Forex Trading Mein Broadening Pattern:

Forex trading, yani foreign exchange market, duniya ki sabse bari aur most liquid market hai, jahan currencies ki kharid aur farokht ki jati hai. Is market ki khas baat yeh hai ke yeh 24 ghante kaam karti hai. Aaj hum is article mein Broadening Pattern ka tajziya karenge, jo forex trading mein bohot ahmiyat rakhta hai.

Broadening Pattern Kya Hai?

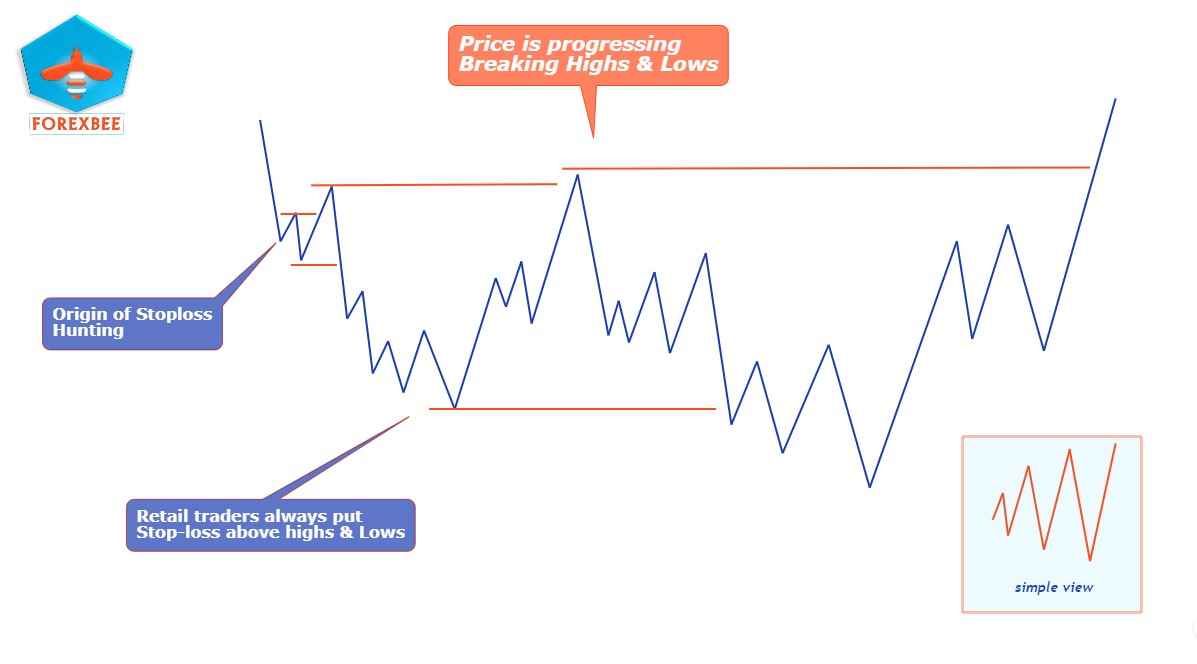

Broadening pattern ko megaphone pattern bhi kaha jata hai. Yeh ek technical analysis ka pattern hai jo price movements ki shakl ko darshata hai. Is pattern ki pehchaan iski khas shape se hoti hai, jo do diverging trend lines se mil kar banti hai. Ek upper trend line jo price ke highest points ko jorti hai aur doosri lower trend line jo lowest points ko milati hai. Yeh pattern dono bullish aur bearish signals generate kar sakta hai.

Broadening Pattern Ki Iqsaam

Broadening pattern ki do mukhtalif qisamain hoti hain:

1. Broadening Top: Yeh pattern tab banta hai jab market mein upar jane ka rujhan hota hai, lekin prices zyada fluctuate kar rahi hoti hain. Yeh pattern aksar bullish trend ke baad dikhai deta hai aur market reversal ka ishara karta hai.

2. Broadening Bottom: Yeh pattern tab samne aata hai jab market downward trend mein hoti hai, lekin price fluctuations kaafi barh jate hain. Yeh pattern bearish trend ke baad banta hai aur bullish reversal ka signal deta hai.

Is Pattern Ka Istemaal Kaise Karein?

Broadening patterns ka sahi istemaal karne ke liye traders ko kuch ahem baaton ka khayal rakhna zaroori hai. Pehle step mein is pattern ki pehchaan zaroori hai. Traders ko is pattern ki do trend lines ko chart par draw karna chahiye aur dekhna chahiye ke price movements is pattern ke mutabiq hain ya nahi.

Entry Aur Exit Points

Broadening pattern mein entry aur exit points kaise choose karna hai, yeh samajhna bohot zaroori hai. Traders aksar upper trend line par sell aur lower trend line par buy karte hain. Yeh points market reversal ke waqt ka ishara dete hain, jo trading strategy ko guide karte hain.

Volume Ka Role

Broadening pattern ke sahi interpretation ke liye volume ka bhi aham kirdar hota hai. Jab volume badhta hai to yeh market ki increased activity ka ishara hota hai aur pattern ki accuracy ko barhata hai. Agar volume ke sath sath price movements bhi consistent hain, to yeh pattern ki reliability ko confirm karta hai.

Market Sentiment Ki Ahmiyat

Market sentiment bhi broadening pattern mein aik important role ada karta hai. Agar market mein optimism hai aur price upar ja rahi hai, to upper trend line par selling pressure aasakta hai. Isi tarah lower trend line ke aas paas buying pressure dikhai de sakta hai jab traders market ko bullish dekhte hain.

Risk Management Ki Strategies

Forex trading mein risk management bohot ahem hota hai, khaaskar jab broadening pattern ka istemaal kiya jata hai. Stop-loss orders ka istemaal zaroori hai taake agar market aapke khilaf chali jaye to losses ko minimize kiya ja sake. Yeh traders ko unnecessary losses se bacha sakta hai.

Real-Time Examples Aur Historical Analysis

Broadening patterns ko samajhne ke liye real-time market examples ka dekhna aur historical data ka analysis bohot madadgar hota hai. Market charts par yeh patterns asani se identify kiye ja sakte hain aur inke zariye trading decisions liye ja sakte hain. Historical data se yeh samajhna bhi asaan hota hai ke kis tarah yeh patterns pehle kaam karte rahe hain aur future mein kis tarah react karenge.

Broadening Pattern Ke Faide Aur Nuksan

Jese har trading strategy ke kuch faide aur nuksan hote hain, waisa hi broadening pattern ke sath bhi hai. Is pattern ka faida yeh hai ke yeh market ke price fluctuations ko clearly show karta hai aur traders ko entry aur exit points ka andaza dene mein madad karta hai. Lekin, kabhi kabhi yeh false signals bhi generate kar sakta hai, isliye caution zaroori hai.

Forex Trading Mein Psychological Factors

Forex trading mein traders ke jazbaat bhi ahm role ada karte hain. Fear aur greed jaise emotions aksar impulsive decisions ka sabab bante hain, jo ke trading results ko negatively impact karte hain. Isliye, broadening pattern ka sahi istemal karne ke liye emotional discipline zaroori hai.

Technical Indicators Ka Istemaal

Broadening pattern ke sath sahi trading decisions lene ke liye technical indicators jaise RSI (Relative Strength Index) aur MACD (Moving Average Convergence Divergence) ka bhi istemaal zaroori hai. Yeh indicators market ke momentum aur trend ke bare mein valuable information provide karte hain, jo traders ko informed decisions lene mein madad deti hai.

Mazboot Trading Plan Banana

Broadening patterns ke sath trading karte waqt ek mazboot trading plan banana zaroori hai. Is plan mein entry aur exit points, risk management techniques aur market analysis ko shamil karna chahiye. Is se traders ko apne decisions guide karne mein madad milti hai aur unki strategies ziada effective hoti hain.

Nateejah

Forex trading mein broadening patterns ek qeemti tool hain jo market ke price fluctuations ko samajhne aur unse fayda uthane mein madad karte hain. Agar sahi tareeqe se use kiya jaye, to yeh patterns trading strategies ko behtar bana sakte hain. Lekin, caution aur thorough analysis bohot zaroori hai taake false signals se bacha ja sake. Forex trading mein disciplined approach aur regular research kaafi ahmiyat rakhti hai, jo aapko lambe arsay tak profitable banaye rakh sakti hai.

Forex trading, yani foreign exchange market, duniya ki sabse bari aur most liquid market hai, jahan currencies ki kharid aur farokht ki jati hai. Is market ki khas baat yeh hai ke yeh 24 ghante kaam karti hai. Aaj hum is article mein Broadening Pattern ka tajziya karenge, jo forex trading mein bohot ahmiyat rakhta hai.

Broadening Pattern Kya Hai?

Broadening pattern ko megaphone pattern bhi kaha jata hai. Yeh ek technical analysis ka pattern hai jo price movements ki shakl ko darshata hai. Is pattern ki pehchaan iski khas shape se hoti hai, jo do diverging trend lines se mil kar banti hai. Ek upper trend line jo price ke highest points ko jorti hai aur doosri lower trend line jo lowest points ko milati hai. Yeh pattern dono bullish aur bearish signals generate kar sakta hai.

Broadening Pattern Ki Iqsaam

Broadening pattern ki do mukhtalif qisamain hoti hain:

1. Broadening Top: Yeh pattern tab banta hai jab market mein upar jane ka rujhan hota hai, lekin prices zyada fluctuate kar rahi hoti hain. Yeh pattern aksar bullish trend ke baad dikhai deta hai aur market reversal ka ishara karta hai.

2. Broadening Bottom: Yeh pattern tab samne aata hai jab market downward trend mein hoti hai, lekin price fluctuations kaafi barh jate hain. Yeh pattern bearish trend ke baad banta hai aur bullish reversal ka signal deta hai.

Is Pattern Ka Istemaal Kaise Karein?

Broadening patterns ka sahi istemaal karne ke liye traders ko kuch ahem baaton ka khayal rakhna zaroori hai. Pehle step mein is pattern ki pehchaan zaroori hai. Traders ko is pattern ki do trend lines ko chart par draw karna chahiye aur dekhna chahiye ke price movements is pattern ke mutabiq hain ya nahi.

Entry Aur Exit Points

Broadening pattern mein entry aur exit points kaise choose karna hai, yeh samajhna bohot zaroori hai. Traders aksar upper trend line par sell aur lower trend line par buy karte hain. Yeh points market reversal ke waqt ka ishara dete hain, jo trading strategy ko guide karte hain.

Volume Ka Role

Broadening pattern ke sahi interpretation ke liye volume ka bhi aham kirdar hota hai. Jab volume badhta hai to yeh market ki increased activity ka ishara hota hai aur pattern ki accuracy ko barhata hai. Agar volume ke sath sath price movements bhi consistent hain, to yeh pattern ki reliability ko confirm karta hai.

Market Sentiment Ki Ahmiyat

Market sentiment bhi broadening pattern mein aik important role ada karta hai. Agar market mein optimism hai aur price upar ja rahi hai, to upper trend line par selling pressure aasakta hai. Isi tarah lower trend line ke aas paas buying pressure dikhai de sakta hai jab traders market ko bullish dekhte hain.

Risk Management Ki Strategies

Forex trading mein risk management bohot ahem hota hai, khaaskar jab broadening pattern ka istemaal kiya jata hai. Stop-loss orders ka istemaal zaroori hai taake agar market aapke khilaf chali jaye to losses ko minimize kiya ja sake. Yeh traders ko unnecessary losses se bacha sakta hai.

Real-Time Examples Aur Historical Analysis

Broadening patterns ko samajhne ke liye real-time market examples ka dekhna aur historical data ka analysis bohot madadgar hota hai. Market charts par yeh patterns asani se identify kiye ja sakte hain aur inke zariye trading decisions liye ja sakte hain. Historical data se yeh samajhna bhi asaan hota hai ke kis tarah yeh patterns pehle kaam karte rahe hain aur future mein kis tarah react karenge.

Broadening Pattern Ke Faide Aur Nuksan

Jese har trading strategy ke kuch faide aur nuksan hote hain, waisa hi broadening pattern ke sath bhi hai. Is pattern ka faida yeh hai ke yeh market ke price fluctuations ko clearly show karta hai aur traders ko entry aur exit points ka andaza dene mein madad karta hai. Lekin, kabhi kabhi yeh false signals bhi generate kar sakta hai, isliye caution zaroori hai.

Forex Trading Mein Psychological Factors

Forex trading mein traders ke jazbaat bhi ahm role ada karte hain. Fear aur greed jaise emotions aksar impulsive decisions ka sabab bante hain, jo ke trading results ko negatively impact karte hain. Isliye, broadening pattern ka sahi istemal karne ke liye emotional discipline zaroori hai.

Technical Indicators Ka Istemaal

Broadening pattern ke sath sahi trading decisions lene ke liye technical indicators jaise RSI (Relative Strength Index) aur MACD (Moving Average Convergence Divergence) ka bhi istemaal zaroori hai. Yeh indicators market ke momentum aur trend ke bare mein valuable information provide karte hain, jo traders ko informed decisions lene mein madad deti hai.

Mazboot Trading Plan Banana

Broadening patterns ke sath trading karte waqt ek mazboot trading plan banana zaroori hai. Is plan mein entry aur exit points, risk management techniques aur market analysis ko shamil karna chahiye. Is se traders ko apne decisions guide karne mein madad milti hai aur unki strategies ziada effective hoti hain.

Nateejah

Forex trading mein broadening patterns ek qeemti tool hain jo market ke price fluctuations ko samajhne aur unse fayda uthane mein madad karte hain. Agar sahi tareeqe se use kiya jaye, to yeh patterns trading strategies ko behtar bana sakte hain. Lekin, caution aur thorough analysis bohot zaroori hai taake false signals se bacha ja sake. Forex trading mein disciplined approach aur regular research kaafi ahmiyat rakhti hai, jo aapko lambe arsay tak profitable banaye rakh sakti hai.

تبصرہ

Расширенный режим Обычный режим