Three Bar Play Candlestick Pattern

three bar play candlestick pattern aik kesam ka jare candlestick pattern hota hey jo keh forex market mein teen candlestick par he moshtamel hota hey yeh es bat ke paish goi karta hey keh forex market mein pechla trend jaree reh sakta hey

retail trader forex market mein trend k anay wale direction ko he paish karta hey market ko profit able banay kay ley zaroore hota hey keh forex market men trend saze ke jay forex market mein trade karna bhe kamyab honay ke he key hote hey jo keh ap ke trade ko hamaisha he khasaray mein dallay ge

Types of Three Bar Play Candlestick Pattern

Bullish Three Bar Play Candlestick Pattern

Bearish Three Bar Play Candlestick Pattern

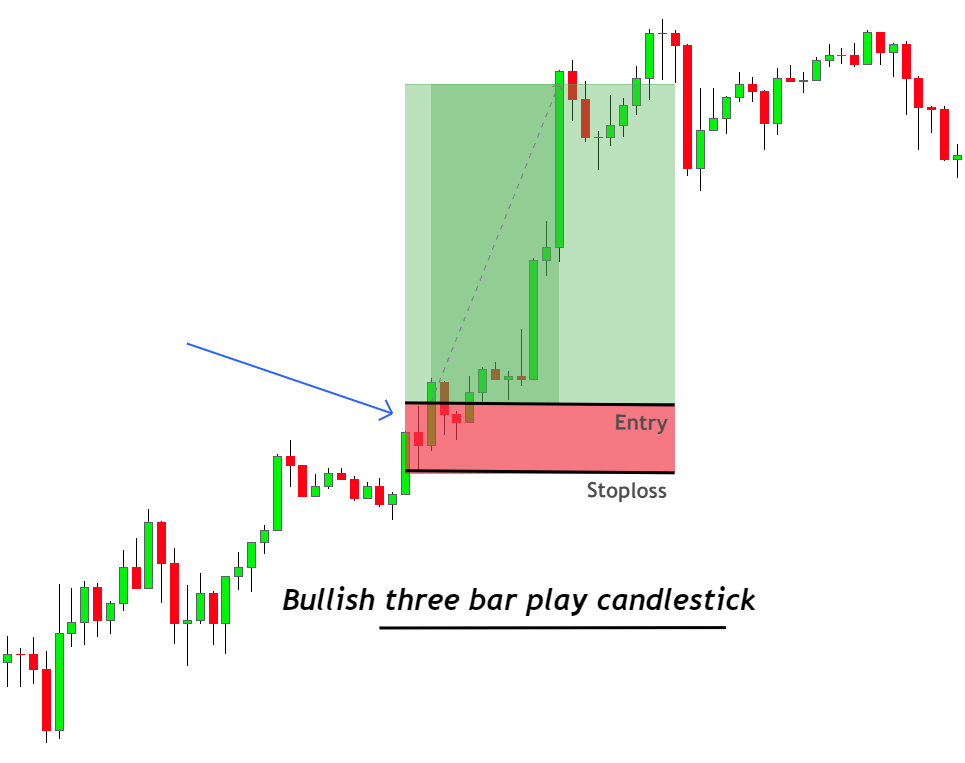

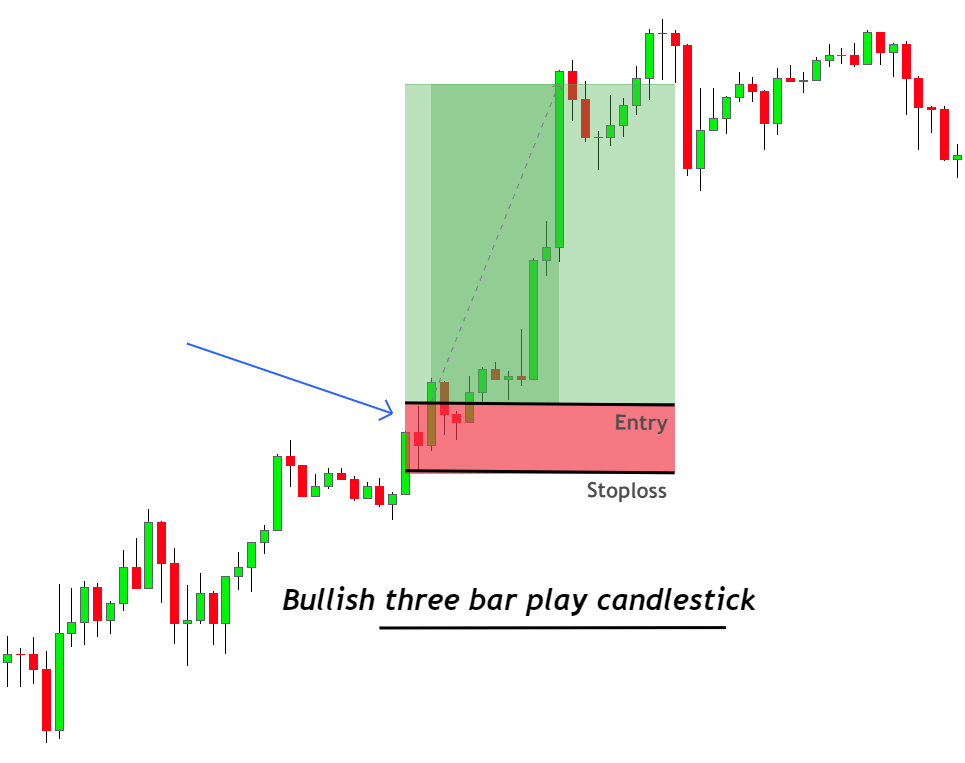

Bullish Three Bar Play Candlestick Pattern

bullish three bar play candlestick pattern trend ko jare barhnay ko he identify karta hey yeh aik chote pull back candlestick pattern hota hey jo keh forex market mein 2 bare candlestick par moshtamel hota hey jo keh chote pull back candlestick kay inside mein he bante hote hein

Bearish Three Bar Play Candlestick Pattern

yeh forex market mein bearish trend kay sath he gerta hey jo keh forex market mein Bearish Three Bar Play Candlestick Pattern banta hey yeh chote pull back candlestick kay sath he 2 bare candlestick he ban sakte hey

Trading Strategy With Three Bar Play Candlestick Pattern

yeh trading strategy forex market mein breakout, pull back or jare pattern par he moshtamel hote hey hum forex market mein pull back kay bad jare pattern ko he open kar saken gay yeh os time trade ko oen ka saken gay jab tak trend jare reh sakay ga

Open sell stop order

jab forex market mein aik bare bearish candlestick aik important key level or breakout ko he open kar sakte hey or yeh forex market mein breakout ke shape mein he ban sakte hey to forex market me breakout candlestick kay bad he ban sakta hey yeh forex market mein price ke aik chote pull back kay bad he break kar day ge

forex arket mein aik chote candlestick kay nechay he sell stop order ko he open kar saken gay trend jare rehnay kay bad order khod he fill ho jay ga three bar play candlestick pattern trend kay reversal janay ke he wajah ban sakta hey dosree sorat mein tesaree bearish candlestick nahi ban sakte hey to trade ko close karna chihay

Open buy stop order

jab forex market mein aik bare bullish candlestick ai strong key level ko he break kar dayte hey toforex market ke price aik chote candlestick ke shape mein aik chota sa pull back day day ge phir chote candlestick ke highs kay oper he buy stop order ko he day dein gay

age tesaree candlestick mein bare bullish candlestick nahi bante hey to woh three bar play candlestick patter par he nahi otarta hey or order close kar kay dosra chance bhe talash kar saktay hein aik baray trend kay reversal janay kay ley trade ko stop kar dayna chihay

three bar play candlestick pattern aik kesam ka jare candlestick pattern hota hey jo keh forex market mein teen candlestick par he moshtamel hota hey yeh es bat ke paish goi karta hey keh forex market mein pechla trend jaree reh sakta hey

retail trader forex market mein trend k anay wale direction ko he paish karta hey market ko profit able banay kay ley zaroore hota hey keh forex market men trend saze ke jay forex market mein trade karna bhe kamyab honay ke he key hote hey jo keh ap ke trade ko hamaisha he khasaray mein dallay ge

Types of Three Bar Play Candlestick Pattern

Bullish Three Bar Play Candlestick Pattern

Bearish Three Bar Play Candlestick Pattern

Bullish Three Bar Play Candlestick Pattern

bullish three bar play candlestick pattern trend ko jare barhnay ko he identify karta hey yeh aik chote pull back candlestick pattern hota hey jo keh forex market mein 2 bare candlestick par moshtamel hota hey jo keh chote pull back candlestick kay inside mein he bante hote hein

Bearish Three Bar Play Candlestick Pattern

yeh forex market mein bearish trend kay sath he gerta hey jo keh forex market mein Bearish Three Bar Play Candlestick Pattern banta hey yeh chote pull back candlestick kay sath he 2 bare candlestick he ban sakte hey

Trading Strategy With Three Bar Play Candlestick Pattern

yeh trading strategy forex market mein breakout, pull back or jare pattern par he moshtamel hote hey hum forex market mein pull back kay bad jare pattern ko he open kar saken gay yeh os time trade ko oen ka saken gay jab tak trend jare reh sakay ga

Open sell stop order

jab forex market mein aik bare bearish candlestick aik important key level or breakout ko he open kar sakte hey or yeh forex market mein breakout ke shape mein he ban sakte hey to forex market me breakout candlestick kay bad he ban sakta hey yeh forex market mein price ke aik chote pull back kay bad he break kar day ge

forex arket mein aik chote candlestick kay nechay he sell stop order ko he open kar saken gay trend jare rehnay kay bad order khod he fill ho jay ga three bar play candlestick pattern trend kay reversal janay ke he wajah ban sakta hey dosree sorat mein tesaree bearish candlestick nahi ban sakte hey to trade ko close karna chihay

Open buy stop order

jab forex market mein aik bare bullish candlestick ai strong key level ko he break kar dayte hey toforex market ke price aik chote candlestick ke shape mein aik chota sa pull back day day ge phir chote candlestick ke highs kay oper he buy stop order ko he day dein gay

age tesaree candlestick mein bare bullish candlestick nahi bante hey to woh three bar play candlestick patter par he nahi otarta hey or order close kar kay dosra chance bhe talash kar saktay hein aik baray trend kay reversal janay kay ley trade ko stop kar dayna chihay

تبصرہ

Расширенный режим Обычный режим