**Tasuki Gap Candlestick Pattern: Forex Mein Iska Istemal**

Forex trading mein candlestick patterns kaafi popular aur powerful tools hote hain, jo market ki movement aur potential reversal points ko identify karne mein madad karte hain. Unmein se ek important pattern **Tasuki Gap** hai. Yeh ek continuation pattern hota hai, jo market ke current trend ko further continuation ka signal deta hai. Aaj hum **Tasuki Gap Candlestick Pattern** ko samjhenge aur dekhenge ke yeh forex market mein kis tarah se kaam karta hai.

### Tasuki Gap Kya Hai?

Tasuki Gap ek candlestick pattern hai jo typically ek uptrend ya downtrend ke baad develop hota hai aur market mein us trend ke continuation ka signal deta hai. Is pattern mein, do candlesticks hote hain: ek bullish candlestick aur ek gap-up opening ke saath bullish candlestick jo pehle wale candlestick ke upar open hoti hai. Is pattern ko generally upward trend mein pehchana jata hai, lekin downtrend mein bhi iski ek inverted form hoti hai, jise "Inverted Tasuki Gap" kaha jata hai.

Tasuki Gap pattern ka sabse important feature yeh hai ke yeh ek gap-up ya gap-down movement ko dikhata hai, jo market mein strong momentum ka indication hai. Agar yeh pattern kisi strong trend ke beech ban raha ho, toh yeh pattern trend ka continuation signal deta hai.

### Tasuki Gap Candlestick Pattern Ka Structure

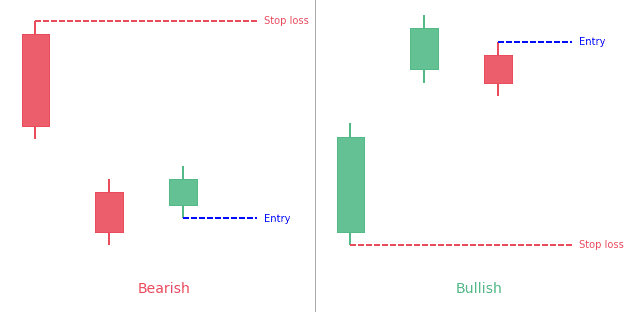

1. **First Candlestick**: Tasuki Gap pattern mein pehli candlestick strong bullish (green) ya bearish (red) hoti hai, jo market mein ek clear direction establish karti hai.

2. **Gap-Up (Ya Gap-Down) Candlestick**: Dusri candlestick pehli candlestick ke upar open hoti hai, jo gap-up ya gap-down ki form mein hoti hai. Agar yeh pattern uptrend mein hai, toh second candlestick gap-up open hoti hai, aur agar downtrend mein hai, toh gap-down open hoti hai.

3. **Close Confirmation**: Dusri candlestick ka close pehli candlestick ke range mein hona chahiye. Iska matlab hai ke price ne pehli candlestick ke gap ko fill nahi kiya aur trend ko continue rakha.

### Tasuki Gap Pattern Ka Forex Market Mein Istemal

1. **Trend Continuation**

Tasuki Gap pattern ka main use trend continuation signal ke liye hota hai. Agar yeh pattern uptrend mein develop ho raha ho, toh yeh strong signal hota hai ke market bullish trend ko continue karega. Agar yeh downtrend mein develop ho, toh yeh market ke downward movement ko continue karne ka indication deta hai.

2. **Entry Point**

Is pattern mein entry point kaafi clear hota hai. Agar aap uptrend mein Tasuki Gap pattern dekhte hain, toh aap apni buy position tab open kar sakte hain jab second candlestick gap-up ke baad close ho jaye aur confirmation mile ke market bullish direction mein move karega. Similarly, downtrend mein aap sell position open kar sakte hain agar pattern downside gap ke baad confirm ho.

3. **Stop Loss Placement**

Aap apni stop loss ko previous low (uptrend mein) ya high (downtrend mein) ke thoda neeche rakh sakte hain. Isse agar market unexpectedly reverse hota hai, toh aap apne losses ko limit kar sakte hain. Yeh risk management ka important part hai.

4. **Target Price**

Tasuki Gap pattern ko use karke aap target price ka bhi estimation kar sakte hain. Aap apne target ko previous resistance (uptrend mein) ya support levels (downtrend mein) par set kar sakte hain. Yeh aapko ek clear exit strategy provide karta hai.

### Tasuki Gap Pattern Ke Liye Risk Management

1. **Volume Confirmation**

Tasuki Gap pattern ki success kaafi volume confirmation par depend karti hai. Jab market gap-up ya gap-down move karta hai, toh volume ka high hona zaroori hota hai, taake yeh pattern zyada reliable ho. Agar volume low ho, toh yeh pattern fake ho sakta hai.

2. **False Signals**

Jaise har candlestick pattern mein hota hai, Tasuki Gap pattern bhi kabhi-kabhi false signals de sakta hai. Isliye, is pattern ko doosre technical indicators, jaise moving averages, RSI, ya MACD ke sath combine karke trade karna chahiye. Yeh aapko confirmation deta hai ke trend continuation pattern sahi hai.

3. **Risk-Reward Ratio**

Jab aap Tasuki Gap pattern ko use karte hain, toh apne risk-reward ratio ko dhyan mein rakhna bohot zaroori hai. Ideally, aapka risk-reward ratio 1:2 ya usse zyada hona chahiye taake aap profitable trades execute kar sakein.

### Conclusion

Tasuki Gap candlestick pattern forex market mein ek bohot useful tool hai, jo trend continuation ka strong signal deta hai. Yeh pattern uptrend aur downtrend dono mein kaam karta hai aur aapko market ki next move ka prediction karne mein madad karta hai. Agar aap is pattern ko apni trading strategy mein include karte hain, toh aap apne entry aur exit points ko accurately determine kar sakte hain aur apne profits ko maximize kar sakte hain. Lekin, hamesha yaad rakhein ke kisi bhi candlestick pattern ko trade karte waqt, aapko risk management aur volume confirmation ka dhyan rakhna zaroori hai.

Forex trading mein candlestick patterns kaafi popular aur powerful tools hote hain, jo market ki movement aur potential reversal points ko identify karne mein madad karte hain. Unmein se ek important pattern **Tasuki Gap** hai. Yeh ek continuation pattern hota hai, jo market ke current trend ko further continuation ka signal deta hai. Aaj hum **Tasuki Gap Candlestick Pattern** ko samjhenge aur dekhenge ke yeh forex market mein kis tarah se kaam karta hai.

### Tasuki Gap Kya Hai?

Tasuki Gap ek candlestick pattern hai jo typically ek uptrend ya downtrend ke baad develop hota hai aur market mein us trend ke continuation ka signal deta hai. Is pattern mein, do candlesticks hote hain: ek bullish candlestick aur ek gap-up opening ke saath bullish candlestick jo pehle wale candlestick ke upar open hoti hai. Is pattern ko generally upward trend mein pehchana jata hai, lekin downtrend mein bhi iski ek inverted form hoti hai, jise "Inverted Tasuki Gap" kaha jata hai.

Tasuki Gap pattern ka sabse important feature yeh hai ke yeh ek gap-up ya gap-down movement ko dikhata hai, jo market mein strong momentum ka indication hai. Agar yeh pattern kisi strong trend ke beech ban raha ho, toh yeh pattern trend ka continuation signal deta hai.

### Tasuki Gap Candlestick Pattern Ka Structure

1. **First Candlestick**: Tasuki Gap pattern mein pehli candlestick strong bullish (green) ya bearish (red) hoti hai, jo market mein ek clear direction establish karti hai.

2. **Gap-Up (Ya Gap-Down) Candlestick**: Dusri candlestick pehli candlestick ke upar open hoti hai, jo gap-up ya gap-down ki form mein hoti hai. Agar yeh pattern uptrend mein hai, toh second candlestick gap-up open hoti hai, aur agar downtrend mein hai, toh gap-down open hoti hai.

3. **Close Confirmation**: Dusri candlestick ka close pehli candlestick ke range mein hona chahiye. Iska matlab hai ke price ne pehli candlestick ke gap ko fill nahi kiya aur trend ko continue rakha.

### Tasuki Gap Pattern Ka Forex Market Mein Istemal

1. **Trend Continuation**

Tasuki Gap pattern ka main use trend continuation signal ke liye hota hai. Agar yeh pattern uptrend mein develop ho raha ho, toh yeh strong signal hota hai ke market bullish trend ko continue karega. Agar yeh downtrend mein develop ho, toh yeh market ke downward movement ko continue karne ka indication deta hai.

2. **Entry Point**

Is pattern mein entry point kaafi clear hota hai. Agar aap uptrend mein Tasuki Gap pattern dekhte hain, toh aap apni buy position tab open kar sakte hain jab second candlestick gap-up ke baad close ho jaye aur confirmation mile ke market bullish direction mein move karega. Similarly, downtrend mein aap sell position open kar sakte hain agar pattern downside gap ke baad confirm ho.

3. **Stop Loss Placement**

Aap apni stop loss ko previous low (uptrend mein) ya high (downtrend mein) ke thoda neeche rakh sakte hain. Isse agar market unexpectedly reverse hota hai, toh aap apne losses ko limit kar sakte hain. Yeh risk management ka important part hai.

4. **Target Price**

Tasuki Gap pattern ko use karke aap target price ka bhi estimation kar sakte hain. Aap apne target ko previous resistance (uptrend mein) ya support levels (downtrend mein) par set kar sakte hain. Yeh aapko ek clear exit strategy provide karta hai.

### Tasuki Gap Pattern Ke Liye Risk Management

1. **Volume Confirmation**

Tasuki Gap pattern ki success kaafi volume confirmation par depend karti hai. Jab market gap-up ya gap-down move karta hai, toh volume ka high hona zaroori hota hai, taake yeh pattern zyada reliable ho. Agar volume low ho, toh yeh pattern fake ho sakta hai.

2. **False Signals**

Jaise har candlestick pattern mein hota hai, Tasuki Gap pattern bhi kabhi-kabhi false signals de sakta hai. Isliye, is pattern ko doosre technical indicators, jaise moving averages, RSI, ya MACD ke sath combine karke trade karna chahiye. Yeh aapko confirmation deta hai ke trend continuation pattern sahi hai.

3. **Risk-Reward Ratio**

Jab aap Tasuki Gap pattern ko use karte hain, toh apne risk-reward ratio ko dhyan mein rakhna bohot zaroori hai. Ideally, aapka risk-reward ratio 1:2 ya usse zyada hona chahiye taake aap profitable trades execute kar sakein.

### Conclusion

Tasuki Gap candlestick pattern forex market mein ek bohot useful tool hai, jo trend continuation ka strong signal deta hai. Yeh pattern uptrend aur downtrend dono mein kaam karta hai aur aapko market ki next move ka prediction karne mein madad karta hai. Agar aap is pattern ko apni trading strategy mein include karte hain, toh aap apne entry aur exit points ko accurately determine kar sakte hain aur apne profits ko maximize kar sakte hain. Lekin, hamesha yaad rakhein ke kisi bhi candlestick pattern ko trade karte waqt, aapko risk management aur volume confirmation ka dhyan rakhna zaroori hai.

تبصرہ

Расширенный режим Обычный режим