**Trend Continuation Patterns in Forex Trading**

- **Taaruf**:

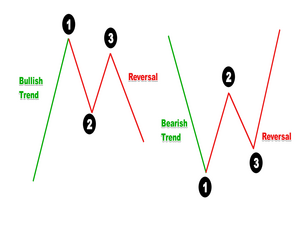

Trend continuation patterns aise price patterns hain jo market ki existing trend ko continue karne ki nishani dete hain. Forex trading mein, in patterns ki pehchan karna traders ko profitable trades lene mein madad karta hai.

- **Types of Patterns**:

Kuch aam trend continuation patterns mein shamil hain:

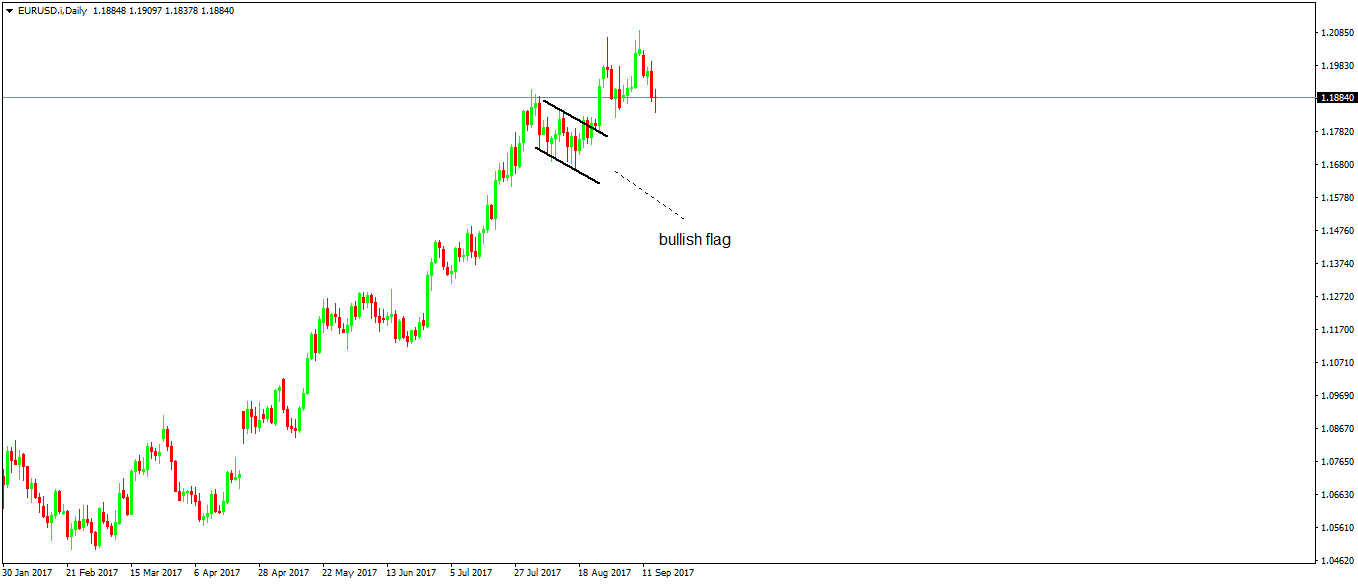

- **Flags**: Short-term consolidation zones jo upward ya downward trends ke beech bante hain. Yeh pattern ek flag pole ki tarah nazar aata hai.

- **Pennants**: Yeh patterns flags ki tarah hote hain lekin ismein price action converging lines ke beech hota hai.

- **Triangles**: Ascending, descending aur symmetrical triangles. Yeh patterns market ki volatility ko darshate hain aur breakout ka signal dete hain.

- **Rectangles**: Yeh patterns horizontal price movements ko darshate hain, jo trend ki continuation ki nishani hoti hai.

- **Identification**:

Patterns ko pehchanana zaroori hai. Trader ko patterns ke formation ke doran price action aur volume ka jaiza lena chahiye. Jab volume increase hota hai, tou yeh strong trend ki confirmation hoti hai.

- **Breakout Points**:

Jab price pattern ke boundaries ko todti hai, tou yeh breakout point hota hai. Traders ko is point par entry lene ka sochna chahiye, kyun ke yeh trend ki continuation ka indication hota hai.

- **Stop Loss aur Target Levels**:

Trend continuation patterns ka istemal karte waqt stop loss levels ka tayun zaroori hai. Yeh stop loss pattern ki opposite side par rakhna chahiye taake losses se bacha ja sake. Target levels ko pehle ke high ya low par set kiya ja sakta hai, jo trend ki expected duration ko darshata hai.

- **Risk Management**:

Trend continuation patterns ka istemal karte waqt risk management strategies ka khayal rakhna chahiye. Ismein position sizing, stop loss aur risk-reward ratio shamil hote hain.

- **Confirmation Indicators**:

Trend continuation patterns ke saath doosre indicators, jaise ke Moving Averages ya RSI, ka istemal karna confirmation ka kaam karta hai. Yeh indicators trader ko trend ki strength aur sustainability ke bare mein zyada information dete hain.

- **Conclusion**:

Forex trading mein trend continuation patterns ka sahi istemal traders ko profitable opportunities de sakta hai. Yeh patterns market ki psychology ko samajhne mein madadgar hain aur successful trading strategies ka hissa ban sakte hain.

- **Taaruf**:

Trend continuation patterns aise price patterns hain jo market ki existing trend ko continue karne ki nishani dete hain. Forex trading mein, in patterns ki pehchan karna traders ko profitable trades lene mein madad karta hai.

- **Types of Patterns**:

Kuch aam trend continuation patterns mein shamil hain:

- **Flags**: Short-term consolidation zones jo upward ya downward trends ke beech bante hain. Yeh pattern ek flag pole ki tarah nazar aata hai.

- **Pennants**: Yeh patterns flags ki tarah hote hain lekin ismein price action converging lines ke beech hota hai.

- **Triangles**: Ascending, descending aur symmetrical triangles. Yeh patterns market ki volatility ko darshate hain aur breakout ka signal dete hain.

- **Rectangles**: Yeh patterns horizontal price movements ko darshate hain, jo trend ki continuation ki nishani hoti hai.

- **Identification**:

Patterns ko pehchanana zaroori hai. Trader ko patterns ke formation ke doran price action aur volume ka jaiza lena chahiye. Jab volume increase hota hai, tou yeh strong trend ki confirmation hoti hai.

- **Breakout Points**:

Jab price pattern ke boundaries ko todti hai, tou yeh breakout point hota hai. Traders ko is point par entry lene ka sochna chahiye, kyun ke yeh trend ki continuation ka indication hota hai.

- **Stop Loss aur Target Levels**:

Trend continuation patterns ka istemal karte waqt stop loss levels ka tayun zaroori hai. Yeh stop loss pattern ki opposite side par rakhna chahiye taake losses se bacha ja sake. Target levels ko pehle ke high ya low par set kiya ja sakta hai, jo trend ki expected duration ko darshata hai.

- **Risk Management**:

Trend continuation patterns ka istemal karte waqt risk management strategies ka khayal rakhna chahiye. Ismein position sizing, stop loss aur risk-reward ratio shamil hote hain.

- **Confirmation Indicators**:

Trend continuation patterns ke saath doosre indicators, jaise ke Moving Averages ya RSI, ka istemal karna confirmation ka kaam karta hai. Yeh indicators trader ko trend ki strength aur sustainability ke bare mein zyada information dete hain.

- **Conclusion**:

Forex trading mein trend continuation patterns ka sahi istemal traders ko profitable opportunities de sakta hai. Yeh patterns market ki psychology ko samajhne mein madadgar hain aur successful trading strategies ka hissa ban sakte hain.

تبصرہ

Расширенный режим Обычный режим