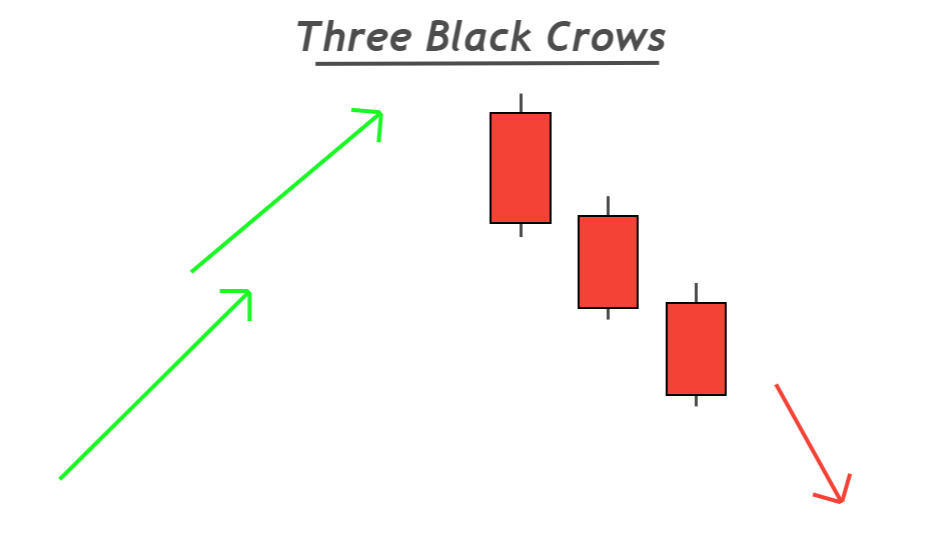

three black crows candlestick pattern

forex market mei three black crows candlestick pattern aik kesam ka bearish trend reversal candlestick pattern hota hey jo keh forex market mei teen kesam ke bare bearish candlestick par moshtamel hota hey jo keh forex market mein lower kam high ko banata hey yeh teno candlestick aik line mein he bante hein or es candlestick pattern ka jesmane size qadray chotay shadow hoty hein

zyada winning ke sharah ko hasell karnay kay ley three black crows candlestick chart pattern pricekay upper trend kay oper he banta hey or winning ka imkan es time kam ho jay ga jab yeh candlestick pattern katay hove market kay side way mein he banta hey

Three Black Crows Pattern ke pehchan

forex market kay aik mesale candlestick pattern par amal karnay kay ley khas kesam kay asol hotay hein yeh asol candlestick chart par best pattern ko he talash kar saktay hein or forex market kay pattern ko talash karna assan bana saktay hein

trader har candlestick pattern par trade nahi karna chihay laken ap ko forex market ke wining mein higher ratio ko hasel karnay kay ley serf best pattern par trade karna ho ge

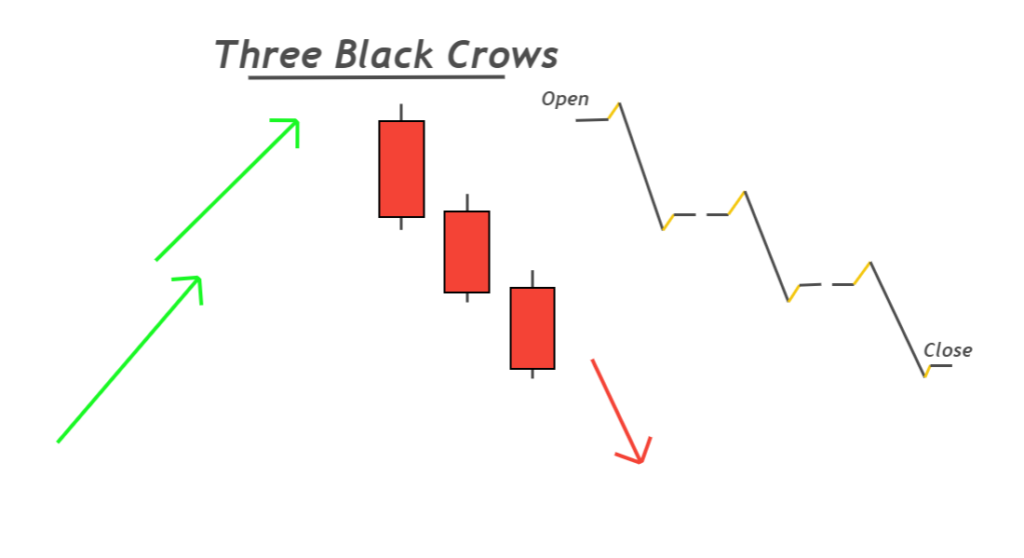

har candlestick ke body to wick ke % 60% say zyada hone chihay end mein 2 bearish candlestick ke lower level he hone chihay or forex market mein lower highs banane chihay jo keh forex market kay trend kay start ke nomaindge kar saktay hein

forex market kay en teno candlestick kay shadow ya wick chotay honay chihay baray shadow forex market ka faisla na honay ko he identify kar saktay hein es ley candlestick kay oper ya nechay baray shadow par trade nahi karne chihay

Three Black Crows Candlestick Pattern

forex market ke yeh strategy currency pair ya kese assert ka he analysis kar sakte hey forex market mein H4 daily ya weekly chart pattern ka analysis karnay kay ley estamal keya ja sakta hey bad mei yeh oper batay gay sharat ka he estamal kar saktay hein en time frame ko he en candlestick pattern par he talash karnay ke zaroorat hote hey lower time frame par three black crows ke direction par he trade karne chihay

Example

nechay dey gay chart pattern par three black crows pattern par he trade kar saktay hein higher time frame par forex market kay bearish trend ka he kheyal rakhna chihay bearish kay trend kahe kheyal rakhna chihay woh ab 30 M or 15 M kay lower time frame par he forex market ka analysis daikh saktay hein forex market mein seller kay ley trade es ley open karay ga zyada time frame par market bearish ka shekar ho jata hey

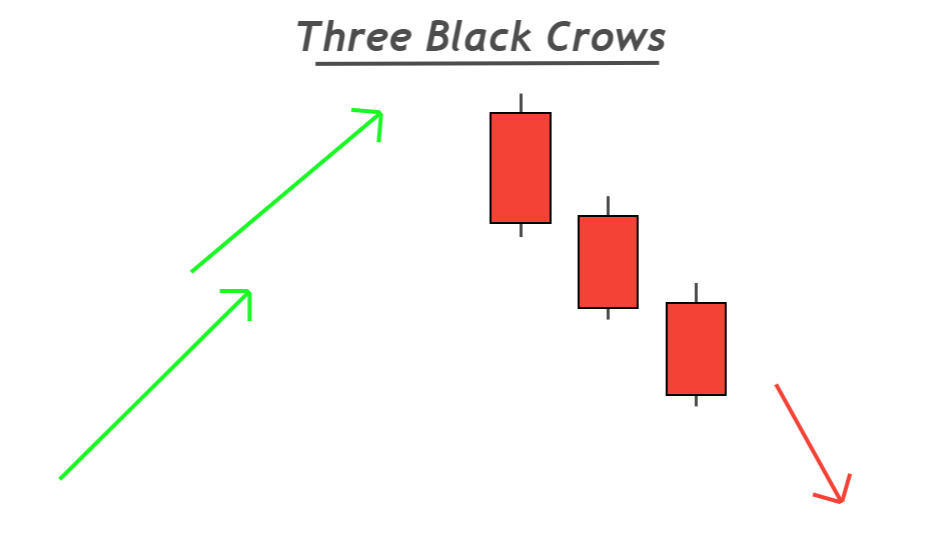

forex market mei three black crows candlestick pattern aik kesam ka bearish trend reversal candlestick pattern hota hey jo keh forex market mei teen kesam ke bare bearish candlestick par moshtamel hota hey jo keh forex market mein lower kam high ko banata hey yeh teno candlestick aik line mein he bante hein or es candlestick pattern ka jesmane size qadray chotay shadow hoty hein

zyada winning ke sharah ko hasell karnay kay ley three black crows candlestick chart pattern pricekay upper trend kay oper he banta hey or winning ka imkan es time kam ho jay ga jab yeh candlestick pattern katay hove market kay side way mein he banta hey

Three Black Crows Pattern ke pehchan

forex market kay aik mesale candlestick pattern par amal karnay kay ley khas kesam kay asol hotay hein yeh asol candlestick chart par best pattern ko he talash kar saktay hein or forex market kay pattern ko talash karna assan bana saktay hein

trader har candlestick pattern par trade nahi karna chihay laken ap ko forex market ke wining mein higher ratio ko hasel karnay kay ley serf best pattern par trade karna ho ge

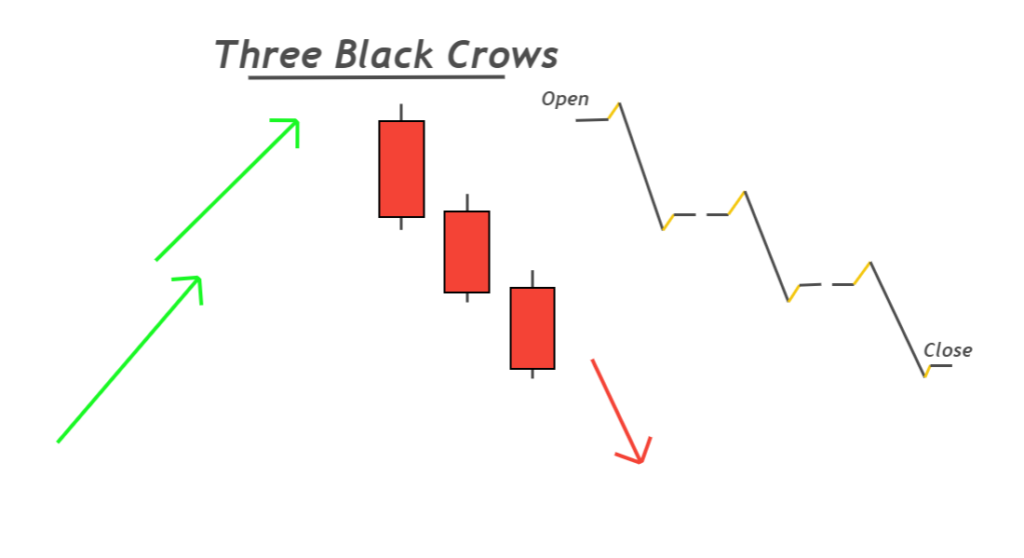

har candlestick ke body to wick ke % 60% say zyada hone chihay end mein 2 bearish candlestick ke lower level he hone chihay or forex market mein lower highs banane chihay jo keh forex market kay trend kay start ke nomaindge kar saktay hein

forex market kay en teno candlestick kay shadow ya wick chotay honay chihay baray shadow forex market ka faisla na honay ko he identify kar saktay hein es ley candlestick kay oper ya nechay baray shadow par trade nahi karne chihay

Three Black Crows Candlestick Pattern

forex market ke yeh strategy currency pair ya kese assert ka he analysis kar sakte hey forex market mein H4 daily ya weekly chart pattern ka analysis karnay kay ley estamal keya ja sakta hey bad mei yeh oper batay gay sharat ka he estamal kar saktay hein en time frame ko he en candlestick pattern par he talash karnay ke zaroorat hote hey lower time frame par three black crows ke direction par he trade karne chihay

Example

nechay dey gay chart pattern par three black crows pattern par he trade kar saktay hein higher time frame par forex market kay bearish trend ka he kheyal rakhna chihay bearish kay trend kahe kheyal rakhna chihay woh ab 30 M or 15 M kay lower time frame par he forex market ka analysis daikh saktay hein forex market mein seller kay ley trade es ley open karay ga zyada time frame par market bearish ka shekar ho jata hey

bhali kay badlay bhali

bhali kay badlay bhali

تبصرہ

Расширенный режим Обычный режим