**Advance Block Candlesticks Pattern:**

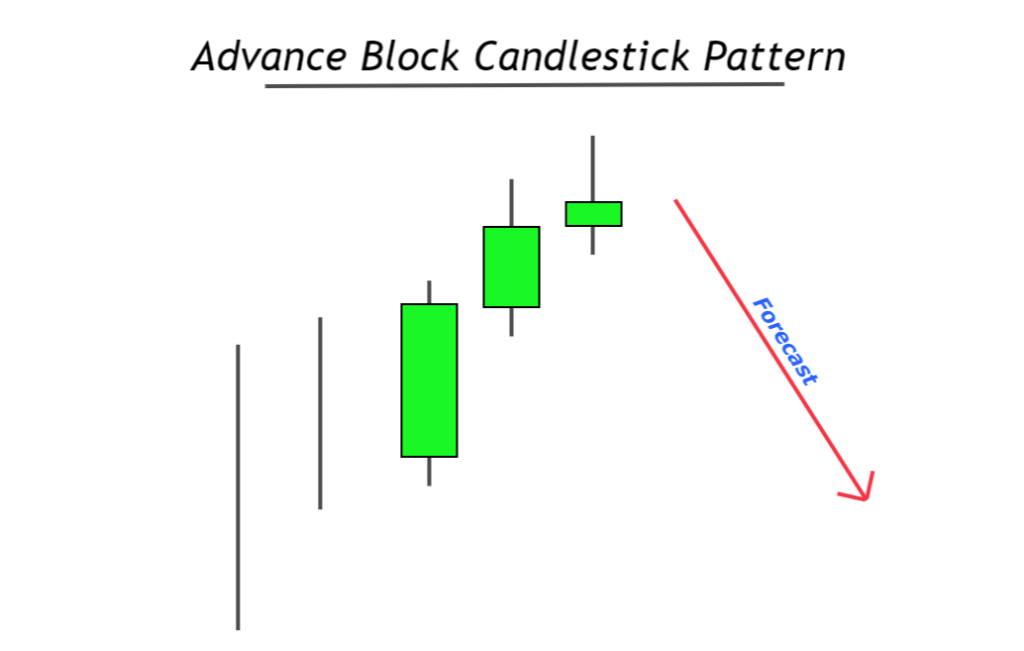

Dear member, Forex market mein Advance Block Candlesticks pattern price ke top ya bullish trend ke dauran banta hai jab buyers ki market mein dilchaspi dheere dheere kam hoti jati hai. Yeh pattern teen bullish candles par mushtamil hota hai, aur yeh ek bearish trend reversal pattern hai. Iski pehli candle ek long real body wali bullish candle hoti hai, jo ke ek strong trend ko dikhati hai. Is candle ke upper aur lower sides par shadows ya wicks kaafi chhoti hoti hain. Pattern ki doosri candle bhi bullish hoti hai, lekin iski real body chhoti hoti hai jab ke shadow lamba hota hai. Pattern ki aakhri candle ek shooting star candle hoti hai. Advance Block Candlestick pattern price ke bottom mein banne wale "Descending Block" pattern ka bilkul opposite hota hai.

**Identification of Advance Block Candlesticks Pattern:**

Dear member, Advance Block Candlestick pattern ko pehchanna asaan hai kyun ke yeh pattern teen bullish candles par mushtamil hota hai, jo ke formation mein "Three White Soldiers" pattern se milta-julta hota hai. Magar, ismein shamil candles ke shadows thode lamba hote hain. Is pattern mein pehli candle ek long real body wali bullish candle hoti hai jo ke aksar white ya green color mein hoti hai. Yeh candle price ke pehle se aate trend ki taraf ishara karti hai.

Advance Block Candlestick pattern ki doosri candle bhi bullish hoti hai, lekin yeh candle pehli candle ke muqable mein chhoti real body mein hoti hai, aur iske saath lamba shadow hota hai. Yeh candle price ko pehli candle ki tarah aggressively push nahi karti. Pattern ki teesri candle ek shooting star candle hoti hai. Yeh candle bhi bullish hoti hai lekin iski real body pehli do candles se kaafi chhoti hoti hai, aur iska shadow upper side par zyada lamba hota hai, lekin neeche side par bhi mumkin hai.

**Trading With Advance Block Candlesticks Pattern:**

Dear member, Advance Block Candlestick pattern traders ko market mein entry ka mauka deta hai, jismein wo bears candles ke baad entry karte hain. Bears candles trend reversal ke liye important hai aur yeh real body mein honi chahiye. Pattern ki teesri candle price ko upar jaane se rokti hai, jo ke ek samjhadar bullish body create karti hai. Trend entry CCI indicator ya Stochastic Oscillator se bhi confirm ki ja sakti hai, jab ke stop-loss last pattern ki sabse top position ya shooting star candle ke high price se do pips upar rakh sakte hain.

Dear Advance Block Candlestick pattern, price ke bullish top trend ko bearish trend reversal mein tabdeel karne ka kaam karta hai. Yeh pattern teen bullish candles par mushtamil hota hai, lekin iska function bearish trend ka hota hai. Advance Block Candlesticks pattern ki pehli candle ek long real body wali bullish candle hoti hai, jo ke aksar bagair shadow ke ya bahut chhoti shadow ke saath hoti hai. Yeh candle price mein bullish trend ki strength ko dikhati hai. Pattern ki doosri candle bhi bullish hoti hai lekin pehli candle se size mein chhoti hoti hai. Yeh candle shadow ke saath hoti hai, jo aksar upper side par hota hai. Pattern ki aakhri candle ek shooting star candle banti hai, jiska upper side par ek lamba shadow hota hai, jo ke price mein girawat ka ishara karta hai.

Dear member, Forex market mein Advance Block Candlesticks pattern price ke top ya bullish trend ke dauran banta hai jab buyers ki market mein dilchaspi dheere dheere kam hoti jati hai. Yeh pattern teen bullish candles par mushtamil hota hai, aur yeh ek bearish trend reversal pattern hai. Iski pehli candle ek long real body wali bullish candle hoti hai, jo ke ek strong trend ko dikhati hai. Is candle ke upper aur lower sides par shadows ya wicks kaafi chhoti hoti hain. Pattern ki doosri candle bhi bullish hoti hai, lekin iski real body chhoti hoti hai jab ke shadow lamba hota hai. Pattern ki aakhri candle ek shooting star candle hoti hai. Advance Block Candlestick pattern price ke bottom mein banne wale "Descending Block" pattern ka bilkul opposite hota hai.

**Identification of Advance Block Candlesticks Pattern:**

Dear member, Advance Block Candlestick pattern ko pehchanna asaan hai kyun ke yeh pattern teen bullish candles par mushtamil hota hai, jo ke formation mein "Three White Soldiers" pattern se milta-julta hota hai. Magar, ismein shamil candles ke shadows thode lamba hote hain. Is pattern mein pehli candle ek long real body wali bullish candle hoti hai jo ke aksar white ya green color mein hoti hai. Yeh candle price ke pehle se aate trend ki taraf ishara karti hai.

Advance Block Candlestick pattern ki doosri candle bhi bullish hoti hai, lekin yeh candle pehli candle ke muqable mein chhoti real body mein hoti hai, aur iske saath lamba shadow hota hai. Yeh candle price ko pehli candle ki tarah aggressively push nahi karti. Pattern ki teesri candle ek shooting star candle hoti hai. Yeh candle bhi bullish hoti hai lekin iski real body pehli do candles se kaafi chhoti hoti hai, aur iska shadow upper side par zyada lamba hota hai, lekin neeche side par bhi mumkin hai.

**Trading With Advance Block Candlesticks Pattern:**

Dear member, Advance Block Candlestick pattern traders ko market mein entry ka mauka deta hai, jismein wo bears candles ke baad entry karte hain. Bears candles trend reversal ke liye important hai aur yeh real body mein honi chahiye. Pattern ki teesri candle price ko upar jaane se rokti hai, jo ke ek samjhadar bullish body create karti hai. Trend entry CCI indicator ya Stochastic Oscillator se bhi confirm ki ja sakti hai, jab ke stop-loss last pattern ki sabse top position ya shooting star candle ke high price se do pips upar rakh sakte hain.

Dear Advance Block Candlestick pattern, price ke bullish top trend ko bearish trend reversal mein tabdeel karne ka kaam karta hai. Yeh pattern teen bullish candles par mushtamil hota hai, lekin iska function bearish trend ka hota hai. Advance Block Candlesticks pattern ki pehli candle ek long real body wali bullish candle hoti hai, jo ke aksar bagair shadow ke ya bahut chhoti shadow ke saath hoti hai. Yeh candle price mein bullish trend ki strength ko dikhati hai. Pattern ki doosri candle bhi bullish hoti hai lekin pehli candle se size mein chhoti hoti hai. Yeh candle shadow ke saath hoti hai, jo aksar upper side par hota hai. Pattern ki aakhri candle ek shooting star candle banti hai, jiska upper side par ek lamba shadow hota hai, jo ke price mein girawat ka ishara karta hai.

تبصرہ

Расширенный режим Обычный режим