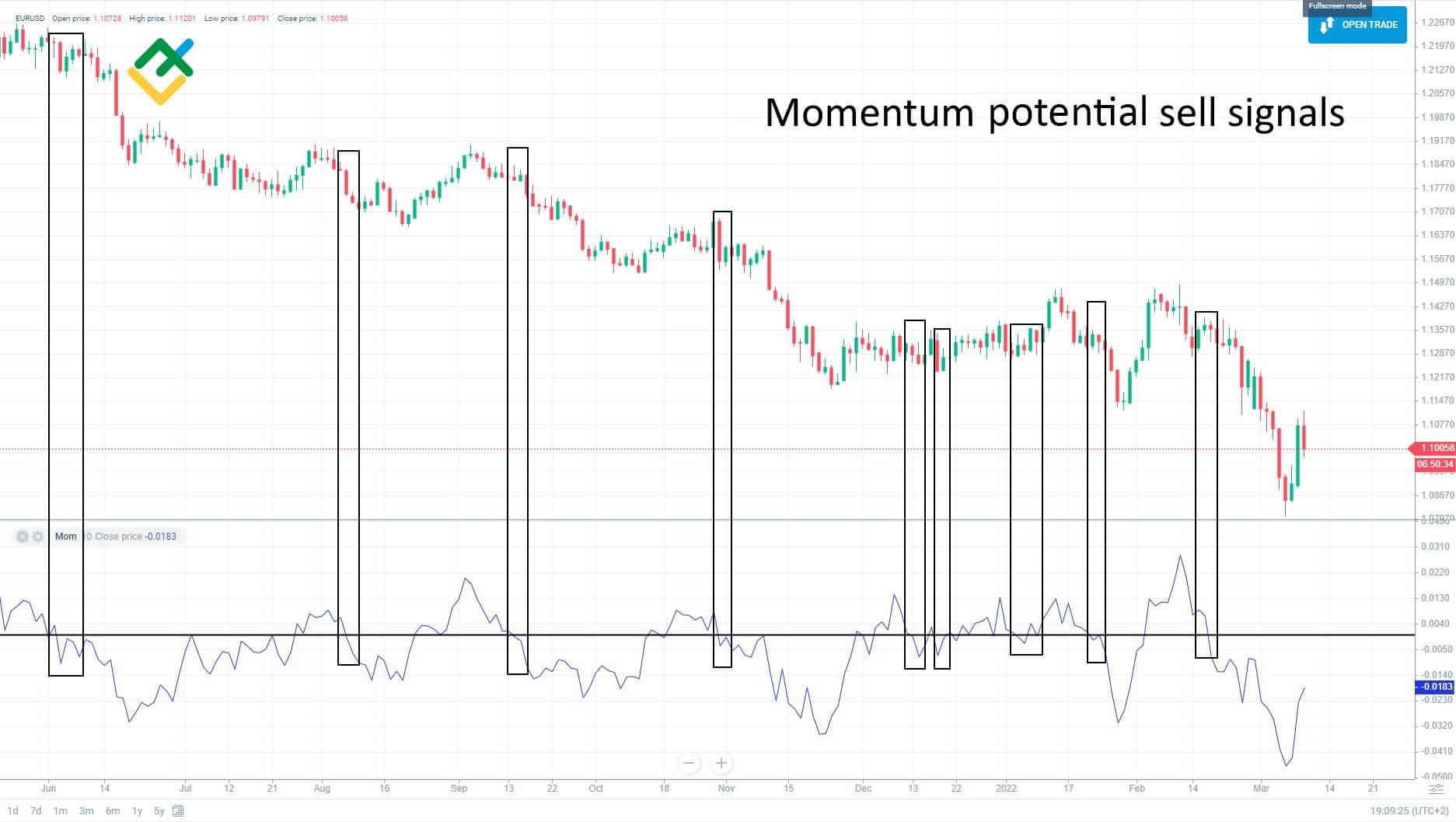

Momentum Indicator Strategy in Forex Trading

1. Momentum Indicator Ka Taaruf

Momentum indicator forex trading mein ek ahem aur maqbool tool hai. Yeh indicator traders ko market ki movement aur price ki speed ko samajhne mein madad karta hai. Iska main objective yeh hai ke market ki strength aur weakness ko assess kiya jaye, jo trading decisions ko behtar banane mein madadgar hota hai. Momentum ko samajhne se traders ko market ke trends aur potential reversal points ka pata chal sakta hai, jo unki trading strategies ko enhance kar sakta hai.

Momentum indicator price action ko analyze karta hai aur traders ko bataata hai ke current market conditions kaisi hain. Jab market mein momentum strong hota hai, to price ki movement tez hoti hai aur trend ki strength zyada hoti hai. Is indicator ke zariye traders price ki speed aur direction ko evaluate kar sakte hain aur trend continuation ya reversal ke signals dekh sakte hain. Yeh indicator trading strategies ko support karne ke liye use kiya jata hai, jo traders ko market mein behtar decision-making mein madad karta hai.

Momentum indicator ki basic principle yeh hai ke market trends ko track kiya jaye aur unke changes ko analyze kiya jaye. Jab market strong momentum dikhata hai, to price movement consistent hoti hai aur traders ko clear buy ya sell signals milte hain. Yeh indicator price changes aur volatility ko bhi measure karta hai, jo trading decisions ko aur bhi accurate banaata hai. In short, momentum indicator trading strategies mein ek crucial role play karta hai jo market ke trends ko identify karne mein madad karta hai.

2. Momentum Indicator Ka Kaam

Momentum indicator ka primary kaam market ki movement ki speed ko measure karna hai. Yeh indicator current price ko ek specific time period ke average price se compare karta hai aur is comparison se market ki strength aur weakness ka pata lagata hai. Jab price ki speed barh jaati hai, to momentum indicator positive reading show karta hai, aur jab speed kam hoti hai, to negative reading show karta hai. Isse traders ko market trends aur potential changes ka indication milta hai.

Momentum indicator market ke trends ko monitor karta hai aur yeh identify karta hai ke kya trend strong hai ya weak. Agar indicator ki reading high hoti hai, to yeh indicate karta hai ke market mein strong momentum hai aur trend continue kar sakta hai. Conversely, agar reading low hoti hai, to yeh market ke weak momentum ko indicate karta hai jo trend reversal ka signal ho sakta hai. Yeh indicator price ke historical data ke basis par current market conditions ka analysis karta hai, jo trading decisions ko support karta hai.

Market trends ke analysis ke liye momentum indicator ko frequently monitor kiya jata hai. Traders is indicator ke zariye price ki speed aur direction ko track karte hain aur yeh assess karte hain ke market kis direction mein move kar raha hai. Isse unhe market ke changes aur potential trading opportunities ke baare mein information milti hai. Yeh indicator price movements ke trends ko visualize karne mein madad karta hai aur trading strategies ko refine karne mein help karta hai.

3. Momentum Indicator Ki Types

Momentum indicator ki do main types hain: simple momentum indicators aur oscillators. Simple momentum indicator ek straightforward tool hai jo current price ko past price levels se compare karta hai. Yeh price movements ke trends ko track karta hai aur traders ko market ke strength aur weakness ke signals provide karta hai. Is indicator ka primary focus price ki current level ko evaluate karna hota hai aur isse traders ko market ki movement ka idea milta hai.

Oscillators, on the other hand, ek complex type ke momentum indicators hain jo market ke overbought aur oversold conditions ko identify karte hain. Popular oscillators mein Relative Strength Index (RSI) aur Moving Average Convergence Divergence (MACD) shamil hain. RSI market ki overbought aur oversold levels ko measure karta hai, jabke MACD moving averages ke gap ko track karta hai. Dono oscillators market trends aur potential reversals ko identify karne mein madadgar hote hain.

Momentum indicators ki types ke selection ka depend traders ke personal preferences aur trading strategies par hota hai. Simple momentum indicators easy to use hote hain aur basic price trends ko analyze karte hain. Oscillators zyada advanced tools hain jo market ke intricate details ko analyze karte hain aur inke signals zyada accurate hote hain. In types ke behtareen istemal se traders market ki movement ko accurately track kar sakte hain aur behtar trading decisions le sakte hain.

4. Simple Momentum Indicator

Simple momentum indicator ek basic tool hai jo price changes ko measure karta hai. Is indicator mein, current price ko ek fixed time period ke average price se compare kiya jata hai. Agar current price average price se higher hota hai, to momentum positive hota hai aur agar lower hota hai, to momentum negative hota hai. Yeh indicator price movements ke trends ko visualize karne mein madad karta hai aur trading signals generate karta hai.

Simple momentum indicator ka analysis karke traders ko market ki movement ki speed aur direction ka pata chal sakta hai. Jab momentum positive hota hai, to traders buy signals dekhte hain aur jab negative hota hai, to sell signals generate karte hain. Yeh indicator market ki trends ko track karta hai aur price movements ke patterns ko identify karne mein madad karta hai.

Simple momentum indicator ka istemal trading strategies ko refine karne ke liye kiya jata hai. Traders is indicator ke signals ko combine kar ke apne trading decisions ko enhance karte hain. Yeh indicator market ke basic trends ko analyze karta hai aur traders ko clear trading signals provide karta hai jo unki strategies ko improve karta hai.

5. Relative Strength Index (RSI)

RSI ek popular momentum oscillator hai jo market ke overbought aur oversold conditions ko measure karta hai. Yeh indicator 0 se 100 tak scale par operate karta hai aur typically 14-period ke data ko use karta hai. RSI ki readings 70 se upar overbought conditions aur 30 se neeche oversold conditions ko indicate karti hain. Yeh trader ko market ke potential reversal points identify karne mein madad karta hai.

RSI ka analysis karte waqt traders market ke overbought aur oversold levels ko observe karte hain. Agar RSI 70 se upar hota hai, to market overbought conditions ko indicate karta hai aur sell signals generate ho sakte hain. Agar RSI 30 se neeche hota hai, to market oversold conditions ko indicate karta hai aur buy signals generate ho sakte hain. Yeh indicator market ke strength aur weakness ko identify karne mein madad karta hai aur trading decisions ko support karta hai.

RSI ka use trading strategies ko enhance karne ke liye bhi kiya jata hai. Traders RSI ke signals ko other technical tools ke saath combine kar ke apni trading strategies ko refine karte hain. Yeh combination traders ko accurate trading signals provide karta hai aur market ke trends ko better analyze karne mein madad karta hai.

6. Moving Average Convergence Divergence (MACD)

MACD ek aur popular momentum oscillator hai jo moving averages ke gap ko track karta hai. Yeh indicator market ki momentum aur trend strength ko measure karta hai aur trading signals generate karta hai. MACD line aur signal line ke beech ke differences ko track karta hai aur histogram ke zariye trends ko visualize karta hai.

MACD ka analysis karte waqt traders MACD line aur signal line ke beech ke crossovers ko observe karte hain. Jab MACD line signal line ko upar se cross karti hai, to buy signal generate hota hai. Conversely, jab MACD line signal line ko neeche se cross karti hai, to sell signal generate hota hai. Yeh indicator market ke trends aur potential reversals ko identify karne mein madad karta hai.

MACD ka use trading strategies ko refine karne ke liye kiya jata hai. Traders MACD ke signals ko other technical indicators ke saath combine kar ke apni trading strategies ko improve karte hain. Yeh combination accurate trading signals provide karta hai aur market ke trends ko better analyze karne mein madad karta hai.

7. Momentum Indicator Ka Analysis

Momentum indicator ka analysis karte waqt, traders price trends aur fluctuations ko closely observe karte hain. Indicator ki readings market ki momentum aur strength ko indicate karti hain. Agar momentum positive hota hai, to market mein strong trend ki expectation hoti hai. Agar momentum negative hota hai, to market ke weak trend aur potential reversal ka signal hota hai.

Momentum indicator ki readings ko analyze karte waqt traders price movements ke patterns ko identify karte hain. Yeh patterns market ke trends aur potential changes ko visualize karne mein madadgar hote hain. Indicator ka use kar ke traders market ke strength aur weakness ko assess karte hain aur trading decisions ko refine karte hain.

Momentum indicator ke analysis ke zariye traders market ke trends aur fluctuations ko better samajh sakte hain. Yeh indicator price movements ke patterns ko identify karne mein madad karta hai aur trading strategies ko enhance karta hai. Effective analysis se traders market ke trends ko accurately track kar sakte hain aur profitable trading decisions le sakte hain.

8. Entry Points Aur Exit Points

Momentum indicators ka use entry aur exit points determine karne ke liye kiya jata hai. Jab momentum positive hota hai, to traders buy signals generate karte hain aur market mein entry points identify karte hain. Jab momentum negative hota hai, to traders sell signals generate karte hain aur market se exit points determine karte hain.

Entry points ko identify karne ke liye traders momentum indicator ki readings ko analyze karte hain. Agar indicator ki reading high hoti hai aur trend strong hai, to traders market mein enter karte hain. Exit points ko identify karne ke liye traders indicator ke signals aur price movements ke patterns ko observe karte hain. Jab momentum weaken hota hai, to traders market se exit karte hain.

Effective entry aur exit points ko determine karne ke liye traders momentum indicators ko other technical tools ke saath combine karte hain. Yeh combination traders ko accurate trading signals provide karta hai aur market ke trends ko better analyze karne mein madad karta hai. Entry aur exit points ke accurate determination se traders ki trading strategies improve hoti hain.

9. Divergence Aur Convergence

Divergence aur convergence momentum indicators ki key concepts hain jo market trends aur potential reversals ko identify karte hain. Divergence tab hoti hai jab price aur indicator ke beech ke trends different hote hain. Yeh trend reversal ka signal hota hai aur market ke potential changes ko indicate karta hai.

Convergence tab hoti hai jab price aur indicator ke beech ke trends aligned hote hain. Yeh trend continuation ka signal hota hai aur market ke strength ko indicate karta hai. Divergence aur convergence ko analyze kar ke traders market ke trends aur potential reversals ko identify karte hain aur trading decisions ko refine karte hain.

Divergence aur convergence ka analysis market ke patterns aur trends ko visualize karne mein madad karta hai. Yeh concepts trading strategies ko enhance karte hain aur market ke potential changes ko accurately predict karne mein madadgar hote hain. Effective analysis se traders apni trading strategies ko refine kar sakte hain aur profits ko maximize kar sakte hain.

10. Trend Confirmation

Momentum indicators trend confirmation mein bhi madadgar hote hain. Jab momentum indicator trend ke direction ke saath aligned hota hai, to yeh signal hota hai ke trend continue kar sakta hai. Yeh confirmation traders ko market ke current trends ke strength aur sustainability ka idea deta hai.

Trend confirmation ke liye traders momentum indicators ko price trends aur fluctuations ke saath compare karte hain. Agar momentum indicator trend ke direction ke saath aligned hota hai aur price movements consistent hoti hain, to traders trend continuation ke signals dekhte hain. Yeh confirmation trading decisions ko support karta hai aur market ke trends ko accurately track karne mein madad karta hai.

Effective trend confirmation se traders market ke potential reversals aur continuations ko accurately predict kar sakte hain. Yeh confirmation trading strategies ko refine karne mein madad karta hai aur traders ko market ke trends ke strength aur sustainability ke baare mein insights provide karta hai.

11. Risk Management

Momentum indicators ke saath risk management bhi zaroori hai. Traders ko apne stop-loss aur take-profit levels ko carefully set karna chahiye taake unexpected market movements se bach sakain. Risk management strategies trading decisions ko protect karne ke liye zaroori hain aur trading capital ko safeguard karne mein madad karti hain.

Stop-loss aur take-profit levels ko set karne ke liye traders momentum indicators aur price movements ke patterns ko analyze karte hain. Yeh levels market ke fluctuations ke against protection provide karte hain aur trading losses ko minimize karte hain. Effective risk management se traders market ke potential reversals aur trends ke changes ko handle kar sakte hain.

Risk management strategies ko implement karne se traders ki trading performance improve hoti hai aur trading capital ko protect kiya jata hai. Yeh strategies market ke unexpected movements ke against safeguard provide karte hain aur traders ko consistent profitability achieve karne mein madad karti hain.

12. Combining Indicators

Ek effective trading strategy mein, traders momentum indicators ko doosre technical tools ke saath combine karte hain. Is combination se trading signals aur market trends ke analysis ko enhance kiya jata hai. Combination of indicators trading decisions ko accurate aur reliable banane mein madad karta hai.

Traders momentum indicators ko moving averages, support/resistance levels, aur other technical tools ke saath combine karte hain. Yeh combination accurate trading signals provide karta hai aur market ke trends aur potential reversals ko better analyze karne mein madad karta hai. Combining indicators se trading strategies ko refine kiya jata hai aur market ke complex patterns ko identify kiya jata hai.

Effective combination of indicators se traders ko market ke movements aur trends ke baare mein comprehensive insights milte hain. Yeh combination trading signals ko enhance karta hai aur trading decisions ko accurate banane mein madad karta hai. Traders ko apne indicators aur tools ko carefully select karna chahiye taake effective trading strategies develop ki ja sakein.

13. Practice Aur Backtesting

Momentum indicator strategy ko implement karne se pehle practice aur backtesting zaroori hai. Historical data ka analysis karke aap apni strategy ki effectiveness ko evaluate kar sakte hain aur improvements kar sakte hain. Practice aur backtesting se traders apni trading strategies ko refine kar sakte hain aur market ke trends ko better samajh sakte hain.

Backtesting ke zariye traders historical data par apni strategies ko test karte hain aur trading performance ko evaluate karte hain. Yeh process unhe apni strategies ke strengths aur weaknesses ke baare mein insights provide karta hai aur improvements karne mein madad karta hai. Practice aur backtesting se traders apne trading decisions ko enhance kar sakte hain aur market ke trends ko accurately predict kar sakte hain.

Effective practice aur backtesting se traders ki trading performance improve hoti hai aur trading strategies ko refine kiya jata hai. Yeh process trading decisions ko accurate aur reliable banane mein madad karta hai aur traders ko market ke complex patterns ko identify karne mein help karta hai.

14. Conclusion

Momentum indicator forex trading mein ek valuable tool hai jo market ki movement aur strength ko analyze karne mein madad karta hai. Is indicator ka sahi istemal aur effective strategy trading decisions ko enhance kar sakti hai aur profits ko maximize kar sakti hai. Traders ko momentum indicators ke signals ko carefully analyze karna chahiye aur apni trading strategies ko refine karna chahiye.

Momentum indicator ki effectiveness ko increase karne ke liye traders ko practice aur backtesting ka istemal karna chahiye. Yeh process trading decisions ko accurate aur reliable banane mein madad karta hai aur market ke trends ko better samajhne mein help karta hai. Effective use of momentum indicators se traders ki trading performance improve hoti hai aur market ke potential opportunities ko capitalize karna possible hota hai.

1. Momentum Indicator Ka Taaruf

Momentum indicator forex trading mein ek ahem aur maqbool tool hai. Yeh indicator traders ko market ki movement aur price ki speed ko samajhne mein madad karta hai. Iska main objective yeh hai ke market ki strength aur weakness ko assess kiya jaye, jo trading decisions ko behtar banane mein madadgar hota hai. Momentum ko samajhne se traders ko market ke trends aur potential reversal points ka pata chal sakta hai, jo unki trading strategies ko enhance kar sakta hai.

Momentum indicator price action ko analyze karta hai aur traders ko bataata hai ke current market conditions kaisi hain. Jab market mein momentum strong hota hai, to price ki movement tez hoti hai aur trend ki strength zyada hoti hai. Is indicator ke zariye traders price ki speed aur direction ko evaluate kar sakte hain aur trend continuation ya reversal ke signals dekh sakte hain. Yeh indicator trading strategies ko support karne ke liye use kiya jata hai, jo traders ko market mein behtar decision-making mein madad karta hai.

Momentum indicator ki basic principle yeh hai ke market trends ko track kiya jaye aur unke changes ko analyze kiya jaye. Jab market strong momentum dikhata hai, to price movement consistent hoti hai aur traders ko clear buy ya sell signals milte hain. Yeh indicator price changes aur volatility ko bhi measure karta hai, jo trading decisions ko aur bhi accurate banaata hai. In short, momentum indicator trading strategies mein ek crucial role play karta hai jo market ke trends ko identify karne mein madad karta hai.

2. Momentum Indicator Ka Kaam

Momentum indicator ka primary kaam market ki movement ki speed ko measure karna hai. Yeh indicator current price ko ek specific time period ke average price se compare karta hai aur is comparison se market ki strength aur weakness ka pata lagata hai. Jab price ki speed barh jaati hai, to momentum indicator positive reading show karta hai, aur jab speed kam hoti hai, to negative reading show karta hai. Isse traders ko market trends aur potential changes ka indication milta hai.

Momentum indicator market ke trends ko monitor karta hai aur yeh identify karta hai ke kya trend strong hai ya weak. Agar indicator ki reading high hoti hai, to yeh indicate karta hai ke market mein strong momentum hai aur trend continue kar sakta hai. Conversely, agar reading low hoti hai, to yeh market ke weak momentum ko indicate karta hai jo trend reversal ka signal ho sakta hai. Yeh indicator price ke historical data ke basis par current market conditions ka analysis karta hai, jo trading decisions ko support karta hai.

Market trends ke analysis ke liye momentum indicator ko frequently monitor kiya jata hai. Traders is indicator ke zariye price ki speed aur direction ko track karte hain aur yeh assess karte hain ke market kis direction mein move kar raha hai. Isse unhe market ke changes aur potential trading opportunities ke baare mein information milti hai. Yeh indicator price movements ke trends ko visualize karne mein madad karta hai aur trading strategies ko refine karne mein help karta hai.

3. Momentum Indicator Ki Types

Momentum indicator ki do main types hain: simple momentum indicators aur oscillators. Simple momentum indicator ek straightforward tool hai jo current price ko past price levels se compare karta hai. Yeh price movements ke trends ko track karta hai aur traders ko market ke strength aur weakness ke signals provide karta hai. Is indicator ka primary focus price ki current level ko evaluate karna hota hai aur isse traders ko market ki movement ka idea milta hai.

Oscillators, on the other hand, ek complex type ke momentum indicators hain jo market ke overbought aur oversold conditions ko identify karte hain. Popular oscillators mein Relative Strength Index (RSI) aur Moving Average Convergence Divergence (MACD) shamil hain. RSI market ki overbought aur oversold levels ko measure karta hai, jabke MACD moving averages ke gap ko track karta hai. Dono oscillators market trends aur potential reversals ko identify karne mein madadgar hote hain.

Momentum indicators ki types ke selection ka depend traders ke personal preferences aur trading strategies par hota hai. Simple momentum indicators easy to use hote hain aur basic price trends ko analyze karte hain. Oscillators zyada advanced tools hain jo market ke intricate details ko analyze karte hain aur inke signals zyada accurate hote hain. In types ke behtareen istemal se traders market ki movement ko accurately track kar sakte hain aur behtar trading decisions le sakte hain.

4. Simple Momentum Indicator

Simple momentum indicator ek basic tool hai jo price changes ko measure karta hai. Is indicator mein, current price ko ek fixed time period ke average price se compare kiya jata hai. Agar current price average price se higher hota hai, to momentum positive hota hai aur agar lower hota hai, to momentum negative hota hai. Yeh indicator price movements ke trends ko visualize karne mein madad karta hai aur trading signals generate karta hai.

Simple momentum indicator ka analysis karke traders ko market ki movement ki speed aur direction ka pata chal sakta hai. Jab momentum positive hota hai, to traders buy signals dekhte hain aur jab negative hota hai, to sell signals generate karte hain. Yeh indicator market ki trends ko track karta hai aur price movements ke patterns ko identify karne mein madad karta hai.

Simple momentum indicator ka istemal trading strategies ko refine karne ke liye kiya jata hai. Traders is indicator ke signals ko combine kar ke apne trading decisions ko enhance karte hain. Yeh indicator market ke basic trends ko analyze karta hai aur traders ko clear trading signals provide karta hai jo unki strategies ko improve karta hai.

5. Relative Strength Index (RSI)

RSI ek popular momentum oscillator hai jo market ke overbought aur oversold conditions ko measure karta hai. Yeh indicator 0 se 100 tak scale par operate karta hai aur typically 14-period ke data ko use karta hai. RSI ki readings 70 se upar overbought conditions aur 30 se neeche oversold conditions ko indicate karti hain. Yeh trader ko market ke potential reversal points identify karne mein madad karta hai.

RSI ka analysis karte waqt traders market ke overbought aur oversold levels ko observe karte hain. Agar RSI 70 se upar hota hai, to market overbought conditions ko indicate karta hai aur sell signals generate ho sakte hain. Agar RSI 30 se neeche hota hai, to market oversold conditions ko indicate karta hai aur buy signals generate ho sakte hain. Yeh indicator market ke strength aur weakness ko identify karne mein madad karta hai aur trading decisions ko support karta hai.

RSI ka use trading strategies ko enhance karne ke liye bhi kiya jata hai. Traders RSI ke signals ko other technical tools ke saath combine kar ke apni trading strategies ko refine karte hain. Yeh combination traders ko accurate trading signals provide karta hai aur market ke trends ko better analyze karne mein madad karta hai.

6. Moving Average Convergence Divergence (MACD)

MACD ek aur popular momentum oscillator hai jo moving averages ke gap ko track karta hai. Yeh indicator market ki momentum aur trend strength ko measure karta hai aur trading signals generate karta hai. MACD line aur signal line ke beech ke differences ko track karta hai aur histogram ke zariye trends ko visualize karta hai.

MACD ka analysis karte waqt traders MACD line aur signal line ke beech ke crossovers ko observe karte hain. Jab MACD line signal line ko upar se cross karti hai, to buy signal generate hota hai. Conversely, jab MACD line signal line ko neeche se cross karti hai, to sell signal generate hota hai. Yeh indicator market ke trends aur potential reversals ko identify karne mein madad karta hai.

MACD ka use trading strategies ko refine karne ke liye kiya jata hai. Traders MACD ke signals ko other technical indicators ke saath combine kar ke apni trading strategies ko improve karte hain. Yeh combination accurate trading signals provide karta hai aur market ke trends ko better analyze karne mein madad karta hai.

7. Momentum Indicator Ka Analysis

Momentum indicator ka analysis karte waqt, traders price trends aur fluctuations ko closely observe karte hain. Indicator ki readings market ki momentum aur strength ko indicate karti hain. Agar momentum positive hota hai, to market mein strong trend ki expectation hoti hai. Agar momentum negative hota hai, to market ke weak trend aur potential reversal ka signal hota hai.

Momentum indicator ki readings ko analyze karte waqt traders price movements ke patterns ko identify karte hain. Yeh patterns market ke trends aur potential changes ko visualize karne mein madadgar hote hain. Indicator ka use kar ke traders market ke strength aur weakness ko assess karte hain aur trading decisions ko refine karte hain.

Momentum indicator ke analysis ke zariye traders market ke trends aur fluctuations ko better samajh sakte hain. Yeh indicator price movements ke patterns ko identify karne mein madad karta hai aur trading strategies ko enhance karta hai. Effective analysis se traders market ke trends ko accurately track kar sakte hain aur profitable trading decisions le sakte hain.

8. Entry Points Aur Exit Points

Momentum indicators ka use entry aur exit points determine karne ke liye kiya jata hai. Jab momentum positive hota hai, to traders buy signals generate karte hain aur market mein entry points identify karte hain. Jab momentum negative hota hai, to traders sell signals generate karte hain aur market se exit points determine karte hain.

Entry points ko identify karne ke liye traders momentum indicator ki readings ko analyze karte hain. Agar indicator ki reading high hoti hai aur trend strong hai, to traders market mein enter karte hain. Exit points ko identify karne ke liye traders indicator ke signals aur price movements ke patterns ko observe karte hain. Jab momentum weaken hota hai, to traders market se exit karte hain.

Effective entry aur exit points ko determine karne ke liye traders momentum indicators ko other technical tools ke saath combine karte hain. Yeh combination traders ko accurate trading signals provide karta hai aur market ke trends ko better analyze karne mein madad karta hai. Entry aur exit points ke accurate determination se traders ki trading strategies improve hoti hain.

9. Divergence Aur Convergence

Divergence aur convergence momentum indicators ki key concepts hain jo market trends aur potential reversals ko identify karte hain. Divergence tab hoti hai jab price aur indicator ke beech ke trends different hote hain. Yeh trend reversal ka signal hota hai aur market ke potential changes ko indicate karta hai.

Convergence tab hoti hai jab price aur indicator ke beech ke trends aligned hote hain. Yeh trend continuation ka signal hota hai aur market ke strength ko indicate karta hai. Divergence aur convergence ko analyze kar ke traders market ke trends aur potential reversals ko identify karte hain aur trading decisions ko refine karte hain.

Divergence aur convergence ka analysis market ke patterns aur trends ko visualize karne mein madad karta hai. Yeh concepts trading strategies ko enhance karte hain aur market ke potential changes ko accurately predict karne mein madadgar hote hain. Effective analysis se traders apni trading strategies ko refine kar sakte hain aur profits ko maximize kar sakte hain.

10. Trend Confirmation

Momentum indicators trend confirmation mein bhi madadgar hote hain. Jab momentum indicator trend ke direction ke saath aligned hota hai, to yeh signal hota hai ke trend continue kar sakta hai. Yeh confirmation traders ko market ke current trends ke strength aur sustainability ka idea deta hai.

Trend confirmation ke liye traders momentum indicators ko price trends aur fluctuations ke saath compare karte hain. Agar momentum indicator trend ke direction ke saath aligned hota hai aur price movements consistent hoti hain, to traders trend continuation ke signals dekhte hain. Yeh confirmation trading decisions ko support karta hai aur market ke trends ko accurately track karne mein madad karta hai.

Effective trend confirmation se traders market ke potential reversals aur continuations ko accurately predict kar sakte hain. Yeh confirmation trading strategies ko refine karne mein madad karta hai aur traders ko market ke trends ke strength aur sustainability ke baare mein insights provide karta hai.

11. Risk Management

Momentum indicators ke saath risk management bhi zaroori hai. Traders ko apne stop-loss aur take-profit levels ko carefully set karna chahiye taake unexpected market movements se bach sakain. Risk management strategies trading decisions ko protect karne ke liye zaroori hain aur trading capital ko safeguard karne mein madad karti hain.

Stop-loss aur take-profit levels ko set karne ke liye traders momentum indicators aur price movements ke patterns ko analyze karte hain. Yeh levels market ke fluctuations ke against protection provide karte hain aur trading losses ko minimize karte hain. Effective risk management se traders market ke potential reversals aur trends ke changes ko handle kar sakte hain.

Risk management strategies ko implement karne se traders ki trading performance improve hoti hai aur trading capital ko protect kiya jata hai. Yeh strategies market ke unexpected movements ke against safeguard provide karte hain aur traders ko consistent profitability achieve karne mein madad karti hain.

12. Combining Indicators

Ek effective trading strategy mein, traders momentum indicators ko doosre technical tools ke saath combine karte hain. Is combination se trading signals aur market trends ke analysis ko enhance kiya jata hai. Combination of indicators trading decisions ko accurate aur reliable banane mein madad karta hai.

Traders momentum indicators ko moving averages, support/resistance levels, aur other technical tools ke saath combine karte hain. Yeh combination accurate trading signals provide karta hai aur market ke trends aur potential reversals ko better analyze karne mein madad karta hai. Combining indicators se trading strategies ko refine kiya jata hai aur market ke complex patterns ko identify kiya jata hai.

Effective combination of indicators se traders ko market ke movements aur trends ke baare mein comprehensive insights milte hain. Yeh combination trading signals ko enhance karta hai aur trading decisions ko accurate banane mein madad karta hai. Traders ko apne indicators aur tools ko carefully select karna chahiye taake effective trading strategies develop ki ja sakein.

13. Practice Aur Backtesting

Momentum indicator strategy ko implement karne se pehle practice aur backtesting zaroori hai. Historical data ka analysis karke aap apni strategy ki effectiveness ko evaluate kar sakte hain aur improvements kar sakte hain. Practice aur backtesting se traders apni trading strategies ko refine kar sakte hain aur market ke trends ko better samajh sakte hain.

Backtesting ke zariye traders historical data par apni strategies ko test karte hain aur trading performance ko evaluate karte hain. Yeh process unhe apni strategies ke strengths aur weaknesses ke baare mein insights provide karta hai aur improvements karne mein madad karta hai. Practice aur backtesting se traders apne trading decisions ko enhance kar sakte hain aur market ke trends ko accurately predict kar sakte hain.

Effective practice aur backtesting se traders ki trading performance improve hoti hai aur trading strategies ko refine kiya jata hai. Yeh process trading decisions ko accurate aur reliable banane mein madad karta hai aur traders ko market ke complex patterns ko identify karne mein help karta hai.

14. Conclusion

Momentum indicator forex trading mein ek valuable tool hai jo market ki movement aur strength ko analyze karne mein madad karta hai. Is indicator ka sahi istemal aur effective strategy trading decisions ko enhance kar sakti hai aur profits ko maximize kar sakti hai. Traders ko momentum indicators ke signals ko carefully analyze karna chahiye aur apni trading strategies ko refine karna chahiye.

Momentum indicator ki effectiveness ko increase karne ke liye traders ko practice aur backtesting ka istemal karna chahiye. Yeh process trading decisions ko accurate aur reliable banane mein madad karta hai aur market ke trends ko better samajhne mein help karta hai. Effective use of momentum indicators se traders ki trading performance improve hoti hai aur market ke potential opportunities ko capitalize karna possible hota hai.

تبصرہ

Расширенный режим Обычный режим