**Revised Topic on Flat Top Pattern in Forex Trading:**

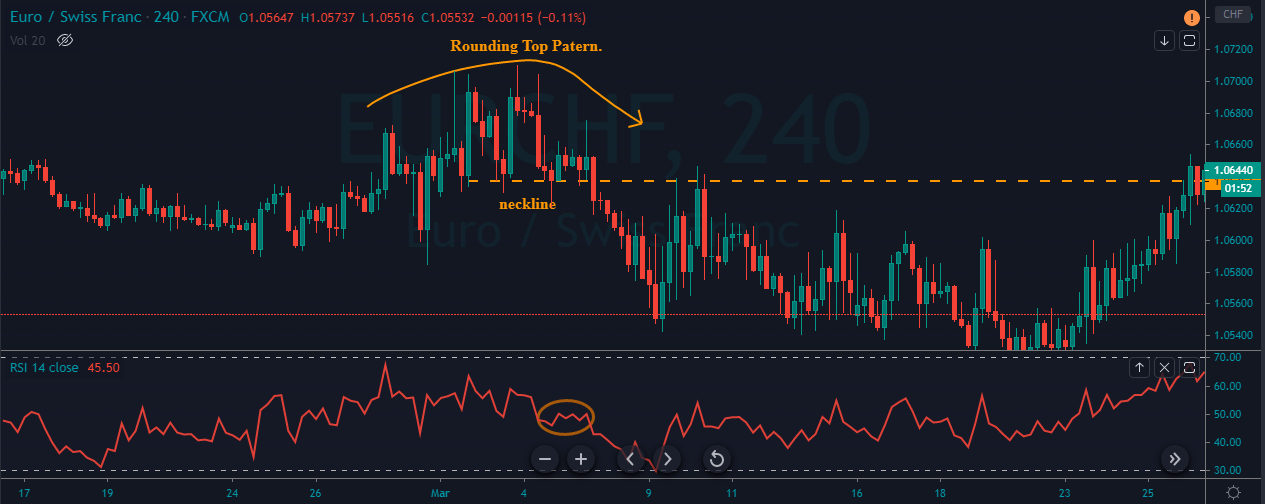

Forex market trading mein Flat Top pattern aik technical analysis ka ek wazeh example hai, jise horizontal resistance level ke zariye identify kiya jata hai, jo baar baar test hota hai lekin price ko upar break karne mein nakaam rehta hai. Yeh pattern aksar ek uptrend ya consolidation phase ke baad ubharta hai. Pattern ke upper portion mein resistance ka level ek strong selling pressure ya supply zone ko represent karta hai, jo price ko aage barhne se rokta hai. Yeh pattern aksar is baat ki nishani hota hai ke current trend mein potential reversal ka imkaan hai, jo market ke bullish se bearish sentiments mein tabdili ka ishara dayta hai.

**Flat Top Pattern Ki Khususiyaat:**

Flat Top pattern apni kuch khas characteristics rakhta hai jo investors ke liye pehchanne layak hoti hain. Sabse pehle, ek saaf horizontal resistance level hota hai jo pattern ke upper side mein form hota hai, jahan price is level ko baar baar test karti hai lekin break karne mein nakami rehti hai. Yeh level upward movement ke liye ek rukawat ke tor par kaam karta hai. Doosra, yeh pattern aksar ek lambi uptrend ke baad develop hota hai, jo ke buying momentum mein exhaustion yaani thakawat ka signal deta hai. Teesra, pattern ki confirmation mein volume ki analysis zaroori hoti hai, kyun ke pattern ke formation ke dauran trading volume mein kami, naye trend mein strength ki kami ka ishara day sakti hai.

**Flat Top Pattern Ke Sath Trading:**

Flat Top pattern ke saath trading karte waqt, traders aksar short positions enter karne ke liye is pattern ki support level ke neeche break ke intezar karte hain. Support level ke neeche break hona, resistance ko upar break karne mein nakami ki tasdeeq karta hai, jo ke trend reversal ka signal deta hai. False breakout se bachne ke liye stop-loss orders aam tor par resistance level ke upar lagaye jate hain. Iske ilawa, traders pattern ki confirmation ke liye additional technical indicators jaise ke moving averages ya oscillators ka istimaal bhi karte hain.

**Flat Top Pattern Ke Liye Trading Strategy:**

Flat Top pattern ke saath trading mein sabse aham cheez confirmation ki importance hai. Agarche pattern apne aap mein potential trend reversal ka signal day sakta hai, lekin additional technical indicators ya price action se confirmation pattern ki reliability ko barha sakti hai. Traders reversal ki confirmation ke liye additional signs jaise bearish candlestick patterns, momentum divergence, ya selling volume mein bara izafa observe karte hain. Confirmation dekh kar, investors false signals se bachne aur successful trades ke chances barhane mein madad hasil karte hain.

**Flat Top Pattern Mein Risk Management:**

Har doosray technical pattern ki tarah, Flat Top pattern ke saath trading karte waqt effective risk management intehai zaroori hoti hai. Traders ko chahiye ke woh apni positions ke against trade hone ki surat mein potential losses ko limit karne ke liye stop-loss orders ko madde nazar rakhen. Over-leverage ya large position size se bachne ke liye account size aur risk tolerance ke mutabiq trading size ka tayun bhi aham hai. Iske ilawa, traders ko apne trading plan par qaim rehna chahiye aur emotional decisions se bach kar appropriate risk management strategies ko follow karna chahiye. Solid risk management practices apna kar, traders apne capital ko protect karne aur forex market mein long-term success hasil karne mein kamyab ho sakte hain.

Forex market trading mein Flat Top pattern aik technical analysis ka ek wazeh example hai, jise horizontal resistance level ke zariye identify kiya jata hai, jo baar baar test hota hai lekin price ko upar break karne mein nakaam rehta hai. Yeh pattern aksar ek uptrend ya consolidation phase ke baad ubharta hai. Pattern ke upper portion mein resistance ka level ek strong selling pressure ya supply zone ko represent karta hai, jo price ko aage barhne se rokta hai. Yeh pattern aksar is baat ki nishani hota hai ke current trend mein potential reversal ka imkaan hai, jo market ke bullish se bearish sentiments mein tabdili ka ishara dayta hai.

**Flat Top Pattern Ki Khususiyaat:**

Flat Top pattern apni kuch khas characteristics rakhta hai jo investors ke liye pehchanne layak hoti hain. Sabse pehle, ek saaf horizontal resistance level hota hai jo pattern ke upper side mein form hota hai, jahan price is level ko baar baar test karti hai lekin break karne mein nakami rehti hai. Yeh level upward movement ke liye ek rukawat ke tor par kaam karta hai. Doosra, yeh pattern aksar ek lambi uptrend ke baad develop hota hai, jo ke buying momentum mein exhaustion yaani thakawat ka signal deta hai. Teesra, pattern ki confirmation mein volume ki analysis zaroori hoti hai, kyun ke pattern ke formation ke dauran trading volume mein kami, naye trend mein strength ki kami ka ishara day sakti hai.

**Flat Top Pattern Ke Sath Trading:**

Flat Top pattern ke saath trading karte waqt, traders aksar short positions enter karne ke liye is pattern ki support level ke neeche break ke intezar karte hain. Support level ke neeche break hona, resistance ko upar break karne mein nakami ki tasdeeq karta hai, jo ke trend reversal ka signal deta hai. False breakout se bachne ke liye stop-loss orders aam tor par resistance level ke upar lagaye jate hain. Iske ilawa, traders pattern ki confirmation ke liye additional technical indicators jaise ke moving averages ya oscillators ka istimaal bhi karte hain.

**Flat Top Pattern Ke Liye Trading Strategy:**

Flat Top pattern ke saath trading mein sabse aham cheez confirmation ki importance hai. Agarche pattern apne aap mein potential trend reversal ka signal day sakta hai, lekin additional technical indicators ya price action se confirmation pattern ki reliability ko barha sakti hai. Traders reversal ki confirmation ke liye additional signs jaise bearish candlestick patterns, momentum divergence, ya selling volume mein bara izafa observe karte hain. Confirmation dekh kar, investors false signals se bachne aur successful trades ke chances barhane mein madad hasil karte hain.

**Flat Top Pattern Mein Risk Management:**

Har doosray technical pattern ki tarah, Flat Top pattern ke saath trading karte waqt effective risk management intehai zaroori hoti hai. Traders ko chahiye ke woh apni positions ke against trade hone ki surat mein potential losses ko limit karne ke liye stop-loss orders ko madde nazar rakhen. Over-leverage ya large position size se bachne ke liye account size aur risk tolerance ke mutabiq trading size ka tayun bhi aham hai. Iske ilawa, traders ko apne trading plan par qaim rehna chahiye aur emotional decisions se bach kar appropriate risk management strategies ko follow karna chahiye. Solid risk management practices apna kar, traders apne capital ko protect karne aur forex market mein long-term success hasil karne mein kamyab ho sakte hain.

تبصرہ

Расширенный режим Обычный режим