STARC Bands Indicator Kya Hai:

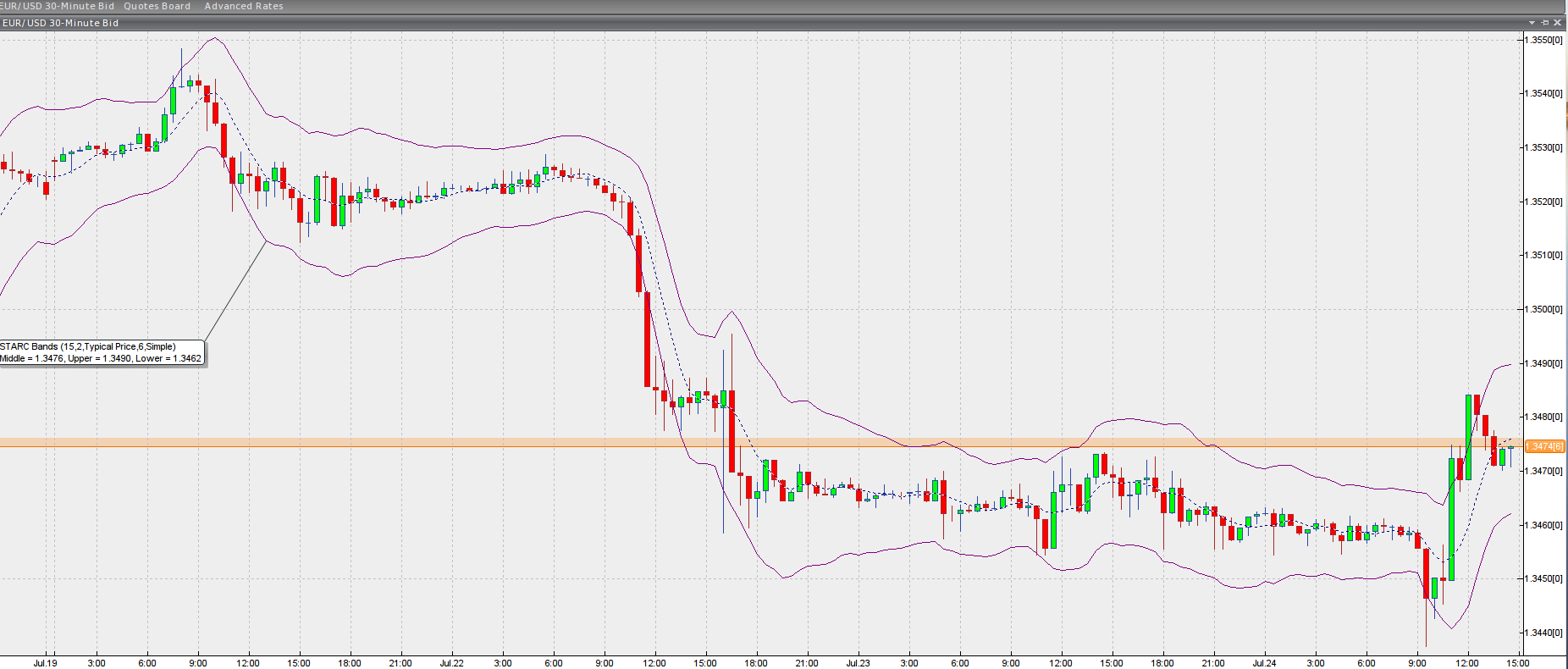

STARC Bands (Stoller Average Range Channels) ek technical indicator hai jo forex trading mein price range aur volatility ko measure karne ke liye use hota hai. Iska maksad yeh hota hai ke ek trader ko current price ke aas paas ka ek range bata sake jisme price movement ho sakti hai. Is indicator ka naam iske creator Manning Stoller ke naam par rakha gaya hai.

STARC Bands Ke Components:

STARC Bands mein 3 lines hoti hain:

STARC Bands ko calculate karne ka formula kuch is tarah hai:

STARC Bands ko dusre indicators ke sath mila kar use karna faydemand ho sakta hai, jese RSI ya MACD. Yeh indicator dynamic hai kyun ke yeh price volatility ko measure karta hai aur market conditions ke mutabiq adjust hota hai.

Conclusion:

STARC Bands ek valuable tool hai jo price ke potential range ko indicate karta hai, aur traders ko overbought/oversold conditions aur volatility ko measure karne mein madad deta hai. Isko samajh kar, traders apni trading strategies mein isse shamil kar ke fayda utha sakte hain.

STARC Bands (Stoller Average Range Channels) ek technical indicator hai jo forex trading mein price range aur volatility ko measure karne ke liye use hota hai. Iska maksad yeh hota hai ke ek trader ko current price ke aas paas ka ek range bata sake jisme price movement ho sakti hai. Is indicator ka naam iske creator Manning Stoller ke naam par rakha gaya hai.

STARC Bands Ke Components:

STARC Bands mein 3 lines hoti hain:

- Upper Band: Yeh price ke upper side ka ek limit set karti hai. Upper band ko calculate karne ke liye moving average ke sath Average True Range (ATR) ka multiple add kiya jata hai.

- Middle Line (SMA): Yeh ek simple moving average hota hai jo price ki average direction ko show karta hai.

- Lower Band: Yeh price ke lower side ka ek limit set karti hai. Isse calculate karne ke liye moving average mein ATR ka multiple subtract kiya jata hai.

STARC Bands ko calculate karne ka formula kuch is tarah hai:

- Upper Band = SMA + ATR × multiplier

- Lower Band = SMA - ATR × multiplier

- Overbought aur Oversold Levels: Agar price upper band ke kareeb ho to iska matlab hai ke market overbought hai, aur agar price lower band ke kareeb ho to market oversold hai. Yeh signals traders ko batate hain ke price ab shayad reverse ho sakti hai.

- Volatility Measure Karna: STARC Bands ka range wide ya narrow ho sakta hai. Agar bands wide ho rahe ho to iska matlab hai ke market mein zyada volatility hai, aur agar narrow ho to market calm hai.

- Trend Following: STARC Bands ko trend ke sath bhi use kiya jata hai. Agar price upper band ke upar close kare to yeh trend continuation ka signal ho sakta hai, aur agar lower band ke niche close kare to downtrend ka signal ho sakta hai.

STARC Bands ko dusre indicators ke sath mila kar use karna faydemand ho sakta hai, jese RSI ya MACD. Yeh indicator dynamic hai kyun ke yeh price volatility ko measure karta hai aur market conditions ke mutabiq adjust hota hai.

Conclusion:

STARC Bands ek valuable tool hai jo price ke potential range ko indicate karta hai, aur traders ko overbought/oversold conditions aur volatility ko measure karne mein madad deta hai. Isko samajh kar, traders apni trading strategies mein isse shamil kar ke fayda utha sakte hain.

تبصرہ

Расширенный режим Обычный режим