4H Trading Strategy with EMA

forex market 4H trading strategy 4 ghantay kay chart pattern say he hote hey jo keh forex market mein teen kesam ke moving average or candlestick pattern par he moshtamel hota hey jo keh forex trade kay system mein he shamel hota hey

yeh forex market mein ai wnning wala he trading system he hota hey jo keh forex market mein risk management kay sath he chalna hota hey forex trader kay ley H4 ke aik trading strategy he hote hey jes ko market kay trade asani kay sath he samajh saktay hein

Component of H4 Trading Strategy

yeh forex market mein aik kesam ka trend trading system hota hey jo keh forex market kay 2 ajza par he moshtamel hota hey forex market mein winning wala nezam bananay kay ley es ko forex market mein aik khas maksad kay ley he estamal keya ja sakta hey es kay 2 component hotay hein

1 3 Exponential Moving Average

2 candlestick chart pattern

3 Exponential Moving average

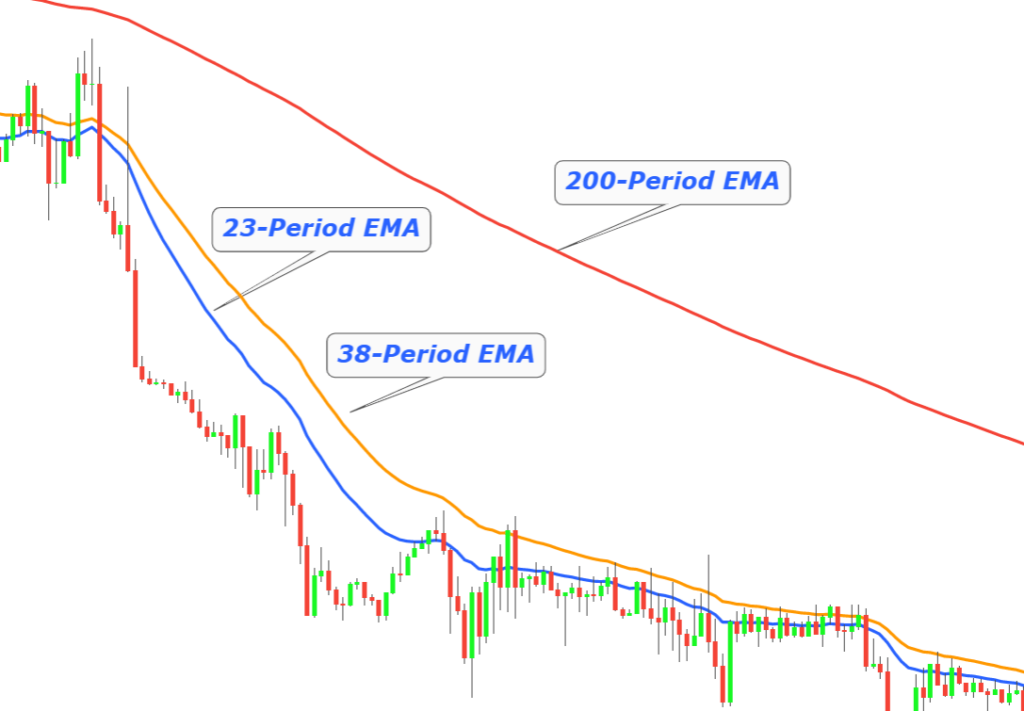

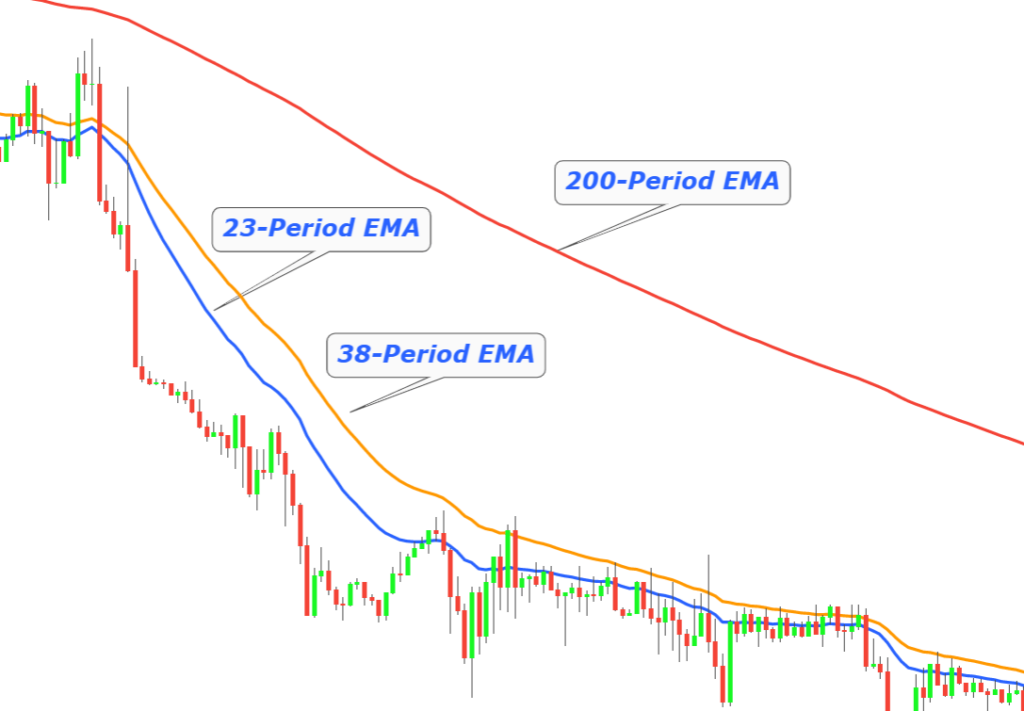

1: 23-Period exponential moving average

2: 38-period exponential moving average

3: 200-period exponential moving average

Candlestick Pattern ka trading strategy mein estamal

es kesam ke trading strategy mein 2 kesam kay candlestick pattern estamal hotay hein

Pin bar candlestick pattern

Engulfing candlestick pattern

Moving Average ka estamal

forex market mein moving average ko price chart trend or market ke movement ka analysis karnay kay ley he estamal keya ja sakta hey

200 period ke moving average aik khas kesam kay currency pair ko he analysis karnay kay ley he estamal keyaja sakta hey or forex market ke curency ya stock trend filter kay tor par he kam ka sakta hey

23 or 38 period ke moving average stock market mein trend filter kay tor he kam kar sakte hey or forex market mein support ya resistance zone kay tor par kam kar sakte hey

4H ke trading strategy

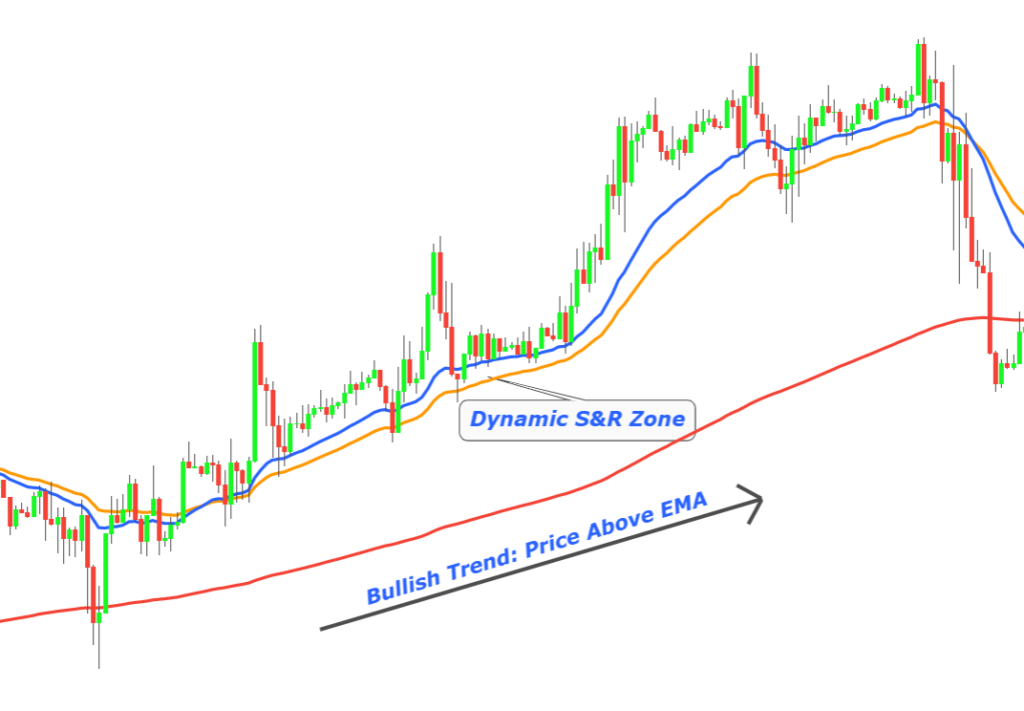

sab say pehlay 200 period ke exponential moving average ka estamal kar kay market ke direction ko he identify karna chihay or forex market mein es bat ke pehchan hone chihay keh trend bullish ka hona chihay price nechay say oper ke taraf movement hoe chihay

dynamic support zone mein EMA 23 or 38 ko reject kane chihay bearish ya bullish engulfing candlestick ko he talash kana chihay or price ke 38 EMA ko reject karna chihay

forex market mein candlestick ke formation kay bad buy ka order open karna chihay or candlestick kay lower hesay mein kuch pips kay faslay par stop loss rakhna chihay ap forex market mein take profit level ko increase karnay kay ley Fibonacci extension level ka he estamal kar saktay hein

forex market 4H trading strategy 4 ghantay kay chart pattern say he hote hey jo keh forex market mein teen kesam ke moving average or candlestick pattern par he moshtamel hota hey jo keh forex trade kay system mein he shamel hota hey

yeh forex market mein ai wnning wala he trading system he hota hey jo keh forex market mein risk management kay sath he chalna hota hey forex trader kay ley H4 ke aik trading strategy he hote hey jes ko market kay trade asani kay sath he samajh saktay hein

Component of H4 Trading Strategy

yeh forex market mein aik kesam ka trend trading system hota hey jo keh forex market kay 2 ajza par he moshtamel hota hey forex market mein winning wala nezam bananay kay ley es ko forex market mein aik khas maksad kay ley he estamal keya ja sakta hey es kay 2 component hotay hein

1 3 Exponential Moving Average

2 candlestick chart pattern

3 Exponential Moving average

1: 23-Period exponential moving average

2: 38-period exponential moving average

3: 200-period exponential moving average

Candlestick Pattern ka trading strategy mein estamal

es kesam ke trading strategy mein 2 kesam kay candlestick pattern estamal hotay hein

Pin bar candlestick pattern

Engulfing candlestick pattern

Moving Average ka estamal

forex market mein moving average ko price chart trend or market ke movement ka analysis karnay kay ley he estamal keya ja sakta hey

200 period ke moving average aik khas kesam kay currency pair ko he analysis karnay kay ley he estamal keyaja sakta hey or forex market ke curency ya stock trend filter kay tor par he kam ka sakta hey

23 or 38 period ke moving average stock market mein trend filter kay tor he kam kar sakte hey or forex market mein support ya resistance zone kay tor par kam kar sakte hey

4H ke trading strategy

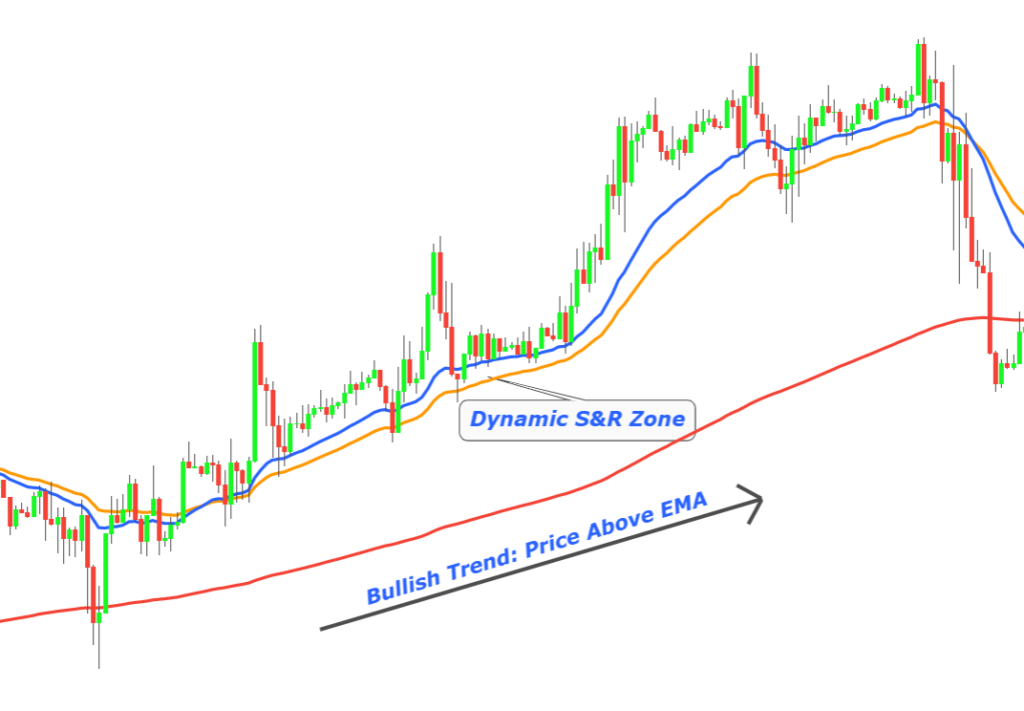

sab say pehlay 200 period ke exponential moving average ka estamal kar kay market ke direction ko he identify karna chihay or forex market mein es bat ke pehchan hone chihay keh trend bullish ka hona chihay price nechay say oper ke taraf movement hoe chihay

dynamic support zone mein EMA 23 or 38 ko reject kane chihay bearish ya bullish engulfing candlestick ko he talash kana chihay or price ke 38 EMA ko reject karna chihay

forex market mein candlestick ke formation kay bad buy ka order open karna chihay or candlestick kay lower hesay mein kuch pips kay faslay par stop loss rakhna chihay ap forex market mein take profit level ko increase karnay kay ley Fibonacci extension level ka he estamal kar saktay hein

تبصرہ

Расширенный режим Обычный режим