Tower Bottom Candlestick Pattern

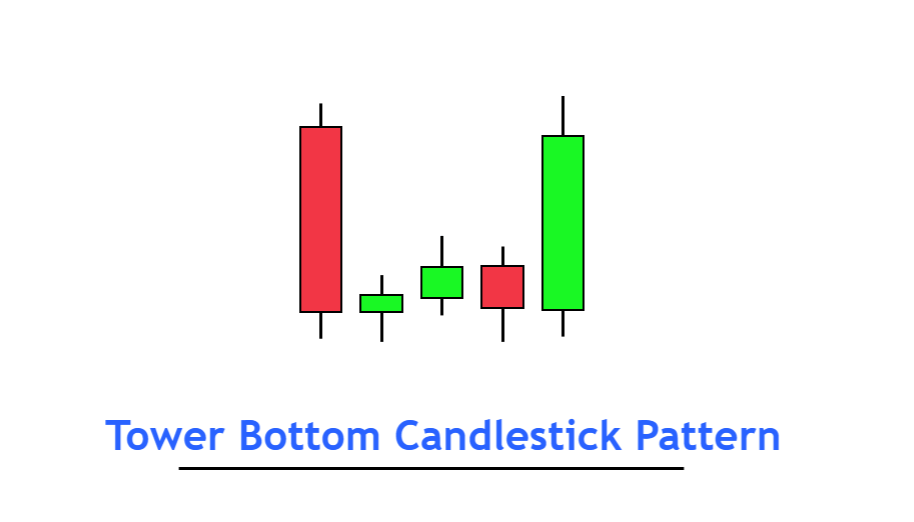

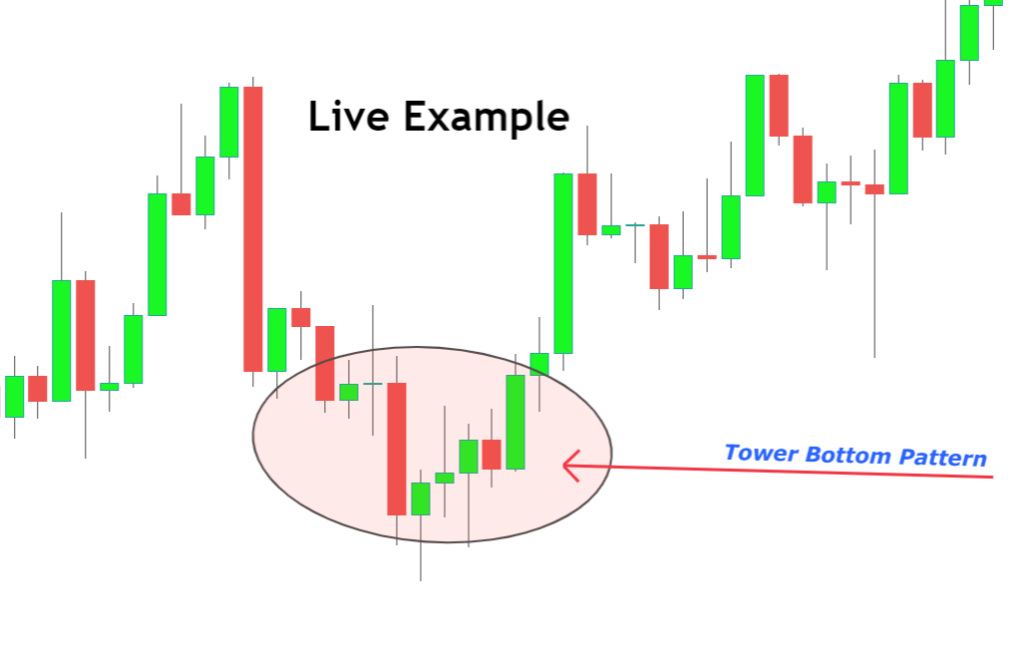

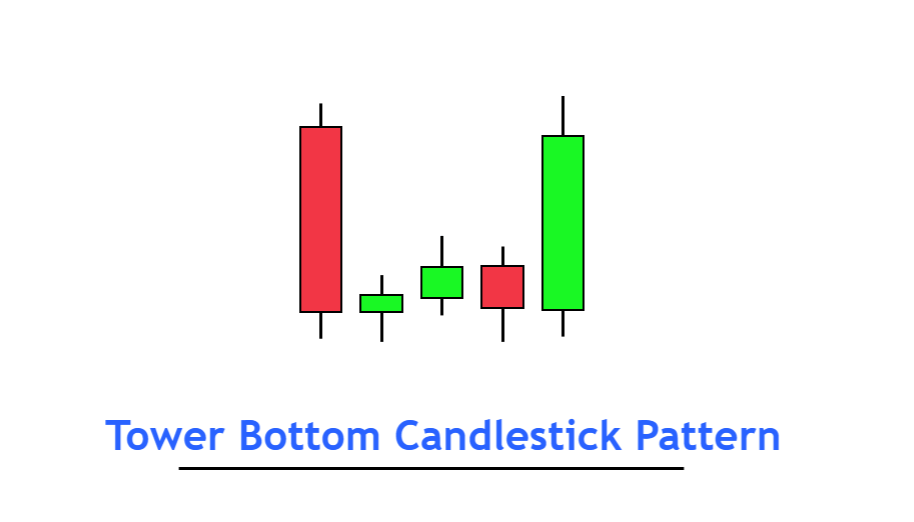

Tower Bottom candlestick pattern forex market mein bullish trend reversal candlestick pattern hota hey forex market kay es kesam kay chart pattern mein 2 bare opposite rang ke hote or 3 candlestick central mein chote hote hey total 5 candlestick hote hein

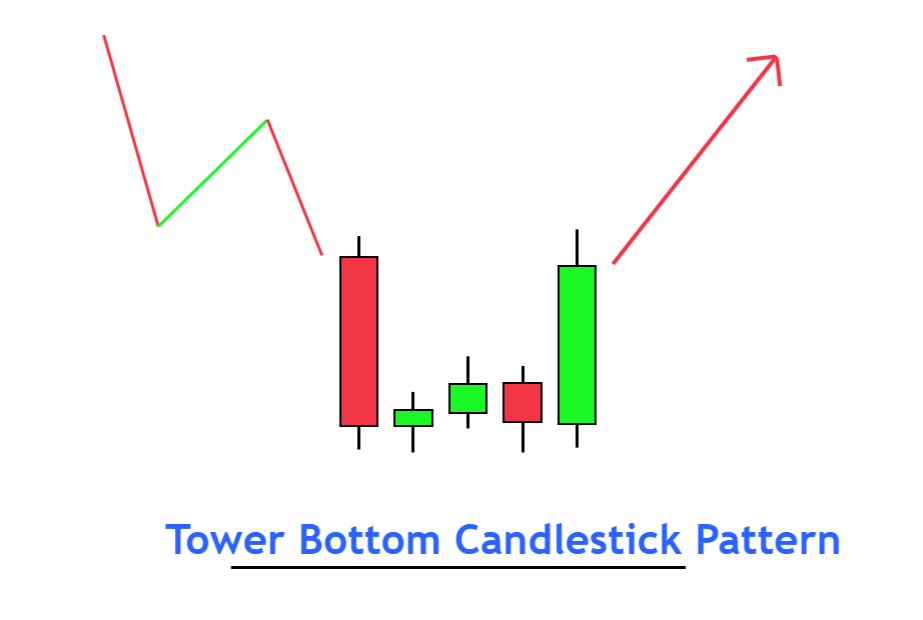

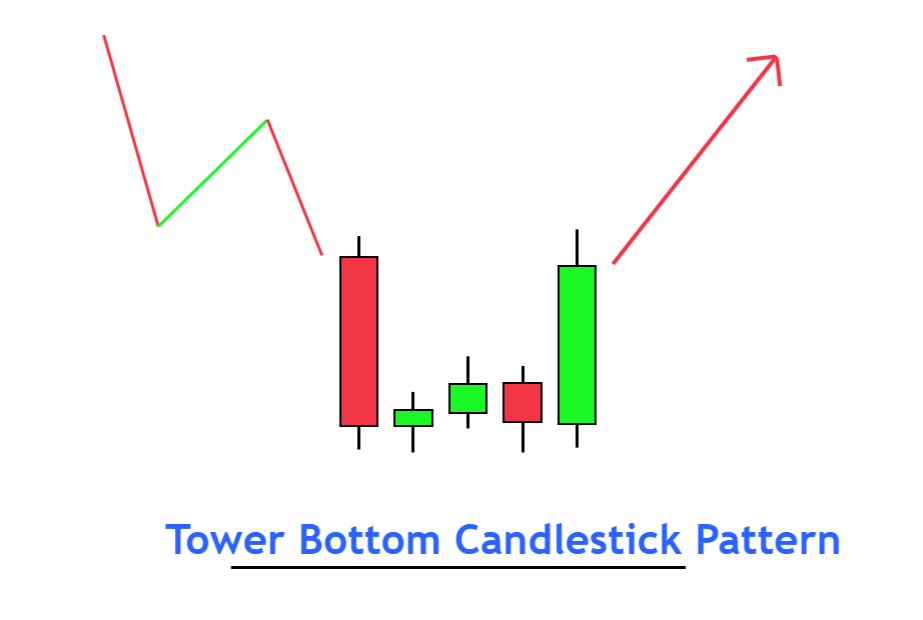

yeh forex market mein price chart kay nechay ka pattern hota hey trend bearish ka bhe hota hey or forex market mein trend bullish ka bhe hota hey forex market mein crop up rally kay sath he meltay jultay patte hotay hein or basic tor parjadeed technical analysis ka he estamal karta hey

Pehchan Tower Bottom Candlestick Pattern

forex market mein pehle candlestick bearish candlestick hote hey or es candlestick say pehlay trend bearish ka he hota hey

pehle bearish candlestick kaybad teen say 5 base candlestick hote hein s kay bad forex markeet mein chote doji spinning wale candlestick he hote hey body say wick ke ratio 25% he ho sakte hey es ka matlab yeh hota hey keh forex market mein body small ho sakte hey o forex market kay shadow zyada hota hein

forex market ke end mein candlestick bare bearish candlestick hote hey es candlestick ke 50% bod Fibonacci kay ope ja kar close ho jate hey

Understanding Tower Bottom Candlestick Pattern

forex market mein bearish trend kay bad end mein bare he bearish candlestick ban jay ge jes say zahair hotay hein keh forex market mein seller control mein he hotay hein or price ko kam karnay kay ley apni total raftar ko he kam kar saktay hein

forex market mein selle nay apni total raftar stamal kar le hote hey buyer nay ab bhe apni seller ke raftar kay ley shakest daynay kay ley kafe nahi hotay hein yeh he wajah hey keh price aik limit mein price kay structure ke taraf he hota hey

side way market kaybad aik bare bullish candlestick ban jay ge jes say yeh zahair hota hey keh buyer he control mein hotay hein or forex market ka trend badal jay ga

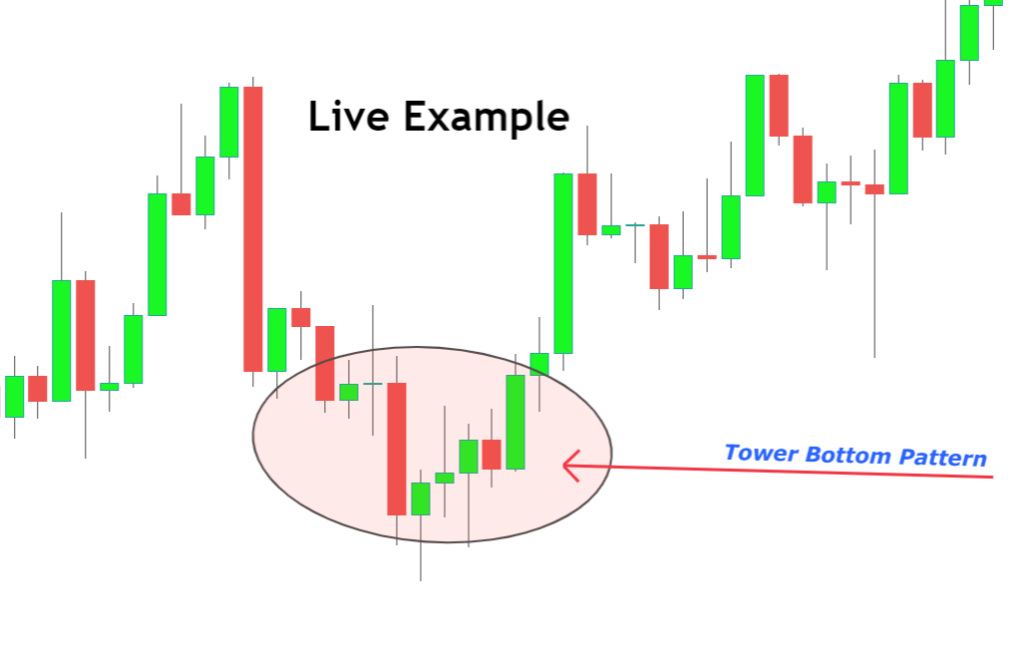

Best Working with Tower Bottom Candlestick Pattern

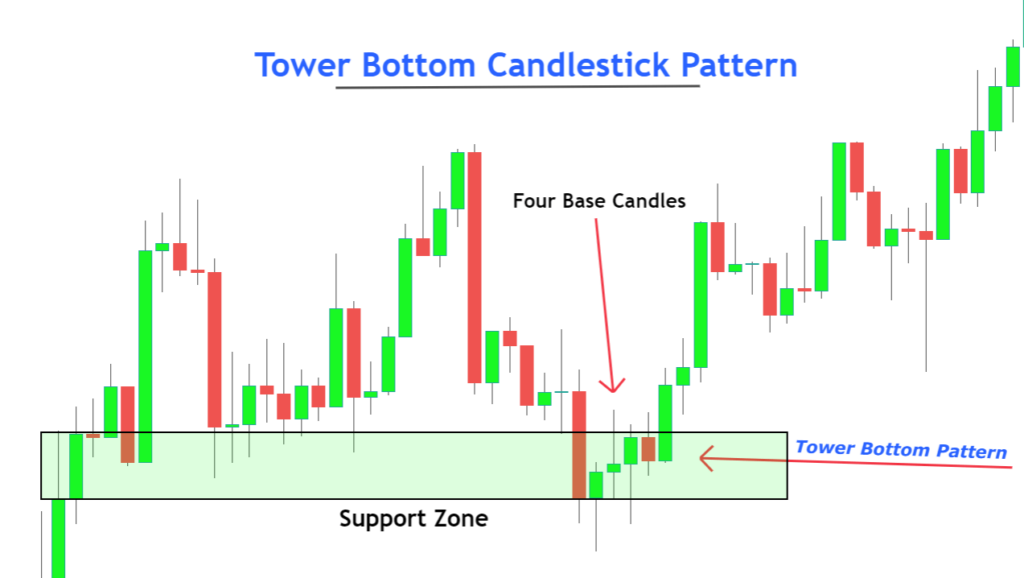

foex market mein zyada imkane trading set up hasel karnay kay ley hum forex market mein dosray technical allat or indicator ka he estamal kar saktay hein trading strategy ke winning ke ratio ko he increase kar saktay hein

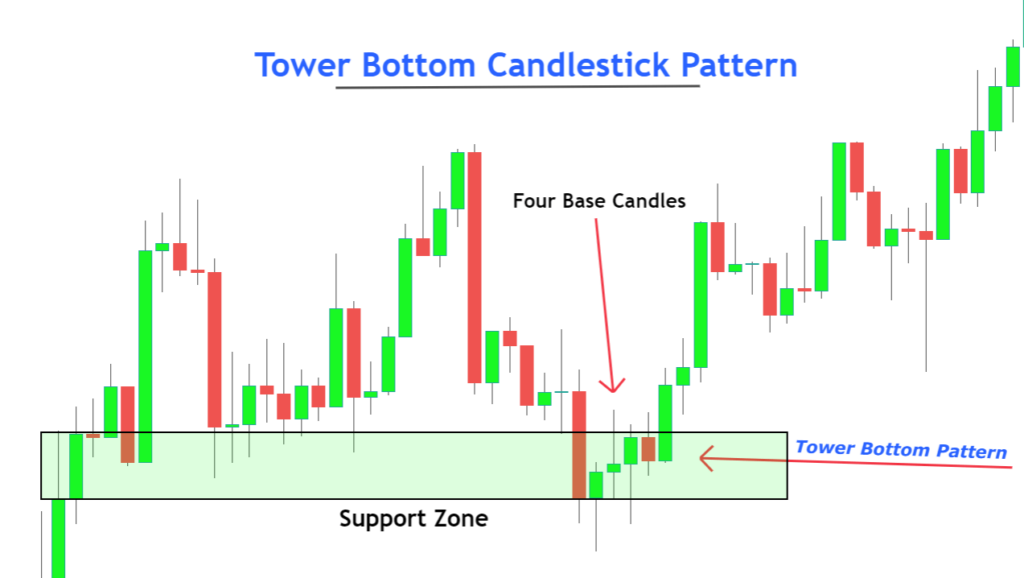

Demand zone ya support zone

tower bottom candlestick kay sath he en key levels or indicator ko he shamel karna chihay jo keh bullish trend reversal kay imkan ko he behtar kar saktay hein

Oversold Condition

forex market mein RSI indicator kay sath shamel kar kay estamal kartay hein karkardge ko behtar kartay hein

Tower Bottom candlestick pattern forex market mein bullish trend reversal candlestick pattern hota hey forex market kay es kesam kay chart pattern mein 2 bare opposite rang ke hote or 3 candlestick central mein chote hote hey total 5 candlestick hote hein

yeh forex market mein price chart kay nechay ka pattern hota hey trend bearish ka bhe hota hey or forex market mein trend bullish ka bhe hota hey forex market mein crop up rally kay sath he meltay jultay patte hotay hein or basic tor parjadeed technical analysis ka he estamal karta hey

Pehchan Tower Bottom Candlestick Pattern

forex market mein pehle candlestick bearish candlestick hote hey or es candlestick say pehlay trend bearish ka he hota hey

pehle bearish candlestick kaybad teen say 5 base candlestick hote hein s kay bad forex markeet mein chote doji spinning wale candlestick he hote hey body say wick ke ratio 25% he ho sakte hey es ka matlab yeh hota hey keh forex market mein body small ho sakte hey o forex market kay shadow zyada hota hein

forex market ke end mein candlestick bare bearish candlestick hote hey es candlestick ke 50% bod Fibonacci kay ope ja kar close ho jate hey

Understanding Tower Bottom Candlestick Pattern

forex market mein bearish trend kay bad end mein bare he bearish candlestick ban jay ge jes say zahair hotay hein keh forex market mein seller control mein he hotay hein or price ko kam karnay kay ley apni total raftar ko he kam kar saktay hein

forex market mein selle nay apni total raftar stamal kar le hote hey buyer nay ab bhe apni seller ke raftar kay ley shakest daynay kay ley kafe nahi hotay hein yeh he wajah hey keh price aik limit mein price kay structure ke taraf he hota hey

side way market kaybad aik bare bullish candlestick ban jay ge jes say yeh zahair hota hey keh buyer he control mein hotay hein or forex market ka trend badal jay ga

Best Working with Tower Bottom Candlestick Pattern

foex market mein zyada imkane trading set up hasel karnay kay ley hum forex market mein dosray technical allat or indicator ka he estamal kar saktay hein trading strategy ke winning ke ratio ko he increase kar saktay hein

Demand zone ya support zone

tower bottom candlestick kay sath he en key levels or indicator ko he shamel karna chihay jo keh bullish trend reversal kay imkan ko he behtar kar saktay hein

Oversold Condition

forex market mein RSI indicator kay sath shamel kar kay estamal kartay hein karkardge ko behtar kartay hein

تبصرہ

Расширенный режим Обычный режим