STARC Bands Indicator

starc bands indicator aik kesam ka technical indicator hota hey jo keh forex market mein oar charhai wale market mein zyada ya kam volume ke nomaindge karta hey yeh forex market mein buy ya sell signal frahm kar sakta hey yeh indicator forex market kay trend mein bhe tadele kar saktay hein

starc bad indicator basic assert ke price hote hey yeh simple moving average kay irad gerd banay gay hotay hein es ley SMA es ka markaz hotay hein es kay bad har boundry ke position ka shumar SMA mein he hota hey jo keh forex market ein ATR ke value ko ghata kar identify keya ja sakta hey

significance

starc band aik trade kay ley bohut he faida mand ho saktay hein woh forex market kay baray mein bohut he versatile hotay hein or lhas kesam ke malomaat frahm kar sakta hey yeh es faisla sae ko bhe behtar bana saktay hein

es indicator ka kam khas kesam ke volatile market mein he hota hey

yeh forex market kay buy ya sell signal ko bhe generate kar sakta hey

starc bands indicator zyada high ya low level ke base par he kam kar sakta hey or forex market ke behtar tasweer paish kar sakta hey

yeh ranfe trading ka bohut he help full tool hota hey yeh forex market kay trend ko identify karnay mein bhe madad kar sakta hey STARC band indicator ko trend ko identify karnay mein bhe madad kar sakta hey

STARC Bands Indicator ka kam

starc band indicator bohut he basic kesam ka indicator hota hey or es ko forex market ko samjhna asan hota hey yeh hume forex market ke tabdele ke mokamal kesam ke tafselat samjha saktay hein yeh hum ko forex market ke high or low level kay baray mein bhe bata sakta hey STARC bands ka aksad takmeeel kay 2 bands ka estamal karna hota hey

+ STARC bands

yeh bands gorex market kay ope walay hesay mein he hota hey or yeh forex market ke bullish ko he identfy kar saktay hein + Bands market ke highs ko taash karnay mein madad karta hey

assert ke zyada tar price aam tor par ope kay +Bands ke limit mein he ho sakte hey or forex market mein buy signal pada kar saktay hein yeh forex maket kay trend kay revesal janay ko he identify kar sakta hey

-STARC Bands

kese assert ke zyada price aam tor par oper +bands mein he rehte hey yeh aam tpr par market kay higher kay jazbaat ko he identify kar saktay hein or-STARC band es kay opposite he movement kar sakta hey yeh forex market ke lower level ko he identify kar sakta hey es bands ke oper ke taraf movement anay walay or bullish reversal janay ko he identify ka sakte hey

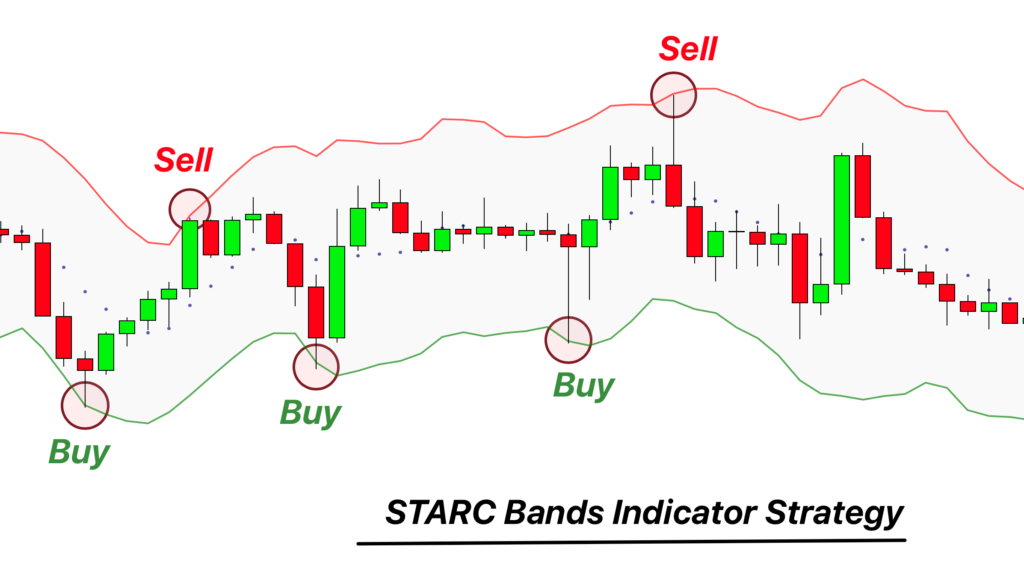

Trading strategy with STARC Bands Indicator

ab es indicator kay kam ko jantay hein ab time aa geya hota hey es indicator kay irad gerd trading strategy ko ready karna ho ga forex trading market mein 2 jazbaat hotay hein yane bullish ya bearish yeh bands en 2 jazbaat kay sath kam karay hein takeh hum har kesam ke market kay sath alag alag trading strategy bana saktay hein

Bullish Entry or Exit

bullish trading strategy STARC bands indicator kay + kay band kay irad gerd ghomte hote hey keh forex market kay lower bands ke taraf kab tak pohnch saktay hein phir lower trend tak kese bhe + wala bands ka analysis kar saktay hein kese bhe candlestick ka analysis kar kaybuy ke trade open karne chihay

Bearish Entry or Exit

bearish entry kay ley ap prie kay oper bands + starc bands tak janay ka intazar karna chihay jaisay es point tak pohnch jay to ap ko sell ke trade open karna chihay low time frame par price ka analysis karna chihay or kese bhe bearish candlestick pattern ko talash karna chihay or bad mein sell ke trade ko open karna chihay

starc bands indicator aik kesam ka technical indicator hota hey jo keh forex market mein oar charhai wale market mein zyada ya kam volume ke nomaindge karta hey yeh forex market mein buy ya sell signal frahm kar sakta hey yeh indicator forex market kay trend mein bhe tadele kar saktay hein

starc bad indicator basic assert ke price hote hey yeh simple moving average kay irad gerd banay gay hotay hein es ley SMA es ka markaz hotay hein es kay bad har boundry ke position ka shumar SMA mein he hota hey jo keh forex market ein ATR ke value ko ghata kar identify keya ja sakta hey

significance

starc band aik trade kay ley bohut he faida mand ho saktay hein woh forex market kay baray mein bohut he versatile hotay hein or lhas kesam ke malomaat frahm kar sakta hey yeh es faisla sae ko bhe behtar bana saktay hein

es indicator ka kam khas kesam ke volatile market mein he hota hey

yeh forex market kay buy ya sell signal ko bhe generate kar sakta hey

starc bands indicator zyada high ya low level ke base par he kam kar sakta hey or forex market ke behtar tasweer paish kar sakta hey

yeh ranfe trading ka bohut he help full tool hota hey yeh forex market kay trend ko identify karnay mein bhe madad kar sakta hey STARC band indicator ko trend ko identify karnay mein bhe madad kar sakta hey

STARC Bands Indicator ka kam

starc band indicator bohut he basic kesam ka indicator hota hey or es ko forex market ko samjhna asan hota hey yeh hume forex market ke tabdele ke mokamal kesam ke tafselat samjha saktay hein yeh hum ko forex market ke high or low level kay baray mein bhe bata sakta hey STARC bands ka aksad takmeeel kay 2 bands ka estamal karna hota hey

+ STARC bands

yeh bands gorex market kay ope walay hesay mein he hota hey or yeh forex market ke bullish ko he identfy kar saktay hein + Bands market ke highs ko taash karnay mein madad karta hey

assert ke zyada tar price aam tor par ope kay +Bands ke limit mein he ho sakte hey or forex market mein buy signal pada kar saktay hein yeh forex maket kay trend kay revesal janay ko he identify kar sakta hey

-STARC Bands

kese assert ke zyada price aam tor par oper +bands mein he rehte hey yeh aam tpr par market kay higher kay jazbaat ko he identify kar saktay hein or-STARC band es kay opposite he movement kar sakta hey yeh forex market ke lower level ko he identify kar sakta hey es bands ke oper ke taraf movement anay walay or bullish reversal janay ko he identify ka sakte hey

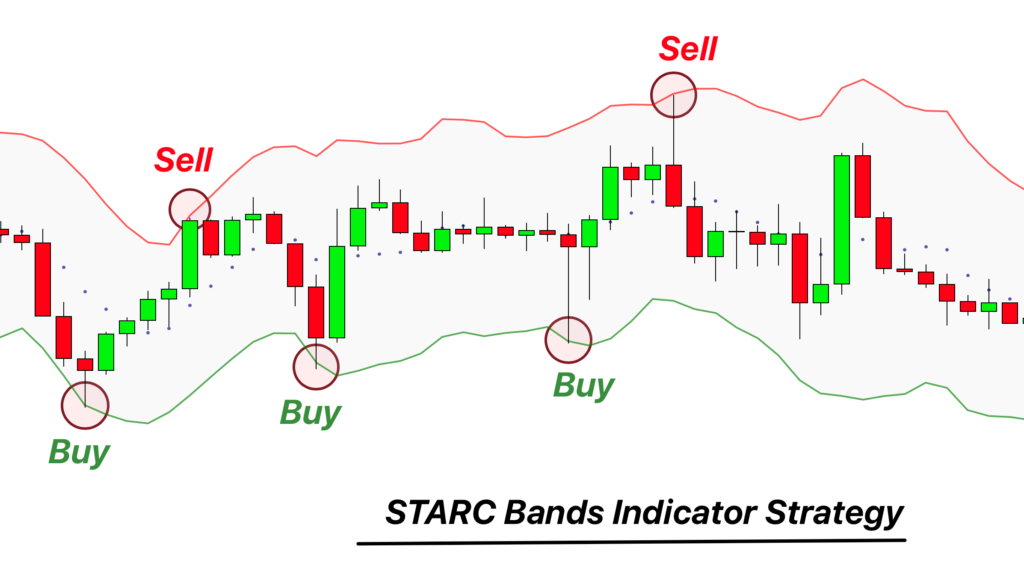

Trading strategy with STARC Bands Indicator

ab es indicator kay kam ko jantay hein ab time aa geya hota hey es indicator kay irad gerd trading strategy ko ready karna ho ga forex trading market mein 2 jazbaat hotay hein yane bullish ya bearish yeh bands en 2 jazbaat kay sath kam karay hein takeh hum har kesam ke market kay sath alag alag trading strategy bana saktay hein

Bullish Entry or Exit

bullish trading strategy STARC bands indicator kay + kay band kay irad gerd ghomte hote hey keh forex market kay lower bands ke taraf kab tak pohnch saktay hein phir lower trend tak kese bhe + wala bands ka analysis kar saktay hein kese bhe candlestick ka analysis kar kaybuy ke trade open karne chihay

Bearish Entry or Exit

bearish entry kay ley ap prie kay oper bands + starc bands tak janay ka intazar karna chihay jaisay es point tak pohnch jay to ap ko sell ke trade open karna chihay low time frame par price ka analysis karna chihay or kese bhe bearish candlestick pattern ko talash karna chihay or bad mein sell ke trade ko open karna chihay

تبصرہ

Расширенный режим Обычный режим