Introduction

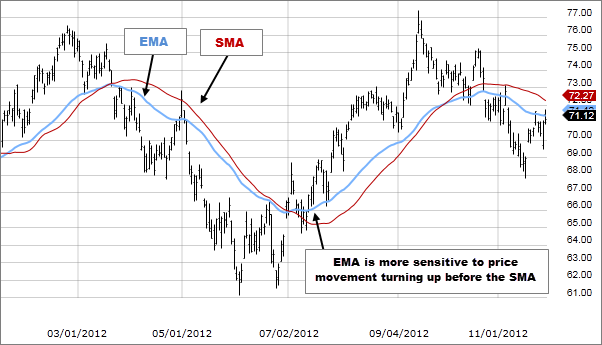

Exponential Moving Average (EMA) ek popular technical indicator hai jo market ki direction ko identify karne mein madad karta hai. Yeh indicator ek moving average hai jo recent price data ko zyada importance deta hai.

EMA ki calculation:

EMA = (Current Price x Smoothing Factor) + (Previous EMA x (1 - Smoothing Factor))

Smoothing Factor = 2 / (Number of Periods + 1)

EMA ki faide:

1. Trend identification: EMA trend ki direction ko identify karne mein madad karta hai.

2. Support aur resistance: EMA support aur resistance levels ko identify karne mein madad karta hai.

3. Buy aur sell signals: EMA buy aur sell signals generate karne mein madad karta hai.

EMA ki kamiyan:

1. Lagging indicator: EMA ek lagging indicator hai, yeh means ki yeh indicator market ki current situation ko reflect nahi karta hai.

2. False signals: EMA false signals generate kar sakta hai, yeh means ki yeh indicator buy aur sell signals ko incorrectly generate kar sakta hai.

EMA ki settings:

1. Period: EMA ki period ko adjust kiya ja sakta hai, yeh means ki yeh indicator ko 50-period, 100-period, ya 200-period ki settings mein use kiya ja sakta hai.

2. Smoothing Factor: EMA ki smoothing factor ko adjust kiya ja sakta hai, yeh means ki yeh indicator ko zyada ya kam sensitive bana ya ja sakta hai.

EMA ki usage:

1. Trend following: EMA trend following strategy mein use kiya ja sakta hai.

2. Mean reversion: EMA mean reversion strategy mein use kiya ja sakta hai.

3. Breakout trading: EMA breakout trading strategy mein use kiya ja sakta hai.

Timeframes for EMA

Alag alag timeframes ke liye EMA calculate kiya ja sakta hey, jaise:

- Short-term EMA: 12-day aur 26-day EMA commonly use kiya jata hey.

- Long-term EMA: 50-day aur 200-day EMA zyada lambi duration ke trends ko track karta hey.

تبصرہ

Расширенный режим Обычный режим