Exchanging Ki Ahmiyat:

Exchanging, aaj ke dor mein ek ahem aur famous action boycott chuki hai. Yeh sirf ek kind of revenue nahi, balki abundance creation ka ek ahem zariya bhi hai. Securities exchanges, Forex, cryptographic forms of money, products, aur other monetary business sectors mein exchanging ne logon ke liye naye open doors aur potential outcomes ka darwaza khola hai. perspective gamble the board hai. Yeh aapko discipline aur tolerance seekhne ka zariya banta hai, kyun ke exchanging mein risk ko control karna aur apne feelings ko oversee karna bohot zaroori hota hai. Fruitful dealers apni procedures ke sath risk ko balance karte hain aur misfortune ko control mein rakhne ki koshish karte hain.

Customary ventures, jaise ke bank accounts, securities, ya land, ke muqable mein exchanging zyada quick aur adaptable tareeqay se benefits create karne ka moka deti hai. Agar aap exchanging ki sahi systems seekh lete hain, to aap restricted waqt mein apne capital ko barha sakte hain. ki ahmiyat aaj ke dor mein bohot zyada barh chuki hai, kyun ke yeh abundance creation, monetary autonomy, aur expertise improvement ka ek zabardast zariya hai. Har shakhs jo market ka sahi examination aur methodologies ko follow karte tint exchanging karta hai, wo beneficial outcomes hasil kar sakta hai. Exchanging sirf ek transient benefit making action nahi, balki ek aisi venture hai jo aapko monetarily solid aur autonomous banane mein madadgar sabit hoti hai. Istemaal.

Customary ventures, jaise ke bank accounts, securities, ya land, ke muqable mein exchanging zyada quick aur adaptable tareeqay se benefits create karne ka moka deti hai. Agar aap exchanging ki sahi systems seekh lete hain, to aap restricted waqt mein apne capital ko barha sakte hain. ki ahmiyat aaj ke dor mein bohot zyada barh chuki hai, kyun ke yeh abundance creation, monetary autonomy, aur expertise improvement ka ek zabardast zariya hai. Har shakhs jo market ka sahi examination aur methodologies ko follow karte tint exchanging karta hai, wo beneficial outcomes hasil kar sakta hai. Exchanging sirf ek transient benefit making action nahi, balki ek aisi venture hai jo aapko monetarily solid aur autonomous banane mein madadgar sabit hoti hai. Istemaal.

Management.

ki doosri ahem wajah yeh hai ke yeh aapko adaptability aur autonomy deti hai. Aap apni marzi se kab aur kitna time exchanging ko dena chahte hain, ispar aapka control hota hai. Is adaptability ke zariye aap exchanging ko parttime ya full-time vocation ke pinnacle standard pick kar sakte hain.Exchanging sirf ek paisa banane ka tareeqa nahi, balki yeh aapki information aur abilities ko barhane ka bhi zariya hai. Monetary business sectors ke elements ko samajhne ke liye aapko market investigation, specialized aur principal examination, aur risk the executives jaisi abilities seekhni parti hain.Exchanging ke zariye aap sirf ek market tak mehdood nahi rehte. Aap different monetary business sectors mein exchange kar sakte hain, jaise ke Forex, stocks, items, cryptographic forms of money, aur others. Yeh exchanging ko ek assorted aur dynamic field banata hai, jahan har waqt naye amazing open doors accessible hoti hain.

Strategies.

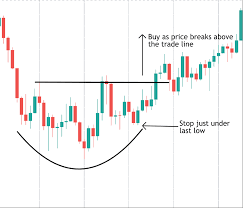

Traders ke liye sabse zaroori baat ye hai ke wo is pattern ko identify karein aur uske breakout par focus karein. Jab price resistance todta hai aur volume barhta hai, tab buying position lena faidemand hota hai. Stop loss us resistance ke neeche lagana chahiye jo ab support ban chuka hota hai. Rounding bottom pattern long-term trading ke liye ideal hai, aur isse steady returns ki umeed hoti hai.Is article mein murmur exchanging ki ahmiyat, uske faiday, aur kyun exchanging ko seekhna aur isme partake karna zaroori hai, in tamam angles ka jaiza lein ge.Exchanging ka sab se bada faida yeh hai ke yeh abundance creation ka zariya hai.

Exchanging, aaj ke dor mein ek ahem aur famous action boycott chuki hai. Yeh sirf ek kind of revenue nahi, balki abundance creation ka ek ahem zariya bhi hai. Securities exchanges, Forex, cryptographic forms of money, products, aur other monetary business sectors mein exchanging ne logon ke liye naye open doors aur potential outcomes ka darwaza khola hai. perspective gamble the board hai. Yeh aapko discipline aur tolerance seekhne ka zariya banta hai, kyun ke exchanging mein risk ko control karna aur apne feelings ko oversee karna bohot zaroori hota hai. Fruitful dealers apni procedures ke sath risk ko balance karte hain aur misfortune ko control mein rakhne ki koshish karte hain.

Management.

ki doosri ahem wajah yeh hai ke yeh aapko adaptability aur autonomy deti hai. Aap apni marzi se kab aur kitna time exchanging ko dena chahte hain, ispar aapka control hota hai. Is adaptability ke zariye aap exchanging ko parttime ya full-time vocation ke pinnacle standard pick kar sakte hain.Exchanging sirf ek paisa banane ka tareeqa nahi, balki yeh aapki information aur abilities ko barhane ka bhi zariya hai. Monetary business sectors ke elements ko samajhne ke liye aapko market investigation, specialized aur principal examination, aur risk the executives jaisi abilities seekhni parti hain.Exchanging ke zariye aap sirf ek market tak mehdood nahi rehte. Aap different monetary business sectors mein exchange kar sakte hain, jaise ke Forex, stocks, items, cryptographic forms of money, aur others. Yeh exchanging ko ek assorted aur dynamic field banata hai, jahan har waqt naye amazing open doors accessible hoti hain.

Strategies.

Traders ke liye sabse zaroori baat ye hai ke wo is pattern ko identify karein aur uske breakout par focus karein. Jab price resistance todta hai aur volume barhta hai, tab buying position lena faidemand hota hai. Stop loss us resistance ke neeche lagana chahiye jo ab support ban chuka hota hai. Rounding bottom pattern long-term trading ke liye ideal hai, aur isse steady returns ki umeed hoti hai.Is article mein murmur exchanging ki ahmiyat, uske faiday, aur kyun exchanging ko seekhna aur isme partake karna zaroori hai, in tamam angles ka jaiza lein ge.Exchanging ka sab se bada faida yeh hai ke yeh abundance creation ka zariya hai.

تبصرہ

Расширенный режим Обычный режим