Three white soldiers candlestick pattern ek bullish reversal signal hai jo ke teen consecutive green candlesticks se milkar banta hai. Is pattern ko samajhne ke liye sabse pehle humein yeh samajhna hoga ke candlestick charts kya hote hain. Candlestick charts trading aur market analysis ka ek maqsad hain jo price movement ko visually represent karte hain. Har candlestick ek specific time frame ka price action dikhata hai, jisme open, high, low, aur close prices shamil hote hain.

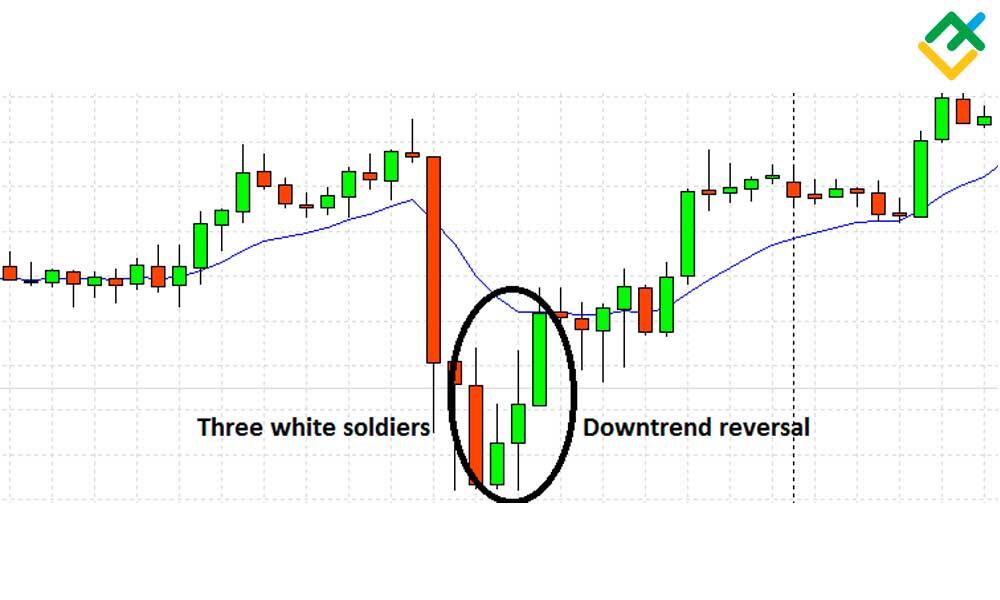

Three white soldiers pattern ka formation tab hota hai jab market pehle downtrend mein hota hai, phir teen consecutive green candlesticks banata hai jo pehle candlestick ke close se upar khulte hain. Har candlestick ke body ka size bada hota hai, jo bullish momentum ko darshata hai. Yeh pattern is baat ki nishani hoti hai ke buyers ne market mein control hasil kar liya hai aur sellers ko push back kar diya hai. Is pattern ki pehchaan ke liye traders ko yeh dekhna hota hai ke har agla candlestick pichlay candlestick se higher close kar raha hai.

Trading strategy banate waqt traders ko kuch important factors par focus karna chahiye. Pehla factor volume hai. Jab bhi three white soldiers pattern form hota hai, to agar iske saath volume bhi badhta hai, to yeh bullish signal ko mazid taqat deta hai. Volume ka badhna is baat ki nishani hota hai ke traders market mein actively participate kar rahe hain. Is pattern ka second confirmation aap support and resistance levels ke analysis se le sakte hain. Agar three white soldiers pattern kisi strong support level par banta hai, to yeh aur bhi reliable signal ban jata hai.

Jab aap is pattern ko trade karna chahte hain, to aapko entry point aur stop-loss levels ka bhi khayal rakhna chahiye. Entry point aap us candlestick ke close price par set kar sakte hain jo last soldier ka hota hai. Yeh point aapko position lene ke liye ek accha mauqa deta hai. Stop-loss level ko aap last soldier ki low price ke thoda niche set kar sakte hain. Isse aapko potential loss se bacha sakta hai agar market aapke against jaye.

Is pattern ki reliability ko increase karne ke liye aapko trend ke saath trade karna chahiye. Yani, agar aap three white soldiers pattern dekh rahe hain, to yeh dekhna zaroori hai ke kya overall market trend bullish hai ya bearish. Agar overall trend bullish hai, to is pattern ka signal aur bhi mazid taqatwar hota hai.

Ek aur important factor jo aapko madad de sakta hai wo hai market news aur events. Kabhi kabhi economic events ya news market ki direction ko badal dete hain, jo ke patterns ki effectiveness ko kam kar sakte hain. Isliye, kisi bhi trade se pehle market ki news aur events ka jaiza lena zaroori hai.

In sab baaton ka khayal rakhte hue, three white soldiers pattern ko ek effective trading tool ki tarah use kiya ja sakta hai. Lekin, hamesha yaad rahe ke kisi bhi trading strategy ko use karne se pehle thorough analysis aur risk management zaroori hai. Har trade mein risk hota hai, isliye aapko apne trading plan ke according disciplined rehna chahiye. Is pattern ka istemal karte waqt aap apne risk tolerance ke mutabiq position size ka khayal rakhein, taake aap unnecessary losses se bachein.

Yeh pattern trading ki duniya mein ek powerful signal hai agar sahi tarike se istemal kiya jaye. Isse samajhna aur effectively trade karna aapke overall trading success mein madadgar ho sakta hai

Three white soldiers pattern ka formation tab hota hai jab market pehle downtrend mein hota hai, phir teen consecutive green candlesticks banata hai jo pehle candlestick ke close se upar khulte hain. Har candlestick ke body ka size bada hota hai, jo bullish momentum ko darshata hai. Yeh pattern is baat ki nishani hoti hai ke buyers ne market mein control hasil kar liya hai aur sellers ko push back kar diya hai. Is pattern ki pehchaan ke liye traders ko yeh dekhna hota hai ke har agla candlestick pichlay candlestick se higher close kar raha hai.

Trading strategy banate waqt traders ko kuch important factors par focus karna chahiye. Pehla factor volume hai. Jab bhi three white soldiers pattern form hota hai, to agar iske saath volume bhi badhta hai, to yeh bullish signal ko mazid taqat deta hai. Volume ka badhna is baat ki nishani hota hai ke traders market mein actively participate kar rahe hain. Is pattern ka second confirmation aap support and resistance levels ke analysis se le sakte hain. Agar three white soldiers pattern kisi strong support level par banta hai, to yeh aur bhi reliable signal ban jata hai.

Jab aap is pattern ko trade karna chahte hain, to aapko entry point aur stop-loss levels ka bhi khayal rakhna chahiye. Entry point aap us candlestick ke close price par set kar sakte hain jo last soldier ka hota hai. Yeh point aapko position lene ke liye ek accha mauqa deta hai. Stop-loss level ko aap last soldier ki low price ke thoda niche set kar sakte hain. Isse aapko potential loss se bacha sakta hai agar market aapke against jaye.

Is pattern ki reliability ko increase karne ke liye aapko trend ke saath trade karna chahiye. Yani, agar aap three white soldiers pattern dekh rahe hain, to yeh dekhna zaroori hai ke kya overall market trend bullish hai ya bearish. Agar overall trend bullish hai, to is pattern ka signal aur bhi mazid taqatwar hota hai.

Ek aur important factor jo aapko madad de sakta hai wo hai market news aur events. Kabhi kabhi economic events ya news market ki direction ko badal dete hain, jo ke patterns ki effectiveness ko kam kar sakte hain. Isliye, kisi bhi trade se pehle market ki news aur events ka jaiza lena zaroori hai.

In sab baaton ka khayal rakhte hue, three white soldiers pattern ko ek effective trading tool ki tarah use kiya ja sakta hai. Lekin, hamesha yaad rahe ke kisi bhi trading strategy ko use karne se pehle thorough analysis aur risk management zaroori hai. Har trade mein risk hota hai, isliye aapko apne trading plan ke according disciplined rehna chahiye. Is pattern ka istemal karte waqt aap apne risk tolerance ke mutabiq position size ka khayal rakhein, taake aap unnecessary losses se bachein.

Yeh pattern trading ki duniya mein ek powerful signal hai agar sahi tarike se istemal kiya jaye. Isse samajhna aur effectively trade karna aapke overall trading success mein madadgar ho sakta hai

تبصرہ

Расширенный режим Обычный режим