Morning Star Candlestick Pattern Trading Strategy

Morning Star Candlestick Pattern Kia Hai?

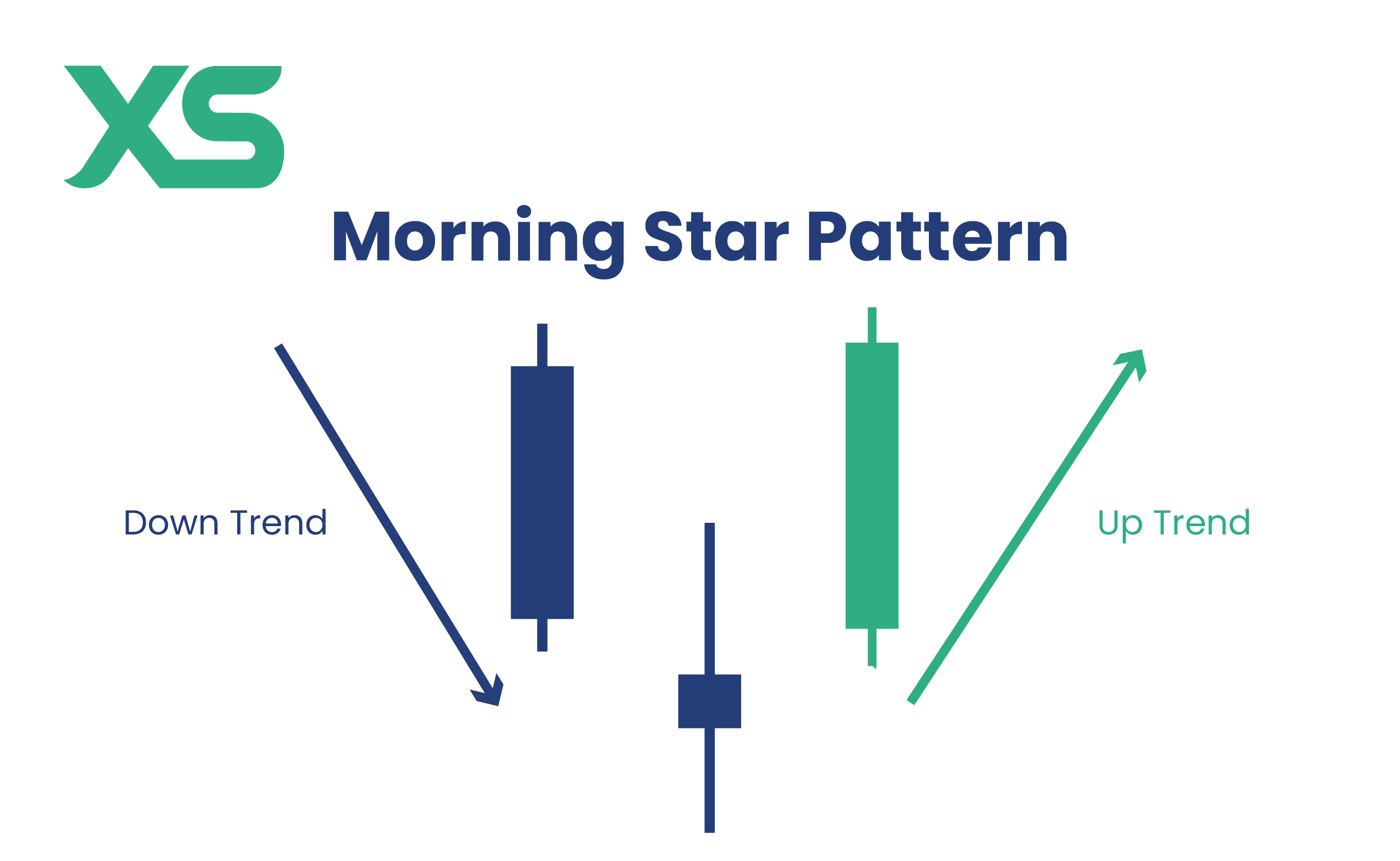

Morning Star ek bullish candlestick pattern hai jo market ke bottom par form hota hai aur yeh indicate karta hai ke market mein reversal aane wala hai. Yeh pattern teen candlesticks ka hota hai. Pehli candlestick ek strong bearish candle hoti hai, doosri ek small-bodied candle hoti hai jo market ke indecision ko dikhati hai, aur teesri ek bullish candle hoti hai jo market ka upward momentum show karti hai.

Pattern Ki Shakal

Morning Star Pattern Ko Kaise Pehchanein?

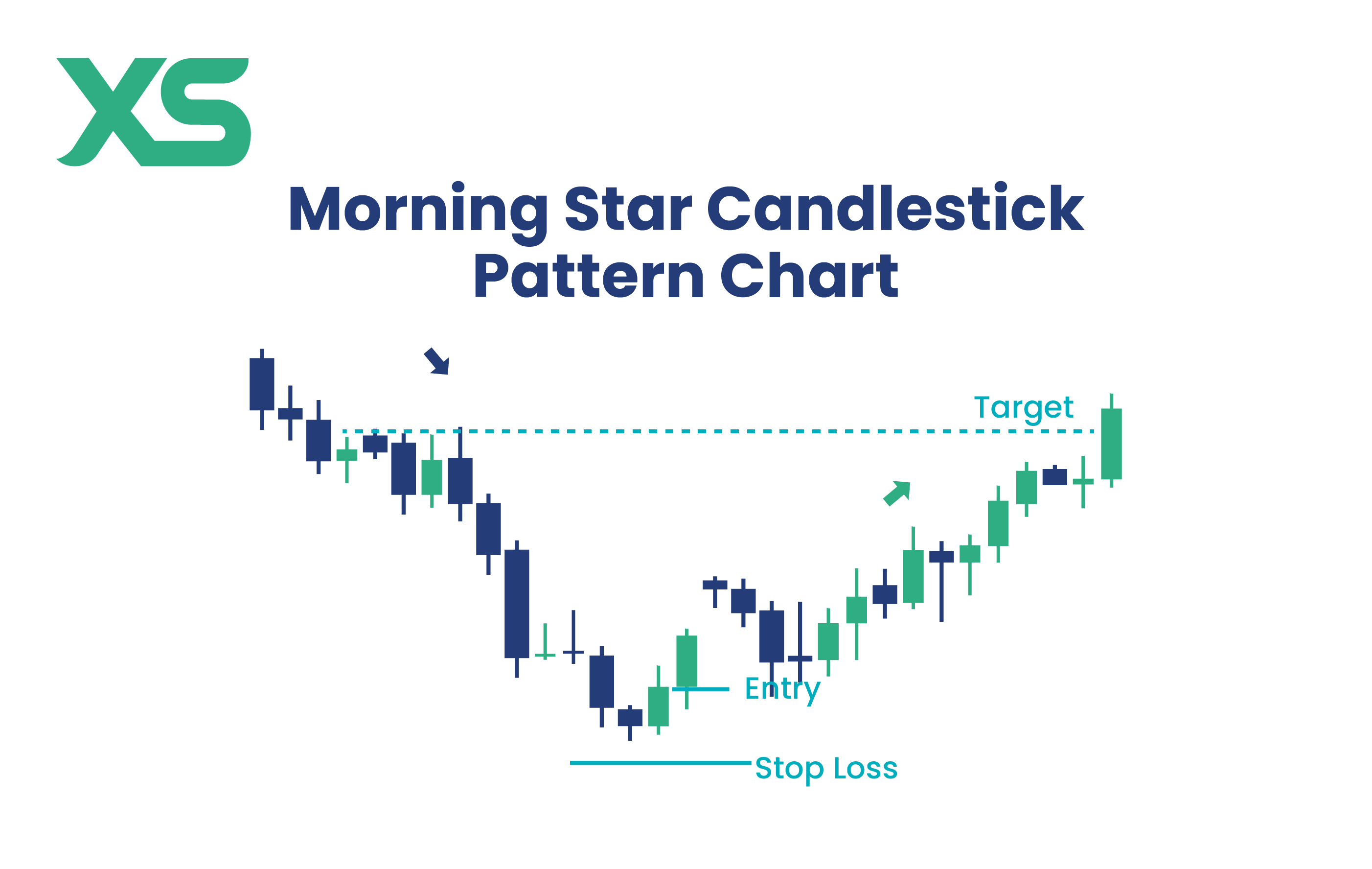

Yeh pattern tab zyada effective hota hai jab pehle se hi downtrend chal raha ho. Is pattern ko dekh kar traders andaza lagate hain ke market mein ab bottom aa gaya hai aur buyers ab strong ho rahe hain. Jab teesri bullish candle close hoti hai, toh yeh ek strong signal hota hai ke ab market upward move karegi.

Trading Strategy

Risk Management

Risk management bohot zaroori hai, aur aapko apne trade ke liye fixed percentage risk use karna chahiye. General rule ke mutabiq, aapko apne account ka 1-2% se zyada risk nahi lena chahiye.

Conclusion

Morning Star candlestick pattern ek powerful bullish reversal pattern hai jo traders ko achi entry points provide karta hai. Agar aap is pattern ko sahi tarah se samajh lein aur risk management ka khayal rakhein, toh yeh aapke trading portfolio ke liye faidemand ho sakta hai.

Morning Star Candlestick Pattern Kia Hai?

Morning Star ek bullish candlestick pattern hai jo market ke bottom par form hota hai aur yeh indicate karta hai ke market mein reversal aane wala hai. Yeh pattern teen candlesticks ka hota hai. Pehli candlestick ek strong bearish candle hoti hai, doosri ek small-bodied candle hoti hai jo market ke indecision ko dikhati hai, aur teesri ek bullish candle hoti hai jo market ka upward momentum show karti hai.

Pattern Ki Shakal

- Pehli Candle: Yeh ek strong bearish candle hoti hai jo downtrend ko confirm karti hai.

- Doosri Candle: Doosri candle chhoti hoti hai aur yeh market ke indecision ko dikhati hai. Is candle ka color kuch bhi ho sakta hai lekin yeh usually small body ke saath aati hai. Yeh candle kabhi kabhi ek Doji bhi ho sakti hai, jo market ki confusion ko aur mazid confirm karti hai.

- Teesri Candle: Teesri candle ek strong bullish candle hoti hai jo yeh signal deti hai ke ab buyers market mein wapas aa gaye hain aur price upward move karegi.

Morning Star Pattern Ko Kaise Pehchanein?

Yeh pattern tab zyada effective hota hai jab pehle se hi downtrend chal raha ho. Is pattern ko dekh kar traders andaza lagate hain ke market mein ab bottom aa gaya hai aur buyers ab strong ho rahe hain. Jab teesri bullish candle close hoti hai, toh yeh ek strong signal hota hai ke ab market upward move karegi.

Trading Strategy

- Entry Point: Jab teesri bullish candle close ho jaye, uske baad aap buy order place kar sakte hain. Yeh confirm karta hai ke market ab bullish trend mein enter kar chuki hai.

- Stop Loss: Aap apna stop loss pehli bearish candle ke low ke neeche set kar sakte hain. Agar price us low ko breach kar jaye, toh iska matlab yeh hai ke reversal pattern fail ho gaya hai.

- Take Profit: Aap apna take profit resistance levels ke aas-paas set kar sakte hain ya phir jab aapko lagay ke upward move kaafi strong ho chuki hai.

Risk Management

Risk management bohot zaroori hai, aur aapko apne trade ke liye fixed percentage risk use karna chahiye. General rule ke mutabiq, aapko apne account ka 1-2% se zyada risk nahi lena chahiye.

Conclusion

Morning Star candlestick pattern ek powerful bullish reversal pattern hai jo traders ko achi entry points provide karta hai. Agar aap is pattern ko sahi tarah se samajh lein aur risk management ka khayal rakhein, toh yeh aapke trading portfolio ke liye faidemand ho sakta hai.

تبصرہ

Расширенный режим Обычный режим