Positive Slippage in forex?

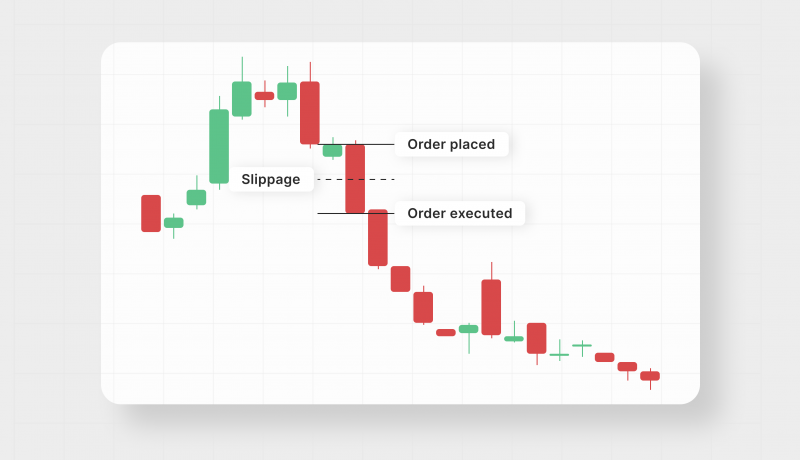

Forex trading mein "Positive Slippage" ka concept aksar samjha nahi jata, lekin ye traders ke liye ek ahm term hai. Slippage wo phenomenon hai jab ek trader ko expected price par trade execute nahi hoti, balki us se thodi si alag price par hoti hai. Iska do tarikon se hona mumkin hai: positive slippage aur negative slippage.

Positive Slippage tab hoti hai jab trade expected price se behtar price par execute hoti hai. Misaal ke taur par, agar aapne ek currency pair ko 1.2000 par buy karne ka order diya hai, lekin aapka order 1.1995 par execute hota hai, to ye positive slippage hai. Is se aapko trade par faida hota hai kyunki aapne behtar price par buy kiya. Positive slippage aksar market volatility ke doran hota hai jab prices tezi se badalte hain.

Iska sabse bada faida ye hai ke agar aap kisi strong trend mein hain, to positive slippage aapki profitability ko behter bana sakta hai. Aksar, news releases ya economic data announcements ke doran positive slippage dekhne ko milta hai, kyunki is waqt market ki liquidity badh jaati hai aur prices tezi se change hote hain.

Yeh dhyan dene wali baat hai ke positive slippage sirf short-term traders ke liye nahi, balki long-term investors ke liye bhi faida mand ho sakti hai. Long-term investors jo regularly positions ko adjust karte hain, unhe bhi positive slippage se faida hota hai jab wo positions ko behtar prices par khareedte hain ya bechte hain.

Magar, positive slippage ka hamesha hona zaroori nahi. Aksar traders ko negative slippage ka samna bhi karna padta hai, jab unki trade unke desired price se kharab price par execute hoti hai. Yeh risk ko manage karne ke liye important hai ke aap apne trading strategies ko aise design karein ke aap positive slippage ka fayda utha sakein.

Aakhir mein, positive slippage forex trading ka ek integral hissa hai, jo aapki trading performance ko behter bana sakta hai. Isliye, traders ko market conditions, liquidity aur volatility ko samajhna chahiye takay wo is opportunity ka fayda utha sakein.

Forex trading mein "Positive Slippage" ka concept aksar samjha nahi jata, lekin ye traders ke liye ek ahm term hai. Slippage wo phenomenon hai jab ek trader ko expected price par trade execute nahi hoti, balki us se thodi si alag price par hoti hai. Iska do tarikon se hona mumkin hai: positive slippage aur negative slippage.

Positive Slippage tab hoti hai jab trade expected price se behtar price par execute hoti hai. Misaal ke taur par, agar aapne ek currency pair ko 1.2000 par buy karne ka order diya hai, lekin aapka order 1.1995 par execute hota hai, to ye positive slippage hai. Is se aapko trade par faida hota hai kyunki aapne behtar price par buy kiya. Positive slippage aksar market volatility ke doran hota hai jab prices tezi se badalte hain.

Iska sabse bada faida ye hai ke agar aap kisi strong trend mein hain, to positive slippage aapki profitability ko behter bana sakta hai. Aksar, news releases ya economic data announcements ke doran positive slippage dekhne ko milta hai, kyunki is waqt market ki liquidity badh jaati hai aur prices tezi se change hote hain.

Yeh dhyan dene wali baat hai ke positive slippage sirf short-term traders ke liye nahi, balki long-term investors ke liye bhi faida mand ho sakti hai. Long-term investors jo regularly positions ko adjust karte hain, unhe bhi positive slippage se faida hota hai jab wo positions ko behtar prices par khareedte hain ya bechte hain.

Magar, positive slippage ka hamesha hona zaroori nahi. Aksar traders ko negative slippage ka samna bhi karna padta hai, jab unki trade unke desired price se kharab price par execute hoti hai. Yeh risk ko manage karne ke liye important hai ke aap apne trading strategies ko aise design karein ke aap positive slippage ka fayda utha sakein.

Aakhir mein, positive slippage forex trading ka ek integral hissa hai, jo aapki trading performance ko behter bana sakta hai. Isliye, traders ko market conditions, liquidity aur volatility ko samajhna chahiye takay wo is opportunity ka fayda utha sakein.

تبصرہ

Расширенный режим Обычный режим