Hanging Man Candlestick

1. Parichay

Hanging Man Candlestick ek ahem technical analysis tool hai jo trading charts par market ke behavior ko samajhne mein madad karta hai. Yeh candlestick pattern aksar downtrend ke doran dikhai deta hai aur iska mqsad potential reversal ki nishani dena hai. Is article mein, hum Hanging Man Candlestick ke tafsilat aur iski importance ko samjhenge.

2. Candlestick Patterns ka Ahamiyat

Candlestick patterns trading ka aik maqsad hain, jinke zariye traders market ki mood aur price action ka andaza lagate hain. Har candlestick ka apna ek specific meaning hota hai, aur inhe samajh kar traders informed decisions le sakte hain. Hanging Man Candlestick iski chunainda patterns mein se ek hai.

3. Hanging Man Candlestick ka Structure

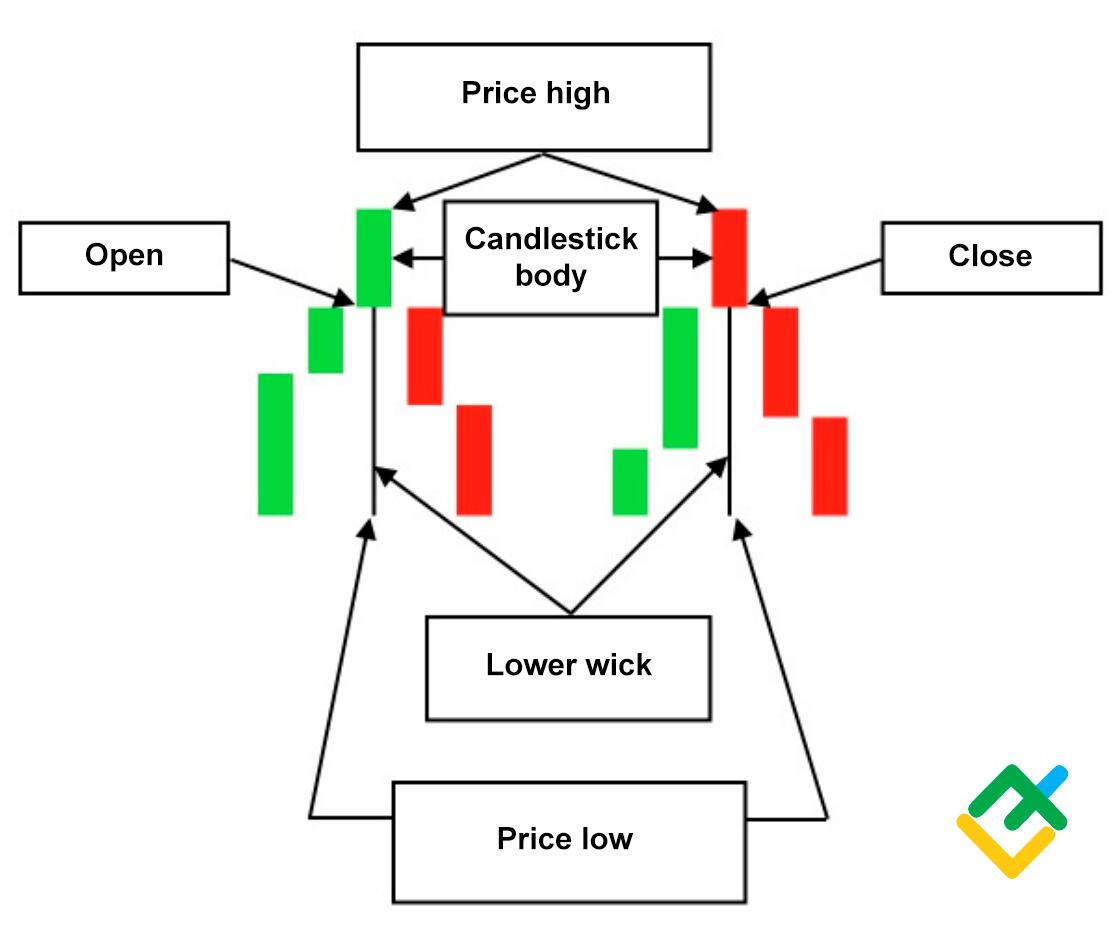

Hanging Man Candlestick ka structure kaafi distinctive hota hai. Is candlestick ka body chhota hota hai, jabke iski shadow (wick) lambi hoti hai. Yeh candlestick pattern aksar market ke upar ki taraf se ghirne ke baad dikhai deta hai. Is pattern ka naam “Hanging Man” isliye rakha gaya hai kyun ke iski shape ek latakte hue aadmi ki tarah hoti hai.

4. Market Context

Hanging Man Candlestick ka pattern sirf us waqt hi valid hota hai jab yeh ek downtrend ke doran dikhai de. Iska mqsad potential reversal ka darshana hota hai. Agar yeh pattern kisi uptrend ke doran aata hai, toh yeh misleading ho sakta hai. Isliye, market context ka khayal rakhna bohot zaroori hai.

5. Signal of Reversal

Jab bhi Hanging Man Candlestick dikhai deta hai, toh yeh market mein reversal ka signal hota hai. Yeh traders ko ye sochne par majboor karta hai ke kya price movement ab change hone wala hai. Lekin, yeh zaroori hai ke traders is signal ko confirm karne ke liye dusre indicators ka bhi istemal karein.

6. Confirmation ki Zaroorat

Hanging Man Candlestick ke signal ko confirm karna bohot zaroori hota hai. Iska matlab hai ke traders ko is pattern ke baad kuch aur signals dekhne chahiye, jese ke volume increase ya dusri bearish candlesticks. Isse traders ko zyada confidence milta hai ke market mein asal mein reversal ho raha hai.

7. Volume ka Role

Volume bhi Hanging Man Candlestick ki validity ko samajhne mein madadgar hota hai. Jab volume high hota hai, toh yeh signal ko zyada majboot bana deta hai. Iska matlab hai ke zyada traders is price action par reactive hain, aur yeh market ke direction ko badal sakta hai.

8. Trading Strategies

Hanging Man Candlestick ka istemal trading strategies mein kiya ja sakta hai. Ek common strategy yeh hai ke traders is pattern ke baad short position lena shuru karte hain. Lekin, traders ko is baat ka khayal rakhna chahiye ke woh stop loss set karein taake kisi bhi ghalat signal se bach sakein.

9. Psychological Aspect

Hanging Man Candlestick ka psychological aspect bhi bohot important hai. Is pattern ko dekhta hai toh traders mein fear aur uncertainty ka ahsas hota hai. Yeh market ke participants ko sochne par majboor karta hai ke kya yeh price levels sustainable hain ya nahi. Is psychological factor ko samajhna trading mein behad madadgar hota hai.

10. Differences Between Hanging Man and Inverted Hammer

Hanging Man aur Inverted Hammer dono candlestick patterns hain, lekin inka context aur implication alag hota hai. Hanging Man aksar downtrend ke doran hota hai, jabke Inverted Hammer uptrend ke doran dikhai deta hai. Dono ka shape similar hota hai, lekin traders ko inki location aur context ka khayal rakhna chahiye.

11. Common Mistakes

Hanging Man Candlestick ke signal ko samajhte waqt kuch aam ghaltiyan ki jaati hain. Ek common ghalti yeh hai ke traders is pattern ko ignore kar dete hain agar volume high nahi hota. Dusri ghalti yeh hai ke traders is signal par bina confirmation ke hi action le lete hain. Yeh ghaltiyan kabhi kabhi bade losses ka sabab ban sakti hain.

12. Market Conditions

Market conditions ka Hanging Man Candlestick ke analysis par bhi asar hota hai. Agar market volatile hai ya news events hone wale hain, toh is pattern ki reliability kam ho sakti hai. Isliye, trading karte waqt market conditions ka khayal rakhna zaroori hai.

13. Alternative Indicators

Hanging Man Candlestick ke saath dusre technical indicators ka istemal bhi kiya ja sakta hai. Moving averages, RSI, aur MACD jese indicators is pattern ki confirmation mein madadgar hote hain. Yeh traders ko zyada confidence dete hain ke kya market mein asal mein reversal ho raha hai.

14. Practical Application

Hanging Man Candlestick ka practical application trading mein bohot zyada hai. Traders is pattern ko chart par identify karte hain aur uske baad appropriate actions lete hain. Yeh pattern ek trading plan ka hissa ban sakta hai jo traders ko structured aur disciplined approach deta hai.

15. Nishkarsh

Hanging Man Candlestick ek powerful tool hai jo traders ko market ke reversal points identify karne mein madad karta hai. Is pattern ko samajhna aur sahi tarike se istemal karna bohot zaroori hai. Lekin, traders ko hamesha confirmation aur market context ka khayal rakhna chahiye taake woh informed decisions le sakein. Trading ek skill hai, aur is skill ko develop karne ke liye consistent practice aur knowledge ki zaroorat hoti hai.

1. Parichay

Hanging Man Candlestick ek ahem technical analysis tool hai jo trading charts par market ke behavior ko samajhne mein madad karta hai. Yeh candlestick pattern aksar downtrend ke doran dikhai deta hai aur iska mqsad potential reversal ki nishani dena hai. Is article mein, hum Hanging Man Candlestick ke tafsilat aur iski importance ko samjhenge.

2. Candlestick Patterns ka Ahamiyat

Candlestick patterns trading ka aik maqsad hain, jinke zariye traders market ki mood aur price action ka andaza lagate hain. Har candlestick ka apna ek specific meaning hota hai, aur inhe samajh kar traders informed decisions le sakte hain. Hanging Man Candlestick iski chunainda patterns mein se ek hai.

3. Hanging Man Candlestick ka Structure

Hanging Man Candlestick ka structure kaafi distinctive hota hai. Is candlestick ka body chhota hota hai, jabke iski shadow (wick) lambi hoti hai. Yeh candlestick pattern aksar market ke upar ki taraf se ghirne ke baad dikhai deta hai. Is pattern ka naam “Hanging Man” isliye rakha gaya hai kyun ke iski shape ek latakte hue aadmi ki tarah hoti hai.

4. Market Context

Hanging Man Candlestick ka pattern sirf us waqt hi valid hota hai jab yeh ek downtrend ke doran dikhai de. Iska mqsad potential reversal ka darshana hota hai. Agar yeh pattern kisi uptrend ke doran aata hai, toh yeh misleading ho sakta hai. Isliye, market context ka khayal rakhna bohot zaroori hai.

5. Signal of Reversal

Jab bhi Hanging Man Candlestick dikhai deta hai, toh yeh market mein reversal ka signal hota hai. Yeh traders ko ye sochne par majboor karta hai ke kya price movement ab change hone wala hai. Lekin, yeh zaroori hai ke traders is signal ko confirm karne ke liye dusre indicators ka bhi istemal karein.

6. Confirmation ki Zaroorat

Hanging Man Candlestick ke signal ko confirm karna bohot zaroori hota hai. Iska matlab hai ke traders ko is pattern ke baad kuch aur signals dekhne chahiye, jese ke volume increase ya dusri bearish candlesticks. Isse traders ko zyada confidence milta hai ke market mein asal mein reversal ho raha hai.

7. Volume ka Role

Volume bhi Hanging Man Candlestick ki validity ko samajhne mein madadgar hota hai. Jab volume high hota hai, toh yeh signal ko zyada majboot bana deta hai. Iska matlab hai ke zyada traders is price action par reactive hain, aur yeh market ke direction ko badal sakta hai.

8. Trading Strategies

Hanging Man Candlestick ka istemal trading strategies mein kiya ja sakta hai. Ek common strategy yeh hai ke traders is pattern ke baad short position lena shuru karte hain. Lekin, traders ko is baat ka khayal rakhna chahiye ke woh stop loss set karein taake kisi bhi ghalat signal se bach sakein.

9. Psychological Aspect

Hanging Man Candlestick ka psychological aspect bhi bohot important hai. Is pattern ko dekhta hai toh traders mein fear aur uncertainty ka ahsas hota hai. Yeh market ke participants ko sochne par majboor karta hai ke kya yeh price levels sustainable hain ya nahi. Is psychological factor ko samajhna trading mein behad madadgar hota hai.

10. Differences Between Hanging Man and Inverted Hammer

Hanging Man aur Inverted Hammer dono candlestick patterns hain, lekin inka context aur implication alag hota hai. Hanging Man aksar downtrend ke doran hota hai, jabke Inverted Hammer uptrend ke doran dikhai deta hai. Dono ka shape similar hota hai, lekin traders ko inki location aur context ka khayal rakhna chahiye.

11. Common Mistakes

Hanging Man Candlestick ke signal ko samajhte waqt kuch aam ghaltiyan ki jaati hain. Ek common ghalti yeh hai ke traders is pattern ko ignore kar dete hain agar volume high nahi hota. Dusri ghalti yeh hai ke traders is signal par bina confirmation ke hi action le lete hain. Yeh ghaltiyan kabhi kabhi bade losses ka sabab ban sakti hain.

12. Market Conditions

Market conditions ka Hanging Man Candlestick ke analysis par bhi asar hota hai. Agar market volatile hai ya news events hone wale hain, toh is pattern ki reliability kam ho sakti hai. Isliye, trading karte waqt market conditions ka khayal rakhna zaroori hai.

13. Alternative Indicators

Hanging Man Candlestick ke saath dusre technical indicators ka istemal bhi kiya ja sakta hai. Moving averages, RSI, aur MACD jese indicators is pattern ki confirmation mein madadgar hote hain. Yeh traders ko zyada confidence dete hain ke kya market mein asal mein reversal ho raha hai.

14. Practical Application

Hanging Man Candlestick ka practical application trading mein bohot zyada hai. Traders is pattern ko chart par identify karte hain aur uske baad appropriate actions lete hain. Yeh pattern ek trading plan ka hissa ban sakta hai jo traders ko structured aur disciplined approach deta hai.

15. Nishkarsh

Hanging Man Candlestick ek powerful tool hai jo traders ko market ke reversal points identify karne mein madad karta hai. Is pattern ko samajhna aur sahi tarike se istemal karna bohot zaroori hai. Lekin, traders ko hamesha confirmation aur market context ka khayal rakhna chahiye taake woh informed decisions le sakein. Trading ek skill hai, aur is skill ko develop karne ke liye consistent practice aur knowledge ki zaroorat hoti hai.

تبصرہ

Расширенный режим Обычный режим