Dark Cover Cloud Pattern in forex Market

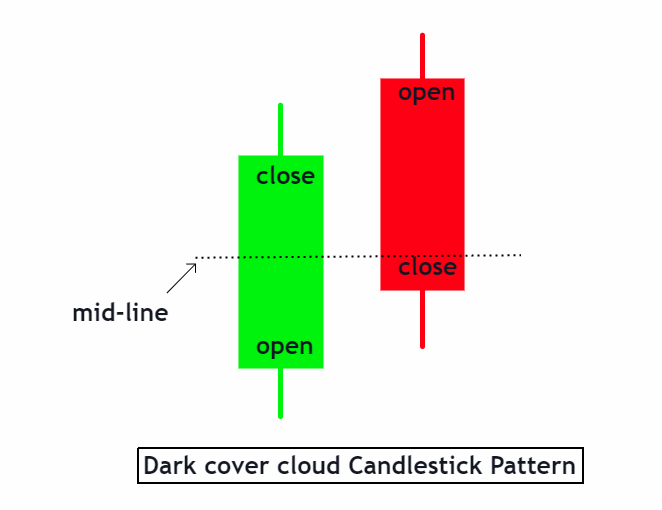

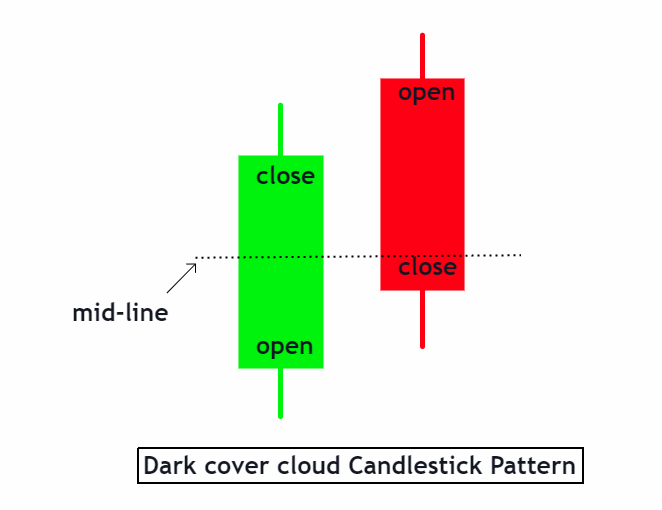

forex market mei dark cover cloud pattern aik kesam ka candlestick pattern hota hey yeh forex market mein candlestick kay opposite he pair paish key ja saktay hein jo keh forex market mein bearish reversal pattern ko he paish kartay hein es kesam kay pattern mein aik bearish candlestick bullish candlestick ko follow kar sakte hey

bearish candlestick ka open hona pehlay bullish white candlestick kay close say he zyada ho sakta hey

bearish candlestick ka close hona forex market mein candlestick kay average point say he nechay ho sakta hey

yeh forex market mein 2 opposite rang ke candlestick ka unique pattern he ho sakta hey

forex market mein bullish candlestick kay close honay or bearish candlestick kay open honay kay darmean mein he distance he hona chihay darmean ka fasla market kay sath he gap ho sakta hey

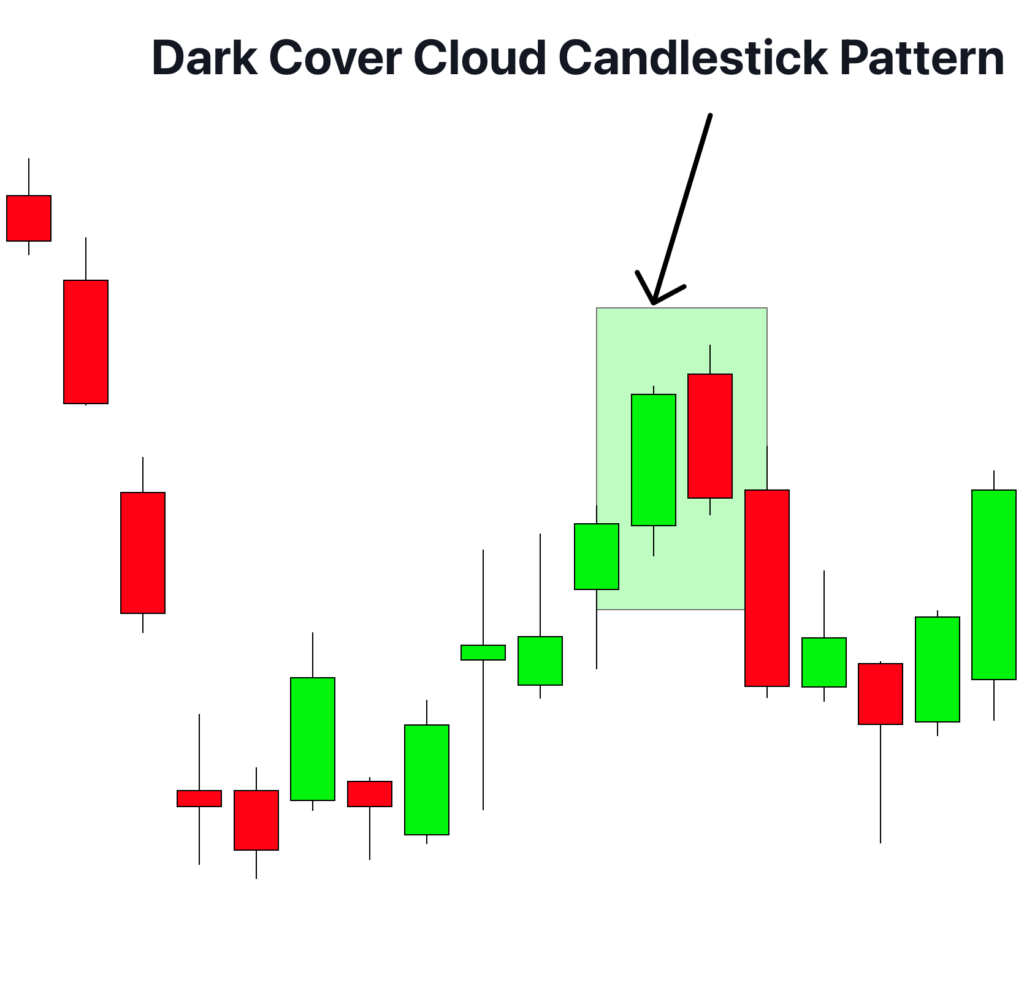

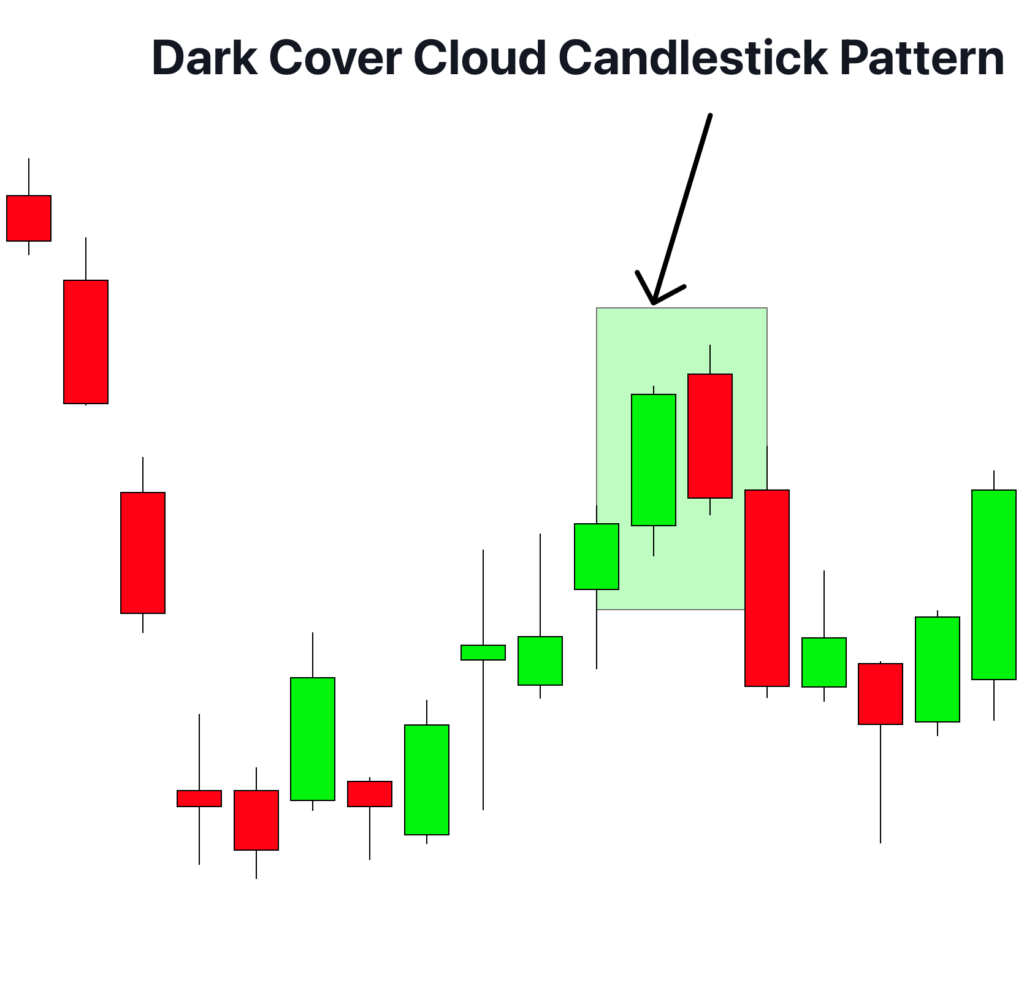

How to find dark cover cloud candlestick pattern

darck cover cloud pattern aik alag kesam ka pattern hota hey es candlestick pattern ke allag noeyat ke wajah ko he tallash karna chihay hum forex arket kay es candlestick pattern kay assan step ko he talash kar saktay hein

step 1

pehlay say he bullish market ka he chart ho sakta hey or forex market mein aik mamol ce bullish candlestick namodar ho ge forex market ke candlestick aik baqaida he ho sakta hey jes ke body or wick ka size baqaida ho

step 2

bearish candlestick ke body bullish candlestick kay size par he depend karte hey bearish black candlestick ka open hona bullish white candlestick kay close say nechay ho sakta hey yeh forex market kay price ay farq ko he identify kar sakta hey

Analysis Dark Cover Cloud Pattern

ap forex market mein es bat say bakhobe he wakaf ho saktay hein keh forex market kay pattern ko pehchan karnay ke importance rakh saktay hein forex market mein es ka aalysis sekhnay ka tie aa geya hey pattern ka analysis karna bohut he important step bhe ho sakta hey

ap ke forex market ke strategy or experience say he farq par sakta hey

ager white candlestick kay open honay or black candlestick kay ope honay mein farq zyada hota hey to forex market mein reversal trend bhe bara ho sakta hey ager forex market ke bullish or bearish candlestick ke length bhe ho sakte hey or forex market ke prices mein rad o badal bhe zyada ho sakta hey ager forex market ke bearish candlestick white candlestick say he nechay close ho sakte hey to forex market mein reversal zyada solid ho sakta hey

ager dark cloud candlestick par volume zyada hota hey to reversal janay mein kamyabe ka imkan zyada ho sakta hey

forex market mei dark cover cloud pattern aik kesam ka candlestick pattern hota hey yeh forex market mein candlestick kay opposite he pair paish key ja saktay hein jo keh forex market mein bearish reversal pattern ko he paish kartay hein es kesam kay pattern mein aik bearish candlestick bullish candlestick ko follow kar sakte hey

bearish candlestick ka open hona pehlay bullish white candlestick kay close say he zyada ho sakta hey

bearish candlestick ka close hona forex market mein candlestick kay average point say he nechay ho sakta hey

yeh forex market mein 2 opposite rang ke candlestick ka unique pattern he ho sakta hey

forex market mein bullish candlestick kay close honay or bearish candlestick kay open honay kay darmean mein he distance he hona chihay darmean ka fasla market kay sath he gap ho sakta hey

How to find dark cover cloud candlestick pattern

darck cover cloud pattern aik alag kesam ka pattern hota hey es candlestick pattern ke allag noeyat ke wajah ko he tallash karna chihay hum forex arket kay es candlestick pattern kay assan step ko he talash kar saktay hein

step 1

pehlay say he bullish market ka he chart ho sakta hey or forex market mein aik mamol ce bullish candlestick namodar ho ge forex market ke candlestick aik baqaida he ho sakta hey jes ke body or wick ka size baqaida ho

step 2

bearish candlestick ke body bullish candlestick kay size par he depend karte hey bearish black candlestick ka open hona bullish white candlestick kay close say nechay ho sakta hey yeh forex market kay price ay farq ko he identify kar sakta hey

Analysis Dark Cover Cloud Pattern

ap forex market mein es bat say bakhobe he wakaf ho saktay hein keh forex market kay pattern ko pehchan karnay ke importance rakh saktay hein forex market mein es ka aalysis sekhnay ka tie aa geya hey pattern ka analysis karna bohut he important step bhe ho sakta hey

ap ke forex market ke strategy or experience say he farq par sakta hey

ager white candlestick kay open honay or black candlestick kay ope honay mein farq zyada hota hey to forex market mein reversal trend bhe bara ho sakta hey ager forex market ke bullish or bearish candlestick ke length bhe ho sakte hey or forex market ke prices mein rad o badal bhe zyada ho sakta hey ager forex market ke bearish candlestick white candlestick say he nechay close ho sakte hey to forex market mein reversal zyada solid ho sakta hey

ager dark cloud candlestick par volume zyada hota hey to reversal janay mein kamyabe ka imkan zyada ho sakta hey

تبصرہ

Расширенный режим Обычный режим