Upside Gap Two Crows Candlestick Pattern Trading: Ek Jameel Tafseel

Candlestick patterns trading mein bohot ahmiyat rakhte hain, kyun ke yeh market ke emotions aur investor ke jazbaat ko asaan taur par dikhate hain. Aaj hum ek khaas candlestick pattern "Upside Gap Two Crows" par baat karein ge, jo traders ko market ke potential reversal points ko samajhne mein madad deta hai. Is article mein hum is pattern ke mukhtalif pehluon ko discuss karein ge, jisme iska structure, interpretation, aur trading strategies shamil hain.

1. Upside Gap Two Crows Candlestick Pattern Kya Hai?

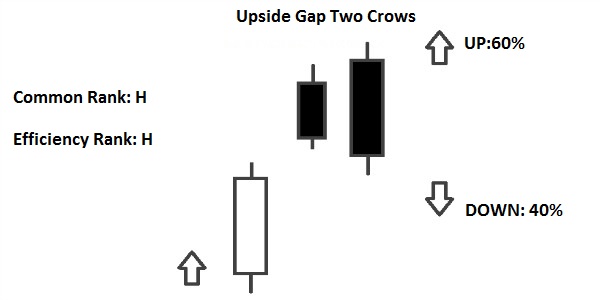

Upside Gap Two Crows candlestick pattern ek bearish reversal pattern hai jo upar ki taraf chalti hui market mein dikhayi deta hai. Yeh pattern tab banta hai jab ek bullish candle ke baad do bearish candles aati hain, jisme pehli bearish candle gap ke sath upar open hoti hai aur doosri bearish candle pehli ke high se neeche close hoti hai.

2. Is Pattern Ka Basic Structure

Is pattern ka basic structure 3 candles par mabni hota hai. Pehli candle ek bullish candle hoti hai, jo market ke uptrend ko signify karti hai. Dusri aur teesri candles bearish hoti hain. Yeh pattern tab mukammal hota hai jab teesri bearish candle pehli bearish candle ke high ke neeche close hoti hai, jo ke market ke potential reversal ka ishara hota hai.

3. Market Mein Iska Asar

Upside Gap Two Crows pattern market mein ek bearish reversal signal deta hai. Yeh signal tab aata hai jab buyers ke paas price ko further upar le jane ki taqat nahi hoti, aur sellers control hasil kar lete hain. Is pattern ka zahoor ek waqt hota hai jab market ka sentiment bullish se bearish mein tabdeel ho raha hota hai.

4. Is Pattern Ko Kaise Pehchaana Jaye?

Upside Gap Two Crows pattern ko pehchaanne ke liye aapko pehli bullish candle ke baad gap ke sath do bearish candles ka zahoor dekhna hoga. Pehli bearish candle gap ke sath open hoti hai, aur doosri bearish candle pehli ke high se neeche close hoti hai. Yeh pehchan is pattern ki khasiyat hai jo isay doosray candlestick patterns se alag karti hai.

5. Is Pattern Ka Mansoobah Band Trading Mein

Upside Gap Two Crows pattern ko trading mein istamaal karne ka tareeqa yeh hai ke jab yeh pattern ek uptrend ke dauran banta hai, to traders ko apni long positions se bahar nikalne ya short positions mein dakhil hone ka sochna chahiye. Yeh pattern asarandaz hota hai jab market mein weak bullish momentum hoti hai aur reversal ka khatka ho.

6. Confirmation Ki Ahmiyat

Sirf Upside Gap Two Crows pattern ke zahoor par aamal karna risky ho sakta hai, is liye confirmation ki zarurat hoti hai. Yeh confirmation kisi aur technical indicator, jaise ke RSI ya MACD ke through ho sakti hai. Jab yeh pattern doosray bearish signals ke sath milta hai, to yeh ek strong bearish trend ka ishara hota hai.

7. Entry aur Exit Points Ka Taa'yun

Trading mein entry aur exit points ka taayun bohot zaroori hota hai. Upside Gap Two Crows pattern ko dekhte hue, traders ko entry point ke tor par teesri bearish candle ke close hone ke baad short position lene ka sochna chahiye. Exit points ka taayun kisi support level ya moving average ke hisaab se kiya ja sakta hai.

8. Risk Management Ki Hikmat

Kisi bhi trading strategy mein risk management ki bohot ahmiyat hoti hai. Upside Gap Two Crows pattern ke sath trading karte waqt stop loss levels ko set karna zaroori hai. Stop loss ko teesri candle ke high ke thoda upar set karna behtareen strategy ho sakti hai, taake agar market trend ke khilaf chale to losses ko control kiya ja sake.

9. Volatility Ka Kirdar

Volatility ke dauran Upside Gap Two Crows pattern ka asar aur bhi zyada ho sakta hai. High volatility markets mein yeh pattern strong reversal ka signal de sakta hai. Lekin low volatility markets mein yeh signal utna reliable nahi hota. Is liye market ki volatility ko samajhna bhi zaroori hai.

10. Historical Data Ka Mutalea

Traders ko Upside Gap Two Crows pattern ka historical mutalea karna chahiye taake woh samajh sakein ke kin market halat mein yeh pattern sab se zyada asarandaz hota hai. Historical data ka mutalea traders ko yeh samajhne mein madad deta hai ke kis waqt yeh pattern sab se zyada accurate trading signals de sakta hai.

11. Combining Upside Gap Two Crows with Other Indicators

Aik trading strategy ko successful banane ke liye aksar aik pattern ko doosray indicators ke sath milaya jata hai. RSI, MACD, aur moving averages jaise indicators Upside Gap Two Crows pattern ke sath istamaal kiye ja sakte hain taake trend ke reversal ka strong signal mil sake.

12. Time Frame Ka Asar

Candlestick patterns ka asar aksar time frame par bhi depend karta hai. Upside Gap Two Crows pattern day trading ke liye, hourly charts ya daily charts par zyada madadgar hota hai. Lekin weekly aur monthly charts par iska asar different ho sakta hai. Is liye yeh dekhna zaroori hai ke aap kis time frame mein trading kar rahe hain.

13. Is Pattern Ka Practical Istemaal

Upside Gap Two Crows pattern ka practical istemaal karna ek disciplined trader ki nishani hai. Har baar is pattern ko dekh kar jaldi mein faislay karne ke bajaye, sabr se kaam le kar aur doosray indicators ka intezar karna behtareen strategy hoti hai. Is pattern ka istamaal tabhi successful hoga jab aap proper risk management aur confirmation techniques ko apnayein.

Nateeja

Upside Gap Two Crows candlestick pattern ek powerful bearish reversal signal hai jo agar theek tareeke se samjha jaye to trading mein kaafi faida mand ho sakta hai. Is pattern ke mukhtalif pehluon ko samajhna aur iska sahi tareeke se istemaal karna aapko profitable trading decisions lene mein madad dega.

Candlestick patterns trading mein bohot ahmiyat rakhte hain, kyun ke yeh market ke emotions aur investor ke jazbaat ko asaan taur par dikhate hain. Aaj hum ek khaas candlestick pattern "Upside Gap Two Crows" par baat karein ge, jo traders ko market ke potential reversal points ko samajhne mein madad deta hai. Is article mein hum is pattern ke mukhtalif pehluon ko discuss karein ge, jisme iska structure, interpretation, aur trading strategies shamil hain.

1. Upside Gap Two Crows Candlestick Pattern Kya Hai?

Upside Gap Two Crows candlestick pattern ek bearish reversal pattern hai jo upar ki taraf chalti hui market mein dikhayi deta hai. Yeh pattern tab banta hai jab ek bullish candle ke baad do bearish candles aati hain, jisme pehli bearish candle gap ke sath upar open hoti hai aur doosri bearish candle pehli ke high se neeche close hoti hai.

2. Is Pattern Ka Basic Structure

Is pattern ka basic structure 3 candles par mabni hota hai. Pehli candle ek bullish candle hoti hai, jo market ke uptrend ko signify karti hai. Dusri aur teesri candles bearish hoti hain. Yeh pattern tab mukammal hota hai jab teesri bearish candle pehli bearish candle ke high ke neeche close hoti hai, jo ke market ke potential reversal ka ishara hota hai.

3. Market Mein Iska Asar

Upside Gap Two Crows pattern market mein ek bearish reversal signal deta hai. Yeh signal tab aata hai jab buyers ke paas price ko further upar le jane ki taqat nahi hoti, aur sellers control hasil kar lete hain. Is pattern ka zahoor ek waqt hota hai jab market ka sentiment bullish se bearish mein tabdeel ho raha hota hai.

4. Is Pattern Ko Kaise Pehchaana Jaye?

Upside Gap Two Crows pattern ko pehchaanne ke liye aapko pehli bullish candle ke baad gap ke sath do bearish candles ka zahoor dekhna hoga. Pehli bearish candle gap ke sath open hoti hai, aur doosri bearish candle pehli ke high se neeche close hoti hai. Yeh pehchan is pattern ki khasiyat hai jo isay doosray candlestick patterns se alag karti hai.

5. Is Pattern Ka Mansoobah Band Trading Mein

Upside Gap Two Crows pattern ko trading mein istamaal karne ka tareeqa yeh hai ke jab yeh pattern ek uptrend ke dauran banta hai, to traders ko apni long positions se bahar nikalne ya short positions mein dakhil hone ka sochna chahiye. Yeh pattern asarandaz hota hai jab market mein weak bullish momentum hoti hai aur reversal ka khatka ho.

6. Confirmation Ki Ahmiyat

Sirf Upside Gap Two Crows pattern ke zahoor par aamal karna risky ho sakta hai, is liye confirmation ki zarurat hoti hai. Yeh confirmation kisi aur technical indicator, jaise ke RSI ya MACD ke through ho sakti hai. Jab yeh pattern doosray bearish signals ke sath milta hai, to yeh ek strong bearish trend ka ishara hota hai.

7. Entry aur Exit Points Ka Taa'yun

Trading mein entry aur exit points ka taayun bohot zaroori hota hai. Upside Gap Two Crows pattern ko dekhte hue, traders ko entry point ke tor par teesri bearish candle ke close hone ke baad short position lene ka sochna chahiye. Exit points ka taayun kisi support level ya moving average ke hisaab se kiya ja sakta hai.

8. Risk Management Ki Hikmat

Kisi bhi trading strategy mein risk management ki bohot ahmiyat hoti hai. Upside Gap Two Crows pattern ke sath trading karte waqt stop loss levels ko set karna zaroori hai. Stop loss ko teesri candle ke high ke thoda upar set karna behtareen strategy ho sakti hai, taake agar market trend ke khilaf chale to losses ko control kiya ja sake.

9. Volatility Ka Kirdar

Volatility ke dauran Upside Gap Two Crows pattern ka asar aur bhi zyada ho sakta hai. High volatility markets mein yeh pattern strong reversal ka signal de sakta hai. Lekin low volatility markets mein yeh signal utna reliable nahi hota. Is liye market ki volatility ko samajhna bhi zaroori hai.

10. Historical Data Ka Mutalea

Traders ko Upside Gap Two Crows pattern ka historical mutalea karna chahiye taake woh samajh sakein ke kin market halat mein yeh pattern sab se zyada asarandaz hota hai. Historical data ka mutalea traders ko yeh samajhne mein madad deta hai ke kis waqt yeh pattern sab se zyada accurate trading signals de sakta hai.

11. Combining Upside Gap Two Crows with Other Indicators

Aik trading strategy ko successful banane ke liye aksar aik pattern ko doosray indicators ke sath milaya jata hai. RSI, MACD, aur moving averages jaise indicators Upside Gap Two Crows pattern ke sath istamaal kiye ja sakte hain taake trend ke reversal ka strong signal mil sake.

12. Time Frame Ka Asar

Candlestick patterns ka asar aksar time frame par bhi depend karta hai. Upside Gap Two Crows pattern day trading ke liye, hourly charts ya daily charts par zyada madadgar hota hai. Lekin weekly aur monthly charts par iska asar different ho sakta hai. Is liye yeh dekhna zaroori hai ke aap kis time frame mein trading kar rahe hain.

13. Is Pattern Ka Practical Istemaal

Upside Gap Two Crows pattern ka practical istemaal karna ek disciplined trader ki nishani hai. Har baar is pattern ko dekh kar jaldi mein faislay karne ke bajaye, sabr se kaam le kar aur doosray indicators ka intezar karna behtareen strategy hoti hai. Is pattern ka istamaal tabhi successful hoga jab aap proper risk management aur confirmation techniques ko apnayein.

Nateeja

Upside Gap Two Crows candlestick pattern ek powerful bearish reversal signal hai jo agar theek tareeke se samjha jaye to trading mein kaafi faida mand ho sakta hai. Is pattern ke mukhtalif pehluon ko samajhna aur iska sahi tareeke se istemaal karna aapko profitable trading decisions lene mein madad dega.

تبصرہ

Расширенный режим Обычный режим