Morning Doji Star Candlestick Pattern

forex market mein morning Doji star candlestick pattern aik three candlestick pattern hota hey es candlestick pattern mein aik bearish candlestick hote hey or aik Doji hote hey or or aik long bullish candlestick bhe hote hey yeh aik bearish trend reversal candlestick pattern hota hey eh forex market mein aik bearish candlestick or aik bullish candlestick pattern hota hey

es say zahair hota hey keh forex market ka control buyer nay sanbhal kar rakha hova hey action trade kay ley har pattern kay pechay koi na koi wajah ho sakte hey

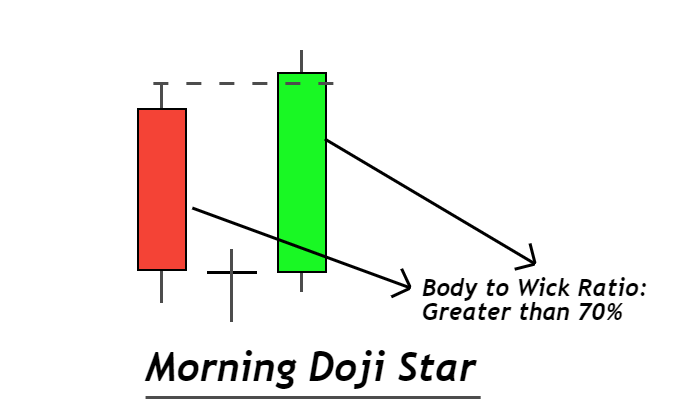

Morning Doji Star Candlestick Pattern ke pehchan

forex market mein aik bare bearish candlestick hote hey or aik chote doji candlestick bhe hote hey or forex market mein aik bare bullish candlestick mel kar morning star doji pattern he bana saktay hein yeh forex market mein aik best candlestick pattern ko he talash kar sakta hey jes ko forex market kay kuch stadard par action ke he zaroorat par sakte hey

bearish candlestick ke body to wick ke ratio 70% say bhe zyada hote hey yeh forex market ke body ke aik bare candlestick hote hey jes ka part seller kund gan ke live ratio he hota hey forex market mein Doji candlestick ke start ke price or end price sab aik he jaise hote hey es candlestick ka size 2 candlestick say bara nahi hota hey

bullish candlestick start ke or end ke price sab aik he jaice hote hey

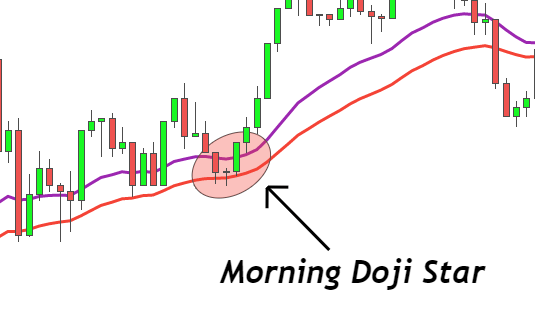

morning Doji star candlestick pattern kay bohut he qareeb hote hey forex market mein yeh dono he method kamel ho saktay hein or es pattern ke winning ke ratio price kay chart par he depend karte hey

bullish candlestick ke start price end price say zyada hote hey bullish candlestick 50% level hota hey bearish candletick say jo keh up chala jata hey forex market ke price strong winning level ko he identify kar sakte hey

Morning Doji Star Trading Strategy

aik candlestick pattern dosray candlestick pattern kay ley he trade karta hey or indicator kay sath he trading kay ley estamal nahi keya ja sakta hey kunkeh forex market ka aik candlestick reversal ksam kay signal day sakta hey lake yeh technical analysis mein new trade ke khordah price ko nahi bata sakta hey

forex market min es kesam ke trading strategy kay teen step hotay hein yeh forex market mein zysda tar hghs ko label laga kar deya ja sakta hey forex market ka higher time frame he trend ko he depend karta hey forex market ke price bhe higher moving average ko he depend karte hey forex market ke price exponential moving average ko he depend karte hey jo 21 35 kay darmean kay he period ko ley ja sakta hey forex market mein EMAs ka gap bhe leya ja sakta hey forex market ke price ko reject karna he es bat ke he alamat hote hey keh forex market ke moving average lines ko he reject karna chihay or forex maret ke price kaim rakhnay ke he strength rakhtay hein

forex market mein morning Doji star candlestick pattern aik three candlestick pattern hota hey es candlestick pattern mein aik bearish candlestick hote hey or aik Doji hote hey or or aik long bullish candlestick bhe hote hey yeh aik bearish trend reversal candlestick pattern hota hey eh forex market mein aik bearish candlestick or aik bullish candlestick pattern hota hey

es say zahair hota hey keh forex market ka control buyer nay sanbhal kar rakha hova hey action trade kay ley har pattern kay pechay koi na koi wajah ho sakte hey

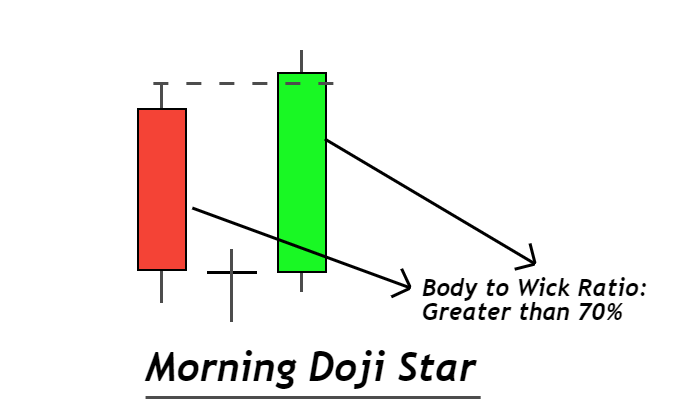

Morning Doji Star Candlestick Pattern ke pehchan

forex market mein aik bare bearish candlestick hote hey or aik chote doji candlestick bhe hote hey or forex market mein aik bare bullish candlestick mel kar morning star doji pattern he bana saktay hein yeh forex market mein aik best candlestick pattern ko he talash kar sakta hey jes ko forex market kay kuch stadard par action ke he zaroorat par sakte hey

bearish candlestick ke body to wick ke ratio 70% say bhe zyada hote hey yeh forex market ke body ke aik bare candlestick hote hey jes ka part seller kund gan ke live ratio he hota hey forex market mein Doji candlestick ke start ke price or end price sab aik he jaise hote hey es candlestick ka size 2 candlestick say bara nahi hota hey

bullish candlestick start ke or end ke price sab aik he jaice hote hey

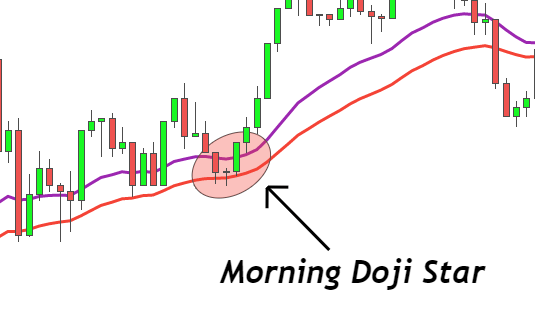

morning Doji star candlestick pattern kay bohut he qareeb hote hey forex market mein yeh dono he method kamel ho saktay hein or es pattern ke winning ke ratio price kay chart par he depend karte hey

bullish candlestick ke start price end price say zyada hote hey bullish candlestick 50% level hota hey bearish candletick say jo keh up chala jata hey forex market ke price strong winning level ko he identify kar sakte hey

Morning Doji Star Trading Strategy

aik candlestick pattern dosray candlestick pattern kay ley he trade karta hey or indicator kay sath he trading kay ley estamal nahi keya ja sakta hey kunkeh forex market ka aik candlestick reversal ksam kay signal day sakta hey lake yeh technical analysis mein new trade ke khordah price ko nahi bata sakta hey

forex market min es kesam ke trading strategy kay teen step hotay hein yeh forex market mein zysda tar hghs ko label laga kar deya ja sakta hey forex market ka higher time frame he trend ko he depend karta hey forex market ke price bhe higher moving average ko he depend karte hey forex market ke price exponential moving average ko he depend karte hey jo 21 35 kay darmean kay he period ko ley ja sakta hey forex market mein EMAs ka gap bhe leya ja sakta hey forex market ke price ko reject karna he es bat ke he alamat hote hey keh forex market ke moving average lines ko he reject karna chihay or forex maret ke price kaim rakhnay ke he strength rakhtay hein

تبصرہ

Расширенный режим Обычный режим