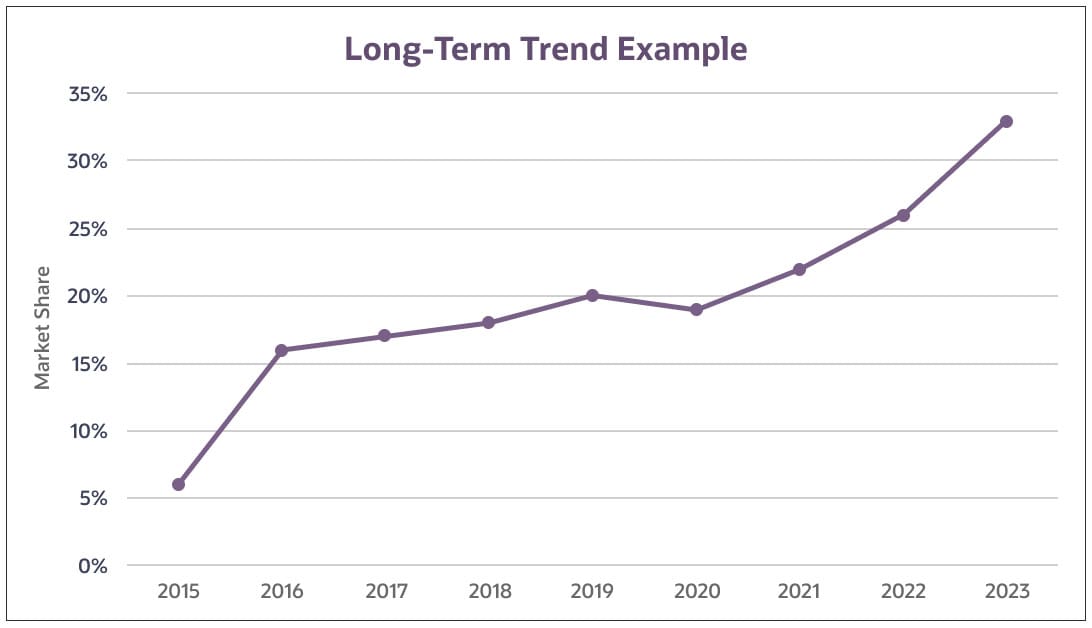

How to Determine Long-Term Trend in Forex Market?

Introduction:

Forex market mein long-term trend ko determine karna trading ka ek ahem hissa hai, kyun ke yeh traders ko major price movements aur market direction samajhne mein madad deta hai. Long-term trends market ki overall direction ko dikhate hain, jo weeks, mahinein, ya kabhi kabhi saalon tak chal sakte hain. Agar aap yeh samajh lein ke market kis direction mein ja raha hai, to aap apne trades ko us direction ke mutabiq place kar sakte hain, jo aapko long-term profit kamaane mein madadgar ho sakta hai.

Use of Moving Averages

Moving averages long-term trends ko determine karne ke liye sabse zyada istimaal ki jane wali strategy hai. Yeh indicator market ke overall trend ko smooth out kar deta hai aur choti-moti fluctuations ko ignore karta hai.

- 200-Day Moving Average: Forex trading mein 200-day moving average bohot mashhoor hai. Agar price 200-day moving average ke ooper ho, to yeh bullish trend ka indication hota hai, aur agar price neeche ho, to yeh bearish trend ka signal hai.

- Golden Cross aur Death Cross: Jab 50-day moving average 200-day moving average ko cross karta hai, to isse Golden Cross kehte hain, jo ek strong bullish signal hota hai. Iske baraks, jab 50-day moving average neeche jata hai aur 200-day moving average ko cross karta hai, to isse Death Cross kehte hain, jo ek bearish trend ka indication hota hai.

Trendlines ka istimaal long-term trends ko dekhne ke liye bohot effective hai. Aap price ke highs aur lows ko connect karke ek trendline draw karte hain. Yeh trendlines aapko dikhati hain ke market kis direction mein move kar raha hai.

- Uptrend Line: Jab market higher highs aur higher lows banata hai, to yeh ek uptrend hota hai. Aap lows ko connect karke ek ascending trendline draw kar sakte hain, jo aapko long-term bullish trend dikhata hai.

- Downtrend Line: Jab market lower highs aur lower lows banata hai, to yeh ek downtrend hota hai. Aap highs ko connect karke ek descending trendline draw karte hain, jo long-term bearish trend ko dikhata hai.

Technical indicators ka use long-term trend ko samajhne ke liye bhi hota hai. Kuch mashhoor indicators jo long-term trends ke liye istimaal hote hain wo ye hain:

- Relative Strength Index (RSI): RSI overbought aur oversold conditions ko measure karta hai. Jab RSI 70 se zyada hota hai, to market overbought hota hai, aur yeh trend reversal ka signal ho sakta hai. Jab RSI 30 se neeche hota hai, to market oversold hota hai, aur yeh buying opportunity ho sakti hai.

- MACD (Moving Average Convergence Divergence): MACD long-term trend ko follow karne wala indicator hai. Jab MACD line signal line ke ooper hoti hai, to yeh bullish trend ka signal hota hai. Aur jab neeche hoti hai, to yeh bearish trend ka indication hota hai.

Fundamental Analysis

Long-term trend ko determine karne ke liye fundamental analysis bhi zaroori hota hai. Aapko economic indicators jaise GDP, inflation rates, aur central bank policies ko dekhna hota hai. Strong economic indicators ka matlab hota hai ke currency ka value long-term mein barh sakta hai, jab ke weak economic indicators market ke downtrend ko indicate karte hain.

Combining Multiple Tools

Long-term trend ko accurately samajhne ke liye aapko sirf ek tool par rely nahi karna chahiye. Aap moving averages, trendlines, technical indicators, aur fundamental analysis ko combine karke ek comprehensive view hasil kar sakte hain. Yeh combination aapko long-term trends ko samajhne mein zyada accuracy aur confidence dega.

Conclusion

Forex market mein long-term trend ko determine karna trading ki successful strategy ka ahem hissa hai. Moving averages, trendlines, technical indicators, aur fundamental analysis ka sahi istimaal karne se aap market ke overall direction ko samajh sakte hain. Jab aap long-term trend ko theek tareeqe se identify kar lete hain, to aap apne trades ko ussi trend ke mutabiq plan kar sakte hain, jo aapko profitable trades aur long-term success ki taraf le jata hai.

تبصرہ

Расширенный режим Обычный режим