Forex Trading Mein Keltner Channel

Keltner Channel ek ahem technical indicator hai jo forex trading mein market ki volatility aur price trends ko samajhne ke liye istemal hota hai. Yeh indicator do moving averages aur Average True Range (ATR) par mabni hota hai. Iss article mein, hum Keltner Channel ke buniyadi concepts, iska istemal, aur kuch faidamand trading strategies par charcha karenge jo is tool ke zariye istifaada uthaya ja sakta hai.

Keltner Channel Kya Hai?

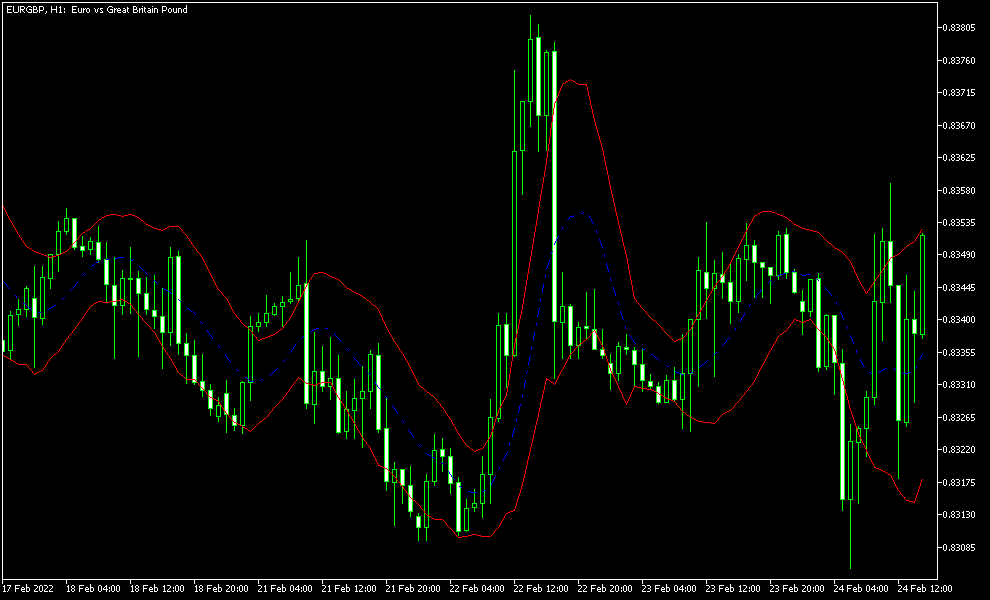

Keltner Channel ek price action aur volatility indicator hai jo market ke trend aur potential reversals ka andaza lagane mein madad karta hai. Yeh ek central line, jo Exponential Moving Average (EMA) hoti hai, aur iske aage peechay do outer bands par mabni hota hai. Yeh bands, Average True Range (ATR) ki madad se calculate kiye jate hain, jo isay volatility ko samajhne ka ek powerful indicator banata hai.

Keltner Channel Ki Tarkeeb

Keltner Channel ke do outer bands ka calculation Exponential Moving Average (EMA) aur Average True Range (ATR) se hota hai. Aam tor par, EMA ko 20-period aur ATR ko 2x multiplier ke sath calculate kiya jata hai. Agar market mein volatility zyada hoti hai, toh yeh bands door door hotay hain, aur agar kam hoti hai toh yeh kareeb aajate hain.

Keltner Channel Ka Faida

Keltner Channel ka sabse bara faida yeh hai ke yeh traders ko price action aur overbought/oversold conditions ka signal deta hai. Jab price upper band ko touch ya cross karta hai, toh yeh overbought condition ka ishara hota hai, jabke lower band ko touch karna oversold condition ka pata deta hai. Is tarah, traders ko entry aur exit points samajhne mein madad milti hai.

Keltner Channel Aur Bollinger Bands Mein Farq

Keltner Channel aur Bollinger Bands, dono hi volatility indicators hain, lekin in mein ek buniyadi farq hai. Bollinger Bands ko standard deviation ke zariye calculate kiya jata hai, jabke Keltner Channel ATR par mabni hota hai. Is wajah se, Keltner Channel zyada realistic signals deta hai jab market volatility mein abrupt changes aate hain.

Keltner Channel Ka Istemal Kaise Karen

Keltner Channel ka istemal karne ke liye, traders ko pehle apne trading platform par EMA aur ATR settings set karni hoti hain. Aksar 20-period EMA aur 2x ATR ka setting use kiya jata hai, jo forex market ke liye zyada useful hota hai. Yeh indicator price action ko behtar samajhne aur accurate trading decisions lene mein madadgar hota hai.

Keltner Channel Se Signals Ko Samajhna

Keltner Channel ke signals samajhna aasaan hai. Jab price upper band ke kareeb ya isay cross karti hai, toh yeh ek selling signal hota hai. Isi tarah, jab price lower band ko cross karti hai, toh yeh buying signal hota hai. Yeh signals traders ko short-term aur long-term trades plan karne mein madad dete hain.

Keltner Channel Aur Price Action Ka Taluq

Keltner Channel ka price action ke sath mazboot taluq hai. Traders jab price movements ko observe karte hain, toh wo Keltner Channel ko support aur resistance ke tor par bhi samajh sakte hain. Yeh indicator market ki trend directions ko samajhne ke liye ek mukammal tool hai.

Dusre Indicators Ke Saath Keltner Channel Ka Istemal

Keltner Channel ko dusre indicators, jaise ke RSI (Relative Strength Index) ya MACD ke sath combine karna zyada effective hota hai. Yeh combination traders ko zyada confident aur accurate decisions lene mein madad karta hai kyunke yeh signals ko confirm karta hai.

Keltner Channel Ki Limitations

Har indicator ki tarah, Keltner Channel bhi apni kuch limitations rakhta hai. Yeh sudden price spikes ya unexpected movements ko accurately predict nahi kar pata. Isliye, traders ko chahiye ke yeh indicator ko dusre tools ke sath combine karen aur sirf is par hi depend na karen.

Keltner Channel Ka Backtesting

Keltner Channel ko backtest karna traders ke liye zaroori hota hai taake wo jaanch sakein ke yeh indicator unke trading style ke liye kitna relevant hai. Historical data ka istemal kar ke, traders ko yeh samajhne ka mauqa milta hai ke Keltner Channel ne past trades mein kis tarah se perform kiya.

Entry Aur Exit Points Ka Taayun

Keltner Channel ka istemal karte waqt, entry aur exit points ka taayun ek ahem step hai. Jab price upper band ke qareeb ho, toh sell signal hota hai, aur jab lower band ke qareeb ho, toh buy signal milta hai. Yeh points aur zyada reliable ban jate hain jab inko price action aur dusre indicators ke zariye confirm kiya jata hai.

Keltner Channel Ki Ahmiyat

Keltner Channel ki ahmiyat is baat mein hai ke yeh traders ko market volatility aur price trends ko simple aur faidamand tareeqe se samajhne ka mauqa deta hai. Yeh indicator price action aur disciplined trading strategies ke liye ek behtareen tool hai jo traders ko profitable trades lene mein madad karta hai.

Keltner Channel Ka Mustaqbil

Aane wale dino mein, Keltner Channel ka mustaqbil kaafi promising hai. Iski simple tareeqa kaar aur effectiveness ki wajah se yeh ek favorite indicator ban gaya hai. Trading platforms bhi isay zyada integrate kar rahe hain jo iski utility ko aur barha rahe hain.

Keltner Channel ek behad useful tool hai jo forex traders ko market trends aur price action ko samajhne mein madad deta hai. Iska behtar istemal karne ke liye, traders ko iska use practice karte rehna chahiye aur isay apni trading toolkit ka hissa banana chahiye.

Keltner Channel ek ahem technical indicator hai jo forex trading mein market ki volatility aur price trends ko samajhne ke liye istemal hota hai. Yeh indicator do moving averages aur Average True Range (ATR) par mabni hota hai. Iss article mein, hum Keltner Channel ke buniyadi concepts, iska istemal, aur kuch faidamand trading strategies par charcha karenge jo is tool ke zariye istifaada uthaya ja sakta hai.

Keltner Channel Kya Hai?

Keltner Channel ek price action aur volatility indicator hai jo market ke trend aur potential reversals ka andaza lagane mein madad karta hai. Yeh ek central line, jo Exponential Moving Average (EMA) hoti hai, aur iske aage peechay do outer bands par mabni hota hai. Yeh bands, Average True Range (ATR) ki madad se calculate kiye jate hain, jo isay volatility ko samajhne ka ek powerful indicator banata hai.

Keltner Channel Ki Tarkeeb

Keltner Channel ke do outer bands ka calculation Exponential Moving Average (EMA) aur Average True Range (ATR) se hota hai. Aam tor par, EMA ko 20-period aur ATR ko 2x multiplier ke sath calculate kiya jata hai. Agar market mein volatility zyada hoti hai, toh yeh bands door door hotay hain, aur agar kam hoti hai toh yeh kareeb aajate hain.

Keltner Channel Ka Faida

Keltner Channel ka sabse bara faida yeh hai ke yeh traders ko price action aur overbought/oversold conditions ka signal deta hai. Jab price upper band ko touch ya cross karta hai, toh yeh overbought condition ka ishara hota hai, jabke lower band ko touch karna oversold condition ka pata deta hai. Is tarah, traders ko entry aur exit points samajhne mein madad milti hai.

Keltner Channel Aur Bollinger Bands Mein Farq

Keltner Channel aur Bollinger Bands, dono hi volatility indicators hain, lekin in mein ek buniyadi farq hai. Bollinger Bands ko standard deviation ke zariye calculate kiya jata hai, jabke Keltner Channel ATR par mabni hota hai. Is wajah se, Keltner Channel zyada realistic signals deta hai jab market volatility mein abrupt changes aate hain.

Keltner Channel Ka Istemal Kaise Karen

Keltner Channel ka istemal karne ke liye, traders ko pehle apne trading platform par EMA aur ATR settings set karni hoti hain. Aksar 20-period EMA aur 2x ATR ka setting use kiya jata hai, jo forex market ke liye zyada useful hota hai. Yeh indicator price action ko behtar samajhne aur accurate trading decisions lene mein madadgar hota hai.

Keltner Channel Se Signals Ko Samajhna

Keltner Channel ke signals samajhna aasaan hai. Jab price upper band ke kareeb ya isay cross karti hai, toh yeh ek selling signal hota hai. Isi tarah, jab price lower band ko cross karti hai, toh yeh buying signal hota hai. Yeh signals traders ko short-term aur long-term trades plan karne mein madad dete hain.

Keltner Channel Aur Price Action Ka Taluq

Keltner Channel ka price action ke sath mazboot taluq hai. Traders jab price movements ko observe karte hain, toh wo Keltner Channel ko support aur resistance ke tor par bhi samajh sakte hain. Yeh indicator market ki trend directions ko samajhne ke liye ek mukammal tool hai.

Dusre Indicators Ke Saath Keltner Channel Ka Istemal

Keltner Channel ko dusre indicators, jaise ke RSI (Relative Strength Index) ya MACD ke sath combine karna zyada effective hota hai. Yeh combination traders ko zyada confident aur accurate decisions lene mein madad karta hai kyunke yeh signals ko confirm karta hai.

Keltner Channel Ki Limitations

Har indicator ki tarah, Keltner Channel bhi apni kuch limitations rakhta hai. Yeh sudden price spikes ya unexpected movements ko accurately predict nahi kar pata. Isliye, traders ko chahiye ke yeh indicator ko dusre tools ke sath combine karen aur sirf is par hi depend na karen.

Keltner Channel Ka Backtesting

Keltner Channel ko backtest karna traders ke liye zaroori hota hai taake wo jaanch sakein ke yeh indicator unke trading style ke liye kitna relevant hai. Historical data ka istemal kar ke, traders ko yeh samajhne ka mauqa milta hai ke Keltner Channel ne past trades mein kis tarah se perform kiya.

Entry Aur Exit Points Ka Taayun

Keltner Channel ka istemal karte waqt, entry aur exit points ka taayun ek ahem step hai. Jab price upper band ke qareeb ho, toh sell signal hota hai, aur jab lower band ke qareeb ho, toh buy signal milta hai. Yeh points aur zyada reliable ban jate hain jab inko price action aur dusre indicators ke zariye confirm kiya jata hai.

Keltner Channel Ki Ahmiyat

Keltner Channel ki ahmiyat is baat mein hai ke yeh traders ko market volatility aur price trends ko simple aur faidamand tareeqe se samajhne ka mauqa deta hai. Yeh indicator price action aur disciplined trading strategies ke liye ek behtareen tool hai jo traders ko profitable trades lene mein madad karta hai.

Keltner Channel Ka Mustaqbil

Aane wale dino mein, Keltner Channel ka mustaqbil kaafi promising hai. Iski simple tareeqa kaar aur effectiveness ki wajah se yeh ek favorite indicator ban gaya hai. Trading platforms bhi isay zyada integrate kar rahe hain jo iski utility ko aur barha rahe hain.

Keltner Channel ek behad useful tool hai jo forex traders ko market trends aur price action ko samajhne mein madad deta hai. Iska behtar istemal karne ke liye, traders ko iska use practice karte rehna chahiye aur isay apni trading toolkit ka hissa banana chahiye.

تبصرہ

Расширенный режим Обычный режим