PINBAR CANDLESTICK ANALYSIS IN FOREX TRADING

INTRODUCTION

Pinbar candlestick strategy aik mashhoor aur moassar (effective) trading strategy hai jo Forex market mein istamal hoti hai. Is strategy ka maqsad price action ka analysis karna hota hai taake market ke trend reversal ko samjha ja sake. Roman Urdu mein is strategy ko samajhne ke liye, neeche mukhtasir taur par izhaar kiya gaya hai. Pinbar ek candlestick pattern hai jo market mein price reversal ko predict karta hai.

Pinbar candlestick ka ek chhota body aur lamba upper ya lower shadow hota hai. Yeh shadow hamesha candle ke opposite direction mein hoti hai, yani agar shadow neeche hai to pinbar bullish hoga aur agar shadow upar hai to pinbar bearish hoga.

COMPOSITION OF STRUCTURE OF PINBAR CANDLESTICK

Pinbar ko pehchanne ke liye kuch khas cheezon par dhyan dena zaroori hai. Shadow candle ke body se kaafi lambi honi chahiye. Candle ka body chhota hona chahiye, jo dikhaye ke price open aur close ke darmiyan zyada difference nahi hai. Pinbar aksar ek trend ke khatam hone par banta hai, jaise ke ek uptrend ke baad bearish pinbar ya downtrend ke baad bullish pinbar. Pinbar candlestick ko identify karne ke baad, traders yeh predict karte hain ke price reversal hone wala hai.

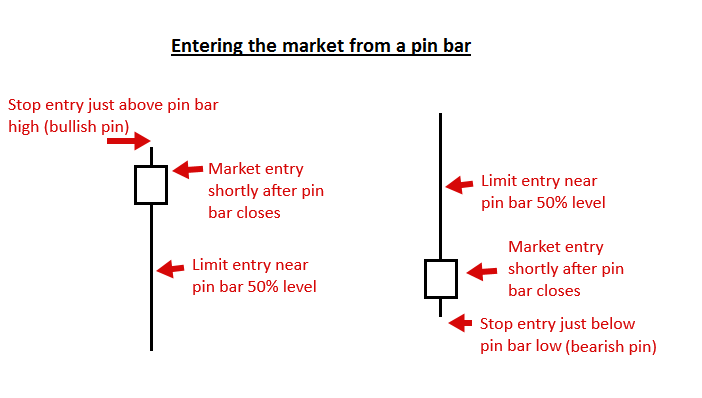

Pinbar strategy ka iste'mal kuch tarah se hota hai. Agar ek bullish pinbar form ho raha hai downtrend ke baad, to trader next candle ke high ko cross karte hi buy position enter kar sakta hai. Agar bearish pinbar ho, to next candle ke low ko cross karte hi sell position enter kar sakta hai. Pinbar ke opposite end par stop loss set kiya jata hai. Yeh trader ko kisi unexpected price movement se bacha sakta hai. Take profit ke liye ek logical level choose karna hota hai, jaise ke previous support ya resistance level.

IMPORTANCE OF PINBAR CANDLESTICK PATTERN

Yeh strategy asaan hai samajhne mein aur Forex market ke beginners ke liye bhi faydemand hoti hai. Pinbar ka pattern price action ka asar achi tarah se dikhata hai, isliye yeh strategy popular hai. Magar, sirf pinbar par bharosa nahi karna chahiye; doosri confirmations jaise ke support /resistance levels ya moving averages ko bhi dekhna chahiye. Pinbar candlestick strategy ek effective tool hai Forex trading mein.

Agar sahi tarah se use kiya jaye, to yeh trader ko market ke reversals samajhne mein madad de sakta hai aur profitable trades ke chances barha sakta hai. Magar, hamesha risk management ka khayal rakhna zaroori hai.

INTRODUCTION

Pinbar candlestick strategy aik mashhoor aur moassar (effective) trading strategy hai jo Forex market mein istamal hoti hai. Is strategy ka maqsad price action ka analysis karna hota hai taake market ke trend reversal ko samjha ja sake. Roman Urdu mein is strategy ko samajhne ke liye, neeche mukhtasir taur par izhaar kiya gaya hai. Pinbar ek candlestick pattern hai jo market mein price reversal ko predict karta hai.

Pinbar candlestick ka ek chhota body aur lamba upper ya lower shadow hota hai. Yeh shadow hamesha candle ke opposite direction mein hoti hai, yani agar shadow neeche hai to pinbar bullish hoga aur agar shadow upar hai to pinbar bearish hoga.

COMPOSITION OF STRUCTURE OF PINBAR CANDLESTICK

Pinbar ko pehchanne ke liye kuch khas cheezon par dhyan dena zaroori hai. Shadow candle ke body se kaafi lambi honi chahiye. Candle ka body chhota hona chahiye, jo dikhaye ke price open aur close ke darmiyan zyada difference nahi hai. Pinbar aksar ek trend ke khatam hone par banta hai, jaise ke ek uptrend ke baad bearish pinbar ya downtrend ke baad bullish pinbar. Pinbar candlestick ko identify karne ke baad, traders yeh predict karte hain ke price reversal hone wala hai.

Pinbar strategy ka iste'mal kuch tarah se hota hai. Agar ek bullish pinbar form ho raha hai downtrend ke baad, to trader next candle ke high ko cross karte hi buy position enter kar sakta hai. Agar bearish pinbar ho, to next candle ke low ko cross karte hi sell position enter kar sakta hai. Pinbar ke opposite end par stop loss set kiya jata hai. Yeh trader ko kisi unexpected price movement se bacha sakta hai. Take profit ke liye ek logical level choose karna hota hai, jaise ke previous support ya resistance level.

IMPORTANCE OF PINBAR CANDLESTICK PATTERN

Yeh strategy asaan hai samajhne mein aur Forex market ke beginners ke liye bhi faydemand hoti hai. Pinbar ka pattern price action ka asar achi tarah se dikhata hai, isliye yeh strategy popular hai. Magar, sirf pinbar par bharosa nahi karna chahiye; doosri confirmations jaise ke support /resistance levels ya moving averages ko bhi dekhna chahiye. Pinbar candlestick strategy ek effective tool hai Forex trading mein.

Agar sahi tarah se use kiya jaye, to yeh trader ko market ke reversals samajhne mein madad de sakta hai aur profitable trades ke chances barha sakta hai. Magar, hamesha risk management ka khayal rakhna zaroori hai.

تبصرہ

Расширенный режим Обычный режим