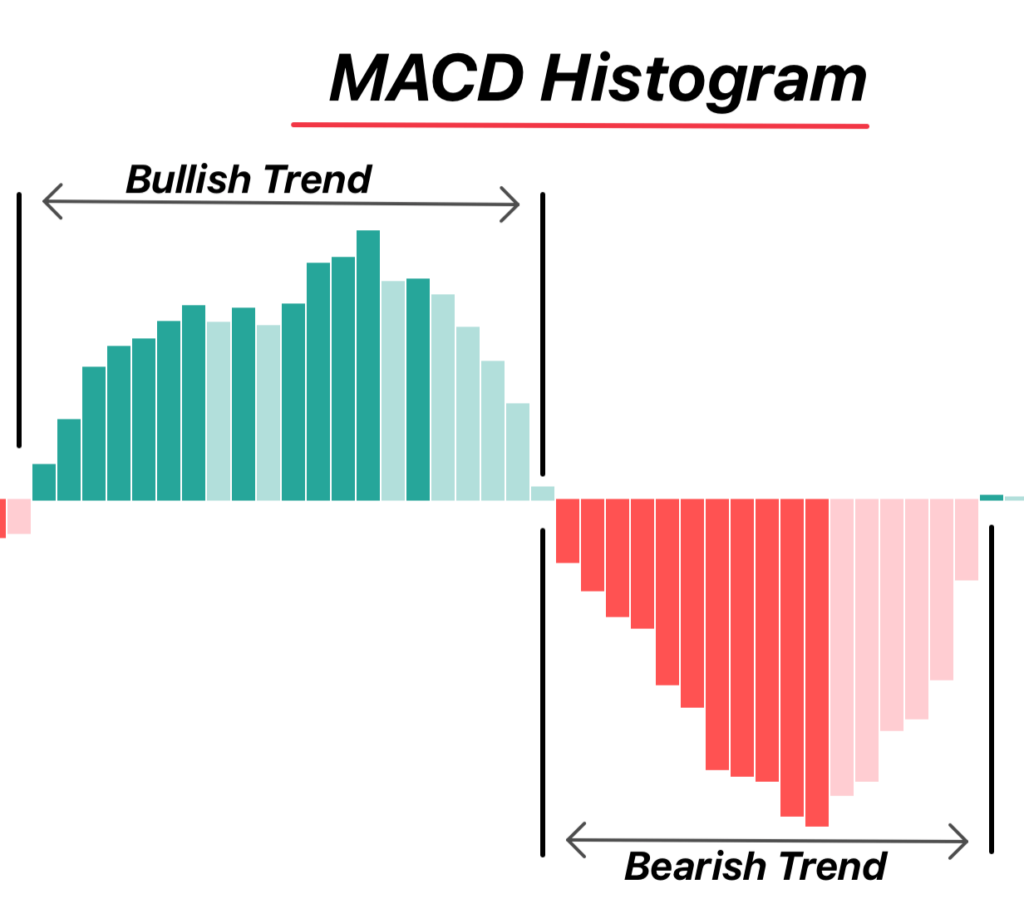

MACD histogram

jadeed kesam kay trading chart mein MACD indicator nomaindge kay 2 tarekay bhe estamal kar sakte hey forex market kay es indicator kay tor par histogram ka chart frahm keya ja sakta hey or yeh forex market mein tarjehe tarekon say he ho sakta hey forex market ka aik histogram 2 rangon ka he estamal keya ja sakta hey oper ala histogram ka area bullish trend ko he identify kar sakta hey dosree taraf 0 line ka area bearish trend ka shekar ho jata hey

forex market mein MACD aik kesam ka technical indicator hota hey jo keh trend ko identify karnay mein bhe madad karta hey yeh forex market mein convergence or divergence trend ko bhe identify karnay mein bhe madad kar sakta hey jo keh forex market mein 2 moving average ko bhe identify kar sakta hey yeh indicator aik kesam ka basic indicator hota hey or forex market kay selling signal paida kar saktay hein ye indicator aik basic hota hey or effective technical indicator hota hey jo keh forex market mein buy ya sell kay signal paida kar saktay hein or forex market mein buy ya sell kay signal paida kar saktay hein

MACD indicator aik real-time ka he indicator hota hey or forex market mein kai dafa divergence or convergence ka estamal keya ja sakta hey

MACD ke pehchan

forex market mein MACD ke darj zail importance hote hey yeh forex market ka aik jadeed kesam ka technical indicator hota hey

yeh forex market ka aik real time ka he indicator hota hey

yeh forex market kay trend or es ke importance kay baray mein malomat frahm kar sakta hey

yeh forex market mein buy ya sell ke madad kar sakta hey

forex market ka aik trader MACD ke madad say sahi entry or exit kay rastay mein bhe madad kar sakta hey

MACD ke types

MACD lines forex market mein tabdele kay sath he chal sakte hein pricce paspai or central line darmean mein he kashesh kar sakte hein hum MACD lines ko 2 types mein taqeem kar saktay hein

MACD lines Divergence

ager forex market ke prices central line say he hat jate hein to forex market ke prices divergence mein bullish trend ko he identify kar sakte hein yeh woh time hota hey jab forex market bullish kay sath he trend kar rehe hote hein or forex market mein buyer ke tadad zyada ho jate hey MACD lines mein Divergence ka fasla barah jata hey MACD lines ko bullish kay sath he sahi direction ko he identify keya ja sakta hey

MACD line Convergence

jaisa keh forex market ke prices MACD line ke taraf barhte hote hein yeh forex market ke prices mein hum ahange hote hey forex market mein prices ko hum ahang karna market mein bearish kay trend ko he identify kar sakte hein or forex market ka trend bearish ka he hota hey yeh forex market mein assert sell ka chance frahm kar sakta hey

MACD histogram

jadeed kesam kay trading chart mein MACD indicator nomaindge kay 2 tarekay bhe estamal kar sakte hey forex market kay es indicator kay tor par histogram ka chart frahm keya ja sakta hey or yeh forex market mein tarjehe tarekon say he ho sakta hey forex market ka aik histogram 2 rangon ka he estamal keya ja sakta hey oper ala histogram ka area bullish trend ko he identify kar sakta hey dosree taraf 0 line ka area bearish trend ka shekar ho jata hey

تبصرہ

Расширенный режим Обычный режим