Wolf Wave Pattern – Ek Powerful Trading Strategy

1. Wolf Wave Pattern kya hai?

Wolf Wave Pattern aik natural price pattern hai jo trading world mein ek bht effective tool ke tor par jana jata hai. Yeh pattern price action ko predict karne mein madad karta hai aur traders ko market ke reversal points dhoondhne mein help karta hai. Iska naam "Wolf" is liye rakha gaya hai kyun ke yeh pattern bilkul ek shikaar karne wale wolf ki tarah kaam karta hai, jo apne shikaar ko pehchan kar us par hamla karta hai.

Wolf Wave Pattern ka asar natural supply aur demand forces par hota hai. Jab market overbought ya oversold hota hai, to yeh pattern un points ko identify karta hai jahan se price reversal hone ke chances barh jate hain. Is pattern ke zariye traders ko is baat ka andaza hota hai ke market ka direction kab aur kaise badalne wala hai.

2. Wolf Wave Pattern ke Components

Wolf Wave Pattern ka aik khas set up hota hai jo panch waves par mabni hota hai. Yeh waves price ke upar neeche hotay hue form hoti hain. Har wave ka ek khas significance hota hai jo pattern ko complete karti hai:

Is setup ko samajhne se trader market me apne entry aur exit points ko effectively identify kar sakte hain.

3. Wolf Wave Pattern ka Use kaise karein?

Wolf Wave Pattern ka use karne ke liye trader ko sab se pehle is pattern ko identify karna hota hai. Jab yeh pattern ban raha hota hai, to price ke upar neeche hone par focus karna hota hai. Aik typical Wolf Wave me 5 points hotay hain jinko properly identify karna zaroori hota hai:

Is pattern ke complete hone ke baad, Wave 5 ka level aik strong indicator hota hai ke market ab reversal ki taraf jaane wala hai. Jab Wave 5 complete hoti hai to trader apne positions ko manage kar sakte hain, ya to buy kar sakte hain agar pattern bearish hai, ya sell kar sakte hain agar pattern bullish hai.

4. Wolf Wave ka Target aur Stop Loss Setting

Jab Wolf Wave Pattern ko trade kiya jata hai to aik khas target aur stop loss level ko set karna zaroori hota hai. Yeh strategy trader ko risk management karne me madad deti hai. Is pattern me target calculation Wave 1 aur Wave 4 ke points ke darmiyan ki range par mabni hoti hai.

5. Wolf Wave Pattern aur Other Indicators

Trading me successful hone ke liye sirf aik pattern par depend karna risk ho sakta hai, is liye Wolf Wave Pattern ko doosre technical indicators ke sath use karna aik behtreen strategy hoti hai. Kuch commonly used indicators jinka combination Wolf Wave Pattern ke sath bht acha kaam karta hai wo hain:

In indicators ke sath Wolf Wave ka combination traders ko more confident decision making me help karta hai.

6. Wolf Wave Pattern ka Faida aur Nuqsan

Har trading strategy ke apne faide aur nuqsan hote hain, aur Wolf Wave Pattern bhi is se alag nahi hai. Is pattern ke faide aur nuqsan ko samajhna zaroori hota hai taake trading me informed decisions liye ja sakein.

Wolf Wave Pattern aik powerful aur effective trading strategy hai lekin iska sahi istemal aur proper risk management zaroori hota hai. Yeh pattern un traders ke liye zyada useful hai jo price action ko samajhne me interested hain aur market me natural moves ka faida uthana chahte hain. Is pattern ko agar baaki technical tools ke sath use kiya jaye to yeh trading journey ko aur zyada successful bana sakta hai.

1. Wolf Wave Pattern kya hai?

Wolf Wave Pattern aik natural price pattern hai jo trading world mein ek bht effective tool ke tor par jana jata hai. Yeh pattern price action ko predict karne mein madad karta hai aur traders ko market ke reversal points dhoondhne mein help karta hai. Iska naam "Wolf" is liye rakha gaya hai kyun ke yeh pattern bilkul ek shikaar karne wale wolf ki tarah kaam karta hai, jo apne shikaar ko pehchan kar us par hamla karta hai.

Wolf Wave Pattern ka asar natural supply aur demand forces par hota hai. Jab market overbought ya oversold hota hai, to yeh pattern un points ko identify karta hai jahan se price reversal hone ke chances barh jate hain. Is pattern ke zariye traders ko is baat ka andaza hota hai ke market ka direction kab aur kaise badalne wala hai.

2. Wolf Wave Pattern ke Components

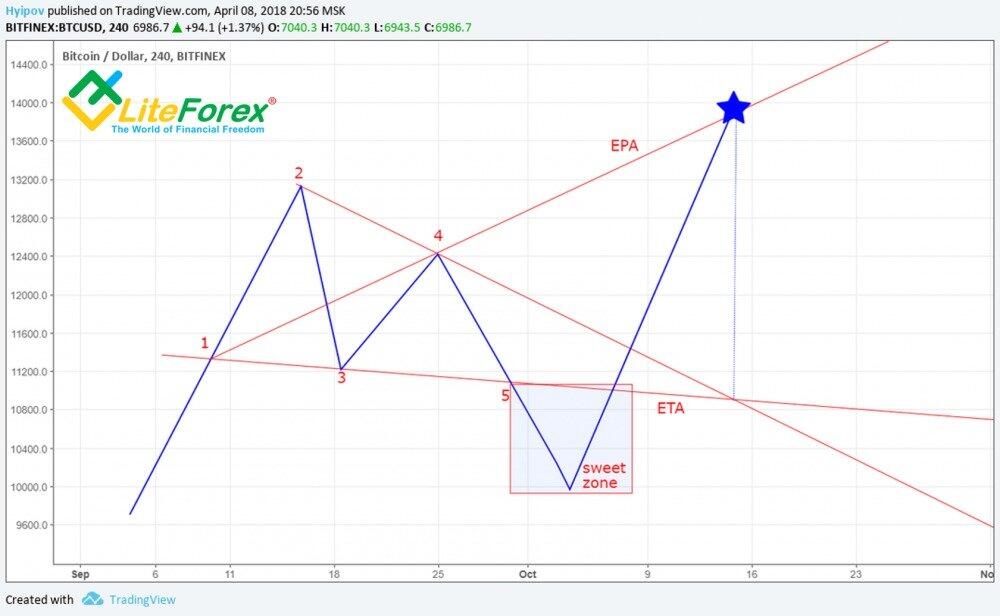

Wolf Wave Pattern ka aik khas set up hota hai jo panch waves par mabni hota hai. Yeh waves price ke upar neeche hotay hue form hoti hain. Har wave ka ek khas significance hota hai jo pattern ko complete karti hai:

- Wave 1 aur 2: Wave 1 se start hoti hai jab price me aik significant move hota hai aur phir Wave 2 ke through ek pullback hota hai.

- Wave 3: Wave 3 aik extended move hota hai jo pehle wave ke muqable me zyada hota hai. Yeh move strong momentum ko indicate karta hai.

- Wave 4: Wave 4 aik opposite direction me hoti hai jisme price temporary reverse hota hai lekin yeh reversal itna strong nahi hota ke trend change ho jaye.

- Wave 5: Wave 5 aik final wave hoti hai jo ek important point tak pohanchti hai jahan se reversal ka chance hota hai. Yeh wave traders ke liye ek clear signal hoti hai ke price ab direction badalne wala hai.

Is setup ko samajhne se trader market me apne entry aur exit points ko effectively identify kar sakte hain.

3. Wolf Wave Pattern ka Use kaise karein?

Wolf Wave Pattern ka use karne ke liye trader ko sab se pehle is pattern ko identify karna hota hai. Jab yeh pattern ban raha hota hai, to price ke upar neeche hone par focus karna hota hai. Aik typical Wolf Wave me 5 points hotay hain jinko properly identify karna zaroori hota hai:

- Aik strong move (Wave 1 se start hota hai).

- Ek pullback (Wave 2 ka point).

- Strong extension (Wave 3 ka form hona).

- Aik minor reversal (Wave 4).

- Aik final push (Wave 5 ka completion).

Is pattern ke complete hone ke baad, Wave 5 ka level aik strong indicator hota hai ke market ab reversal ki taraf jaane wala hai. Jab Wave 5 complete hoti hai to trader apne positions ko manage kar sakte hain, ya to buy kar sakte hain agar pattern bearish hai, ya sell kar sakte hain agar pattern bullish hai.

4. Wolf Wave ka Target aur Stop Loss Setting

Jab Wolf Wave Pattern ko trade kiya jata hai to aik khas target aur stop loss level ko set karna zaroori hota hai. Yeh strategy trader ko risk management karne me madad deti hai. Is pattern me target calculation Wave 1 aur Wave 4 ke points ke darmiyan ki range par mabni hoti hai.

- Target Calculation: Target usually Wave 1 se le kar Wave 4 ke end tak calculate kiya jata hai. Yeh calculation yeh indicate karti hai ke market kitna aage ja sakta hai. Agar price Wave 5 ke baad predicted direction me move kar raha hai to is level par trader apne profits ko lock kar sakte hain.

- Stop Loss: Stop loss ka point Wave 5 ke kuch upar ya neeche set kiya jata hai, depending on the trend. Agar market us level ko break kar le to yeh ek signal hota hai ke prediction galat thi aur market ne direction change kar li hai.

5. Wolf Wave Pattern aur Other Indicators

Trading me successful hone ke liye sirf aik pattern par depend karna risk ho sakta hai, is liye Wolf Wave Pattern ko doosre technical indicators ke sath use karna aik behtreen strategy hoti hai. Kuch commonly used indicators jinka combination Wolf Wave Pattern ke sath bht acha kaam karta hai wo hain:

- Moving Averages: Moving averages trend ke direction ko confirm karte hain aur help karte hain determine karne me ke market bullish ya bearish hai.

- RSI (Relative Strength Index): RSI overbought ya oversold conditions ko detect karta hai, jo Wolf Wave ke sath trade setup ke confirmation ke liye madadgar hota hai.

- MACD (Moving Average Convergence Divergence): MACD momentum aur trend ki strength ko measure karta hai jo Wolf Wave Pattern ko aur zyada reliable banata hai.

In indicators ke sath Wolf Wave ka combination traders ko more confident decision making me help karta hai.

6. Wolf Wave Pattern ka Faida aur Nuqsan

Har trading strategy ke apne faide aur nuqsan hote hain, aur Wolf Wave Pattern bhi is se alag nahi hai. Is pattern ke faide aur nuqsan ko samajhna zaroori hota hai taake trading me informed decisions liye ja sakein.

- Faida:

- Wolf Wave Pattern aik natural pattern hai jo demand aur supply ki basis par kaam karta hai, is liye yeh market ke natural moves ko accurately predict karne ki salahiyat rakhta hai.

- Is pattern ke zariye trading ke andar entry aur exit points ko theek tarah se identify kiya ja sakta hai, jo profitable trades ka chance barhata hai.

- Nuqsan:

- Yeh pattern kabhi kabar complex ho sakta hai aur sab traders isko asani se nahi samajh sakte. Beginners ke liye isko identify karna mushkil ho sakta hai.

- Market ke unpredictable factors, jaise news events ya market manipulation, Wolf Wave ko disrupt kar sakte hain, jo trades ko loss me daal sakte hain.

Wolf Wave Pattern aik powerful aur effective trading strategy hai lekin iska sahi istemal aur proper risk management zaroori hota hai. Yeh pattern un traders ke liye zyada useful hai jo price action ko samajhne me interested hain aur market me natural moves ka faida uthana chahte hain. Is pattern ko agar baaki technical tools ke sath use kiya jaye to yeh trading journey ko aur zyada successful bana sakta hai.

تبصرہ

Расширенный режим Обычный режим