Matching High Candlestick Pattern

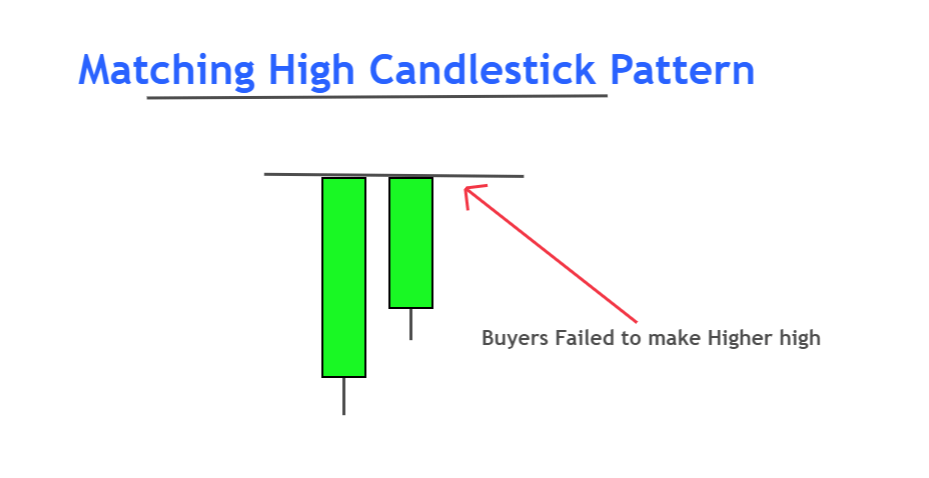

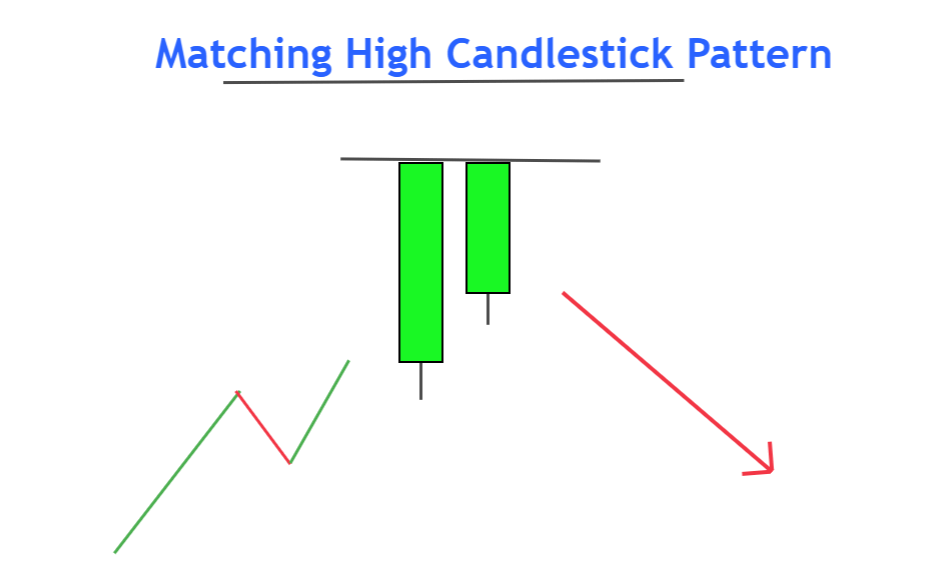

forex market mein matching high candlestick pattern aik bearish reversal candlestick pattern hota hey jes mein 2 bullish candlestick hote hein forex market mein yeh candlestick aik jaice high hote hein or oper ke taraf koi shadow nahi hota hey

dosree candlestick es pattern mein nechay kay gap ke taraf he open ho sakte hein aik jaisa higher pattern es bat ko identify karta hey keh buyer ka pressure khatam ho raha hey or seller aik khas assert mein currency ke price ko kam karnay ko he identify kar saktay hein

Matching High Candlestick Pattern ke pehchan

forex market mei pehle candlestick bare bullish candlestick hote hey jo keh forex chart kay upper hesay parhe banay ge

dosree candlestick aik gap low kay sath he open ho ge or yeh forex market kay es he level par close ho jay ge jes tarah pchle candlestick close ho gay the

Matching High Candlestick Pattern ko samajhna

jab forex market kay bullish pattern kay upper hesay mein aik bare bullish candlestick bante hey to yeh esbat ko zahair kartay hein keh buyer seller say zyada strong ho jatay hein

pehle bullish candlestick kay bad agle candlestick pechle price kay opening price kay nechay he close ho sakte hey achanak gap forex market kay seller kund gan ke higher raftar ko he zahair ka sakta hey jab forex market ke dosree candlestick new higher highs bananay mein nakam ho jate hey to yeh es bat ko zahair kartay hein keh buyer seller ke taraf say banay gay basic level ko break karnay mein nakam ho jatay hein ab seller market ko he control kar saktay hein to es say yeh zahair hota hey keh ab seller market ko control sanbhal rahay hotay hein or price kam ho jay ge

Best Trading Condition Matching High Pattern

forex market kay candlestick pattern mein winning kay imkanat ko barhanay kay ley forex market mein dosray technical tools ko bhe shamel karna chihay yahan par 2 technical tools shamel hotay hein

supply zone or resistance zone

overbought condition

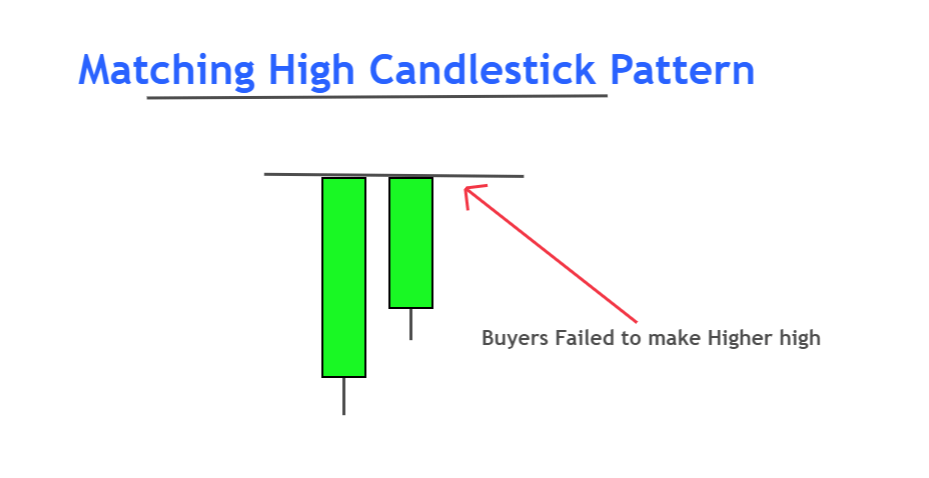

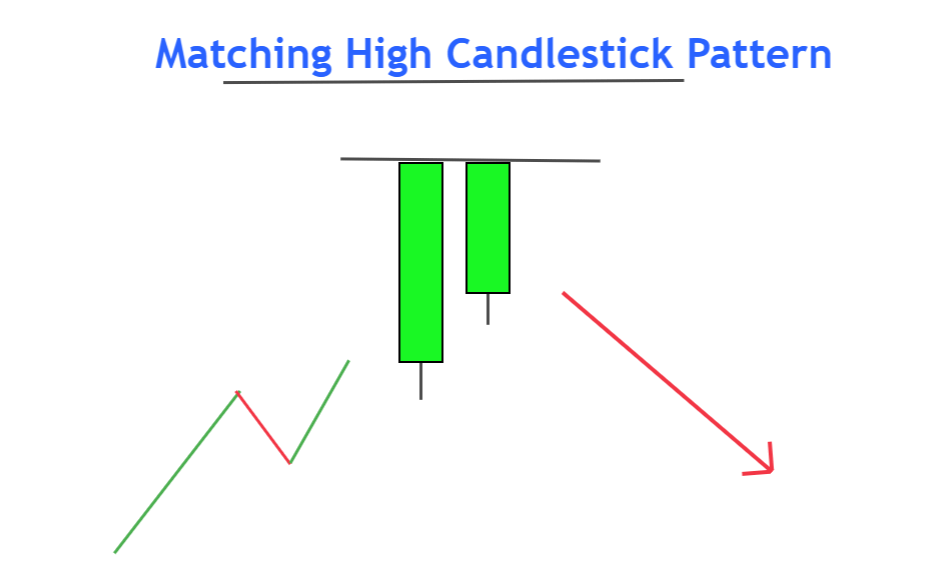

forex market mein matching high candlestick pattern aik bearish reversal candlestick pattern hota hey jes mein 2 bullish candlestick hote hein forex market mein yeh candlestick aik jaice high hote hein or oper ke taraf koi shadow nahi hota hey

dosree candlestick es pattern mein nechay kay gap ke taraf he open ho sakte hein aik jaisa higher pattern es bat ko identify karta hey keh buyer ka pressure khatam ho raha hey or seller aik khas assert mein currency ke price ko kam karnay ko he identify kar saktay hein

Matching High Candlestick Pattern ke pehchan

forex market mei pehle candlestick bare bullish candlestick hote hey jo keh forex chart kay upper hesay parhe banay ge

dosree candlestick aik gap low kay sath he open ho ge or yeh forex market kay es he level par close ho jay ge jes tarah pchle candlestick close ho gay the

Matching High Candlestick Pattern ko samajhna

jab forex market kay bullish pattern kay upper hesay mein aik bare bullish candlestick bante hey to yeh esbat ko zahair kartay hein keh buyer seller say zyada strong ho jatay hein

pehle bullish candlestick kay bad agle candlestick pechle price kay opening price kay nechay he close ho sakte hey achanak gap forex market kay seller kund gan ke higher raftar ko he zahair ka sakta hey jab forex market ke dosree candlestick new higher highs bananay mein nakam ho jate hey to yeh es bat ko zahair kartay hein keh buyer seller ke taraf say banay gay basic level ko break karnay mein nakam ho jatay hein ab seller market ko he control kar saktay hein to es say yeh zahair hota hey keh ab seller market ko control sanbhal rahay hotay hein or price kam ho jay ge

Best Trading Condition Matching High Pattern

forex market kay candlestick pattern mein winning kay imkanat ko barhanay kay ley forex market mein dosray technical tools ko bhe shamel karna chihay yahan par 2 technical tools shamel hotay hein

supply zone or resistance zone

overbought condition

تبصرہ

Расширенный режим Обычный режим