STRATEGY OF RENKO CHART PATTERN IN FOREX STRATEGY

OVERVIEW

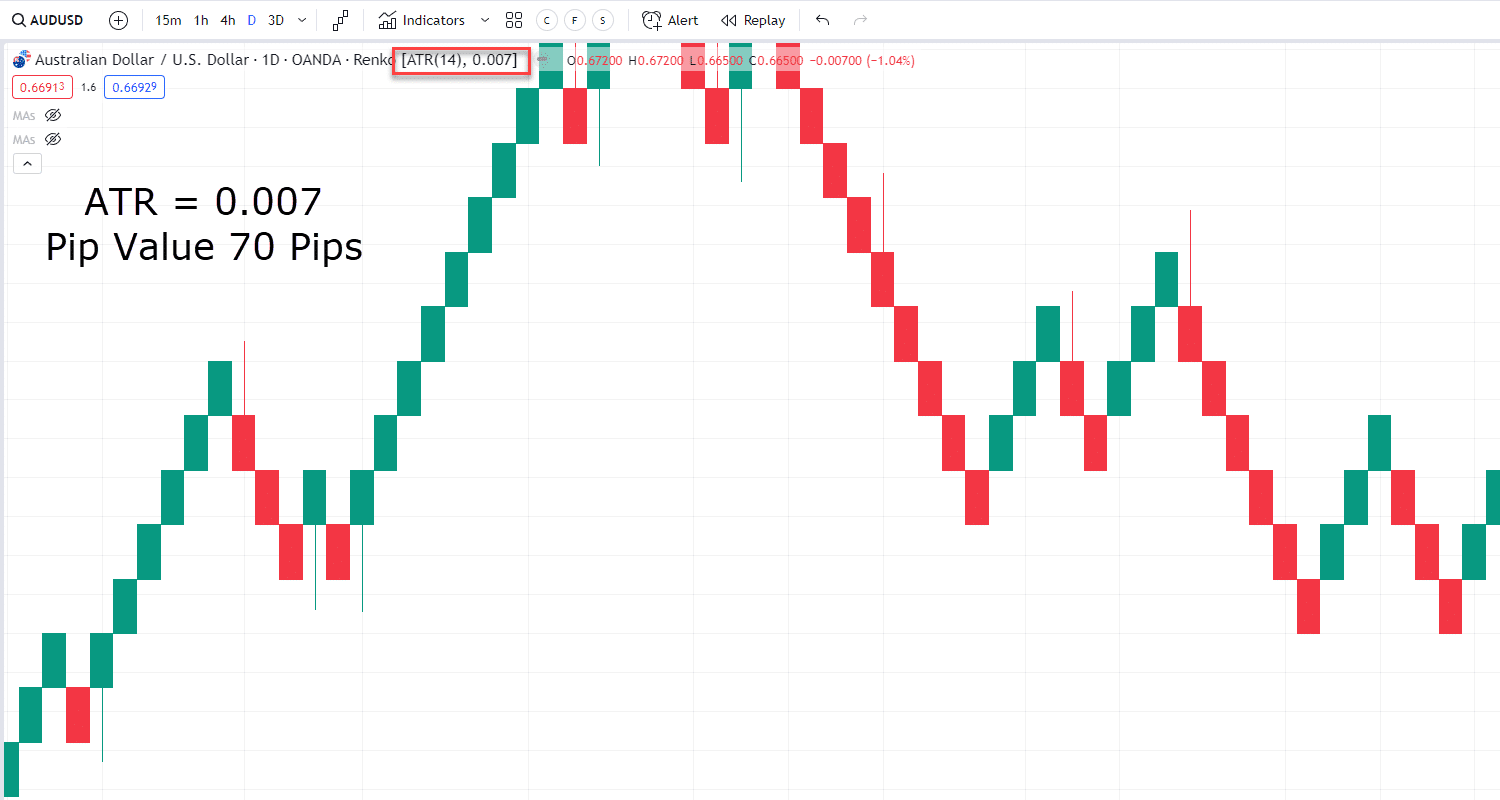

Renko chart aik tarah ka chart hai jo sirf price movement par focus karta hai. Is chart mein time aur volume ka koi khas role nahi hota. Renko chart bricks ya boxes se banta hai, jo price ke specific movement ke baad banta hai. Agar price upar jata hai to white/green brick banta hai, aur agar price neeche jata hai to red brick banta hai. Renko chart mein har brick aik fixed price range ke baad banta hai, jese ke 10 pips, 20 pips, etc. Agar price 10 pips ya 20 pips se zyada barh jata hai, to ek nayi brick chart par show hoti hai. Yeh method noise ko filter karta hai aur sirf trend par focus rakhta hai. Renko chart ka Forex trading mein istimaal asaan aur simple hota hai. Isse trend ko identify karna aur trade signals lena asaan hota hai. Agar chart par green bricks banti hain to yeh uptrend ka signal hota hai, aur red bricks downtrend ka signal deti hain.

RENKO CHART STRATEGY FOR FOREX TRADING

Renko chart se trend identify karna bohot asaan hai. Jab green bricks banti jayein, to yeh uptrend ka signal hota hai. Is waqt traders buy trade karte hain. Wohi agar red bricks banti jayein, to yeh downtrend ka signal hai, aur traders sell trade karte hain. Renko charts support aur resistance levels ko identify karne mein bhi madadgar hotay hain. Jab price ek specific level par ruk jaye aur wahan se opposite direction mein bricks banni shuru hoon, to yeh level support ya resistance ka hoga. Renko chart mein breakout trading strategy bhi bohot achi tarah se kaam karti hai. Jab price support ya resistance level ko cross kare aur nayi bricks banein, to yeh ek strong breakout ka signal hota hai.

Is signal par traders buy ya sell kar sakte hain. Renko chart mein stop loss aur take profit levels set karna bhi asaan hota hai. Aam tor par, previous brick ka low ya high stop loss ke liye use hota hai, aur multiple bricks ka target profit ke liye set kiya jata hai.

TRADING STRATEGIES OF RENKO CHART PATTERN

Renko chart market noise ko hatakar clear trend dikhata hai. Is chart mein trend ko pehchanna asaan hota hai. Iski strategy simple hoti hai aur beginners ke liye friendly hoti hai. Renko chart mein thoda delay ho sakta hai kyunki yeh price ke movement ke baad bricks banata hai.

Brick size ko customize karna zaroori hota hai, aur har market condition ke liye different size set karna padta hai. Renko chart pattern aik simple aur effective strategy hai Forex trading ke liye, lekin isko samajhna aur sahi brick size set karna zaroori hai. Yeh chart aapki trading ko zyada disciplined aur systematic bana sakta hai.

OVERVIEW

Renko chart aik tarah ka chart hai jo sirf price movement par focus karta hai. Is chart mein time aur volume ka koi khas role nahi hota. Renko chart bricks ya boxes se banta hai, jo price ke specific movement ke baad banta hai. Agar price upar jata hai to white/green brick banta hai, aur agar price neeche jata hai to red brick banta hai. Renko chart mein har brick aik fixed price range ke baad banta hai, jese ke 10 pips, 20 pips, etc. Agar price 10 pips ya 20 pips se zyada barh jata hai, to ek nayi brick chart par show hoti hai. Yeh method noise ko filter karta hai aur sirf trend par focus rakhta hai. Renko chart ka Forex trading mein istimaal asaan aur simple hota hai. Isse trend ko identify karna aur trade signals lena asaan hota hai. Agar chart par green bricks banti hain to yeh uptrend ka signal hota hai, aur red bricks downtrend ka signal deti hain.

RENKO CHART STRATEGY FOR FOREX TRADING

Renko chart se trend identify karna bohot asaan hai. Jab green bricks banti jayein, to yeh uptrend ka signal hota hai. Is waqt traders buy trade karte hain. Wohi agar red bricks banti jayein, to yeh downtrend ka signal hai, aur traders sell trade karte hain. Renko charts support aur resistance levels ko identify karne mein bhi madadgar hotay hain. Jab price ek specific level par ruk jaye aur wahan se opposite direction mein bricks banni shuru hoon, to yeh level support ya resistance ka hoga. Renko chart mein breakout trading strategy bhi bohot achi tarah se kaam karti hai. Jab price support ya resistance level ko cross kare aur nayi bricks banein, to yeh ek strong breakout ka signal hota hai.

Is signal par traders buy ya sell kar sakte hain. Renko chart mein stop loss aur take profit levels set karna bhi asaan hota hai. Aam tor par, previous brick ka low ya high stop loss ke liye use hota hai, aur multiple bricks ka target profit ke liye set kiya jata hai.

TRADING STRATEGIES OF RENKO CHART PATTERN

Renko chart market noise ko hatakar clear trend dikhata hai. Is chart mein trend ko pehchanna asaan hota hai. Iski strategy simple hoti hai aur beginners ke liye friendly hoti hai. Renko chart mein thoda delay ho sakta hai kyunki yeh price ke movement ke baad bricks banata hai.

Brick size ko customize karna zaroori hota hai, aur har market condition ke liye different size set karna padta hai. Renko chart pattern aik simple aur effective strategy hai Forex trading ke liye, lekin isko samajhna aur sahi brick size set karna zaroori hai. Yeh chart aapki trading ko zyada disciplined aur systematic bana sakta hai.

تبصرہ

Расширенный режим Обычный режим